Cryptocurrency markets have seen losses over the past 24 hours and since our final markets replace 5 days in the past. Since then, many of the prime cryptocurrencies have been shifting sideways in a decent consolidated sample. At the second, the market capitalization of your entire digital asset economic system is valued at roughly $125 billion and markets are seeing round $13.four billion in world commerce quantity.

Cryptocurrency Markets Drop in Value Once Again

It’s one other day of buying and selling inside the digital asset economic system as merchants patiently look forward to cryptocurrencies to make the following massive market transfer. Prices are decrease immediately after bulls tried to maneuver increased a few occasions over the weekend. This Monday, Dec. 3, the highest 10 digital currency markets are down 3-11% over the past 24 hours. Bitcoin core (BTC) markets are down 6.5% immediately however are nonetheless up 0.87% over the past seven days.

At the time of publication, one BTC is being swapped for $3,889 and the currency’s general market valuation is simply above $67 billion. Ripple (XRP) nonetheless instructions the second place among the many prime digital belongings and one XRP is buying and selling for $0.35. The third largest capitalization, held by ethereum (ETH), is down 7.3% immediately. Ethereum has a mean value of $108 per coin and an general market valuation of $11.2 billion. Stellar (XLM) has managed to seize the fourth spot from bitcoin money (BCH) however is down 6.7% over the past 24 hours. One XLM is being swapped for $0.15 per coin and the market continues to be up over 2% for your entire week.

