On Saturday September 29, cryptocurrency costs are meandering alongside after an fascinating two weeks of ups and downs. Since final week’s crypto market dips, digital asset markets have been seemingly much less unstable and many cryptocurrencies are following a decent wedge formation indicating a doable accumulation part.

The Cryptocurrency Economy Gains US$13 Billion This Week

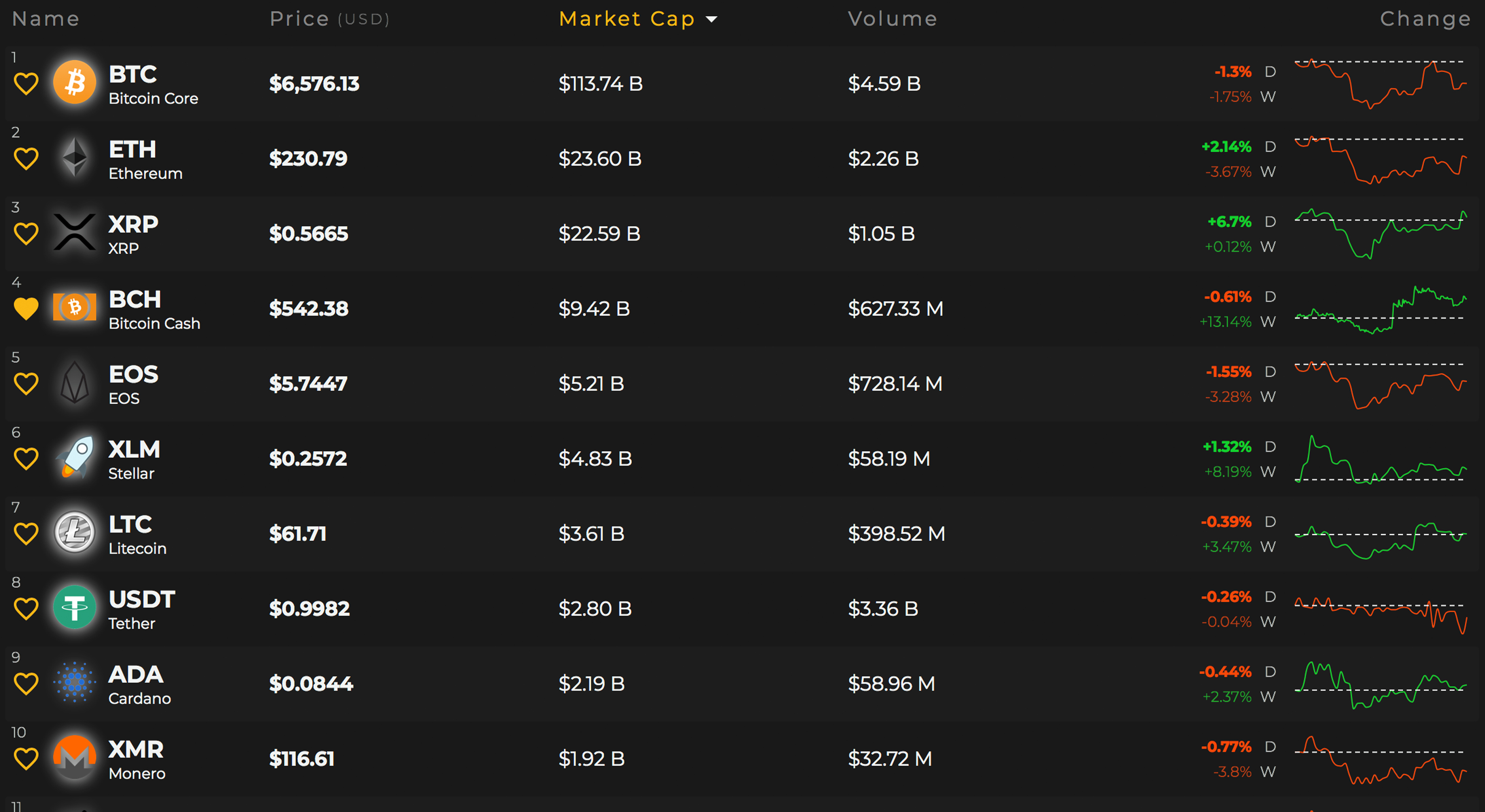

The weekend is right here and digital asset merchants try to determine what’s subsequent within the land of crypto buying and selling. There’s been some enchancment since our final markets replace 4 days in the past as the complete crypto-economy on the time was valued at US$210 billion. Today, because of positive factors stemming from ethereum, ripple, and bitcoin money, the general market capitalization has gained over $13 billion because it presently rests at $223.7 billion. The high belongings in the present day with probably the most 24-hour commerce quantity embody bitcoin core (BTC), tether (USDT), ethereum (ETH), ripple (XRP), eos (EOS), and bitcoin money (BCH).

