Cryptocurrencies dropped in worth the other day after the New York Attorney General’s court filings versus Bitfinex and Tether were released. Currently, the whole market capitalization is approximately $170 billion and most cryptocurrencies have actually lost 2-10% of their worth given that the statement.

NYAG Announcement Creates Crypto Market Uncertainties

On April 25, the New York Attorney General’s (NYAG) workplace released a court order that declared the cryptocurrency exchange Bitfinex lost $850 million and utilized Tether to cover the loss. NYAG Letitia James stated her department discovered inconsistencies and the moms and dad business of both Bitfinex and Tether “engaged in a cover-up to hide the apparent loss of $850 million of co-mingled client and corporate funds.” Bitfinex has actually reacted to the accusations specifying: “The New York Attorney General’s court filings were written in bad faith and are riddled with false assertions, including as to a purported $850 million “loss” at Crypto Capital.” Armchair sleuths also saw that 550 BTC ($1.6M) that were linked to the 2016 Bitfinex hack started moving right away after the NYAG filing.

Cryptos See Slight Recovery After the Losses

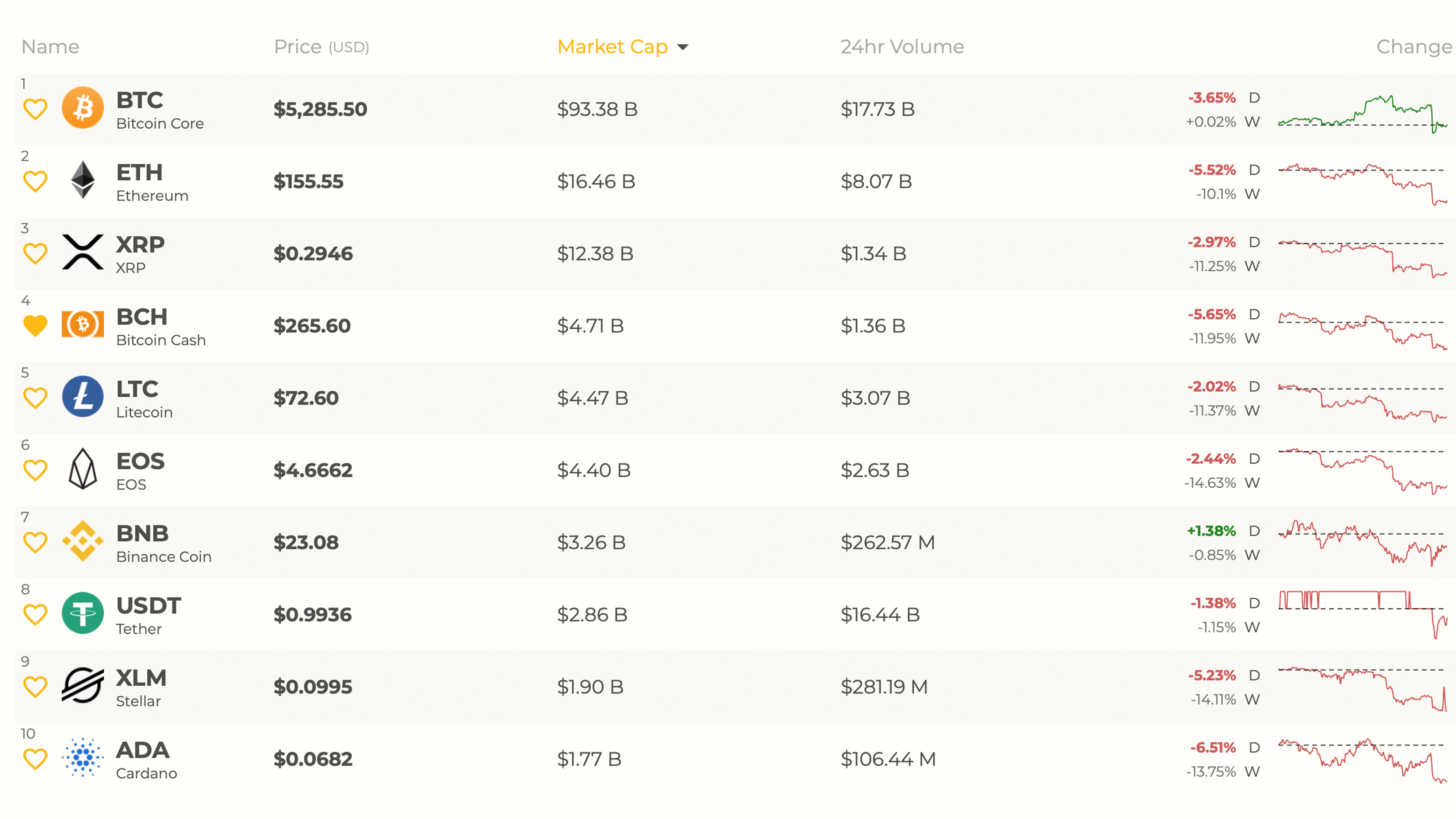

With all the controversy surrounding Bitfinex and Tether, the crypto market saw instant losses and bitcoin core (BTC) plunged to $5,005 per coin on Thursday. The whole community trembled for a couple of hours however numerous coins have actually gained back some momentum. Currently, bitcoin core (BTC) is trading for $5,285 however is down 3.6% in the last 24 hours.