Bitcoin Cash (BCH) Market Action

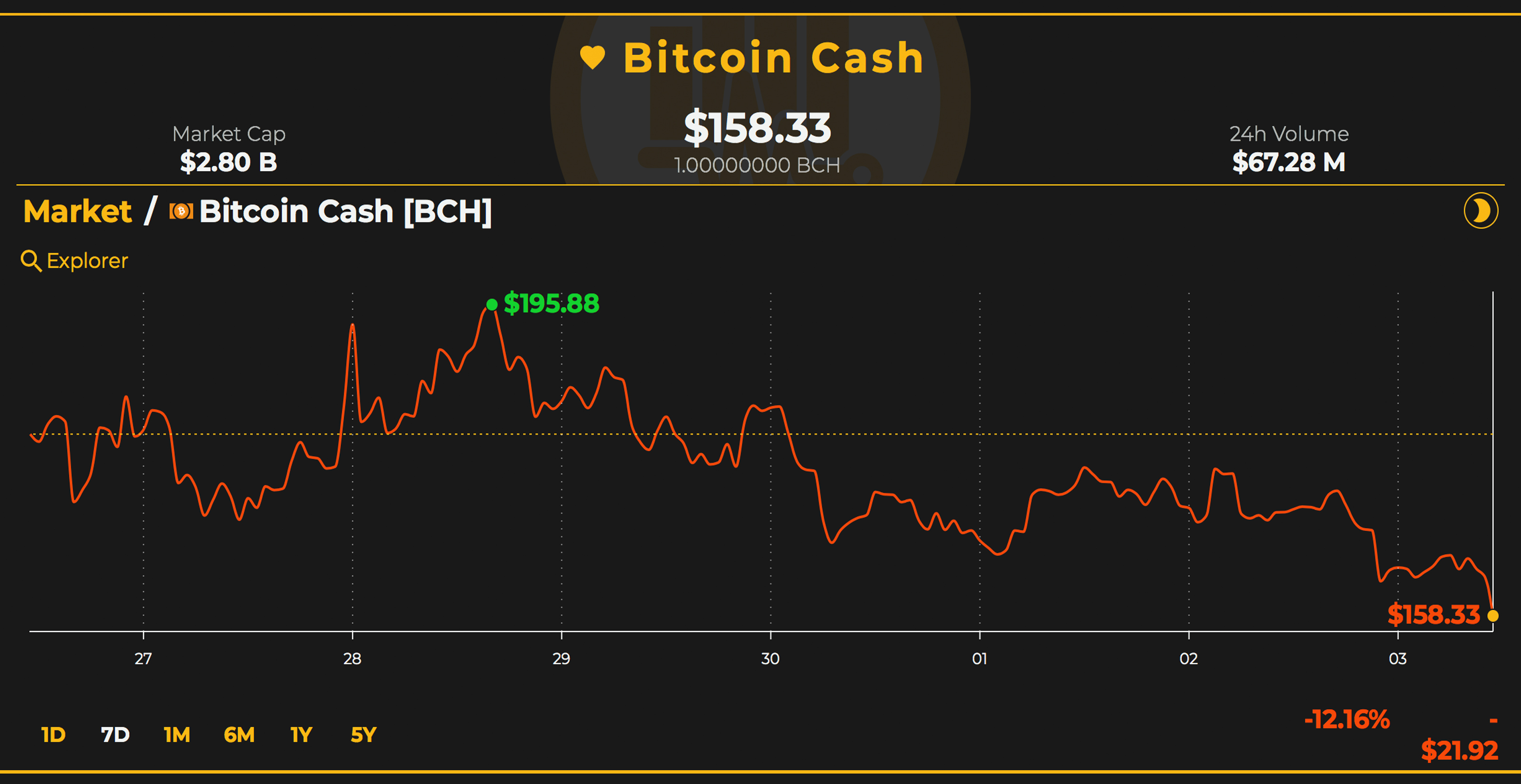

Bitcoin money (BCH) markets are down 7.2% over the past day and have misplaced over 15% this week as properly. One BCH is buying and selling for roughly $155-165 per coin and is right down to its lowest worth in over a 12 months. At the second, BCH markets have a capitalization of round $2.Eight billion and world trades this Monday are capturing $67 million.

BCH commerce quantity is considerably decrease than regular as a result of it was roughly $120 million 5 days in the past. This has put BCH within the 15th place, when it as soon as commanded fifth place in 24-hour commerce quantity for weeks on finish. Ethereum is dominating BCH trades this Monday by 63% out of all bitcoin money swaps worldwide. This metric is adopted by buying and selling pairs like BTC (24%), USDT (8.9%), JPY (1.7%), and the KRW (1%).

BCH/USD Technical Indicators

Looking on the BCH/USD charts exhibits bulls have a ton of labor to do to ensure that the value to achieve some extra upward momentum. Technical indicators nonetheless level towards the draw back, trying on the four-hour interval throughout this afternoon’s buying and selling periods. The two widespread Simple Moving Averages (SMA) have a a lot wider hole now, with the long-term 200 SMA properly above the short-term 100. This signifies the trail towards the least resistance continues to be down somewhat than up and markets have been displaying this information play out in real-time.

The Relative Strength Index (RSI) oscillator also exhibits BCH markets are nonetheless oversold however it’s not as excessive as RSI ranges two weeks in the past. Looking at order books exhibits bulls need to press previous the present vantage level and different promote partitions all the way in which as much as $225. If consumers can handle to get the value that prime, then there appears to be some smoother seas after that. However, issues are trying bearish, and if the bears proceed to claw costs down, they are going to be stopped by consumers briefly between now and $130.

The Verdict: An Elusive Search for Benchmark Prices

Plenty of merchants thought the final spike was merely a ‘dead cat bounce’ and costs have plunged considerably over the past six hours. More optimistic people proceed to consider cryptocurrency costs will rebound by the 12 months’s finish. With the value of bitcoin core (BTC) below the $4K mark, many digital asset lovers are questioning when the market backside will seem. The founding father of the cryptocurrency information internet portal Cryptocompare, Charles Hayter, thinks a value indicator will come up from the present storm.

“Bitcoin has been correlated to its hashrate and with it now falling, so is the price,” defined Hayter final Tuesday. “The idea is that the hash rate gives some idea of what underlying opex and capital costs people are willing to utilize to generate bitcoin and give it a benchmark price.”

Where do you see the value of BCH, BTC and different cash heading from right here? Let us know within the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.