Digital asset costs are seeing modest enhancements on Monday, Dec. 17 as the prime 10 cryptocurrencies have recorded positive factors between 5-19% over the final 24 hours. The total crypto-economy has captured a market valuation of $108 billion however world commerce quantity has remained flat, displaying no speedy indicators of a market development reversal.

One Year Ago Today Cryptocurrencies Touched All-Time Highs

Cryptocurrencies have had a tricky yr contemplating right now is the anniversary of when the value of bitcoin core (BTC) touched an all-time excessive of $19,600 on a number of exchanges on Dec. 17, 2017. This means BTC has misplaced 82.65% of its worth since that day. In reality, a big majority of digital currencies touched all-time highs final yr right now and haven’t returned to these ranges since. The total crypto-economy at the time had round 1,600 cash however was valued at near half a trillion U.S. {dollars}. Now there are over 2,000 cash and the market is barely value $100 billion, so it’s secure to say there have been some vital modifications in the interim.

Digital Currency Markets Show Slight Recovery

Today the value of BTC is up 5.2% and has been steadily making positive factors throughout the early morning buying and selling periods. The worth of bitcoin core is down 2.2% over the final seven days and has a mean value of about $3,445 per coin. Ripple (XRP) nonetheless holds the second place and its markets have gained 5.4% over the final 24 hours. One XRP is swapping for $0.30 per coin and has erased its weekly losses.

Ethereum (ETH) is buying and selling for $91 per ETH at the second and markets have jumped 4.9% this morning. The fourth highest worth market is held by eos (EOS) and its market is the forerunner right now out of the prime 10 cash. One EOS is swapping for $2.32 and markets have gained over 19% throughout the morning buying and selling periods. Stellar (XLM) is up 7.6% at the second and is buying and selling for $0.10 per XLM on world exchanges.

Bitcoin Cash (BCH) Market Action

Bitcoin money (BCH) markets are doing significantly better since our final markets replace as BCH has gained over 8.6% over the final 24 hours. However, BCH markets are nonetheless down roughly 16% over the course of the final week. The value of bitcoin money this Monday is $88 and the total market valuation is about $1.56 billion. BCH has misplaced 94.77% of its worth since the cryptocurrency’s all-time excessive.

