Digital currency costs have actually been dropping in worth today and on November 21 the whole cryptoconomy fell below $200 billion. At the minute, a lot of cryptocurrencies are down in between 4-12% in the last 24 hours and 10-25% over the last 7 days. Traders are presently contemplating what will occur next as costs sanctuary’t been this low considering that May.

Also Read: The Bank of Google Wants Your Spending Data

Crypto Markets Swim in a Sea of Red

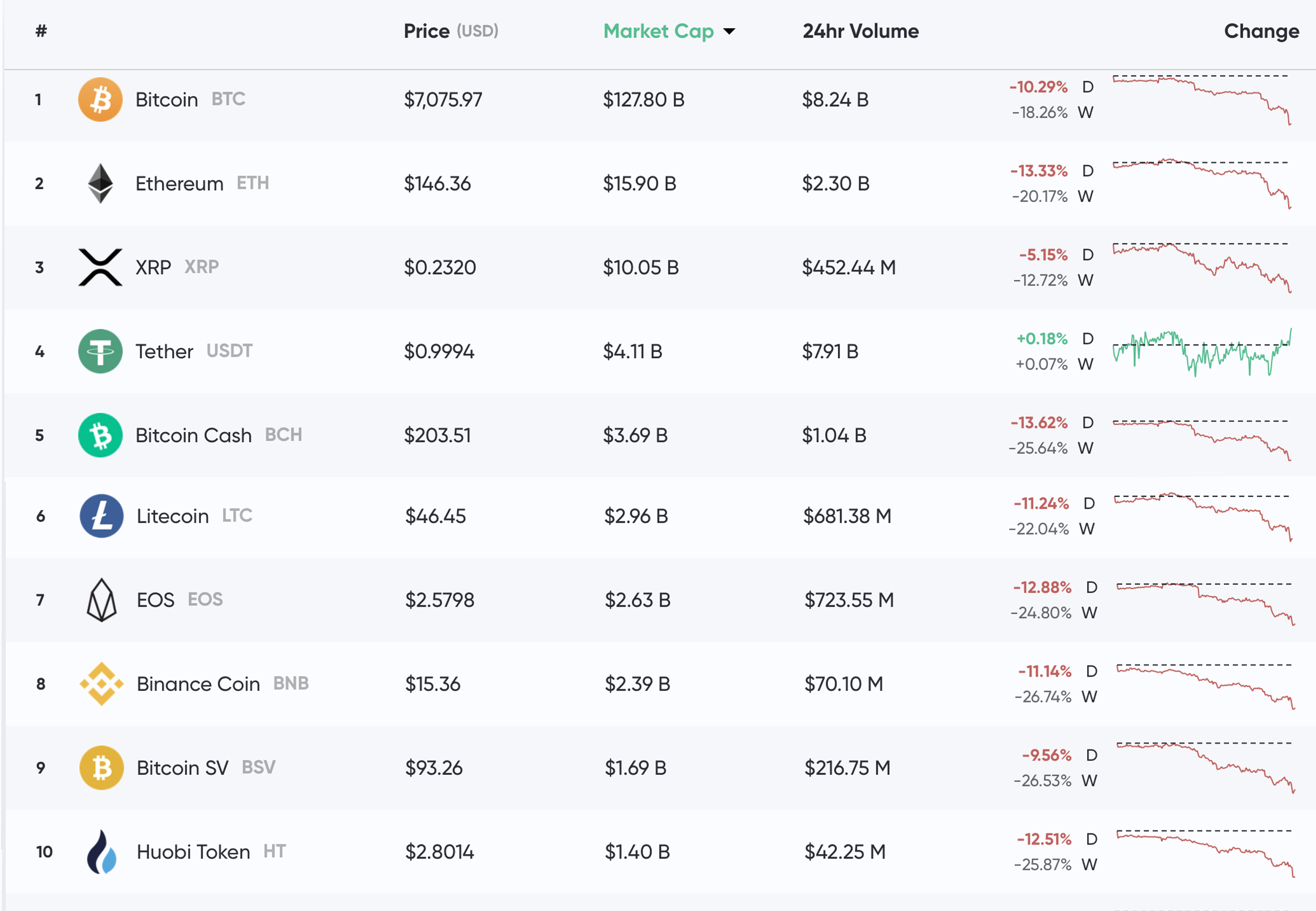

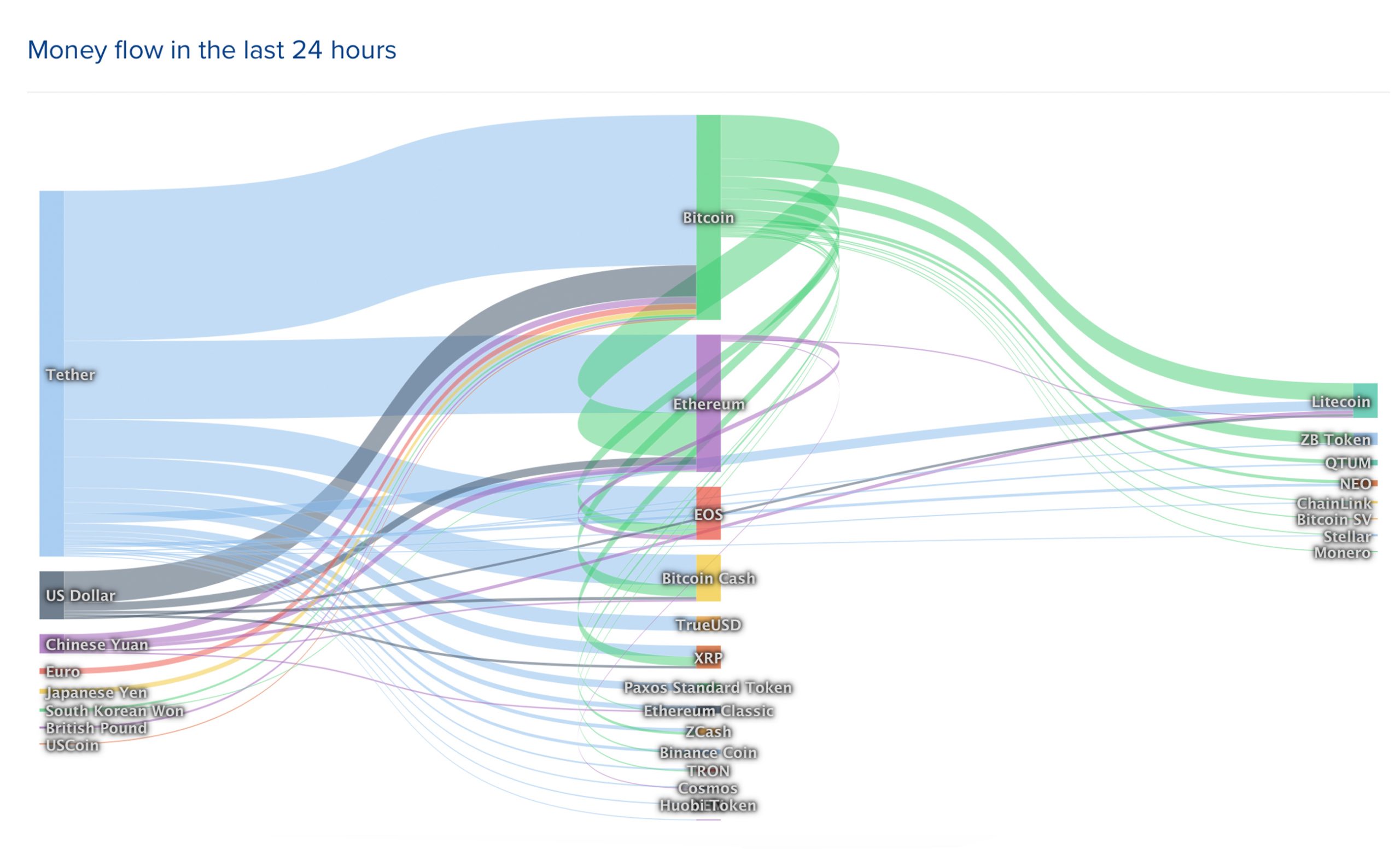

Crypto market value have actually dropped significantly today with much of the losses taking place in the last 48 hours. At the time of composing, the whole cryptoconomy is hovering around $195 billion after dropping below the $200 billion mark today. Global trade volume is flat with just $23.4 billion in crypto swaps in a 24-hour duration. Right now BTC is switching for $7,075 per coin with a general market evaluation of around $127 billion or 66% supremacy. Most of the BTC trades today are with tether (USDT) which records 75% of all action. This is followed by USD (9.53%), JPY (6.97%), EUR (2.39%), and KRW (1.34%) sets versus BTC.

