Digital currency costs have actually dropped once again as the whole crypto market capitalization has actually dropped below $200 billion. At press time, the majority of the leading digital possessions are down a couple of portions after collecting some gains over the last couple of days. With several coins getting declined after attempting to go beyond upper resistance, doubters believe crypto costs might see additional decreases. However, BTC/USD long positions have actually increased substantially despite market uncertainty.

Also Read: Gocrypto SLP Token Starts Trading on Bitscoins.web Exchange

Crypto Cap Drops Below $200 Billion

The cryptocurrency market cap on Wednesday is hovering around $197 billion and there’s approximately $58.9 billion in 24-hour worldwide trade volume today. A couple of days ago cryptocurrency traders tried to press costs northbound however after being squashed by upper resistance, crypto possession worths went south. For circumstances, on December 9, BTC costs soared to $7,600 however considering that gone away and each coin is now switching for $7,230 per BTC. The greatly associated markets below BTC followed the coin’s down course and the whole market appraisal of all 3,000+ possessions moved substantially.

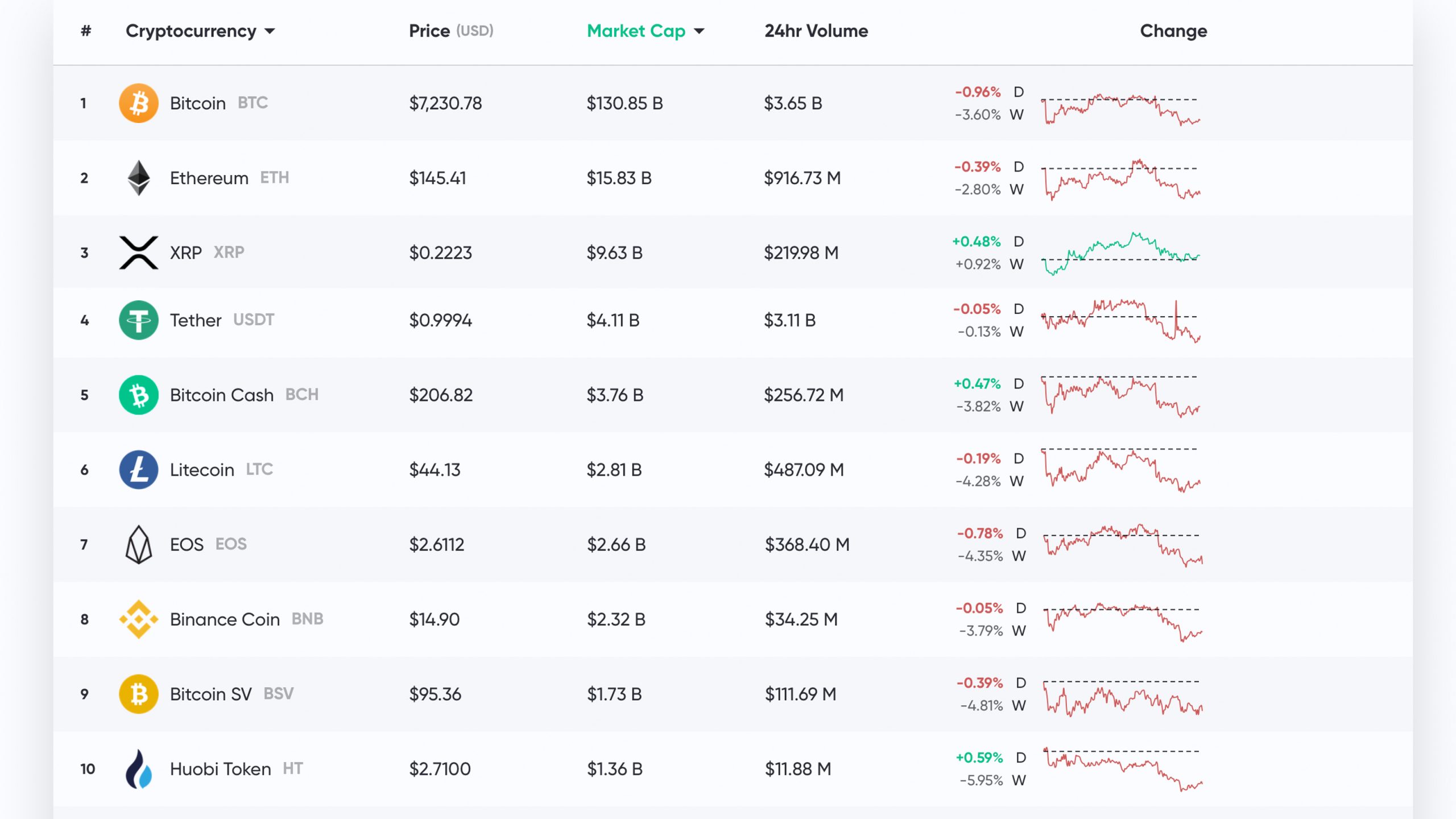

Currently, BTC is down 0.96% today and has a general market cap of approximately $130 billion. The second biggest market appraisal is held by ETH as each coin is trading for $145 today. ETH is down 0.39% on Wednesday and 2.8% for the whole week. This is followed by XRP markets which are up 0.48% today and 0.92% over the last 7 days. With a $9.63 billion market appraisal, each XRP is presently switching for $0.22 per coin. Tether (USDT) holds the 4th biggest market cap and is the most dominant stablecoin coupled with a lot of coins in the cryptoconomy. At press time, stats from coinlib.io program USDT catches approximately 2 thirds of the worldwide crypto volume.

Bitcoin Cash (BCH) Market Action

