Three days back, cryptocurrency markets were holding fundamental assistance after coins plunged 2-14% and the whole cryptoconomy dropped below $200 billion. Crypto costs continued to move in a bearish pattern, and over the last 12 hours, the whole market appraisal of all 3,000+ coins lost another $7 billion. However, after BTC dropped to a low of $6,529 per coin, digital currency markets got better, removing the majority of the losses caused throughout the early morning trading sessions.

Also Read: Gocrypto SLP Token Starts Trading on Bitscoins.web Exchange

BTC Markets Quickly Plunge Below $7K But Regain the Losses Hours Later

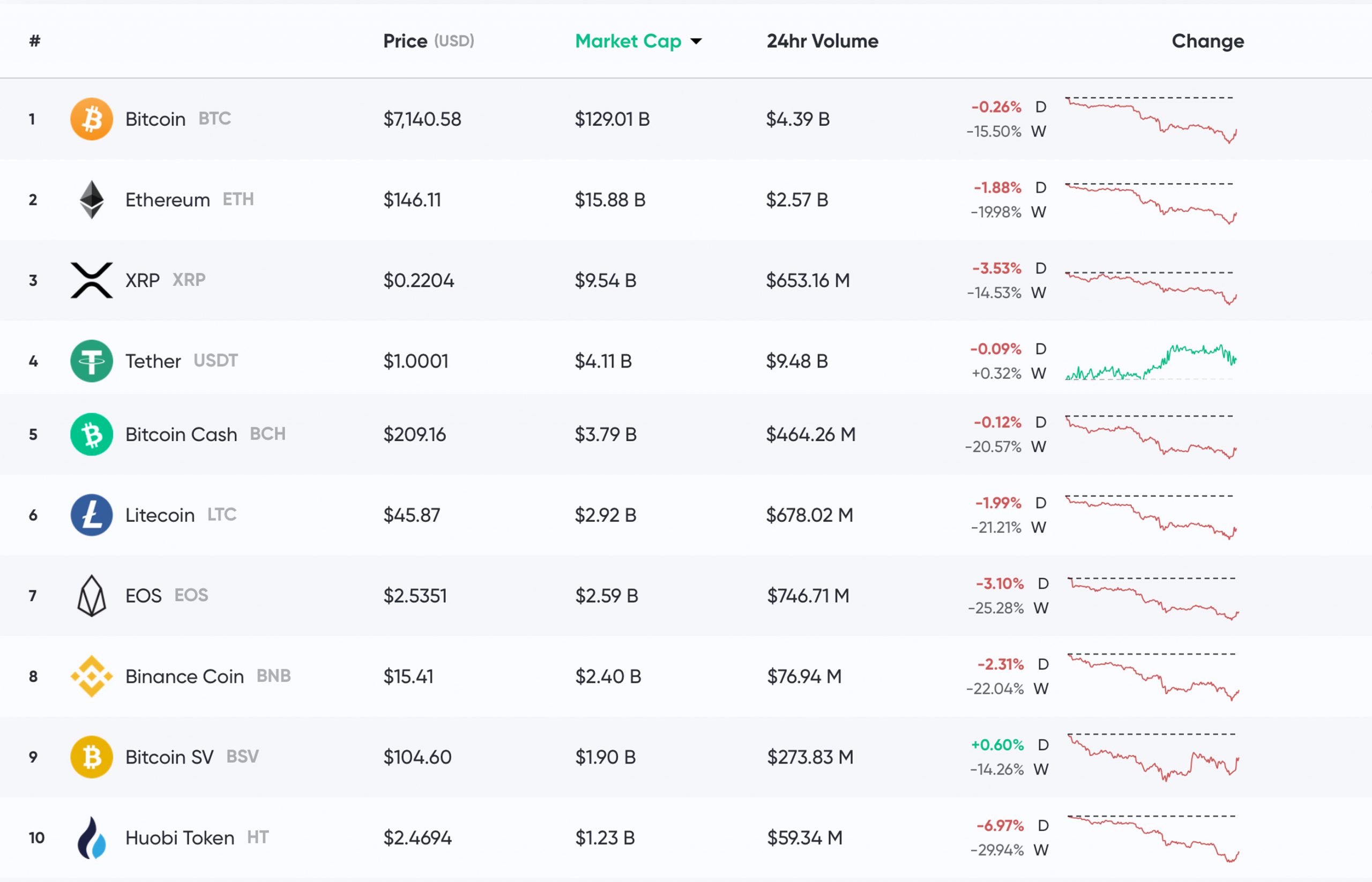

Typically after a couple of days of bearish belief, cryptocurrencies rebound, collecting back a few of the portion losses or removing them completely. That’s not the case this Monday as digital property worths have actually continued to move and today most coins are still down over the last 7 days. BTC markets dropped below the $7K zone, touching a low of $6,529 on Bitstamp throughout the very first hour of Monday early morning (EST). BTC’s area markets have around $4.39 billion in worldwide trades today while the general market cap is around $129 billion, with a supremacy of around 66%.

