Since our final markets replace 5 days in the past, loads has modified as a superb chunk of the high cryptocurrency markets have dipped in worth over the final three and a half days. Bitcoin money markets touched a excessive of $638 on Wednesday, Nov. 7, however now costs are hovering round $544 per BCH on Sunday, Nov. 11.

Digital Assets See Some Slight Losses Over the Last Three Days

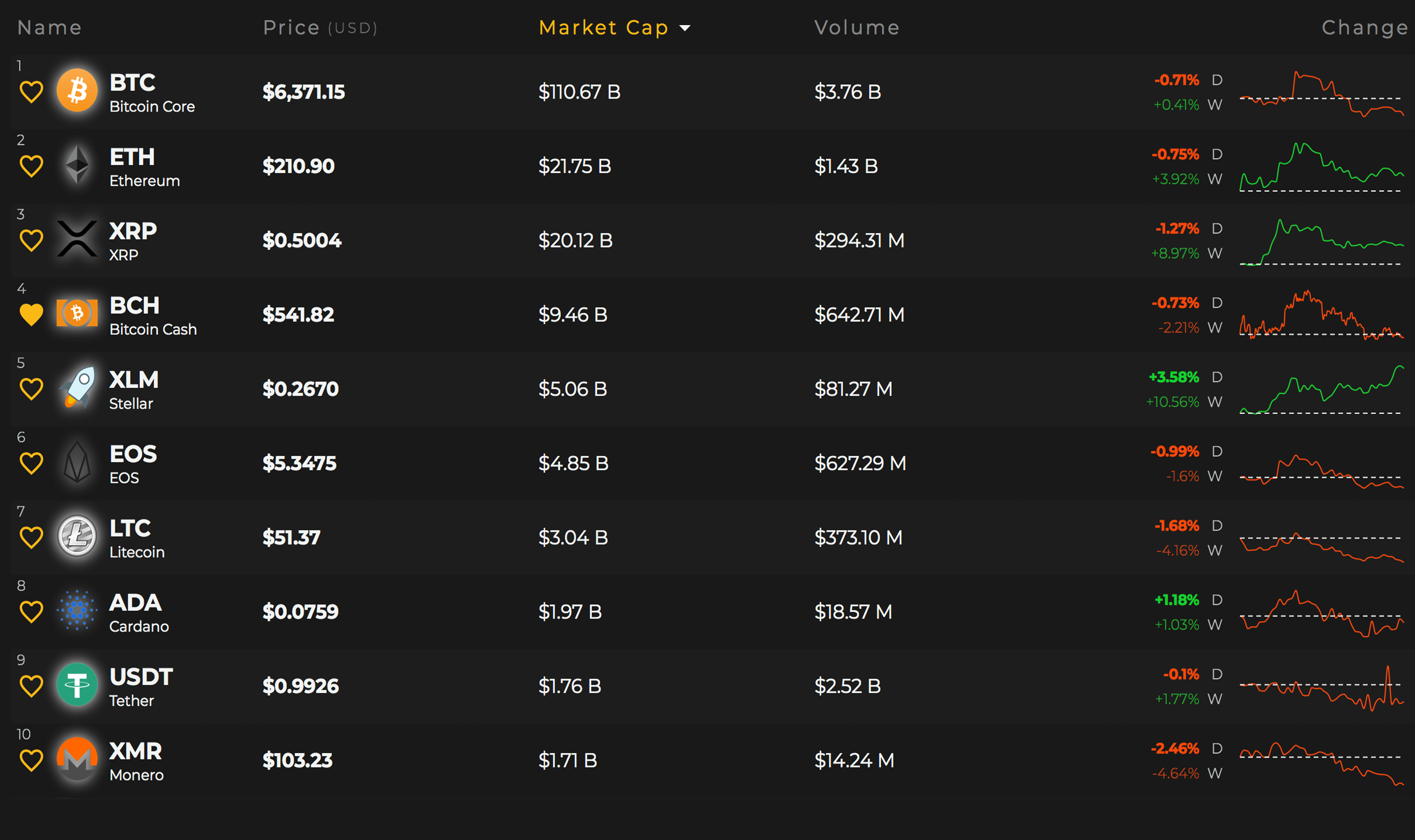

Cryptocurrency markets have had an fascinating week after a protracted interval of boring value motion and stability. Last week bitcoin money markets lead the pack out of all 2000+ digital property, climbing over 51% in worth and touching a excessive of $638 per coin. Digital asset markets, basically, have all seen some slight losses as the high ten cryptocurrencies are down 1-3% apart from stellar, cardano and the stablecoin tether. The complete market valuation of the complete crypto-economy is price $215.9 billion and there’s been $11.5 billion in world trades over the final 24 hours.

