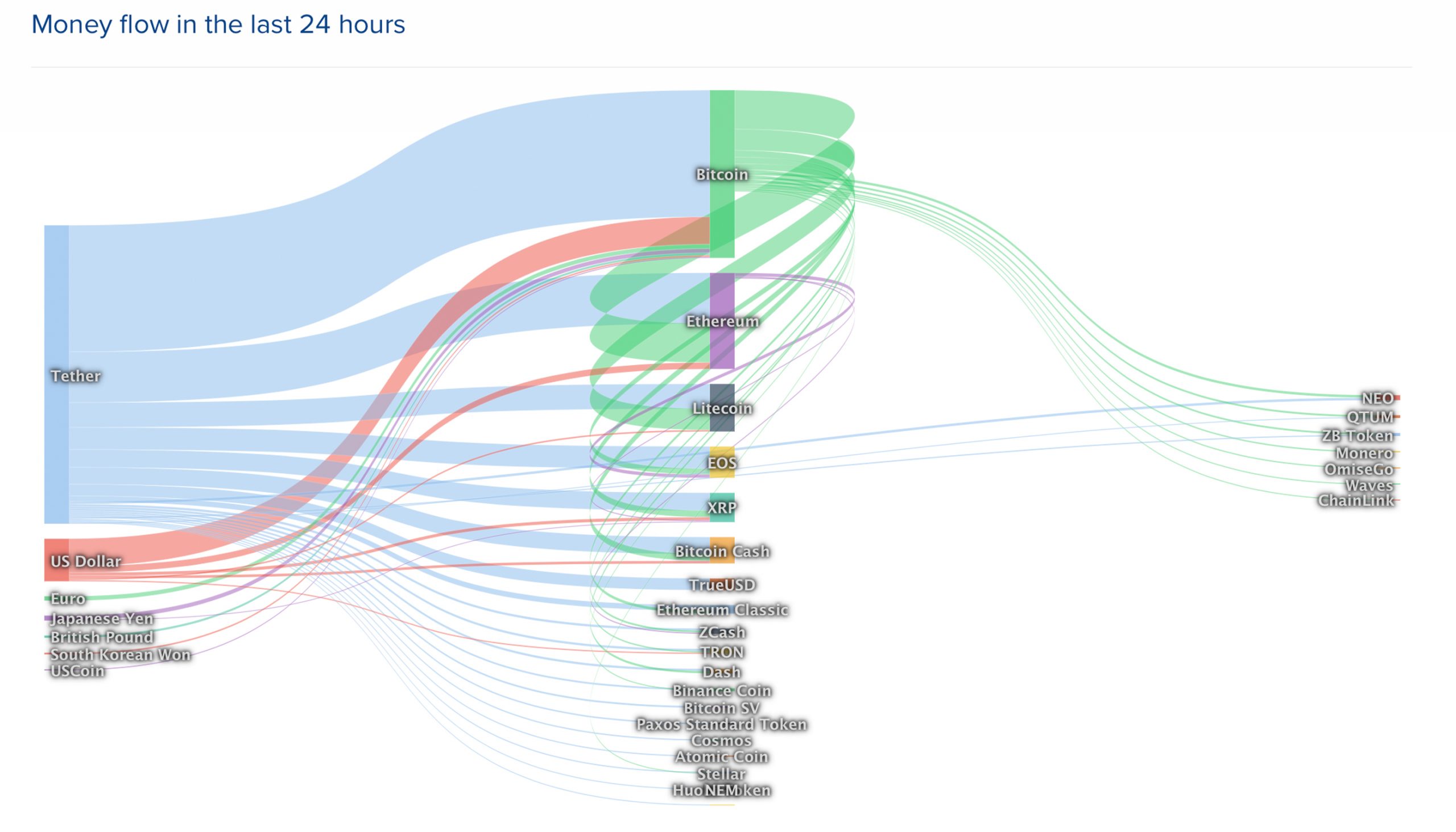

On January 6, digital currency markets saw good gains as the whole crypto market capitalization exceeded the $200 billion mark at 3: 50 p.m. EST. Since then most cryptocurrencies have actually checked heavy resistance and a multitude of possessions are being kept back. Moreover, crypto trade volumes have actually increased substantially and there’s been approximately $83 billion in digital possession swaps in the last day.