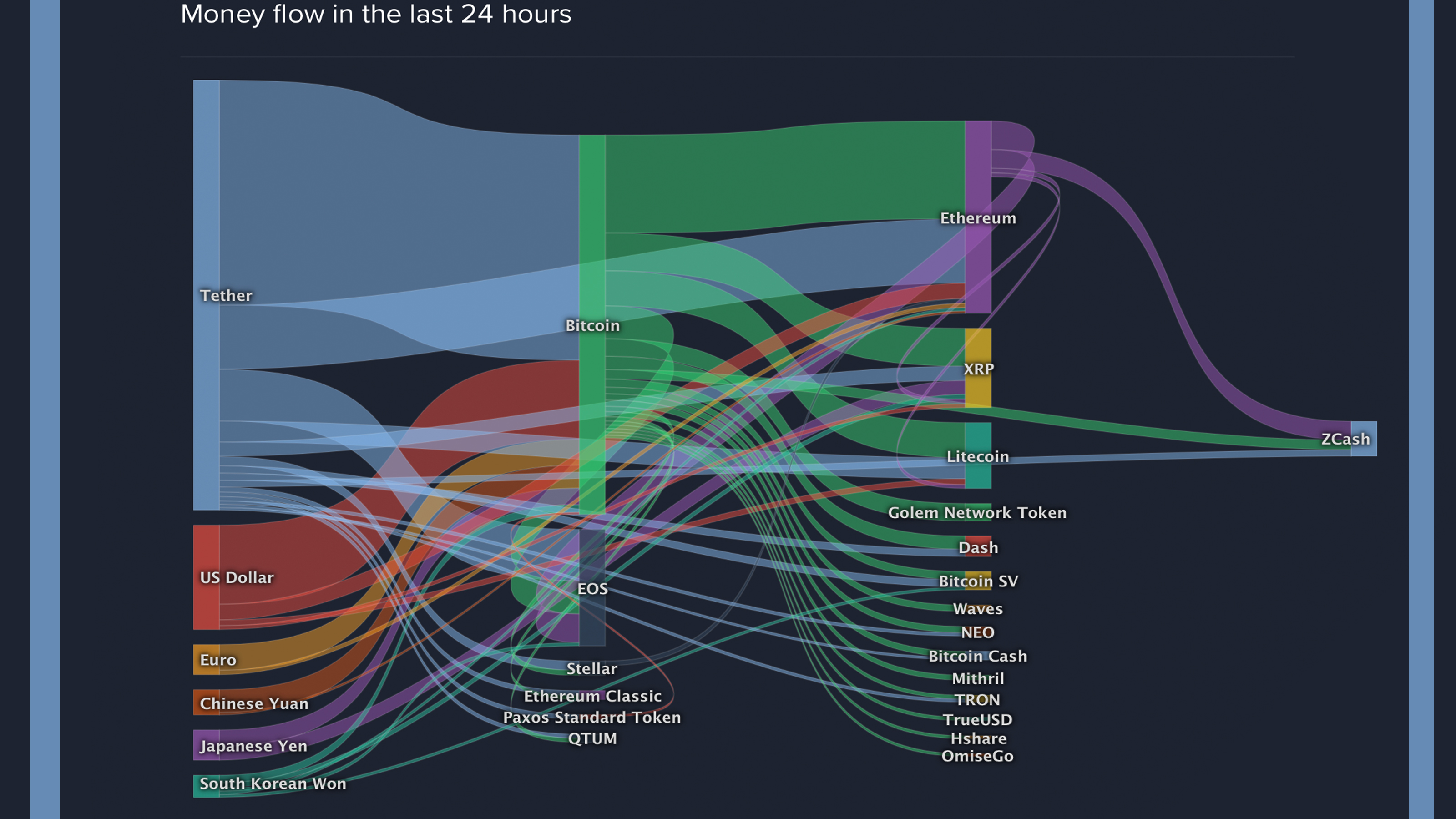

Over the final 24 hours, there’s been a complete of $91 million value of world BCH trades on in style buying and selling platforms. The prime 5 exchanges swapping the most BCH right now are Lbank, Binance, Huobi, Bithumb, and Coinbase. The prime currency pairs swapped with BCH on Dec. 17 embody BTC (39.6%), ETH (29%), USDT (23.2%), USD (3.8%), and the EUR (1.5%). Furthermore, the Japanese yen is correct behind the euro at 1.3% of BCH world trades.

BCH/USD Technical Indicators

Looking at the four-hour BCH/USD chart on Bitstamp exhibits bulls have been making an attempt to push greater over the final 12 hours. Relative Strength Index (RSI) is resting at -53, simply above beforehand oversold situations. The present formation on the 30-minute BCH/USD chart and the RSI/MACd ranges exhibits a contact of bullish divergence. The long-term 200 Simple Moving Average (SMA) nevertheless remains to be using above the short-term 100 SMA.

This signifies that the path towards least resistance remains to be the draw back, however the two trendlines look as if they might cross hairs which may sign additional value upswings. Order books on Bitstamp present bulls must surpass the present vantage level and partitions above the $95 value zone. On the bottom, there are some seemingly strong foundations between now and the $75 vary.

Has the Crypto Speculation Period Run Dry?

Many cryptocurrency merchants are nonetheless skeptical though there’s been some slight restoration right now. For occasion, there’s been so much occurring inside the world economic system with tech shares and equities beginning to droop. Many individuals are beginning to suppose the cryptocurrency hypothesis period is ending. Galaxy Digital founder Mike Novogratz defined earlier this week that crypto contributors are seeing issues extra clearly now. “The viewers is extra sober now – the drug is gone … but it surely’s not going to zero — we’re at the methadone clinic,” Novogratz emphasised.

The CEO of Bitpay, Stephen Pair, hopes to see precise utility rise in the subsequent 5 years as a result of that is what his agency concentrates on. “A very big component of the price is certainly speculation. It’s investors that are speculating on the future usage and adoption of this technology — I’m sure a small component of that price is the actual utility,” Pair said throughout an interview with CNBC on Dec. 13.

Overall, long-term cryptocurrency proponents are fairly assured in the worth of digital belongings over the subsequent 5 years to a decade. The largest query proper now’s how lengthy the present bearish development will lead the crypto-economy and whether or not or not the backside is de facto in.

Where do you see the value of BCH, BTC and different cash heading from right here? Let us know in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.