Bitcoin core (BTC) costs are hovering round $6,587 in the present day, however markets are down 0.86 % over the past 24-hours, and 1.5 % for the week. BTC has an general market valuation of round $113 billion and commerce quantity is meandering round $4.6 billion this weekend. Ethereum (ETH) is up 3.6 % this Saturday and one ETH is buying and selling for $232 per coin at press time. Ripple (XRP) markets have seen a 7.5 % achieve over the past 24-hours and 0.11 % over the week. XRP is buying and selling for $0.56 per coin and the market valuation for ripple in the present day is $22.7 billion. Lastly, eos (EOS) has misplaced 0.96 % in the present day and 2.86 % for the final seven days. One eos is swapping for $5.75 per token with a market capitalization of round $5.2 billion.

Bitcoin Cash (BCH) Market Action

Bitcoin money (BCH) markets are persevering with to do properly this week as costs have gained 13 % over the past seven days. However, BCH markets over the previous 24 hours are down 0.18 % resulting in a value of round $542 per BCH. Currently, the market capitalization for bitcoin money hovers round $9.42 billion and commerce quantity is about $639 million on the time of publication. The high 5 BCH swapping exchanges this weekend are Lbank, Hitbtc, Okex, Binance, and Coinex. The high currency pairs traded with bitcoin money this weekend embody USDT (39.9%), BTC (32.9%), ETH (13%), USD (7.5%), and KRW (2.8%).

BCH/USD Technical Indicators

Looking on the 4-hour buying and selling view charts on each Bitfinex and Bitstamp exhibits BCH bulls could also be exhibiting a bit of exhaustion after the spike a couple of days in the past. The Macd indicator (4-H) exhibits bulls have leveled some higher resistance as the value approached oversold territories yesterday. Both momentum oscillators on the 4-H BCH chart point out some bullish prices proceed as RSI (-58.4) and Stochastic (-22.4) present room for extra enchancment in the present day.

The two simple-moving-averages (SMA) trendlines look as if a crossover pattern might happen over the following 24 hours. However, the SMA 200 remains to be above the 100 SMA indicating the trail in the direction of the least resistance remains to be the draw back. Order books in the direction of the upside present heavy opposition from now up till $575; from there on, books present smoother seas. On the bottom, if bears handle to claw value down some extra we will see sturdy foundational help from the present vantage level and till $488. There also seems to be an enormous wall holding from $485 by $470.

The Verdict: While Traders Wait for Higher Highs in 2018, Some Envision Momentum Building within the Fourth Quarter

There’s been loads occurring within the cryptocurrency world however this week’s headlines have been undoubtedly far much less unfavorable than final week’s crypto information. In the US a federal decide on Sep 26 declared that every one cryptocurrencies ought to be considered as commodities which in flip gives the Commodity Futures Trading Commission (CFTC) with the flexibility to cost digital currency initiatives with fraud. Just a few cryptocurrency analysts and business executives are nonetheless optimistic we are going to see a bull run by the 12 months’s finish.

As 2018’s fourth quarter begins, Naeem Aslam, chief market analyst at Think Markets UK, says he sees momentum rising once more. “September is coming to an end and a very interesting quarter is about to start. Does it remind you of anything? Oh yes, it reminds me of last year’s bull rally,” wrote Aslam on Friday. The Think Markets researcher provides:

It seems to me {that a} related momentum might be build up once more — This have to be music to those that are affected by heavy losses within the crypto market.

Speaking in an interview on the Consensus: Singapore 2018 occasion, Changpeng Zhao (CZ), CEO at Binance, also thinks the bull market will return and cautiously says cryptocurrency costs normally spike throughout fourth quarters. CZ emphasised through the interview:

I feel that any minute the bull market will return, and traditionally, October to December are the nice months — Before Christmas are normally the months when the markets go up fairly often, however I’m not saying that it’ll this 12 months, or that it’ll not.

Where do you see the value of Bitcoin Cash and different cash headed from right here? Let us know within the remark part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.