Also Read: Meet the Multi-Cryptocurrency PoS Device Eletropay

Top Cryptocurrencies Gain 5-10%

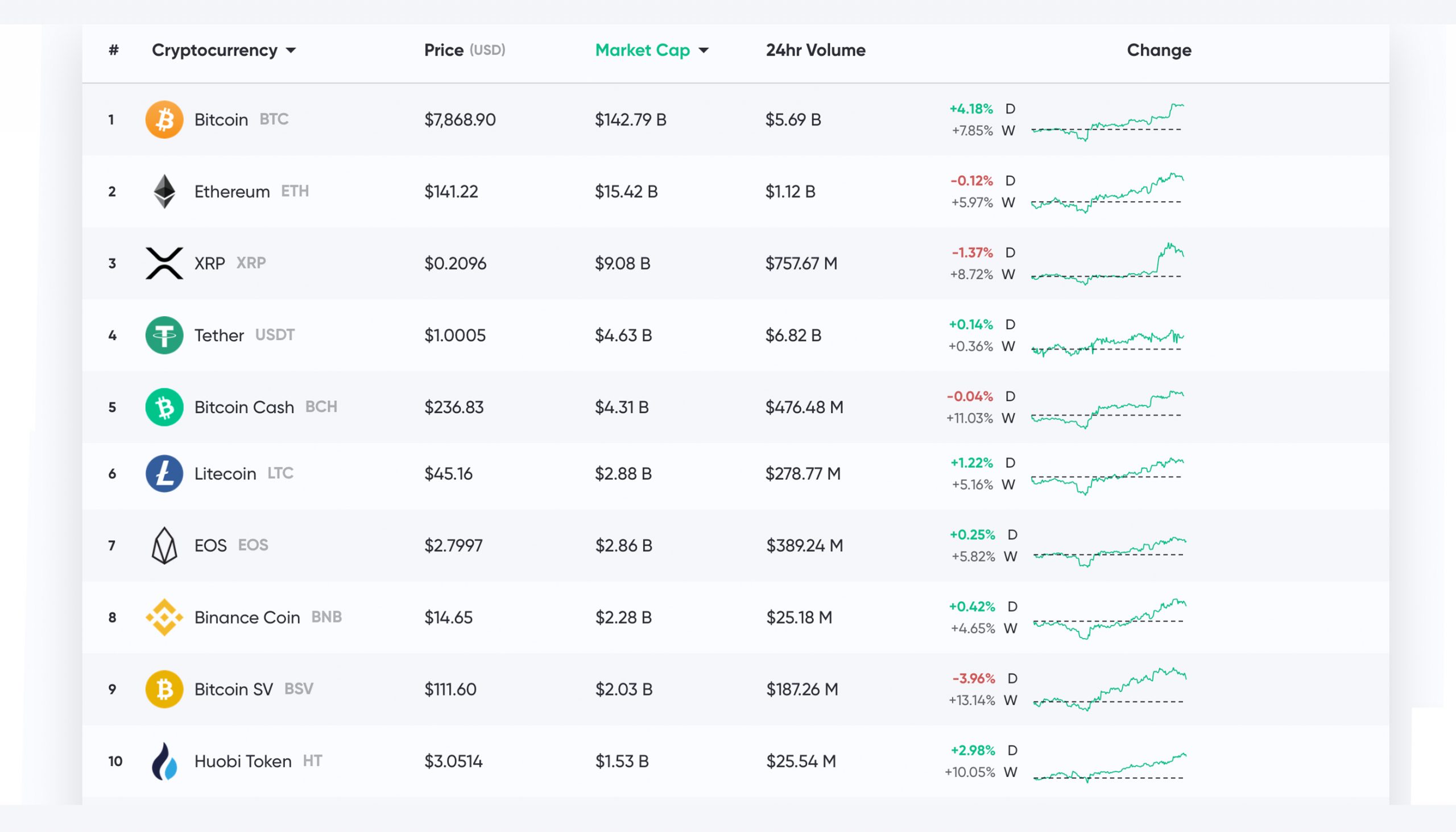

A variety of digital possessions on Monday saw significant spikes in fiat worth as BTC leapt from the $7,400 variety to the $7,900 zone in a matter of no time at all. Today most cryptos have actually lost a little portion of the worth they got the day previously as just 4 out of the top 10 coins are seeing portion gains on Tuesday early morning. At press time the total market appraisal of all 4,000+ cryptocurrencies is around $209 billion. BTC is catching 68% of the cryptoconomy with a $142 billion market cap. Currently, BTC is trading for $7,868 per coin and the crypto is up 4.1% today and 7.8% for the whole week. BTC neared the 100-day typical resistance on Monday and touched a high of $7,999 on Bitstamp prior to being pressed back.

ETH markets are down 0.12% on Tuesday as each coin is switching for $141. The cryptocurrency had a much better week, nevertheless, as ETH got 5.9% throughout the last 7 days. XRP is still tracking behind ETH’s coattails as each XRP is trading for $0.20. That’s approximately a loss of 1.3% throughout Tuesday’s early morning trading sessions however total XRP leapt 8% today. The stablecoin tether (USDT) holds the 4th biggest market cap today which is around $4.63 billion at the time of publication.

Bitcoin Cash (BCH) Market Action

Bitcoin money (BCH) markets had a great week as the decentralized crypto leapt 11% throughout the last 7 days. BCH is down a hair today at -0.04% and is trading for $236 per coin. The digital possession has a total market appraisal of around $4.3 billion on Tuesday and $2 billion worth of BCH trades were switched in the last 24 hours. Fxstreet expert Tanya Abrosimova described on Monday that BCH was the fastest-growing coin as far as portion gains are worried. However, she kept in mind that the “benefit might be restricted by a $240 manage” which ended up being the case late Monday night.

