Since July 13, digital currency rates have actually dropped in worth substantially, however the majority of coins have actually given that experienced some healing. While lots of crypto advocates are positive on where the marketplaces are headed, traders and experts have actually discovered a bullish-to-bearish pattern. BTC and a variety of other currencies increased more than 10% at 11 a.m. EST on Thursday, nevertheless, suggesting the booming market is still in play.

The Bulls Are Back in Town

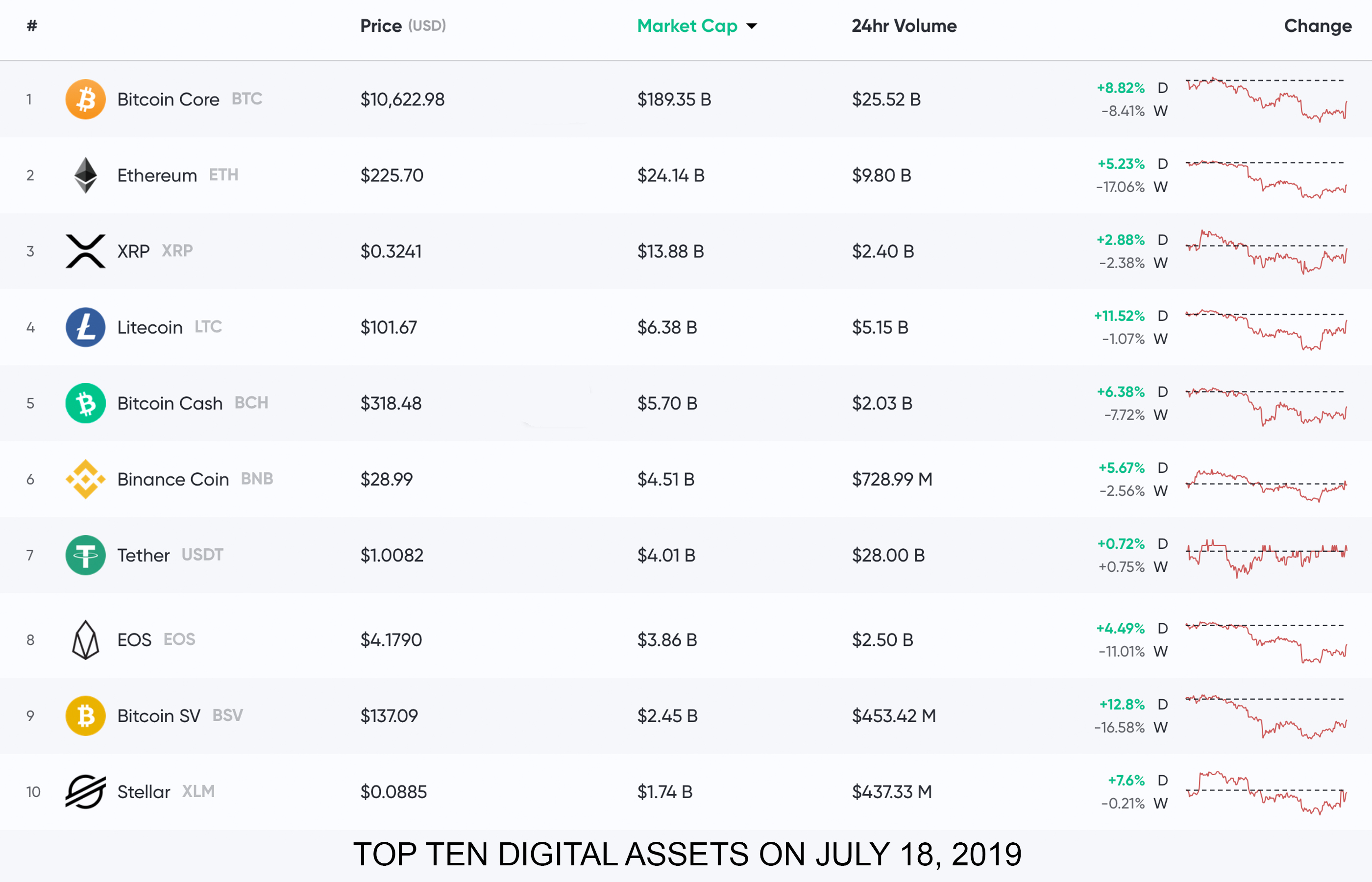

On Wednesday, cryptocurrency bulls were apparently tired and bears had actually briefly taken the reins, clawing back rates over the recently. Currently, the general market capitalization of the whole cryptoconomy is $281 billion with around $83 billion worth of 24-hour worldwide trade volume. The leading digital property by market assessment, bitcoin core (BTC), is down over 8% over the last 7 days. One BTC is trading for $10,622 after touching a low of $9,165 on Wednesday. BTC is followed by the 2nd biggest market cap held by ethereum (ETH) which has actually dipped by 17% this previous week.

ETH is switching for $225 per coin at press time as the cryptocurrency recuperated 5.2% of its losses throughout the earlier early morning trading sessions. Following ethereum, ripple (XRP) is trading for $0.32 per XRP, down by 2.3%. Litecoin (LTC) is switching for $101 per coin and down 1% over the last 7 days. Bitcoin money (BCH) is below litecoin’s market cap in 5th position as each coin is trading for $318, down 7% for the week.

Analyst Insists Libra Scrutiny Pushed the Price of BTC Down

This week has actually been fascinating as U.S. congressional leaders talked about cryptocurrencies at fantastic length to try to comprehend and control Facebook’s upcoming Libra coin. Public blockchains like BTC were explained by political leaders and cryptocurrency supporters over the last 2 days. Financial writer and market expert Naeem Aslam believes the Facebook Libra examinations and political leaders penetrating BTC pressed crypto rates lower. Most of the questioning and dispute in Congress today focused on the production of Libra, the cryptocurrency Facebook prepares to introduce in 2020.