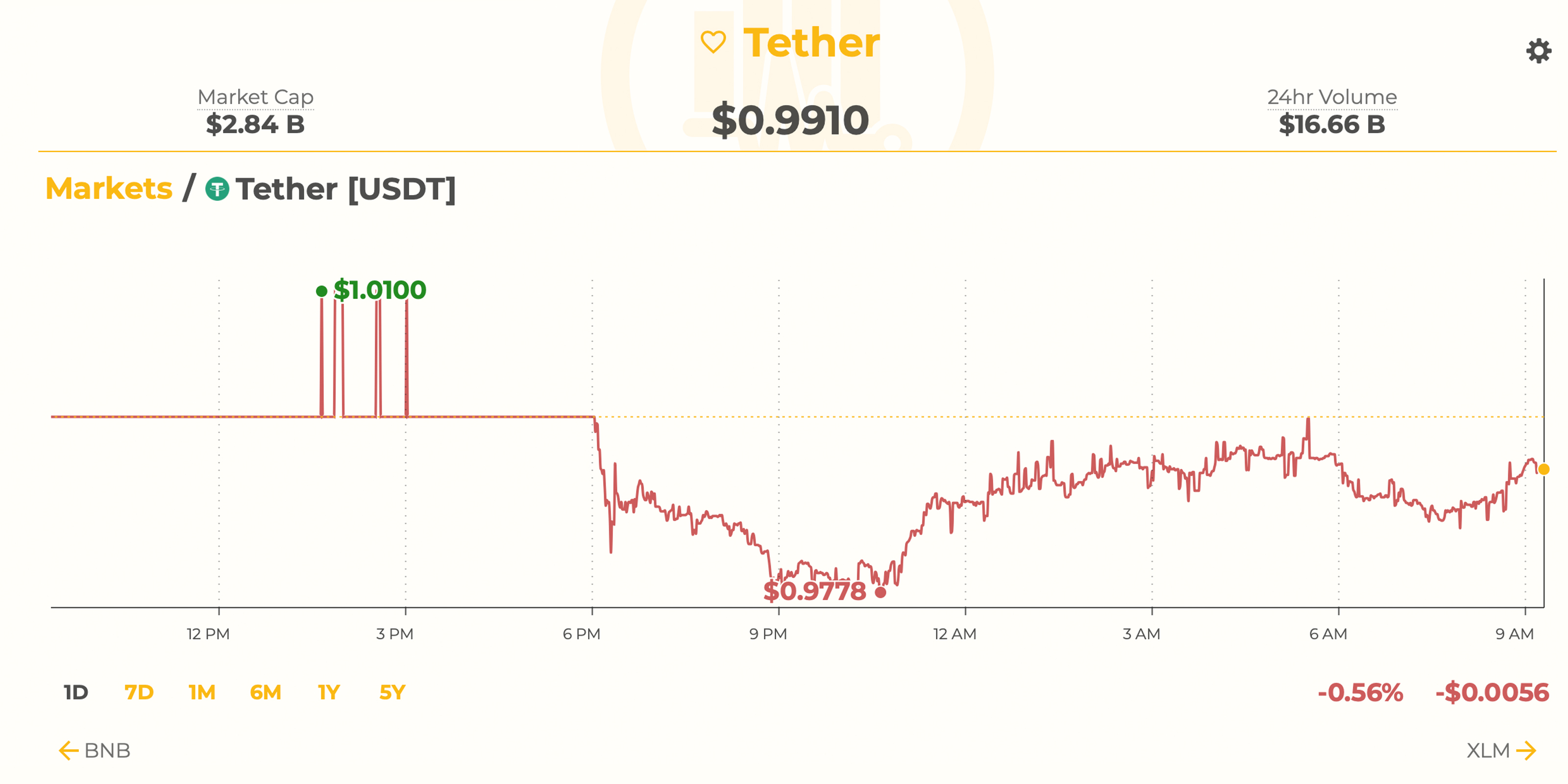

This is followed by ethereum (ETH) which is down 5.5% today and trading for $155 per ETH. The 3rd greatest market appraisal comes from ripple (XRP) and the digital possession has actually lost 2.9% over the last day and trades for $0.29. Lastly, the 5th greatest market litecoin (LTC) is down 2% this Friday and is trading for $72 per coin. At the time of publication, there’s approximately $57 billion in international trade volume in between all the coins in the cryptoconomy. On Thursday night, tether (USDT) dropped below its $1 peg and has actually remained in a downturn since the statement.

Bitcoin Cash (BCH) Market Action

The 4th greatest market capitalization comes from bitcoin money (BCH) which is down 5.6% this Friday. BCH is switching for $265 per coin and has a market appraisal of around $4.7 billion. Bitcoin money is the 6th most traded cryptocurrency by volume on April 26 above XRP and below EOS. Statistics also reveal that BCH has around $1.36 billion in international trade volume. The leading 5 trading platforms switching one of the most BCH are Coinebene, P2pb2b, Fcoin, Lbank, Bitmart, and Bitforex. The top currency couple with BCH is tether (USDT) which records 48.2% of trades. Tether’s set supremacy with BCH is followed by BTC (34%), USD (9%), KRW (4.2%), and the EUR (1.1%). Data also reveals that ETH, JPY, and the 2 stablecoins PAX and TUSD follow behind.

BCH/USD Technical Indicators

Looking at the BCH/USD everyday and 4-hour charts reveal that resistance has actually been constructed in the middle of the Bitfinex and Tether headings. Technical sign determines displayed program that oscillators are yelling oversold conditions while many moving averages show either unpredictability or strong positions to offer. Currently, the 2 Simple Moving Averages (SMA) seek to cross hairs as the 100 SMA is heading southbound. This suggests the course towards the least resistance is still the benefit however might alter quickly. The MACd, a momentum oscillator that deducts the longer-term moving average from the shorter-term moving average, reveals rates might dip lower in the short-term.