Bitcoin money (BCH) markets have actually lost a couple of portions over the last couple of days and BCH holds the 5th biggest market appraisal. Right now each BCH is switching for $206 per coin and markets are up +0.47% today however 3.8% down for the week. Bitcoin money has a general market appraisal of around $3.76 billion and there’s $1.1 million in worldwide BCH trades today.

The leading set traded with BCH is USDT which commands 56.4% of all BCH trades. This is followed by BTC (30.5%), USD (8.3%), ETH (2.6%), and KRW (0.84%) sets. The BCH-based stablecoin honestcoin (HUSD) represents the 6th most traded couple with BCH on Wednesday as the stablecoin has actually been collecting steam. This week Fxstreet expert John Isige stated that although the basic market pattern has actually been sideways, “[BCH] is turning bullish amidst broadening volatility.” Isige highlights that BCH markets have actually been regularly settling above the moving averages.

“The RSI and the MACD recommends that the sideways trading might last through the next sessions on Monday,” Isige’s analysis recommended. “However, a break above the 23.6% Fib level taken in between the last swing high of $308.13 to a swing low of $198.61 will fire up the much-awaited rally above $250 and heading to $300.”

Venture Capitalist Mark Cuban ‘No Chance of BTC Becoming a Reliable Currency’

On December 10, Shark Tank star and owner of the National Basketball Association’s Dallas Mavericks, Mark Cuban, discussed that he doesn’t think BTC has a possibility to end up being a dependable currency. In an e-mail with writer Benjamin Pirus, Cuban informed the press reporter there is “no opportunity.” “Not since it can’t work technically, although there are difficulties, it could, however rather since it’s too tough to utilize, too simple to hack, method too simple to lose, too difficult to comprehend, too difficult to examine worth,” Cuban informed Pirus.

“It is a collectible. If you think about art or gold a practical steady monetary possession, then yes. It can be.” Despite Cuban’s viewpoint, since August 2019, the Dallas Mavericks accept BTC for payments for product and tickets.