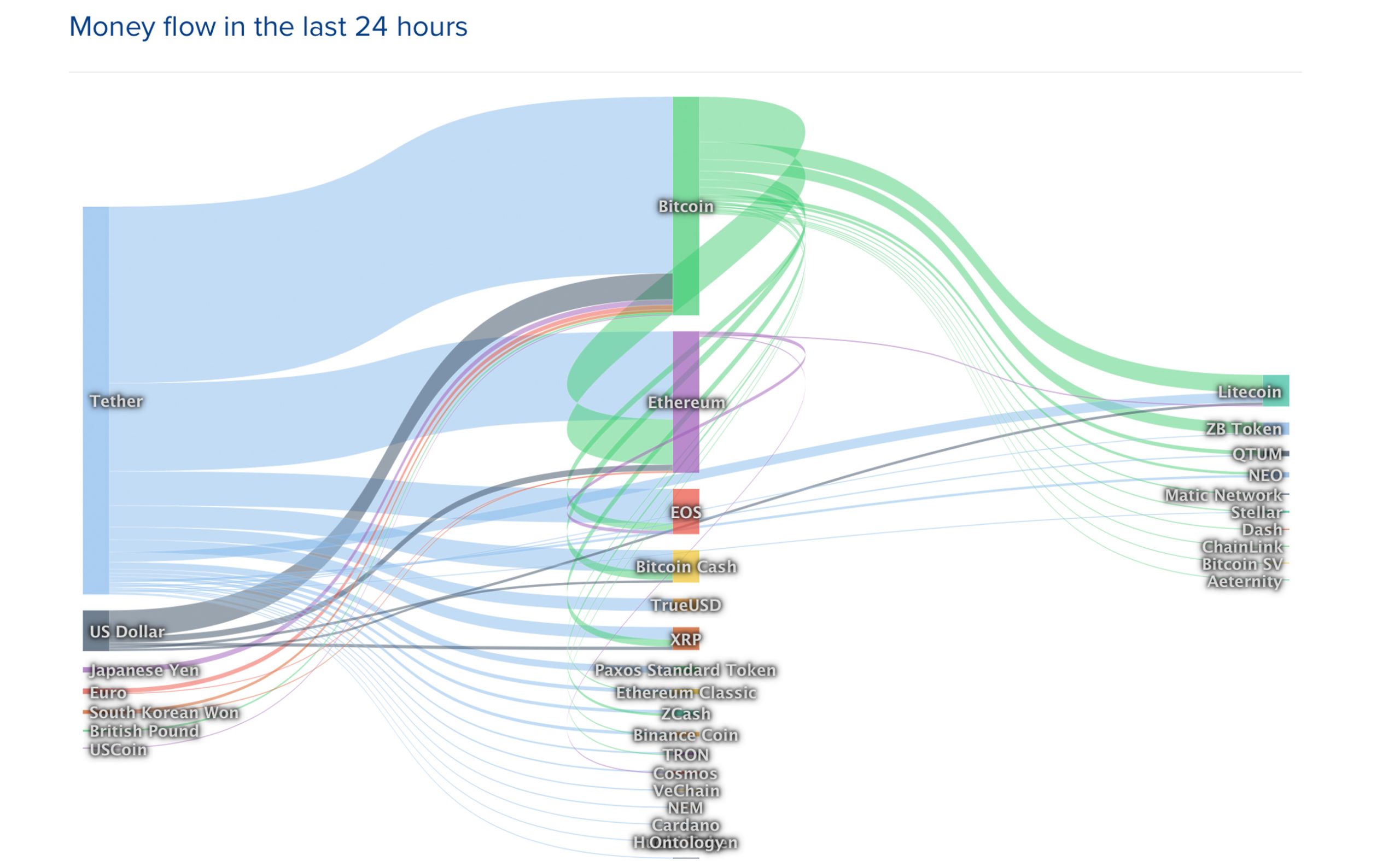

BTC has actually lost 0.26% in the last day and throughout the last 7 days the coin has actually shed 15.5% in worth. The leading couple with BTC consist of tether (75.59%), USD (8.89%), JPY (7.31%), QC (2.47%), EUR (1.78%), and KRW (1.62%). Behind BTC is ETH which still holds the 2nd biggest market cap as each coin is switching for $146. The cryptocurrency is down 1.8% today and ETH has also lost more than 19% for the week. Lastly, tether (USDT) holds the 4th biggest market position on November 25 and the stablecoin has a $4.11 billion dollar market appraisal. Again today, USDT is the most dominant stablecoin, catching more than two-thirds of the worldwide volume on Monday.

