Cryptocurrency markets fell hard on August 21 following the $700 rate drop bitcoin core (BTC) saw throughout the morning trading sessions. Most digital possessions have actually lost 2-8% in worth as the general market assessment of all 2,000+ coins has actually plunged to $263 billion. Crypto rate motions have actually been following a pattern of strong volatility, having actually been unstable for numerous weeks.

The Top Digital Currency Markets See Percentage Losses

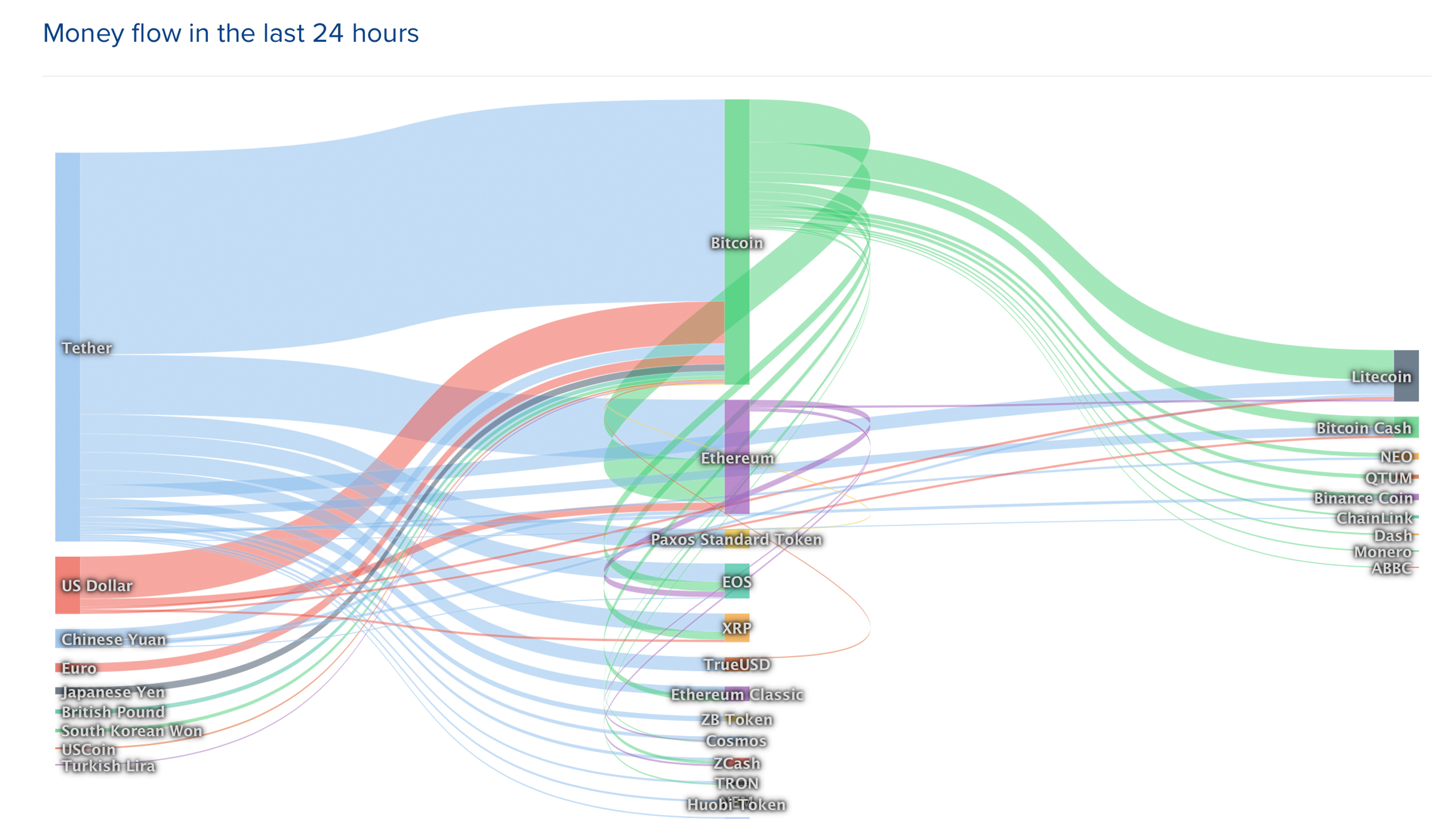

BTC and a variety of other digital possessions dropped substantially on Wednesday. At the time of publication, there’s been around $59 billion worth of everyday trades taking place in between the most popular coins. BTC holds the leading position and commands 69% of the $263 billion dollar market cap. At the minute, BTC is hovering at around $10,124 per coin and has a general market assessment of about $181 billion. The leading fiat currencies traded with BTC on Wednesday consist of JPY and USD and tether (USDT) catches more than 66% of all BTC trades. BTC has actually lost 5.8% over the last 24 hours and 2% in the last 7 days.

The 2nd greatest valued market cap comes from ethereum (ETH) where each coin is being switched for $185 per coin. ETH is down 5.8% today and there’s $7.4 billion in international ETH trades. Following ETH is ripple (XRP) which has actually seen the least volatility over the last couple of weeks. One XRP is trading for $0.26 and markets are down 3.3% today and 4.9% for the week. Lastly, litecoin (LTC) commands the fifth-largest assessment and each LTC is trading for $72. LTC has actually dropped just 3.5% today however lost more than 8% today.