Chinese Blockchain Fever Starts to Fade

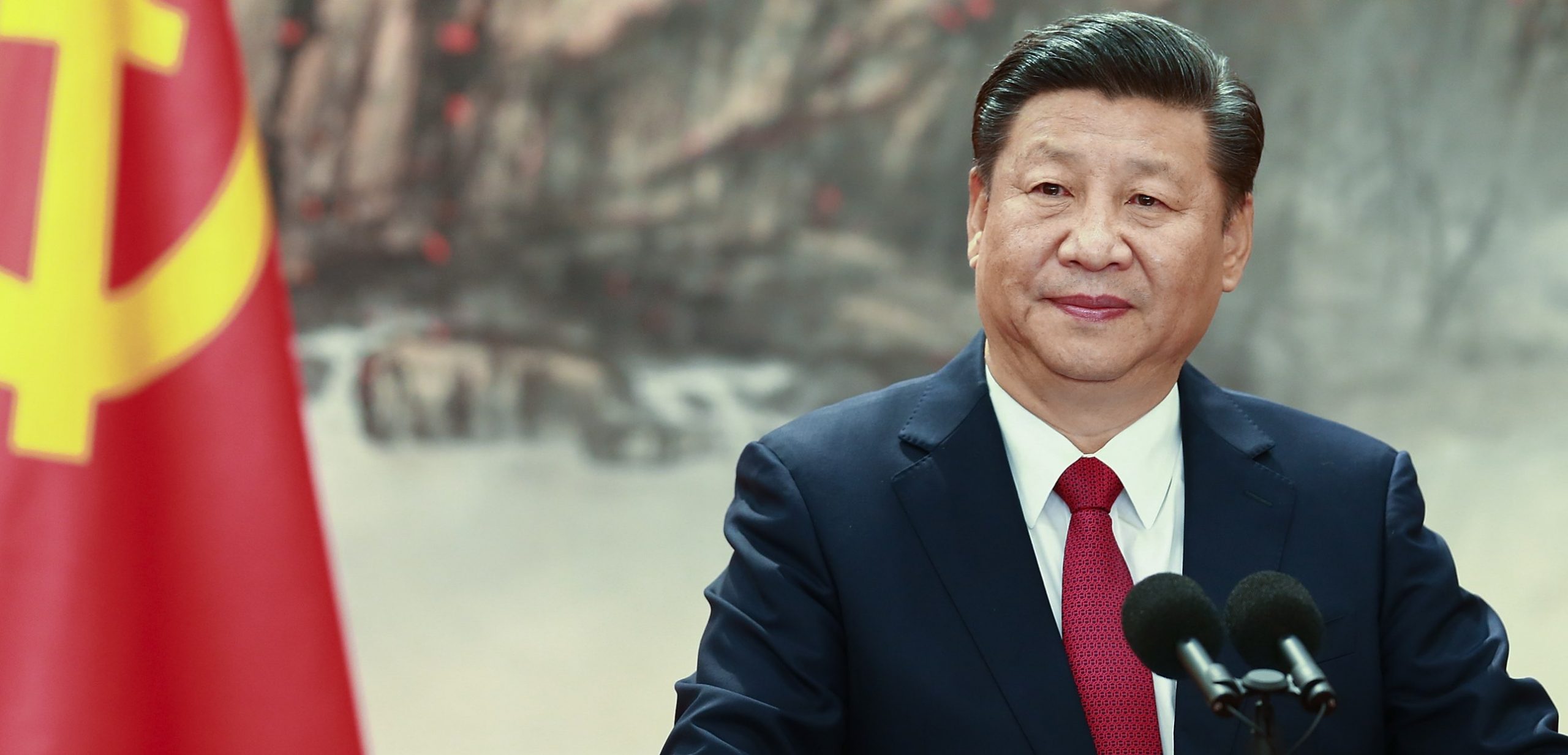

A couple of weeks earlier, crypto market observers believed that China’s President Xi Jinping pressed a great deal of optimism into crypto markets after true blessing blockchain innovation in October. Crypto costs did spike after the statement however rapidly went southbound about a week approximately later on. Crypto experts think President Xi Jinping’s blockchain talk was an incorrect favorable for crypto markets and digital possession costs have actually been gotten rid of from the buzz. “China’s firm positions on blockchain were at first a favorable chauffeur,” stated John Iadeluca the creator and CEO of multi-strategy fund Banz Capital on Monday. “[Regrettably] the Asian market apprehension increased when the state media clarified they didn’t mean cryptocurrency because position,” Iadeluca included.

