Digital property markets have actually regained a few of the losses taken 3 days back, as an excellent bulk of the crypto economy has actually begun to rebound after the marketplace thrashing. Bitcoin has actually climbed up above the $18k handle when again and a myriad of crypto possessions are up in between 1-6% throughout the last 24 hr.

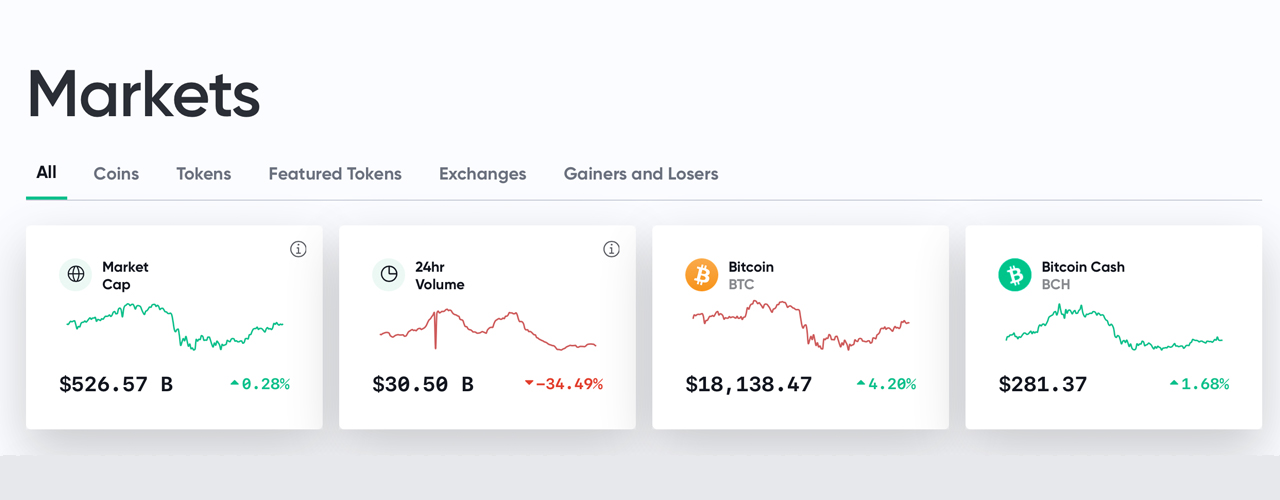

After dropping to a low of $16,300 per coin, bitcoin (BTC) has actually rebounded 11.3% to where the cost stands today at $18,138 per system. BTC is still up 33% for the last thirty days, 54% for the last 90 days, and 139% versus USD for the last 12 months. Bitcoin’s supremacy index, in contrast with the 7,500+ crypto possessions’ market caps, is presently simply above the 63% handle.

The whole crypto-economy on Sunday, November 29, 2020, is hovering around $526.5 billion and there’s approximately $30.50 billion in worldwide trade volume today. The most significant cryptocurrency gains today were caught by zap (ZAP), which is up 71% in 24 hr. The biggest losses today come from carvertical (CV), which is down over 59% on Sunday early morning (EST).

The whole crypto-economy on Sunday, November 29, 2020, is hovering around $526.5 billion and there’s approximately $30.50 billion in worldwide trade volume today. The most significant cryptocurrency gains today were caught by zap (ZAP), which is up 71% in 24 hr. The biggest losses today come from carvertical (CV), which is down over 59% on Sunday early morning (EST).

The second-largest market cap held by ethereum (ETH) is up 5.17% today, however ETH is still down a touch less than 1% for the last 7 days. ETH is switching for $555 per ether and holds a $63 billion market evaluation.

XRP is trading for $0.61 per coin and is up 0.39% on Sunday early morning. Still, XRP commands a $28 billion market capitalization and is up 39% throughout the last 7 days.

Bitcoin money (BCH) holds the fifth-largest market cap below the stablecoin tether (USDT) and is presently trading for $281 per system. BCH is still down some throughout the previous 24 hr, however is up 7.5% for the week. The crypto property bitcoin money (BCH) has a market evaluation of around $5.23 billion on November 29, 2020.

As BTC leaps back to the levels got recently, a couple of experts think that altcoins will capture up too.

“BTC is back at its all-time high levels, however what deserves keeping in mind is the evaluation of the altcoins which are on average still 50% below their all-time highs,” the Head of Trading at NEM, Nicholas Pelecanos stated. “Some altcoins represent jobs that are no longer operating, yet other jobs have actually seen incredible advancement on both adoption and tech. For me, capturing these underestimated altcoins is now the trade to be made,” Pelecanos included.

Other experts presume that the need for bitcoin (BTC) and other crypto possessions come from Millennials and the Gen Z generation.

“The constant increase of Bitcoin in 2020 has not just continued, however sped up, throughout times of political and financial unpredictability. As an entire, the world is looking outside the standard standards for how and where they handle their financial resources. This need originates from Millennials and Gen Z’ers and their progressive outlook on their monetary requirements, both present and future, and rotating far from standard banks as their shop of worth with next-to-nothing rates of interest,” Derek Muhney, Director of Sales at Coinsource described.

Some traders believe that the existing rise might be a “bull trap,” which is generally an incorrect signal in a decreasing pattern. For circumstances, the crypto trader called ‘@Lomahcrypto’ informed his 65,000 Twitter fans that he wishes to be bullish, however he is still unsure.

“I wish to be bullish so bad,” Lomahcrypto tweeted. “Please BTC simply close above $17,400 or discard to $15,800. Also… Binance Futures ALTs that were carrying out well (market leaders) are looking kinda heavy,” he included. “I [have] to concur it appears like garbage,” another trader reacted.

The popular trader @Cryptocapo_ informed his 25k Twitter fans that he’s prepared to brief BTC. “Ready to brief (hedge) $17.5k-$18k,” he tweeted.

Meanwhile, although BTC moved 15% in worth recently, lots of anticipated the crypto property to move a lot more than that, as it has actually generally seen slides much bigger in the past (-30% or more). This has actually triggered unpredictability amongst traders and experts, as some think that the cost will drop once again, however lots of lovers still totally think BTC is when again targeting the 2017 all-time high.

What do you consider the crypto-economy’s current gains? Let us understand what you consider this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.