Just like BTC’s motions, just more powerful, for the very first time in months, BCH/USD costs checked the currency’s 100-day typical resistance. “From the long-lasting perspective, a sustainable relocation above SMA100 (Simple Moving Average) daily at $229.00 has actually enhanced the outlook for BCH/USD and brought $240.00 back into focus,” Abrosimova composed on January 6. “While this barrier stays unbroken, however as long as the rate stays above $230-299 location, we have a possibility for a retest of $240 and a prolonged healing towards $280.30 (SMA200 everyday),” the expert included.

Bitcoin and Iran

Over the last couple of days, there have actually been some rumors that the intensified chaos in between the U.S. and Iran is benefiting BTC’s current rate spike. After Iranian leader Qassem Soleimani was eliminated in a drone attack, BTC’s fiat worth leapt more than 8%. There’s a variety of individuals who think the theory and deVere Group’s creator Nigel Green states: “Bitcoin is measuring up to its track record as ‘digital gold.’” “We’ve seen Bitcoin rate rises prior to throughout times of increased geopolitical stress.”

Additionally, a couple of individuals had actually presumed that BTC was trading for $24,000 per BTC however Perennium.io creator Mehran Jalali described today that’s not the case. “The going market rate for the U.S. dollar to the Iranian rial is one dollar to 136,500 rials,” Jalali specified. “The existing bitcoin to rial rate published on Iranian crypto exchange sites is around one bitcoin to 984,000,000 rials, equivalent to $7,208 per bitcoin in Iran, which is really near the going rate all over else,” he included.

Extremely Optimistic Price Predictions in 2020 Continue

Despite the reality that throughout completion of 2019, digital currency and BTC costs saw substantial decreases, no matter the pattern, BTC rate forecasts continue. Last Friday, Antoni Trenchev, the cofounder of Nexo, informed Bloomberg that BTC will touch $50K by the year’s end. Trenchev declares the BTC story has actually altered a good deal. “The story, that is a lot more convincing is that bitcoin is the brand-new gold, and we see verification with the chaos that we have today. Bitcoin’s rally [is] on par with gold.”

