Cryptocurrency markets at present are seeing a contact of restoration after digital asset costs suffered from some vital losses over the previous few days. The total digital currency economic system has consolidated simply above the $200 billion mark, after dropping effectively below this threshold throughout Saturday night’s buying and selling periods. Over the final seven days, every digital asset in the prime ten (apart from tether) has misplaced between 10-30 % in worth over the final seven days.

Cryptocurrency Markets Lose up To 30 Percent in a Week

Last week wasn’t the biggest for cryptocurrency markets as an incredible majority of them have suffered deep losses. Today, on September 9, there’s a bit of restoration and consolidation happening inside portion of digital currency markets. For occasion, bitcoin core (BTC) costs dropped to a low of $6,094 final evening, bitcoin money (BCH) slid to $464, and ethereum (ETH) dropped to $187 per coin. But at present is a special story as BTC has jumped again to $6,370, BCH $483, and ETH has risen to $202.

The prime 5 cryptocurrency commerce volumes at present are BTC, USDT, ETH, EOS, and BCH. A big quantity of merchants are centered on ethereum markets as they tumbled this week over 30 % and ETH/USD shorts (bets in opposition to ETH) have reached an all-time excessive. The digital property that took the least of the blows this week embrace BTC, XMR, and XML. Overall there actually hasn’t been any horrible cryptocurrency information to justify the sliding costs however there also hasn’t been a lot constructive information both to convey the reverse impact.

Bitcoin Cash (BCH) Market Action

Bitcoin money (BCH) markets are down 3.9 % over the final 24 hours and 23 % over the final seven days. At the time of publication, one BCH is buying and selling for $483 per coin with $325.6 million in each day commerce quantity. The prime exchanges swapping the most bitcoin money at present embrace Lbank ($80.61M), Coinex ($47M), Okex ($40.16M), Huobi ($37.95M), and Bitforex ($32.61M). The largest pair traded with bitcoin money is tether (USDT), capturing 42.6 % of at present’s BCH trades. This is adopted by BTC (27.6%), ETH (17.2%), USD (7%), and QC (2.5%). With the fifth highest commerce quantity at present and the fourth largest market capitalization, bitcoin money has a valuation of round $8.Four billion this Sunday.

