BTC worth motion has damaged above a significant long-term trendline stemming again to December 2017’s all-time highs. When trying on the 2014 – 2015 bear market, an analogous transfer precipitated the ultimate sell-off of the development earlier than worth motion moved into an accumulation sample. BCH also seems to have damaged above two main descending trendlines stemming again to the market’s all-time excessive in latest weeks.

Also Read: Public Transportation Across Argentina Can Now Be Paid With BTC

BTC Breaks Major Descending Trendline

Amid the nervousness and FUD surrounding BTC’s seemingly inevitable retest of assist at 2018’s worth low simply above $3,000, worth motion has firmly damaged above a significant descending trendline stemming again to the all-time excessive of almost $20,000.

The break seems to have taken place throughout a number of time-frames, nevertheless, solely the present weekly candle seems totally outdoors of the trendline’s vary, and is but to shut.

When trying on the 2014 – 2015 bear development, a comparable trendline was damaged following 15 months of bearish fallout after the then-all-time excessive of almost $1,200 was posted in the course of the finish of November 2013. While BTC wouldn’t produce the next excessive till 10 months later, the break of the trendline comprised a catalyst for each a retest of the assist space of the downtrend’s low and the higher facet of the descending line, after which the markets channeled sideways to provide a multi-month accumulation sample.

As of this writing, Bitcoin Core has a market capitalization of $59.64 billion and a dominance of 53.4%. BTC is presently buying and selling for roughly $3,400.

BCH Breaks Multiple ATH Trendlines

BCH/USD seems to have damaged two main trendlines stemming again to the market’s all-time excessive, within the course of breaking out of a variety that has guided worth since November.

The first ATH descending trendline was damaged on the finish of October, with BCH gaining greater than 50% throughout the next two weeks as worth motion rallied from roughly $410 to $640. The failure for costs to interrupt above $650 created a secondary ATH trendline and led to roughly six weeks of promoting stress, throughout which the higher facet of the damaged trendline guided worth motion. After a dramatic rally throughout mid-December, BCH produced sideways consolidation, not too long ago leading to a break of the secondary all-time excessive trendline.

When measured in opposition to BTC, BCH has spent most of 2019 channeling sideways in a good vary between roughly 0.033 BTC and 0.036 BTC.

BCH presently is the fifth-largest cryptocurrency with a market cap of $2.04 billion and dominance of 1.83%.

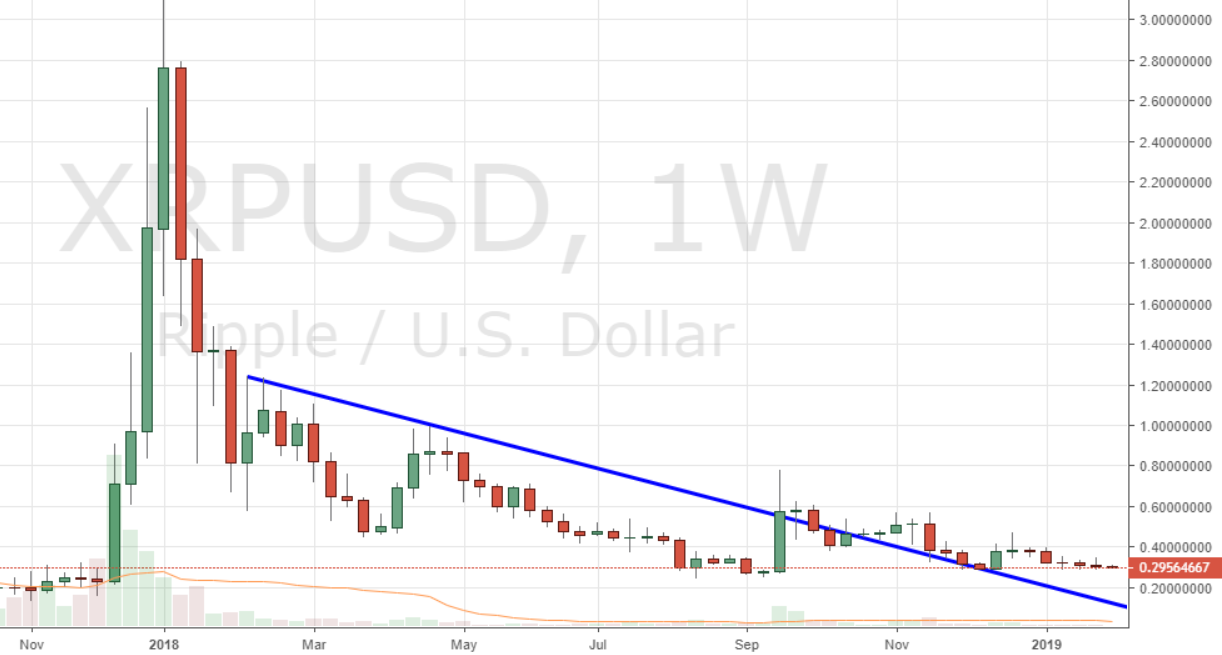

XRP Retains Second Largest Cryptocurrency Market Cap

While the dimensions and velocity of the parabola that drove XRP’s all-time excessive 14 months in the past makes it laborious to attract trendlines from the ATH space, XRP seems to have damaged above its main descending trendline stemming from February 2018 throughout mid-December. As of this writing, XRP is buying and selling for almost $0.30 following a number of weeks of tight consolidation.

When measured in opposition to BTC, XRP has spent roughly 12 weeks consolidating between 0.000085 BTC and 0.00010 BTC.

XRP has continued to rank because the second largest crypto asset by capitalization, posting a market cap of over $12 billion and a dominance of 10.75% as of this writing.

ETH Holds Above $100

ETH worth motion has continued to carry above double digits following a number of weeks of tight consolidation, with ETH presently buying and selling for roughly $105.

When measured in opposition to BTC, ETH has continued to check assist on the 0.03 BTC space following almost 5 months of sideways consolidation.

Ethereum is presently the third largest cryptocurrency with a market cap of almost $11 billion and a dominance of 9.85%.

Do you suppose that the markets are getting ready to shift gears, or will we see additional downtrend all through 2019? Share your ideas within the comments part below!

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.