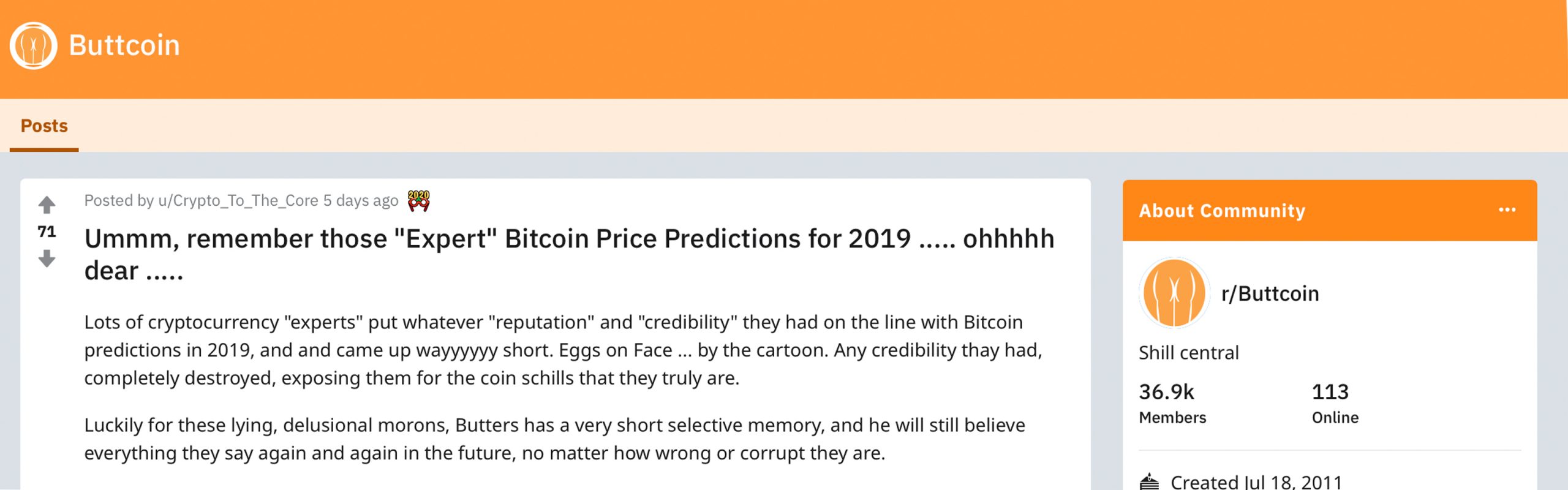

Although BTC rate forecasts from market influencers were the laughing matter of the Reddit online forum r/buttcoin today. The Reddit account u/Crypto_To_The_Core shared 26 ‘professional’ rate forecasts from 2019 that stopped working to emerge. For circumstances, Pantera Capital CEO Dan Morehead stated BTC would strike $20K and expert Ronnie Moas stated the rate would touch $28K by the year’s end.