Bitcoin Cash (BCH) Market Action

Bitcoin Cash (BCH) still holds the 4th position and each BCH is trading for $299. BCH has a general market cap of around $5.3 billion and about $1.39 billion in trade volumes. Today BCH is down more than 5% and over 8% over the last 7 days. Daily deals (txn) this Wednesday have actually been around 43,000 and BCH has had approximately about 40K txn every day considering that April. BCH is the 6th most traded digital possession on August 21, simply below EOS and above XRP. Tether (USDT) catches around 58% of all BCH trades which is followed by BTC (22.5%), USD (8.4%), ETH (6%), and KRW (2.5%).

The Verdict: Short-Term Crypto Sentiment Shows Extreme Fear While Long-Term Believers Are Still Cheerful

Despite the falling prices, traders and crypto lovers on social networks are still positive about digital currency markets and BTC prices. Popular Twitter trader Jacob Canfield states the charts appear like a “quite traditional increasing wedge that struck resistance.” “First assistance zone didn’t hold up rate at all — Ideal purchase zone $8900-$9100 if we can arrive,” Canfield concluded on Wednesday. Meanwhile, Mark Mobius, the creator of Mobius Capital Partners, informed the press today that cryptocurrencies like bitcoin are “psycho currencies.” “I call them psycho currencies since it’s a matter of faith whether you think in bitcoin or any of the other cyber-currencies,” Mobius described throughout an interview.

Meanwhile, conventional markets like stocks and bonds have actually been simply as unstable and some individuals think that institutional and retail financiers are hedging macro dangers with digital currencies. The Financial Times’ chief reporter Henny Sender composed a column for the Nikkei Asian Review which recommends reserve banks are pressing financiers towards cryptocurrencies. “Central banks drive need for bitcoin by cheapening their currencies,” the press reporter detailed. “Cryptocurrency, hugely popular in China, is now a safe-haven possession.” Sender’s editorial continued:

Central banks have actually played a huge function in driving this newest rally in crypto. That is since they have actually embraced policies which total up to competitive currency declines in the name of reflating their economies, in reaction to protectionist policies as the trade war results in slower development all over.

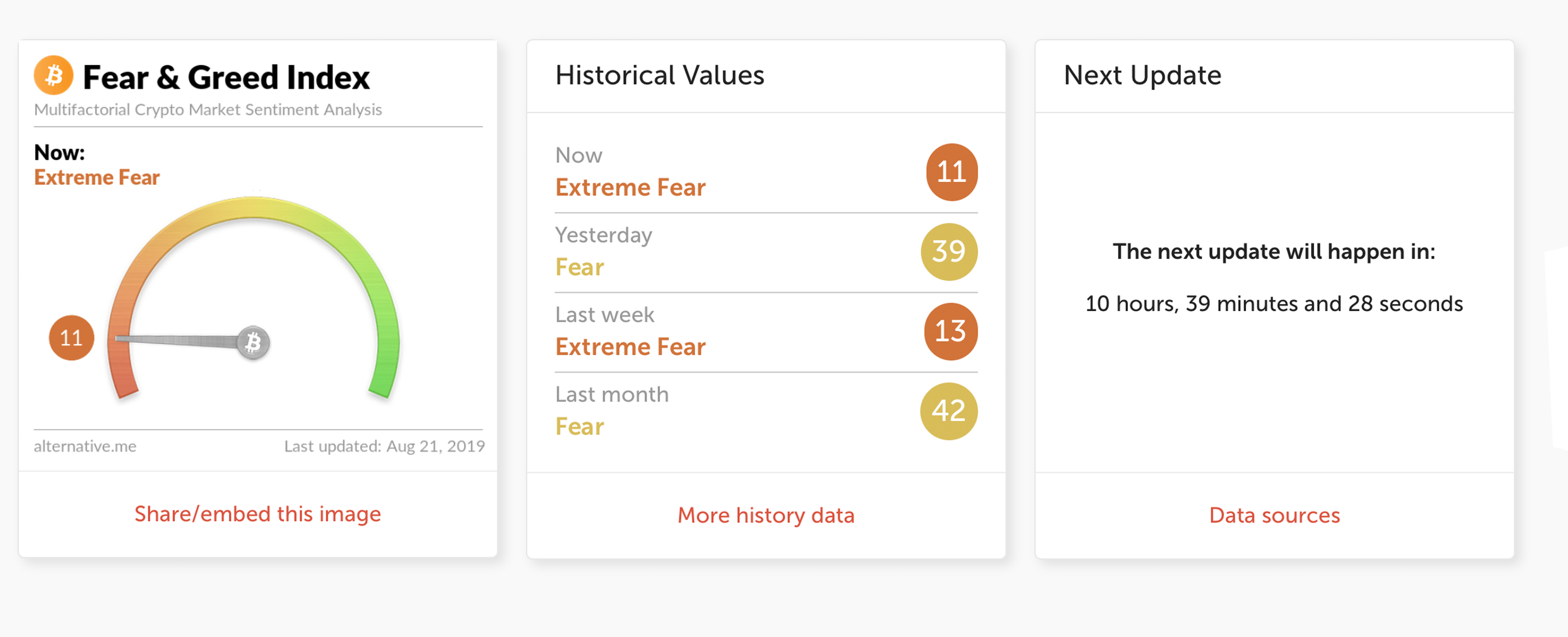

For now, BTC, ETH, BCH and the rest of the leading digital currencies are feeling the pressure of weak hands, day-trading scalpers, and short-sellers. Even with a a great deal of positive hopium huffers on crypto Twitter, individuals doubt of what will occur next according to sentiment information. The present Crypto Fear & Greed Index, which evaluates the feelings and beliefs from various sources and crunches them into one basic number, is low today. At press time, the Fear & Greed Index for BTC and other popular digital possessions rests at “severe fear” or #11. The index remained in “fear” (39) the other day, where it has actually invested the whole month.

Where do you see the rate of bitcoin money and the rest of the crypto markets heading from here? Let us understand what you think of this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.