Bitcoin Cash (BCH) Market Action

Bitcoin money (BCH) has actually been cruising along, holding the 5th biggest market appraisal as each coin swaps for $209 today. BCH has a total market cap of around $3.79 billion and worldwide trade volume has to do with $760 million in 24-hour trades. The everyday portion is down today a hair at 0.03% and BCH has actually lost 20.5% throughout the course of the week. BCH is the seventh most traded coin on Monday simply below litecoin (LTC) and above tron (TRX).

At the time of publication, tether (USDT) records 67.2% of all BCH trades. This is followed by BTC (16.78%), USD (10.97%), KRW (2.47%), ETH (0.89%), EUR (0.63%), and JPY (0.49%) sets. BCH has some heavy resistance above the $250 variety, and presently the $200 zone still reveals good fundamental assistance. Despite the drop in rate, BCH miners have actually not capitulated as the BCH hashrate has actually stayed unharmed in between 2.6 to 3.2 exahash per 2nd (EH/s).

A Purge Before the Bull?

The last 2 weeks of moving cryptocurrency costs have everybody trying to anticipate which method the marketplaces will move moving forward. Speaking with the founding partner at Adamant Capital Tuur Demeester on Twitter, the trading veteran Peter Brandt thinks a huge drop in BTC costs will come prior to the next bull run. “Tuur, I believe an extended journey below the line may be required to completely prepare BTC for the relocate to $50,000,” Brandt wrote. “The bulls need to initially be totally purged. When no bulls can be discovered on Twitter, then we will have an excellent buy signal.”

Following Brandt’s forecast, Demeester replied: “Hey Peter, I believe that an extended purge moving forward is 100% a legitimate situation and one that financiers (including myself) need to mentally and tactically get ready for.” Brandt continued by anticipating his target rate and detailed: “My target of $5,500 is not far below today’s low. But I believe the surprise may be in the period and nature of the marketplace. I am thinking of a low in July 2020. That will break bulls quicker than a rate correction.”

Whale Sightings

While crypto costs like BTC have actually been dragging downwards, cryptocurrency lovers have actually been looking for whales. On Saturday, November 24, one whale moved 44,000 BTC ($314 million) in a single deal according to the Twitter account Whale Alert. For months now digital currency advocates have actually been keeping their eyes concentrated on whale motions. In July, observers seen multiple BTC movements above 40,000 BTC per deal. Then on September 5, the greatest whale motion in rather a long time saw 94,504 BTC relocation from an unidentified wallet to another unidentified wallet.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 44,000 #BTC (310,280,282 USD) moved from unidentified wallet to unidentified wallet

Tx: https://t.co/GgIfMr9eMy

— Whale Alert (@whale_alert) November 24, 2019

The 8-Day Plunge

Market experts have actually been observing BTC and crypto markets dropping every day throughout the recently. At 1 a.m. EST, BTC dropped to its six-month low, plunging to simply above $6,500 on worldwide exchanges on November 25. The chief expert at Markets.com, Neil Wilson, described that “the marketplace is so nontransparent if not totally impenetrable” at the minute. “But it does appear that the China optimism has actually gone and the marketplace has actually rolled over as an outcome. From a technical point of view we’ve burnt out crucial assistance on the 61% Fib level of the huge go up and now we might well see $5K soon ($5,400 is the next significant Fib line and the last line of defence). If that is reached then we want to $3K once again,” Wilson included.

Other experts think the marketplace is simply unsure at the minute since nobody has actually discovered a driver. “There does not seem a single trigger for the sell-off, however it does follow a duration of continuous market uncertainty and we are seeing financiers beginning to want to the year-end and closing positions which they are not sure about,” Marcus Swanepoel, the CEO of the UK-based cryptocurrency platform Luno, stated on Monday.

Long Positions Begin to Climb

Overall, cryptocurrency lovers and traders do appear unsure about the future of digital property markets in the short-term. Despite the 8-day recession, BTC/USD and ETH/USD shorts continue to collect steam prior to every huge drop. The shorts pattern has actually continued despite the fact that costs have actually been moving however BTC/USD long positions are gradually climbing up greater because November 22.

Right now lots of crypto traders are anticipating rate motions and some are just hoping they played their positions properly. The long term technical expert and trader Mr. Anderson on Twitter discussed the BTC/USD “Log-To-Linear Trend Line.” “BTC is attempting to argue at its direct dive off pattern line that started the booming market — As we can see she discarded upon losing the last log parabolic trendline and discarded directly to this direct pattern line — Let the fight continue,” Anderson remarked.

Where do you see the cryptocurrency markets heading from here? Let us understand what you think of this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.