Wyckoff’s Sign of Strength

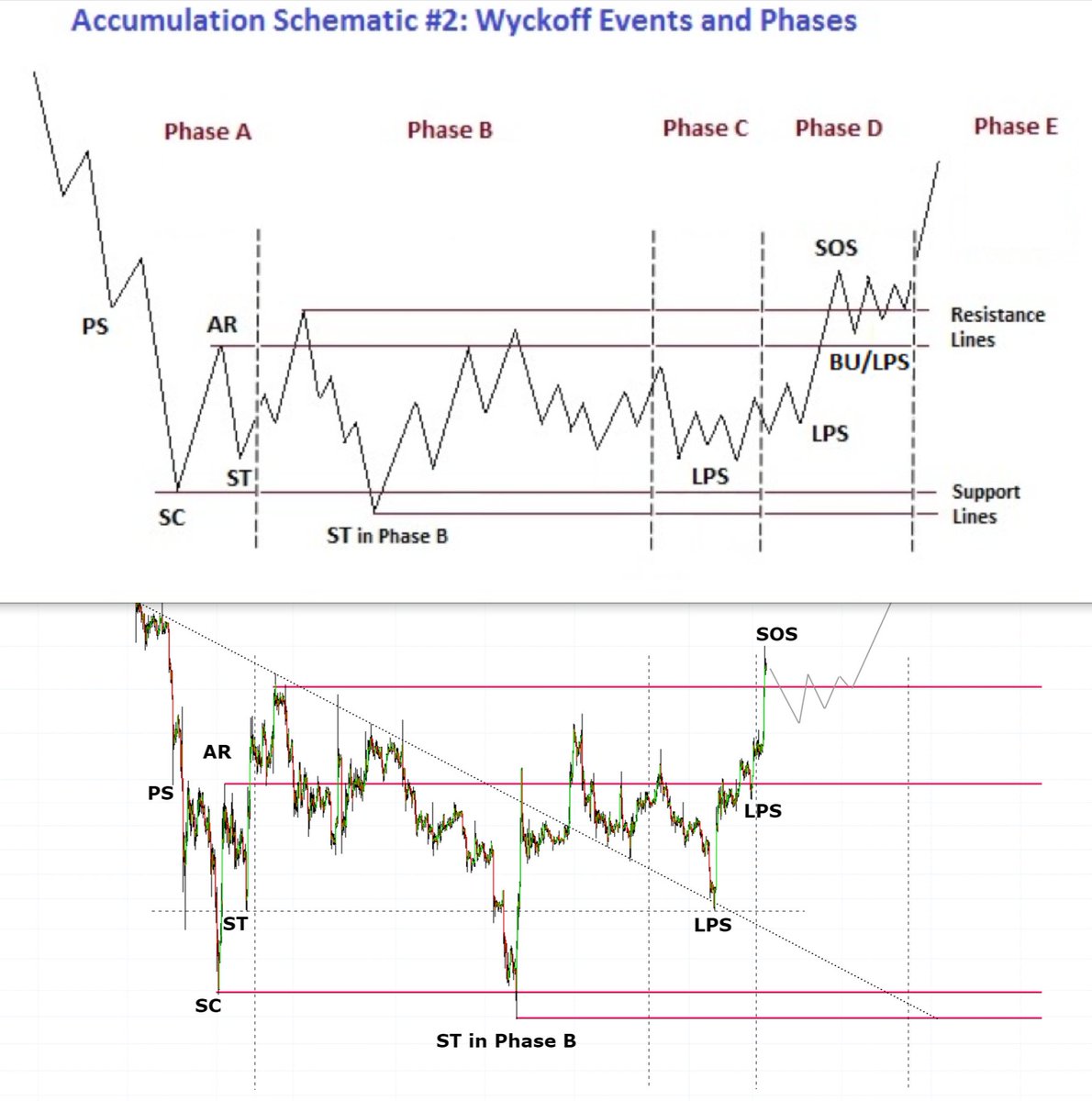

Former Goldman Sachs expert Murad Mahmudov shared a chart on Twitter on Tuesday that reveals BTC might be following a Wyckoff pattern. Wyckoff occasions or stages were developed by the well recognized stock trader Richard Wyckoff which reveal that possible relocations (tops, bottoms) out of the normal pattern can signify traders’ rate shifts.

Mahmudov’s chart reveals that BTC remains in an SOS (indication of strength) stage at the minute and the motion recommends a possible rate increase. Mahmudov didn’t discuss where he believes the rate will go from here however the Wyckoff chart shared has traders questioning if BTC will follow the pattern.