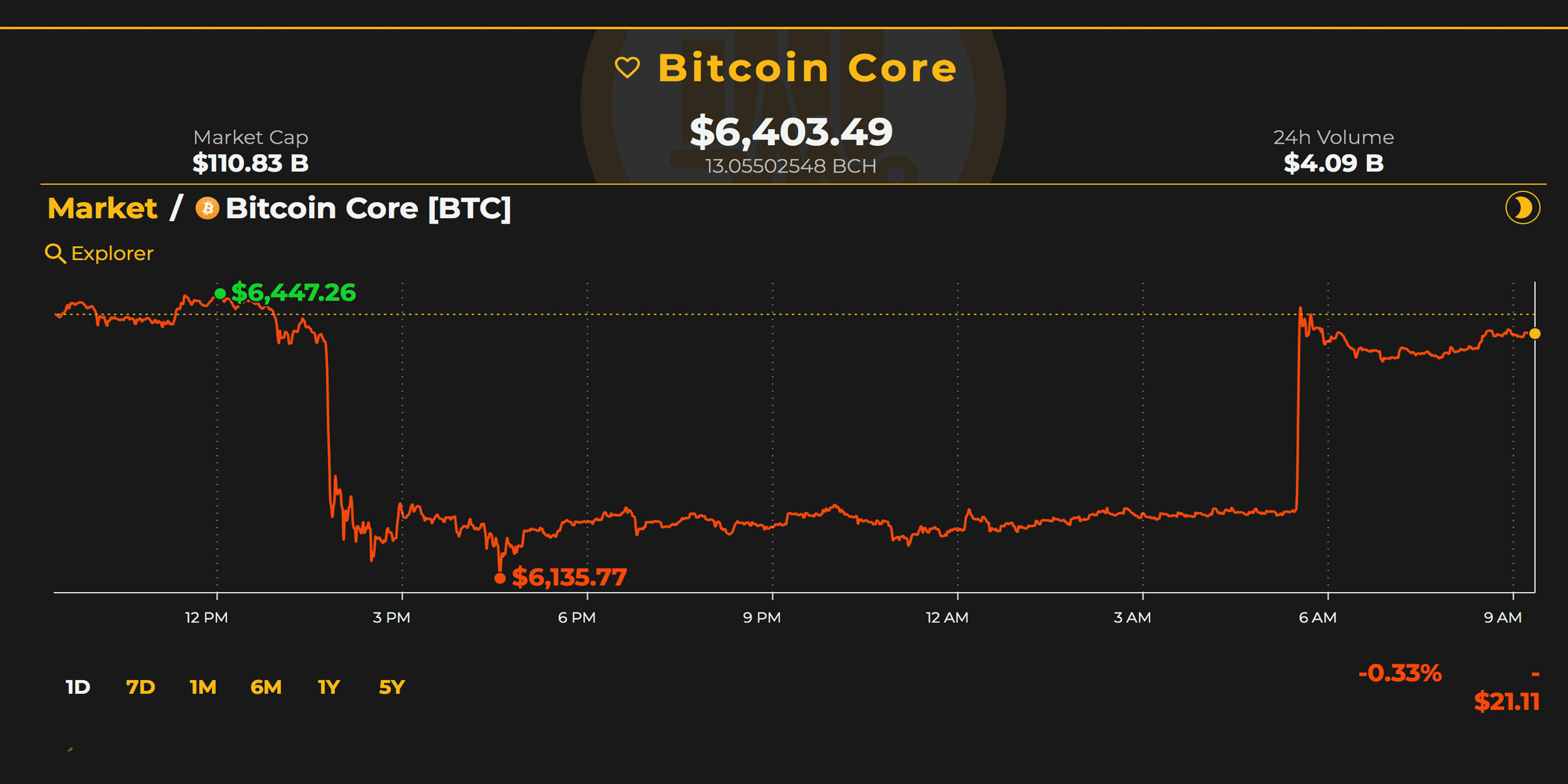

Bitcoin Core (BTC) Market Action

Bitcoin core (BTC) market values have seen losses of round 1.46 % at present and 11.65 % over the final week. Currently, BTC is being swapped for $6,383 per coin and holds a market valuation of about $110.5 billion. 24-hour commerce quantity for BTC is round $Four billion and BTC market dominance is round 55 % at the time of writing. The prime 5 exchanges buying and selling the most BTC at present are Bitflyer ($2.11B), Binance ($238.96M), Bitfinex ($148.64M), Bitmart ($139.35M), and Coinex ($80.79M). The prime 5 pairs traded with BTC this Sunday are tether (USDT 56.2%), USD (22.1%), JPY (10.4%), EUR (3.7%), and KRW (3%).