Over the course of the last 24 hours, BTC is down 10.2% and for the week it’s lost 18.2%. Behind BTC is ETH, which has actually lost 13% today and 20% for the week, trading at $146 per coin. XRP has actually seen little damage today as each coin is trading for $0.23 and XRP markets are down 5% today. Lastly, tether (USDT) has actually bumped BCH out of 4th position since it commands more than 2 thirds of the cryptoconomy’s trades. Tether has a $4 billion dollar market evaluation and $7.9 billion worth of trades today.

Bitcoin Cash (BCH) Market Action

Bitcoin Cash (BCH) markets have actually seen considerable losses in the last 48 hours also, as the crypto holds the 5th biggest market share. At $203 per coin, BCH is down 13% today and 25% for the last 7 days. BCH has a market evaluation of $3.69 billion and $1 billion in international trade volume. The leading trading couple with BCH today is tether (USDT) with more than 69% of all trades. This is followed by BTC (14.99%), USD (10.82%), KRW (2.25%), ETH (0.66%), EUR (0.58%), and JPY (0.43%). BCH has actually lost all of the gains it collected throughout the recently of September and costs sanctuary’t been this low in 6 months. At press time, BCH is the 6th most traded coin below EOS and above XRP.

All Eyes on China

On November 21, The Block released a story that stated “sources” informed the news outlet that Binance’s Shanghai workplace was robbed by the cops. According to the report, approximately 50-100 workers operated at the Shanghai workplace. Many individuals associated this news to cryptocurrency costs moving southbound on Thursday.