For circumstances, lots of Democrat agents consisting of Alexandria Ocasio-Cortez appear to be versus Facebook’s coin principle throughout the hearings. The New York Democrat representative asked Libra CEO David Marcus who backs the monetary foundations of the prepared Facebook currency. “So we are talking about a currency managed by an undemocratically picked union of mostly huge corporations,” Ocasio-Cortez stated to Marcus, not impressed with his statement. Financial Services Committee agent Patrick McHenry (R-N.C.) applauded Satoshi Nakamoto’s production, on the other hand. However, Aslam composes today that the congressional hearing and “the examination of Facebook’s cryptocurrency has actually struck bitcoin’s cost.” Sharing his viewpoint on July 17, the expert specified:

Speaking simply from a cost action viewpoint, the Bitcoin cost decreased as much as 8.9 percent throughout the hearing and for the week it is down almost 16 percent. The cost has actually discovered its assistance near the 50-day moving average which is trading at $9,311. If the cost falls below the 50-day moving average, it is most likely that the cost might continue to move lower and discover assistance around the location of $7,418. The 242-day moving, which has an excellent performance history, is something that I am taking a look at carefully. It is trading at $6,983 and the cost should remain above this line in order for the bulls to keep their hopes alive.

The Dotcom Era

Ceteris Paribus from the crypto analytics company Messari thinks the present BTC market cycle is really comparable to Amazon stock throughout the dotcom bubble. “Not all bubbles are developed equivalent — The most current BTC cycle mirrors Amazon throughout the dot-com bubble, however the healing has actually been far more speedy — Even with the current sell-off, bitcoin is 54% below its high, vs. the 85% Amazon was trading at over a comparable timeframe,” Paribus tweeted on July 17. “Why is this appropriate? While various possessions, they both traded on pure speculation — Bubbles follow comparable patterns, however the fast BTC breakout has actually been exceptionally bullish. Only natural to see a bit of a pullback here — Still much even more ahead than the majority of people pictured in December.”