Bitcoin core (BTC) costs are hovering round $6,406 per coin and there’s round $3.7 billion in world BTC commerce quantity at this time. Following the BTC motion, ethereum (ETH) costs are round $211 per ETH and the cryptocurrency is down 0.3% this weekend. Ripple (XRP) is down 0.9% at this time and every XRP is being swapped for $0.50 per token. Lastly, eos (EOS) has been formally bumped out of the fifth largest market capitalization and stellar (XLM) has taken its place. Stellar is at the moment buying and selling for $0.26 per token and markets are up this Sunday 4.5%.

Bitcoin Cash (BCH) Market Action

The fourth largest market capitalization held by bitcoin money (BCH) is down 0.5% over the final 24 hours. Data stemming from the final seven days exhibits BCH is down 1.7% total for the week. Currently, BCH is buying and selling at a mean of $544 per coin with a market valuation of about $9.Four billion. The final 24 hours of commerce quantity exhibits BCH markets swapped $641 million this weekend. The high exchanges swapping the most BCH at this time embrace Lbank, Okex, Hitbtc, Binance, and Huobi Pro. The buying and selling pairs at this time dominating BCH markets embrace USDT (35.2%), BTC (35%), ETH (10.2%), USD (7.7%), and KRW (3.1%).

The fourth largest market capitalization held by bitcoin money (BCH) is down 0.5% over the final 24 hours. Data stemming from the final seven days exhibits BCH is down 1.7% total for the week. Currently, BCH is buying and selling at a mean of $544 per coin with a market valuation of about $9.Four billion. The final 24 hours of commerce quantity exhibits BCH markets swapped $641 million this weekend. The high exchanges swapping the most BCH at this time embrace Lbank, Okex, Hitbtc, Binance, and Huobi Pro. The buying and selling pairs at this time dominating BCH markets embrace USDT (35.2%), BTC (35%), ETH (10.2%), USD (7.7%), and KRW (3.1%).

BCH/USD Technical Indicators

Looking at the 4-hour charts for BCH/USD on each Bitfinex and Bitstamp exhibits BCH bears could also be feeling some exhaustion in the quick time period going ahead. Currently, there appears like a development shift is in the playing cards as the 100 Simple Moving Average (SMA) has crossed above the long-term 200 SMA. This indication is optimistic for the bulls as the path in direction of the least resistance is actually the upside. The Relative Strength Index (RSI) exhibits issues are meandering in the center (-44.02) however positively nearer to oversold areas.

The stochastic oscillator signifies an identical studying and the MACd also exhibits there’s at the moment room for enchancment going ahead. Order books present an identical forecast too as bulls must muster sufficient power previous the $566 area to realize much more momentum, and there might be one other pitstop at the $600 zone. On the bottom, there may be loads of foundational help at the time of publication between the present vantage level and $495.

The Verdict: Traders Assume the Pending Fork Will Affect Markets Before, During, and After the Fork

Most merchants appear optimistic that the value of BCH will development larger as the fork approaches attributable to the recollections of prior forks in the previous. The 100-day common exhibits there may be numerous room for enchancment over the subsequent 4 days. Furthermore, BCH/USD quick positions are at an all-time excessive this weekend which suggests a superb majority of merchants are betting in opposition to an increase.

However, others consider that these merchants are setting themselves up for a “big squeeze” and count on costs to spike unexpectedly. With the fork approaching and particularly the contentious nature surrounding it, it can probably drive markets in sure instructions earlier than, throughout, and after the community modifications. Per ordinary in crypto-land, bitcoin merchants predict the surprising to happen subsequent week and most are simply crossing their fingers hoping they selected their positions accurately.

Where do you see the value of bitcoin money and different cash headed from right here? Let us know in the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.