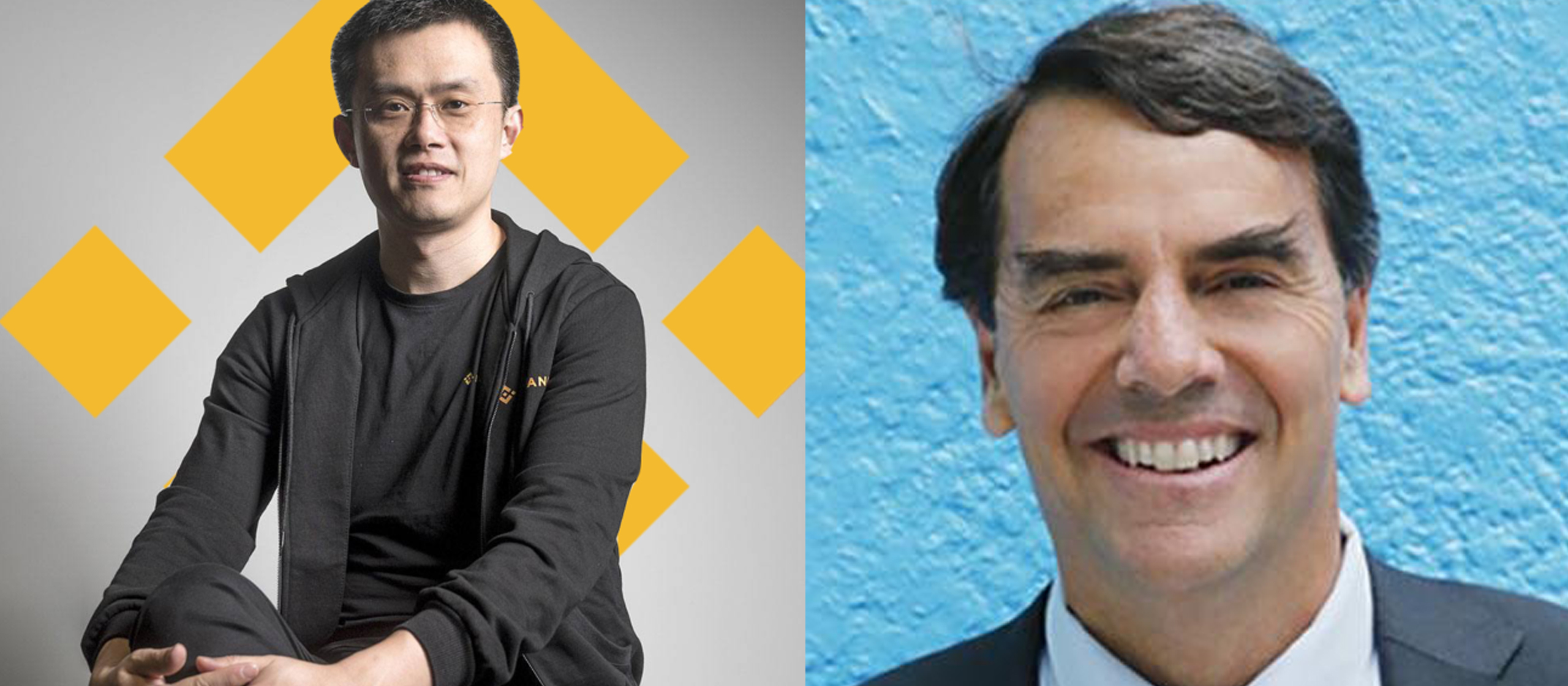

You can argue about the semantics of a workplace, who rented it, for for how long, if it is empty, etc. But you can’t argue about the semantics of a “police raid” that did NOT occur. Without the phony “police raid”, there is no post. Pure FUD! https://t.co/o6xXwrU5WK

— CZ Binance (@cz_binance) November 22, 2019

However, not too long after the report, the Malta-based exchange Binance rejected the cops raid and declared they never ever had a workplace in Shanghai. Now Twitter is seeing an argument in between Binance CEO Changpeng Zhao (CZ) and team members of the crypto publication over the authenticity of the post. Following the report, the financing bureau of Shenzhen town released findings on 39 unknown crypto exchanges that will be examined for prohibited activities.

BTC Shaves Off Months of Gains

This week, Fxpro senior monetary expert Alex Kuptsikevich discussed in a note to financiers that “[BTC] has practically totally balance out the development.” BTC handled to catch some fresh FOMO from China, Kuptsikevich stated, however that fever is now gone. “Bitcoin has actually lost more than 5% in the last 24 hours and trades around $7,500 and the decrease below the 200-day moving typical breaks the ice to $5K, where the previous combination location lies,” Kuptsikevich highlighted. “The crypto neighborhood recommends that the fall might be because of the capitulation of the miners, which is thought about a very bearish signal for the standard coin. It indicates that miners need to offer their possessions to continue working and even need to leave the marketplace. The last time Hash Ribbons indication was inverted Bitcoin began the procedure of decreasing from $6K to $3K.” Kuptsikevich’s keep in mind to financiers even more worried:

The excellent news is that a minimum of for a while the sale has actually stopped. If there are no brand-new selling impulses for a long time, purchasers might begin taking a look at the property. It deserves pointing out that the standard cryptocurrency is in a tight ‘institutional ring.’ These financiers are not interested in the technical potential customers of the property, simply in rate changes, whose triggers will vary. Still, they will have something in typical: to make the bulk relocation in one instructions while opening the positions in the opposite. So it won’t be uninteresting.

Optimism and Hopium Still Thrive

Despite the strong rate decline, cryptocurrency influencers and heavyweights think digital property costs will climb up greater. Binance CEO Changpeng Zhao just recently discussed: “If you take a look at the basic innovation and a longer-term view, throughout a 5 year or 10 years horizon, we’re extremely positive the market will grow and when the market grows the costs will go higher — If you take a look at the short-term view, bitcoin and cryptocurrency is a smaller sized market cap instrument so there will be greater volatility.”

Bitcoin financier and investor Tim Draper thinks that his forecast of $250k per BTC will still concern fulfillment. Discussing the topic at the Malta AI & Blockchain Summit, Draper stated: “I believe bitcoin payment processors are truly going to open the floodgates.”

Back to the Norm?

After 2 days of crypto costs moving, nobody is totally sure what is going to occur next. At the time of publication, the multifactorial crypto market belief analysis index called the Crypto Fear & Greed Index (CFGI) indicate “severe worry.”

Many financiers think the rate is simply stabilizing after an incorrect spike conjured up by China’s blockchain push. “This rate drop is a technical relocation; this is where the rate was prior to the news of China’s assistance of blockchain, which is not crypto,” Joe DiPasquale, ceo of Bitbull Capital stated on Thursday. “So, the rate of [BTC] is merely going back to typical. However, more drawback cannot be eliminated, considering that the current drop has actually turned beliefs to unfavorable.”

Where do you see the cryptocurrency markets heading from here? Let us understand what you consider this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.