Since our final markets replace, cryptocurrencies have been steadily shifting sideways as merchants are patiently ready for the subsequent massive transfer. On Wednesday, Oct. 17, bitcoin core has been hovering between $6,400-6,550, whereas bitcoin money has been coasting alongside round $425-500 per coin. The market capitalization of all 2,000+ cryptocurrencies hasn’t budged a lot during the last two weeks and at present rests at $213.Four billion.

Stablecoins Show More Action Than Most Cryptocurrencies This Week

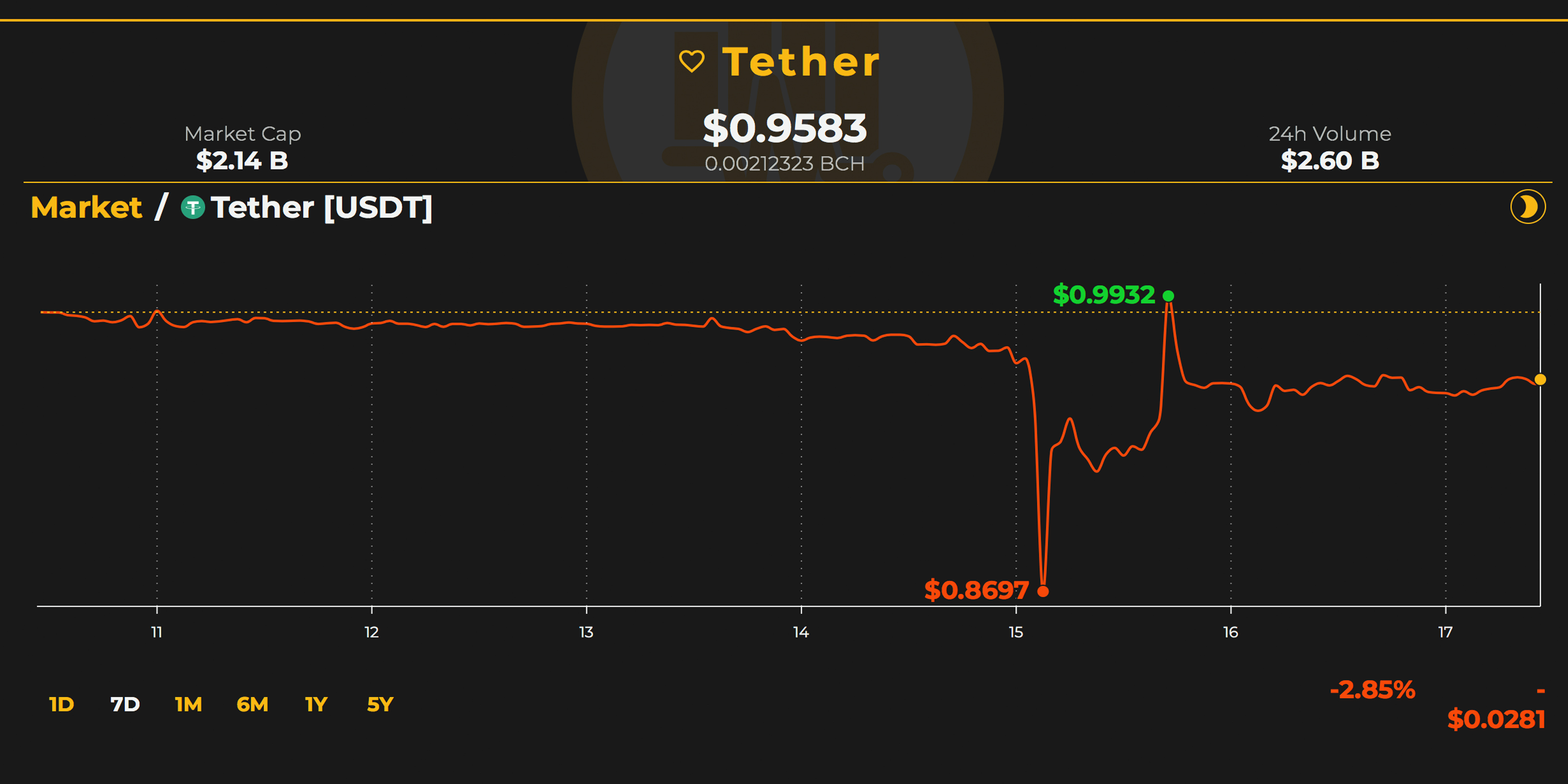

Markets have been buying and selling in a triangular and consolidated sample because the final massive spike on Sunday, Oct. 15. That day, bitcoin core (BTC) spiked to a excessive of $6,760 on a couple of exchanges like Bitstamp, and bitcoin money touched $501. Additionally, exchanges that use the stablecoin tether (USDT) noticed BTC and BCH costs rise even larger than most spot markets and BTC values noticed highs above $7,000. This market habits was on account of USDT dropping below the worth of USD, hitting a low of $0.86 per token.

Other stablecoins like TUSD, GUSD, and USDC noticed important volumes this week as a number of cash poured into these particular markets. On Oct. 16, Circle’s stablecoin USDC grew 2,000 % in seven days on associate exchanges and that day’s USDC quantity surpassed the week prior’s.

During that point, different stablecoins like GUSD and TUSD rose above their greenback pegs whereas USDT dipped below. Following the leap in worth, BCH and BTC costs have dipped a hair and USDT values have regained momentum.

The Top Cryptocurrency Markets

Bitcoin core markets are down right this moment round 1% and one BTC is buying and selling for $6,534 based on Satoshi Pulse information. Ethereum (ETH) costs are down 1.4%, as every ETH trades at $207 this Wednesday. Following behind ETH is ripple (XRP), which is up 1.8% during the last 24 hours. XRP costs are hovering round $0.46 on the time of publication. Lastly, EOS is down 0.68% right this moment and the digital asset is swapped for $5.39 per coin. Overall, the highest contenders are down between one to 13% during the last seven days of buying and selling classes.

Bitcoin Cash (BCH) Market Action

