The BTC markets have rallied to check resistance at the $10,000 space. Despite gaining 60% in simply 4 weeks, BTC’s current beneficial properties have been considerably overshadowed by these produced by many prime performing cryptocurrency markets, together with Bitcoin Cash – which has gained greater than 225% because it’s early April lows.

Also Read: Markets Update: BCH Prices See Uncorrelated Movement Gain 13%

BTC Markets Produce Four Consecutive Green Weekly Candles

The value of BTC has continued to make constant beneficial properties, bouncing by virtually 60% from the current low of roughly $6,400 to the present costs of $9,600. When measuring the bounce in relation to the bear development of early-2018, we are able to see that the worth of BTC seems to be attempting to consolidate at the 0.236% retracement space.

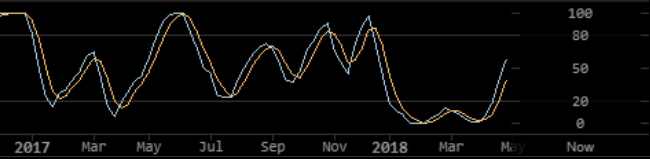

The current value motion has seen BTC get away of its massive descending triangle formation, after establishing an extra level of contact with a long-term ascending triangle. The bounce has also pushed the weekly stochastic RSI to interrupt above the 20 threshold for the primary time since July 2017. During April, BTC produced 4 consecutive inexperienced weekly candles for the primary time since December 2017. This obvious shift in momentum has been interpreted by many as a sign that the current restoration is probably not over.

The bullish value motion for bitcoin comes amid renewed curiosity amongst institutional traders, with Goldman Sachs indicating that they may launch bitcoin futures contracts in coming weeks, and the founding father of Meitu, Cai Wensheng, saying that he gathered 10,000 bitcoins throughout the bear development of early 2018.

BTC Resistance at $10,000 Holds Strong, For Now

Whilst longer-term value motion seems to counsel extra bullish momentum could also be seemingly, quick value motion on the day by day charts seems to be signaling {that a} retracement could also be overdue.

When trying at the day by day chart, the worth of bitcoin fell below its quick ascending trendline and has consolidated in a considerably sideways trajectory in current days. The current value motion which has seen resistance at $10,000 maintain also seems to have produced a failed take a look at of the underside of the aforementioned damaged trendline.

Should the quick ascending trendline on the 4-hourly chart fail to carry up, we might even see a extra important retrace from present value ranges.

BCH and Altcoin Markets Gain Over BTC

Despite the spectacular efficiency of BTC throughout current weeks, its beneficial properties have been dwarfed by these of many different markets, notably Bitcoin Cash (BCH).

When measuring from the lows of early April, BCH has gained by over 225%. With costs at present hovering at roughly $1700’s, BCH has made beneficial properties of roughly 14.5% within the final 24 hours alone – making Bitcoin Cash the strongest gaining market of the 60 largest cryptocurrencies by market capitalization.

When measuring the bounce in relation to Bitcoin Cash’s virtually 85% drop from its all-time excessive of $4,000, BCH seems to be gearing up for a take a look at of the 0.382% fibonacci retracement space of roughly $2,000.

When paired in opposition to BTC, the native value excessive of roughly 0.1875 with the 0.5% retracement space when measuring December’s highs, BCH at present boasts the fourth largest market cap with virtually $30 billion.

ETH Retains Second Largest Market Capitalization

Ethereum has also made spectacular beneficial properties over the last month, rising in worth by virtually 150% from its early-April low. Ethereum’s market cap has retained a powerful lead over all different various cryptocurrency markets – at present at over $82 billion. As of this writing, the worth of ETH is roughly $780.

After testing assist at the low $300’s, ETH has since made a strong restoration – with the present value of roughly $825 sitting between the 0.326% and the 0.5% fibonacci retracement areas.

When paired in opposition to BTC, one can establish the early-April low of roughly 0.05 as comprising the institution of assist at the roughly 0.236% retracement space. When measuring the crash from the June 2017 all-time excessive of roughly 0.15 BTC to the mid-July low of 0.025, the present costs of 0.081 seem like approaching a take a look at of the 0.5% fibonacci retracement space. When measuring from the 2017 excessive of roughly 0.12 to early-April low, present costs seem like sitting simply above the 0.326% retracement space.

Eos Among Highest Gaining of Top Cryptocurrencies by Market Cap

Eos has rallied to provide among the many highest beneficial properties of all main cryptocurrency markets in current months. During mid-March, Eos produced a 75% bounce off its native low of roughly $Four to check resistance at $7 in below per week. Moving into April, the worth of Eos consolidated across the $6 space, earlier than making regular beneficial properties via the month to interrupt into new all-time highs at the tip of April. After establishing new report highs above $22, Eos has since retraced 25%, with costs at present hovering at roughly $16.60. At present costs, Eos has produced beneficial properties of over 175% because the April breakout, and over 300% because the March low of roughly $4. When operating a fibonacci extension from the October 2017, to January 2018’s now-former report highs, and again to the native low of March 2018, we are able to see that the Eos markets have retraced from the 1.0% extension.

According to coinmarketcap, Eos is now the fifth largest cryptocurrency by market capitalization – boasting a complete capitalization of over $14.5 billion.

Other Leading Markets Gain Over 100% In Four Weeks

The respective seventh, eighth, and ninth largest cryptocurrency markets by capitalization, Cardano, Stellar, and IOTA, also produced beneficial properties of over 1000% from early April’s lows.

Cardano at present boasts a market capitalization of practically $9.5 billion, after having bounced practically 150% from an early-April low of roughly $0.145 to at present commerce for practically $0.36. When measuring from Cardano’s all-time excessive of just about $1.40, the ADA markets are sitting simply below the 0.236% retracement space – indicating the potential for additional upside momentum, regardless of the appreciable beneficial properties already made.

Stellar has produced an roughly 125% bounce from its early-April low of simply below $0.19, with present costs buying and selling at virtually $0.43. Stellar seems to be making a small consolidatory retrace after rallying to check resistance at the 0.326% retracement space. As of this writing, Stellar’s market capitalization is nearly $eight billion.

Iota has gained 150% this previous month, bouncing from a neighborhood low of simply below $1 – with costs at present buying and selling at roughly $2.50. When measuring from Iota’s all-time excessive of over $5.50, IOT is at present making a small retrace from the 0.326% retracement space. The market capitalization of Iota is nearly $7 billion.

Do you suppose the cryptocurrency markets are overdue for a correction? Share your ideas within the comments part below!

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.