During the last couple of days, digital currency markets have actually been meandering sideways and costs have actually been less unpredictable. On Sunday, throughout the last 24 hours, the whole cryptoconomy is hovering simply below the $200 billion zone and there’s approximately $71 billion in international trades. Crypto supporters are still unsure about the future trajectory and whether digital currency rate trends will continue moving or increase once again.

The Cryptoconomy Continues to Meander Sideways

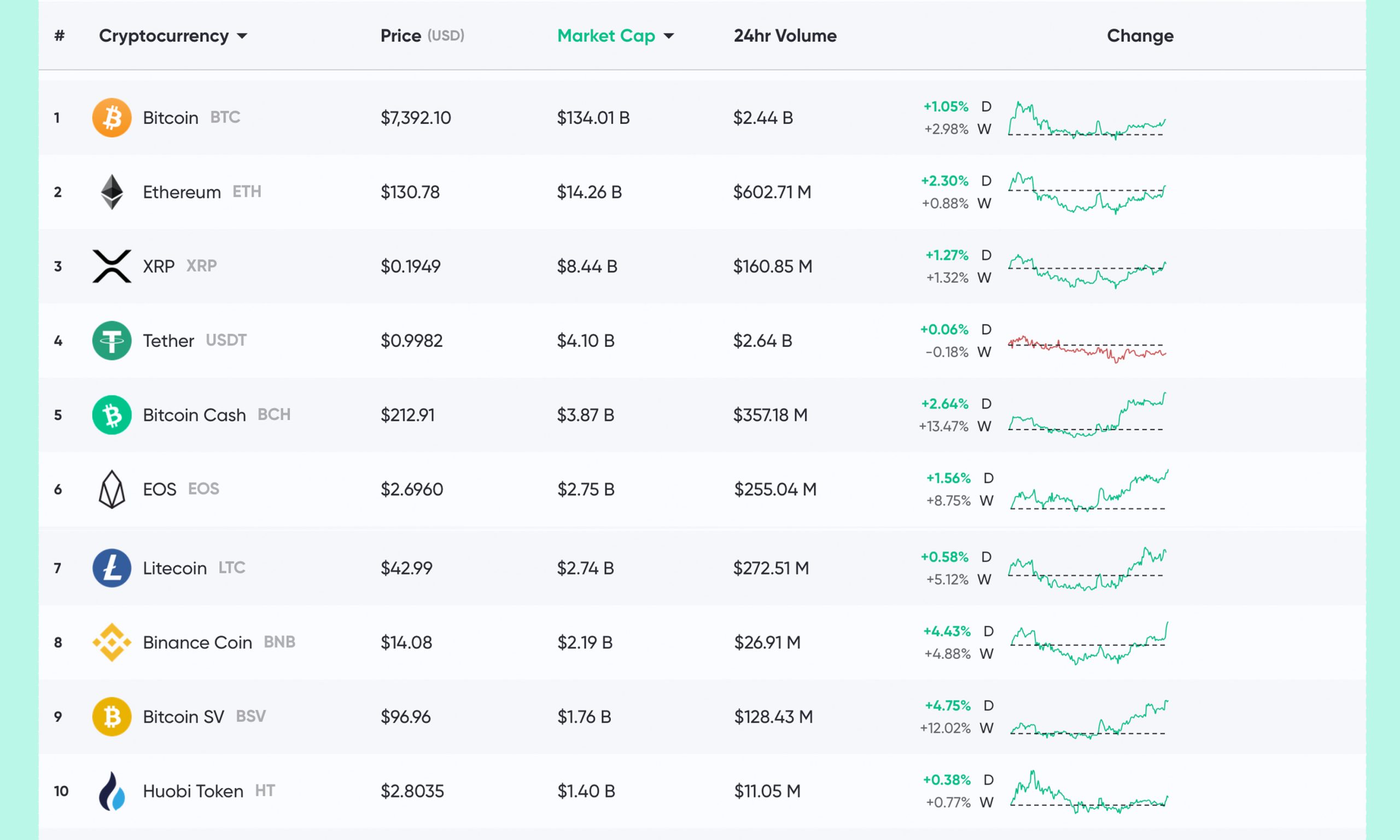

Digital currency markets on Dec. 29, have actually seen a lot of cryptos collect a couple of gains throughout the 24 hours of trading. Currently, the top 10 crypto market capitalizations have actually seen portion boosts in between 0.50% to 5%. At the minute, BTC costs are around $7,392 which is up 1.05% for the day. BTC has a general market evaluation of around $134 billion and approximately $21 billion in 24-hour trade volume. Out of all the coin caps, BTC’s $134 billion market cap is controling by 68%, however 74% of all BTC trades this Sunday remains in tether (USDT).

