Cryptocurrency costs have been fairly secure over the previous couple of weeks as volatility all through many markets has been non-existent. After patiently ready, merchants and traders at the moment are curious to see if one thing transpires after a lengthy spell of tranquil digital asset markets.

Do Calm Crypto-Market Seas Suggest Something Big Is on the Horizon?

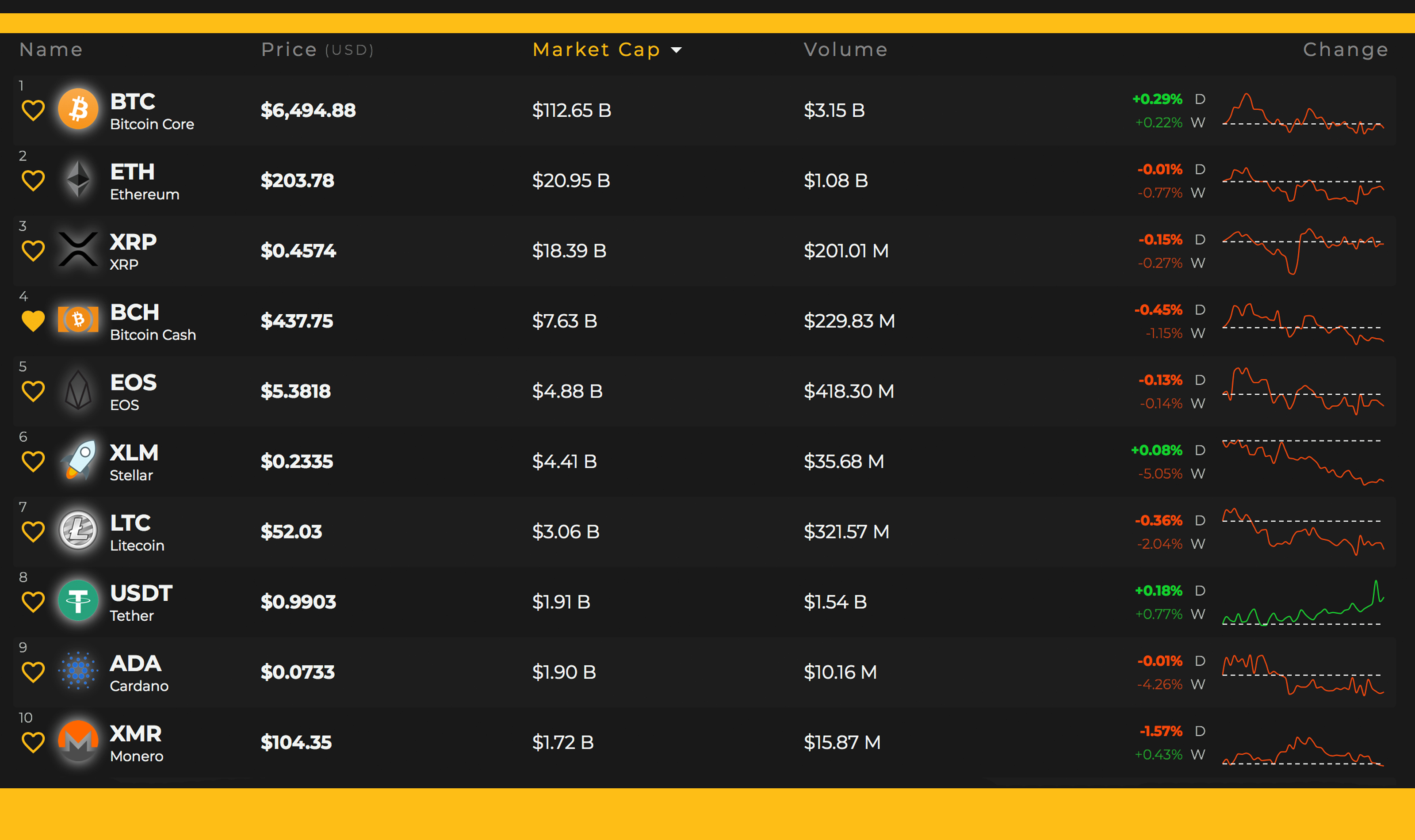

Throughout the flurry of latest stablecoins, the unique pack of digital currencies has been very secure as of late with low volatility. This Saturday, Oct. 27, the whole cryptocurrency economic system is valued at $212.5 billion with round $8.6 billion value of 24-hour international commerce quantity. The prime exchanged coin at this time with essentially the most commerce quantity is bitcoin core (BTC) with a every day quantity of round $3.7 billion. At the second, BTC is buying and selling at a international weighted common of round $6,494 per coin, with an general market valuation of about $112 billion. Following behind BTC is ethereum (ETH), which is buying and selling for $203 per coin. The third highest cryptocurrency capitalization is held by ripple (XRP) and every token is being swapped for $0.45. Lastly, this weekend eos (EOS) tokens are being traded for $5.37, with a capitalization of about $4.Eight billion at this time.