Bollinger Bands were tighter recently however have actually started to broaden given that the selloff. The Ichimoku Cloud (9, 26, 52, 26) standard is neutral at the minute however many moving averages show a bearish divergence. Looking at order books reveals some deep resistance above the $280 zone and more rest stop around $300. A great deal of fundamental assistance has actually developed over the last couple of weeks so if bears get the reins they will see resistance in between now and the $230 zone.

The Verdict: Uncertainty Shows its Face Again

After the Bitfinex and Tether headings, it’s safe to state unpredictability is in the air when again and the previous bullish vitality within the neighborhood has actually begun to fade. It’s also intriguing to keep in mind that cryptocurrency rates have diverged rather a bit throughout popular exchanges and trade volumes also kicked into high equipment. USDT is still a dominant set, catching more than 60% of the entire cryptoconomy and 71% of BTC sets according to Coinlib.io and Crypto Compare stats. Bitcoin money (BCH) has actually held quite constant given that the statement however stopped working to hold above the 50-week moving average. Still, there are numerous other technicals that might enter into play within the digital possession area in the short-term. It’s safe to state the weekend and next week will figure out if crypto markets were really impacted by the NYAG’s court filings and whether the controversy might impact rates once again.

What do you think of the crypto market failure in the middle of the Bitfinex and Tether controversy? Let us understand what you think of this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.