Ethereum (ETH) is switching for $130 per coin and ETH markets are up 2.3% throughout today’s trading sessions. This is followed by ripple (XRP) markets which have actually seen a 1.2% gain today and each XRP is trading for $0.19. The fourth-largest market evaluation comes from the stablecoin tether (USDT) and USDT is catching around two-thirds of every crypto trade on Sunday. On Dec. 29, USDT trade volume is the greatest out of all the coins with $25 billion worth of international swaps.

Bitcoin Cash (BCH/USD) Market Action

Bitcoin money (BCH) markets are up 2.6% today and 13.4% throughout the last 7 days of trading. Each BCH is switching for $212 per coin and BCH has a market evaluation of around $3.87 billion. At the time of publication, there is $1.7 billion worth of bitcoin money being traded on exchanges and USDT catches 53% of all BCH trades. This is followed by BTC (23.29%), USD (13.06%), USDK (4.14%), ETH (3.52%), and KRW (1.32%). Looking at the weekly and day-to-day BCH charts, Fxstreet expert Ken Chigbo discussed on Dec. 27 that BCH/USD is set to evaluate the huge $200 barrier.

“Weekly rate action smashed through the $200 mark, a retest is being observed in the existing week, nevertheless, up until now just leading to rejection,” Chigbo stated. “Price action is resting a breached day-to-day pennant structure, a break and closure above would be vital for the bulls,” the expert included.

Gold Bug Peter Schiff Doesn’t See Bitcoin Gains

On Dec. 27, the well-known gold bug Peter Schiff stated that BTC is the only property worldwide today that’s not rallying towards completion of the year. “Bitcoin is not frustrating those who declare its real worth is that it’s a non-correlated property,” Schiff tweeted. “Every property class worldwide is rallying into completion of the year other than Bitcoin. Not sure what worth this in fact includes, however a minimum of Bitcoin is fulfilling expectations on something,” the economic expert even more said. Despite Schiff’s viewpoint, the digital property climbed up more than 8.9 million percent over the last 10 years compared to gold’s 38% climb. Moreover, the cryptocurrency was still the very best carrying out property in 2019 also, although costs have actually dropped.

Do Bearish Prices Equal an Upcoming Rip Your Face Off Rally?

Even though costs have actually been lagging, bitcoiners and crypto supporters think markets will increase in the future. Bitcoin trader Michaël van de Poppe believes a much deeper bottom is coming and a much bigger rally will follow after. “Very basic, 2020 is going to be a fantastic year for cryptocurrencies and Bitcoin,” the trader tweeted. “If market capitalization stays above $145-150 billion, I won’t be amazed we’ll see a rally towards $500-600 billion.”

In addition to this forecast, the popular BTC analyst Hodlonaut can picture a face-melting rally. “The sort of belief doldrums we remain in now [and] individuals relatively accepting that 7k is reasonable worth,” Hodlonaut wrote. “Dozens of bull stories shown incorrect — Fatigue high, buzz low. [It] is precisely the kind of location where it would be hallmark Bitcoin character to begin a rip your face off rally,” he included.

Overall, most traders and crypto lovers are still unsure regarding where the future will take cryptocurrencies in the short-term. Long term optimism is still high, however a good variety of experts and traders believe the bearish belief is not over. BTC/USD long positions (individuals wagering the rate will increase) have actually dipped a touch however are still exceptionally high compared to regular. Meanwhile, BTC/USD brief positions (individuals wagering versus the rate) are really low and there doesn’t appear to be numerous traders happy to short today.

Where do you see the cryptocurrency markets heading from here? Let us understand what you consider this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.