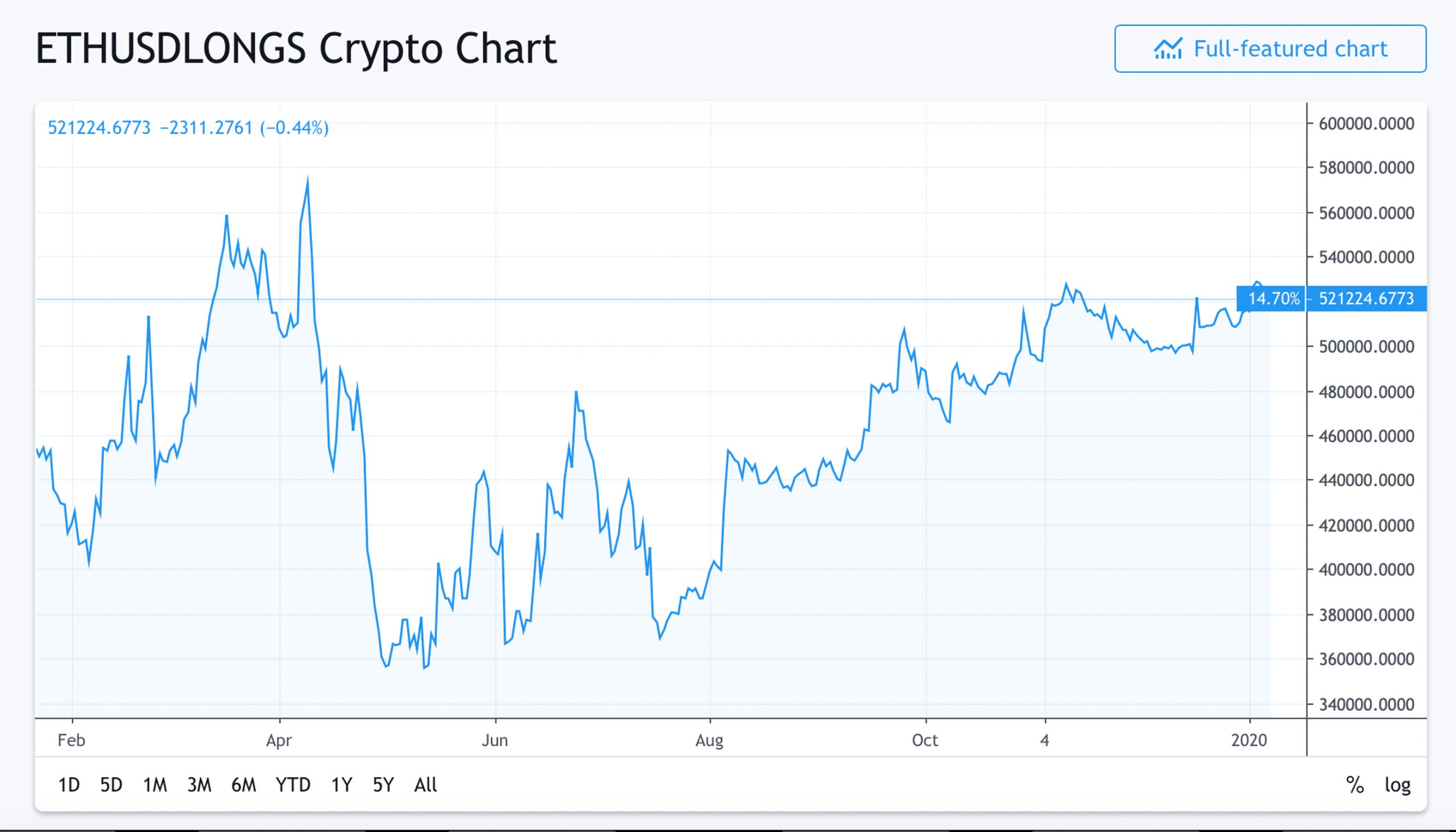

Overall digital currency costs are holding constant, well above the costs they were a couple of days earlier. This is credited to a decrease in BTC/USD long positions which touched an all-time high up on December 22. BTC/USD shorts are low and sanctuary’t collected much steam in the last 2 weeks. ETH/USD longs and shorts have actually been following a comparable pattern as ETH long positions are increasing greatly and ETH shorts are not being played much at all. The current digital currency rate spike has traders curious regarding which method the marketplaces will go next.

Where do you see the cryptocurrency markets heading from here? Let us understand what you consider this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.