Miners Will Defend the Price of BTC

According to trader and expert Filb Filb, miners will safeguard the cost of BTC if it sinks to a particular point. “I have actually seen a great deal of hysterical require bitcoin to discover brand-new lows and wish to review a rational economics-based method which assisted me call the 2018 bottom to near excellence and why I do not think bitcoin will discover brand-new lows,” the trader wrote on Wednesday.

By utilizing particular techniques, miners will constantly optimize their rate of returns. “As Satoshi stated himself appropriately explained that product expenses are most likely to gravitate to production expense. Why? Because miners will offer into need where earnings per system > MC. Likewise, jointly they are disincentivized to offer when revenuedeclared. The popular trader included:

We have also seen the pre halving buzz bottom out at 2x the cycle bottom traditionally — Go try to find yourselves. Coincidence? I believe not.

Money Managers Scour Forums and Social Media for Cryptocurrency Price Clues

According to a Reuters interview with Bin Ren, CEO of Elwood Asset Management, hedge funds and loan supervisors are utilizing algorithms efficient in determining cryptocurrency cost hints throughout online forums and social networks platforms like Twitter. Reuters reports that making use of these algorithms has actually been growing busily amongst conventional market supervisors. “It’s an arms race for loan supervisors — Very couple of gamers have the ability to carry out and provide it, however I think it is extremely lucrative,” Ren informed the news outlet. Moreover, Bitspread, the digital property management service based in London and Singapore, also utilizes social networks algorithm strategies to benefit.

“It’s a matter of collecting all the details, attempting to comprehend who is trading where, what sort of liquidation can appear,” Bitspread CEO Cedric Jeanson stated. “It’s a method that makes good sense.”

Despite the Possibility of BTC Prices Declining Below $7K, Market Parabola Is Still in Play

Well understood Twitter cryptocurrency expert Mr. Anderson detailed that BTC has really strong parabolic pattern lines and the most affordable band is under $7K. Essentially this indicates that regardless of BTC’s present cost decrease, the bull run might still remain in play. For circumstances, regardless of the 10-25% dips for the majority of digital possessions within the cryptoconomy, the bulk are still method up in contrast to the December 2018 lows.

Any of the parabolic pattern lines might function as an assistance for BTC however calling big ones is really challenging according to Mr. Anderson. “BTC Parabolic Curve: Calling completion of a big Parabolic Curve is HARD — It appears apparent which is why it is hard. We currently have a number of relatively sensible para-trend lines that we needed to cancel and we have a couple more that might wind up being canceled too,” Anderson explained on Twitter in referral to his parabolic pattern line chart.

Worldwide Economic Fears, Cut Interest Rates and a No-Deal Brexit

Overall, digital property markets have actually still gotten substantial worth in the middle of around the world financial worries. However, retail sales in June were much better than anticipated according to financial experts and the dive in costs has actually provided hope. However, in the U.S. some speculators think that the Federal Reserve may cut rate of interest when members of the Fed assemble on July 30-31. According to reports, the U.S. Treasury has actually currently priced in the rate cuts in order to boost loans and loaning rates for home loans.

Moreover, the possibility of a no-deal Brexit is being discussed throughout the U.K. and EU. Economists fear that the U.K. will lastly leave the EU financial system, however waiting on Prime Minister Theresa May’s follower has actually stopped briefly an approaching Brexit. With financial experts viewing the worldwide economy carefully and political leaders inspecting digital currencies, how all of this insanity will impact cryptocurrency markets moving forward is anybody’s think. Today’s cost breakout at 11 a.m, nevertheless, recommends that the crypto bulls are still in the video game.

Where do you see the cost of BCH, BTC and the cryptoconomy going from here? Let us understand what you believe in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.