Charles Schwab Says Bitcoin Trust a Top 5 Equity for Millennials

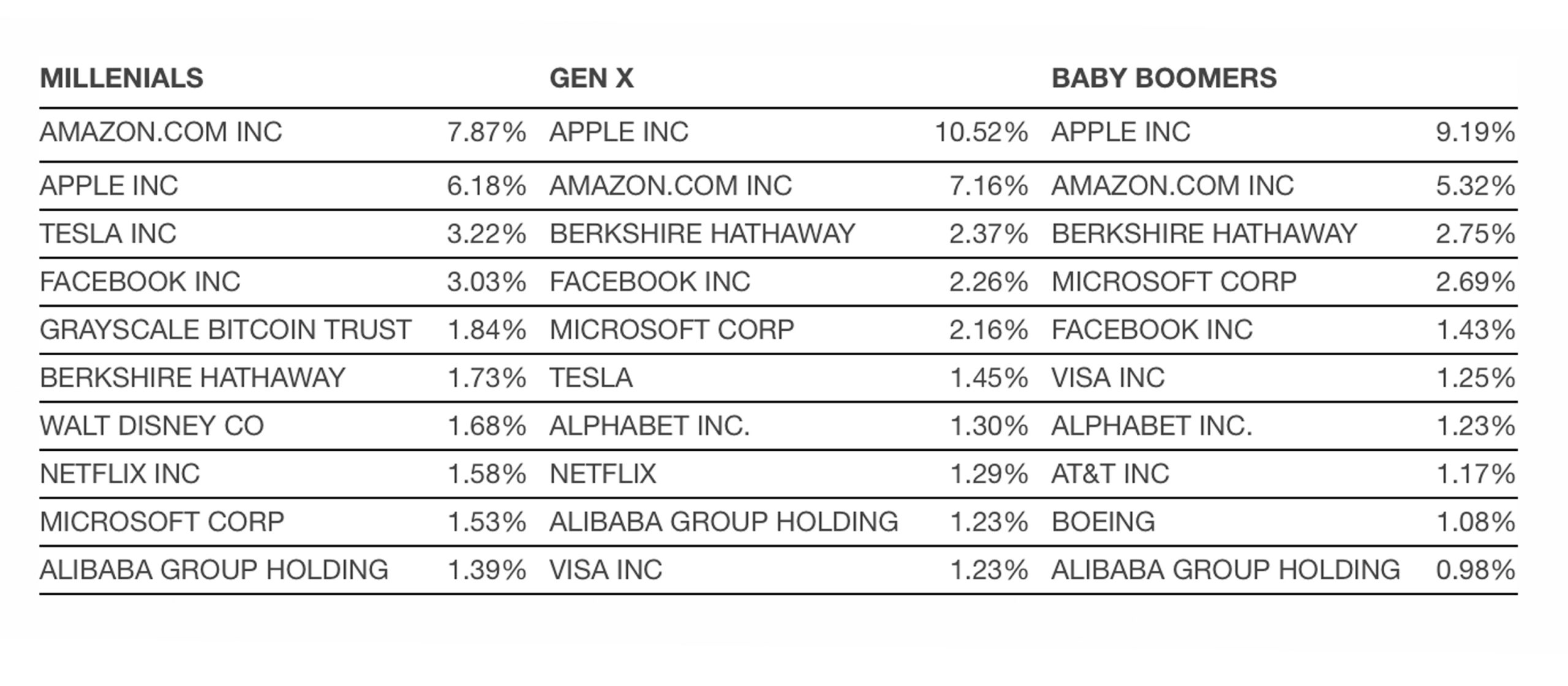

On December 4, U.S.-based stock brokerage Charles Schwab released a report that reveals the openly tradable bitcoin trust fund handled by Grayscale Investments is a leading 5 equity financial investment held by millennials. Grayscale’s Bitcoin Trust signs up with popular equity holdings like Facebook, Amazon, Tesla, Netflix, Microsoft, and Apple. “Millennials continued to designate more to ETFs (24%) than did Gen X (20%) and Baby Boomers (17%), and they also held more money (16%) than other generations (Gen X had 14% followed by Boomers at 12%).” The report reveals that Grayscale’s Bitcoin Trust was held by 1.84% of all the individuals Charles Schwab surveyed.

