Bitcoin has established a new all-time high, with prices quickly surging past the $6000 USD resistance area. The sharp 5% move has set a new record high of $6,345 USD at Bitcoinwisdom, and $6,316.9 USD on Bitstamp. At the time of this writing the price is hovering between approximately $6,100 USD and $6,200 USD.

Bitcoin Set New All-Time High

The rally appears to have been triggered by bitcoin breaking out of the immediate ascending triangle on the 2-hour chart.

The rally once again confirms that the bitcoin markets are able to continue to set new price records despite the diminished role of the Chinese markets that once represented over 90% of all trading volume. The price is currently consolidating around the 1.0 Fibonacci extension from bitcoin’s previous major rally and retracement on the daily chart.

The breakout coincides with the stochastic relative strength indicator (RSI) breaking above the 20 threshold when looking at the daily charts.

When looking at the weekly charts, the stochastic RSI has crossed above the 80 threshold for the first time since May of this year – when bitcoin broke above of the $1300 USD resistance area, before quickly doubling in price and setting highs of almost $3000 USD.

The Total Market Capitalization of Bitcoin Is $102.7 Billion USD at the Time of This Writing

The total market capitalization of all cryptocurrencies is approximately $179 billion USD, up approximately 3% from the 21st of October, signaling slightly renewed strength in the altcoin markets. Bitcoin market dominance sits at approximately 57.3% as of this writing – down almost 2% from the 21st of October.

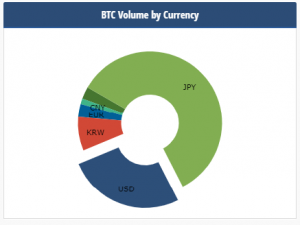

The Japanese markets have further consolidated as the dominant source of bitcoin trading, with JPY/BTC trade currently accounting for approximately 59% of 24-hour trading volume as of this writing. USD/BTC trade accounts for approximately 27%, and South Korean trade roughly 8.3%. Chinese trade volume is only slightly larger than Euro trade presently, with CNY/BTC trade accounting for 1.35% of 24-hour bitcoin trade, and EUR/BTC accounting for 1.29%.

The Immediate Outlook for Bitcoin

The bitcoin markets are signaling bullishness for immediate future, as prices are currently  consolidating above the prior all-time high, and weekly stochastic RSI has penetrated above the 80 threshold for the first time since bitcoin broke out of the $1300 USD area. The price, however, is yet to break out of the ascending bull channel that bitcoin’s price trajectory has been in for months several months now, suggesting that a breakdown below the channel could comprise the technical catalyst for a potential washout. Transversely, a break above the channel could signal the technical catalyst for a major parabolic move into new all-time highs.

consolidating above the prior all-time high, and weekly stochastic RSI has penetrated above the 80 threshold for the first time since bitcoin broke out of the $1300 USD area. The price, however, is yet to break out of the ascending bull channel that bitcoin’s price trajectory has been in for months several months now, suggesting that a breakdown below the channel could comprise the technical catalyst for a potential washout. Transversely, a break above the channel could signal the technical catalyst for a major parabolic move into new all-time highs.

Despite the apparent short-term bullishness, the upcoming Segwit2x still has some traders cautious regarding the medium-term outlook for bitcoin, however, others are predicting that the allure of free tokens will drive a spike in buying pressure leading up to the fork.

What do you think the price of a single bitcoin will be when the Segwit2x fork takes place? Share your thoughts in the comments section below!

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.