Bitcoin money spot markets are seeing BCH commerce for $451 per coin with the currency’s worth down 1.7% during the last 24 hours. Percentages are down even decrease for the week as seven-day statistics present BCH has dipped round 11.7% this previous week. The high 5 exchanges swapping essentially the most BCH this Wednesday are Lbank, Hitbtc, Binance, Okex and Huobi. BTC is the highest buying and selling pair exchanged with BCH, capturing 41.8% of all spot market trades. This is adopted by the buying and selling pairs USDT (27%), ETH (16%), USD (5.2%), and KRW (5.2%). Bitcoin money has the sixth-largest buying and selling quantity, as $301 million price of BCH trades have been processed within the final 24 hours.

BCH/USD Technical Indicators

Looking on the four-hour and each day Bitstamp and Bitfinex BCH/USD charts exhibits some severe sideways motion because the final spike. Many different digital asset charts like BTC/USD are following comparable patterns, as merchants appear to be discovering new positions during the last two days. Currently, the BCH four-hour relative energy index (RSI -40) oscillator is meandering within the midrange and not granting many clues. The two easy shifting averages (100 & 200 SMA) point out a change could also be within the playing cards as the 2 look as if they are going to be crossing hairs quickly.

Unless issues change, the 100 SMA appears to be dropping below the 200 SMA trendline, displaying the trail towards the least resistance would be the draw back. Order books present there are massive hurdles for BCH bulls from now till $465 and one other pitstop above the $500 area. If issues change and the value heads south, BCH bears will likely be stopped at $415 and $390 respectively.

The Verdict: Uncertainty Is within the Air

The verdict this week depends upon who you ask, however could be generalized with one phrase: uncertainty. Some merchants consider a bearish-to-bullish change is imminent, whereas others suppose cryptocurrency costs could sink decrease. BTC/USD and ETH/USD shorts are pretty excessive, however not as a lot as they have been a couple of weeks in the past. The consolidated tight sample and lack of shorts this week present uncertainty within the minds of merchants ready for a breakout in both course.

Where do you see the value of bitcoin money and different cash headed from right here? Let us know within the remark part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.

1 thought on “Markets Update: Stable Cryptocurrencies and Unstable Pegged Coins”

Wow Super Website I Love This Too Much Pls Keep Publish Superb Knowledge

Join to get latest updates on Bitcoins