The Verdict: A Thick Veil of Uncertainty and Confusion

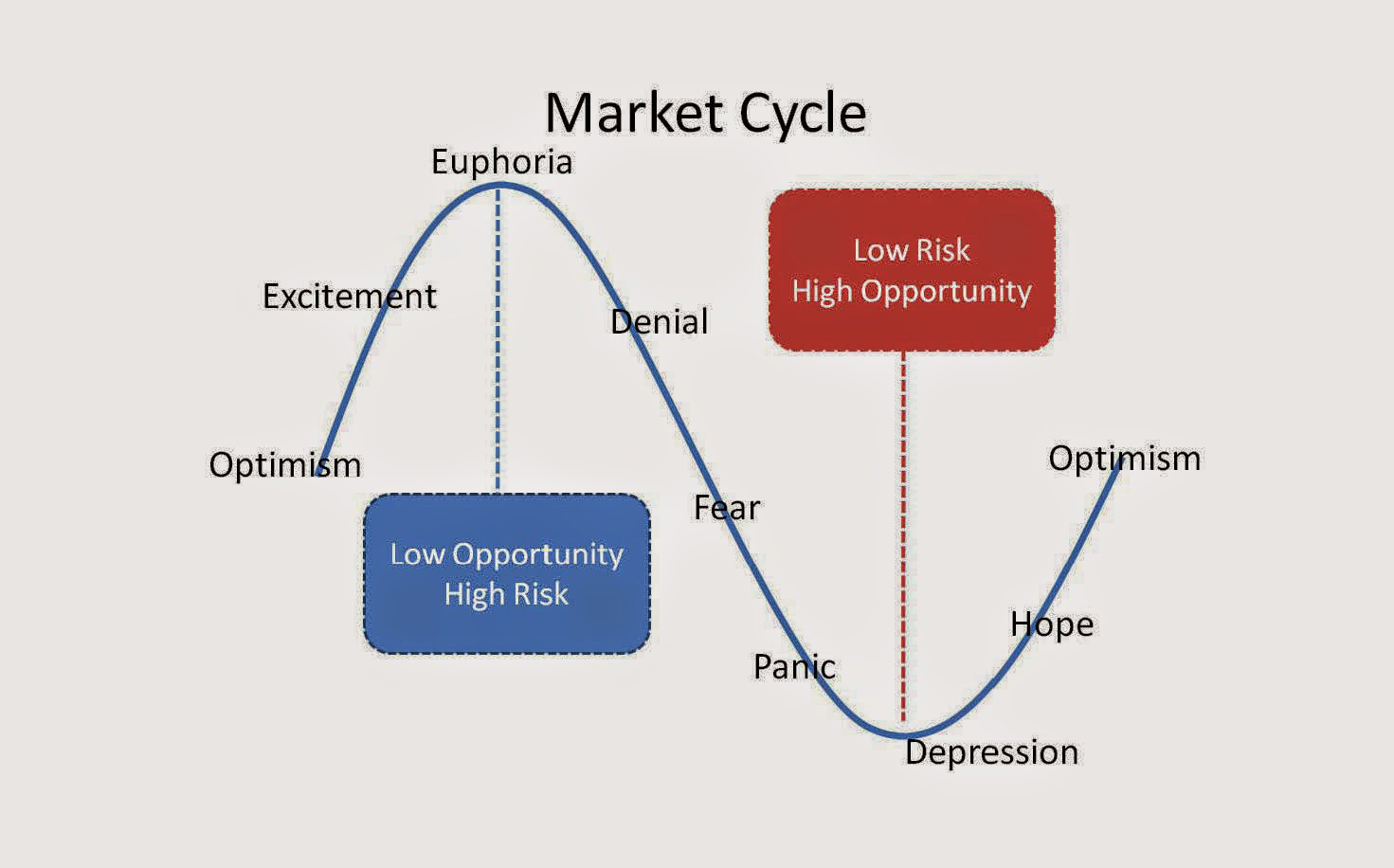

Overall, at present is seemingly higher than the previous 72 hours of buying and selling periods and plenty of cryptocurrency markets are exhibiting some consolidation. 2018 has been tough for individuals who didn’t anticipate a bear market this 12 months as there was a really lengthy cycle of denial and several other bear traps over the final 9 months. The present verdict this week is a thick veil of uncertainty and confusion.

Many are questioning if we’re coming into the capitulation market cycle which is able to then result in despair or despair, a pattern that would lower digital asset values in half from the present vantage level. However, sometimes after the lengthy accumulation part and the despair cycle markets ought to reverse. The drawback is merchants don’t know if we have now already suffered via despair or if we are able to anticipate extra ache in the close to future.

Where do you see the worth of BTC, BCH, and different cash headed from right here? Let us know in the remark part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.