BTC/USD Long Positions Skyrocket

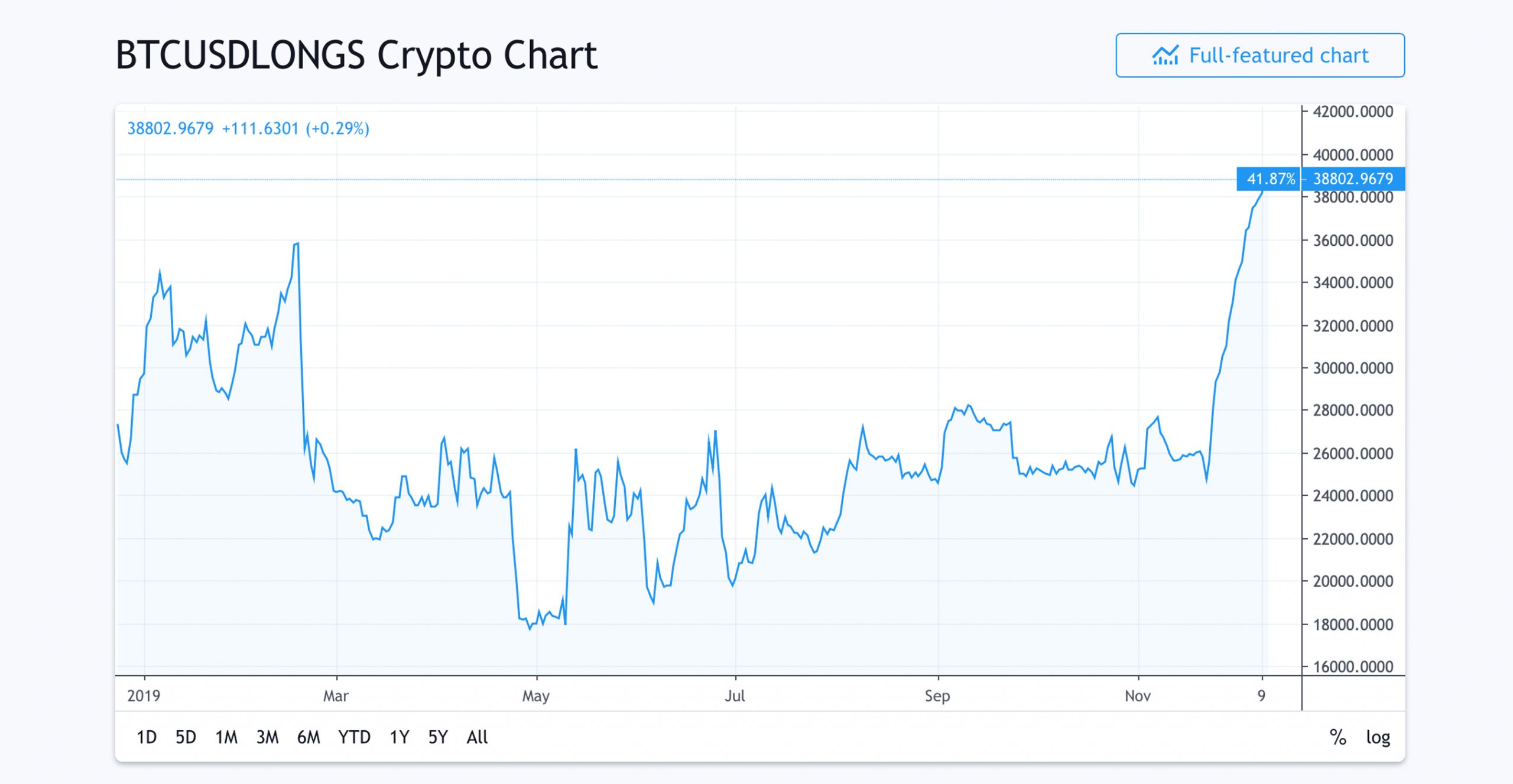

At the minute individuals are still unpredictable of what’s in shop for the cryptoconomy and market value. However, there are a great deal of traders who are long on BTC and BTC/USD long positions have actually escalated considering that November 22.

BTC/USD long positions taped from Bitfinex reveal a tremendous 38,802 longs signed up, while brief positions are low at 5,824 BTC/USD shorts at press time. ETH/USD long positions have actually been collecting steam considering that August however the increase is absolutely nothing compared to the long positions taped for BTC/USD in the last 3 weeks.

Where do you see the cryptocurrency markets heading from here? Let us understand what you consider this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.