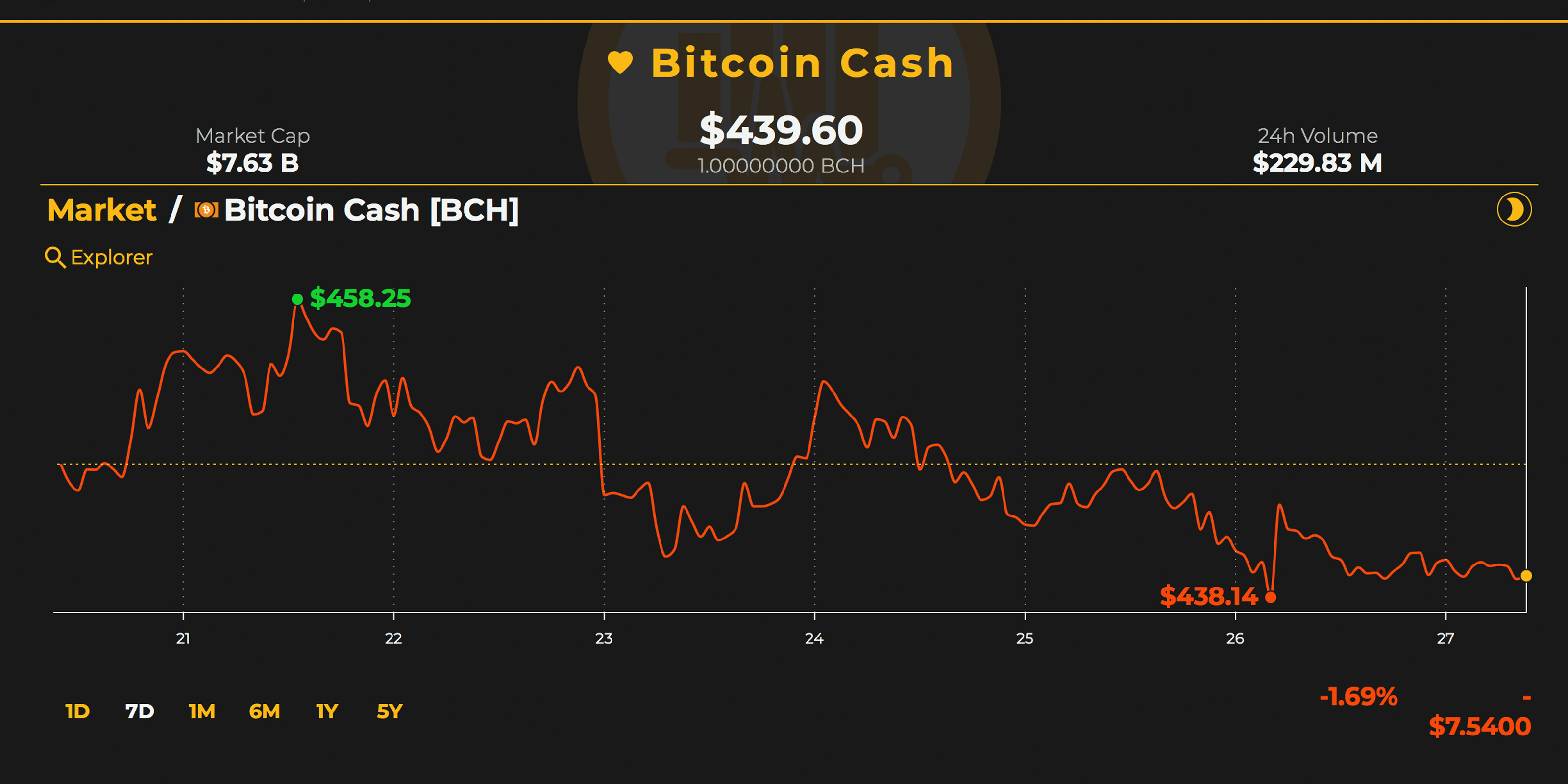

Bitcoin Cash (BCH) Market Action

The fourth largest market valuation amongst all 2000+ digital property belongs to bitcoin money (BCH) this weekend. Bitcoin money is down 0.63% this Saturday and 1.2% over the past seven days. At the time of publication, one BCH is being swapped for $439 per coin and has round $229 million in international commerce quantity. The prime 5 exchanges swapping essentially the most BCH embody Lbank, Hitbtc, Bithumb, Okex, and Digifinex. BTC is the main pair swapped with BCH because the currency captures 38.4%. This is adopted by USDT (25.4%), KRW (18.4%), ETH (10.9%), and ZB (2.2%) pairs. Bitcoin money holds the sixth largest international commerce quantity all through the whole crypto-economy.

BCH/USD Technical Indicators

The BCH/USD 4-hour and every day charts present little or no motion and fewer volatility than we’ve seen in weeks. RSI and stochastic ranges are meandering within the center (between 46-50) and it’s been exhausting to seek out a sign of any huge market strikes coming quickly. The Macd reveals a related outlook although in the intervening time it’s heading southbound. A pattern change could also be imminent as the 2 Simple Moving Average (SMA) trendlines are about to cross.

The longer-term 200 SMA is nearly to dip below the quick time period 100 SMA indicating the trail in direction of the least resistance might change towards the upside. Order books present some robust resistance on the $475 vary and one other hump above the $515 territory. Looking on the bottom, BCH bears will see some pitstops at $410 and a a lot massive wall within the $380 zone.

The Verdict: Apprehensive Traders Among Calmness and Stability Within the Cryptocurrency Economy

An excellent majority of 2018’s market replace verdicts have been stuffed with skepticism and this week’s outlook isn’t any completely different. The final ten months of bearish markets, fakeouts, and intensely flaccid commerce volumes have led to uncertainty amongst many cryptocurrency merchants. However, most digital property have seemingly discovered their bottoms (the bottom the worth will go), or no less than some individuals hope the crypto-price bottoms have been discovered. The reality is nobody really is aware of what costs will appear to be by the yr’s finish. As said above, the eerily serene markets are doubtless making merchants and lovers extra anxious for an surprising breakout in each instructions to happen.

What do you consider the tranquility of cryptocurrency markets as of late? Let us know what you consider this topic within the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.