Banks are laying off employees around the world as earnings decreases throughout the sector. According to reports, banks have actually revealed nearly 60,000 task cuts up until now this year, with the majority of the layoffs occurring in Europe, specifically in Germany.

Almost 60,000 Job Cuts

Bank staff members are being laid off worldwide. Negative rates of interest, political unpredictability and risks of trade wars on an international level have all played their part in deteriorating banks’ balance sheets, in addition to rate of interest cuts which even more minimize margins.

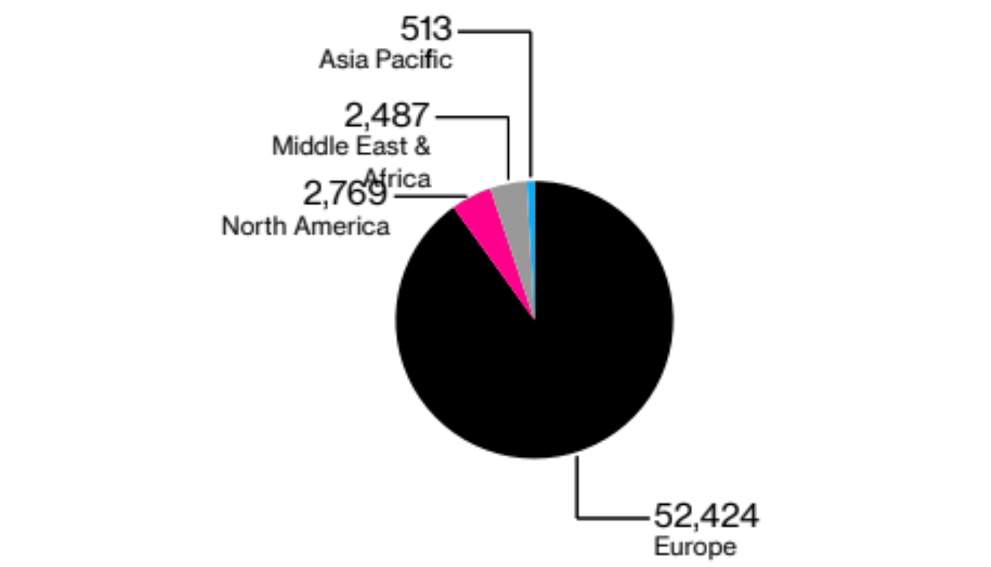

According to year-to-date business filings and labor union disclosures put together by Bloomberg, banks have actually revealed that they are cutting 58,200 jobs up until now this year. The greatest layoffs remain in Europe, where 52,424 jobs, or 90% of the overall layoffs, are being slashed, as the European banking sector continues to have problem with success. Moreover, 2,769 employees in North America are being released, as are 2,487 in the Middle East and Africa and 513 in the Asia Pacific area.

Furthermore, the information reveals 10 banks that have actually laid off the most employees in Europe, with Deutsche Bank leading the pack with 18,000 task cuts. The other rely on the top 10 list are Banco Santander, Commerzbank, HSBC, Barclays, Alfa Bank, KBC, Societe Generale, Caixabank, and the National Bank of Greece.

German Banks Lag Behind Others

The health of Germany’s monetary sector has actually been a leading issue for regulators and political leaders for rather a long time. The low rate of interest environment, an international financial downturn, trade stress, geopolitical unpredictability, contributed to structural vulnerability and domestic financial weak point, have actually adversely affected German banks. Lenders in Europe’s biggest economy rest on big deposits so they are more based on loaning than those in lots of other European nations.

The European banking sector has actually long dealt with require debt consolidation as banks battle to produce revenues. Two leading German banks — Deutsche Bank and Commerzbank — have actually tried a merger, however it failed early this year, leading to the set separately revealing significant layoffs.

At the top of the scale down list is Deutsche Bank, which started laying off 18,000 employees in July as part of an $8.3 billion overhaul. According to reports, Germany’s biggest bank strategies to leave its equities sales and trading service along with its fixed-income service, however will maintain a little equity capital markets service. The bank had 91,737 staff members at the end of 2018, practically 6,000 less than the previous year. The layoffs would diminish its labor force to approximately 74,000 staff members by 2022. Deutsche Bank is also handling German authorities penetrating for info about the relation of its Frankfurt head office to Danske Bank, which is presently at the center of a massive money-laundering scandal.

Domestic competitor Commerzbank, with about 1,000 branches and workplaces in practically 50 nations, is also scaling down. The German federal government is a significant investor of this bank. Commerzbank revealed recently a strategy to lay off 4,300 of its 49,000 staff members in some locations, however will include 2,000 jobs in “tactical locations.” A fifth of its branches will also be shut down in a method overhaul.

Layoffs Happening Worldwide

Other European and worldwide banks have actually made comparable statements. “The primary aspects that might significantly restrain European financial belief and development stay the threat of more financial de-globalization, consisting of an escalation of trade disputes, Brexit and political chaos in some euro location nations,” KBC Group detailed in its second-quarter profits discussion for experts. The bank-insurance group utilizes 42,000 individuals, has 1,389 bank branches, and runs mostly in Belgium, the Czech Republic, Slovakia, Hungary, Bulgaria and Ireland. The group also revealed this month that its Belgian labor force will be lowered by 1,400 in 3 years.

Banking huge HSBC is also scaling down. Following the stepping down of previous CEO John Flint after being on the task for just 18 months, the bank revealed in August that it will cut 4,700 jobs. CFO Ewen Stevenson stated as much as 2% of the bank’s labor force will go. HSBC group employes 237,685 since June 30.

British international bank Barclays currently cut 3,000 jobs in the 2nd quarter, CEO Jes Staley and CFO Tushar Morzaria verified on a revenues employ August. At completion of in 2015, the group used 83,500 personnel, according to its yearly report.

Spain’s biggest bank, Banco Santander, concurred with unions in June to lay off 3,223 employees in Spain as part of the bank’s effort to incorporate Banco Popular, a monetary services corporation with 1,600 branches throughout Spain. At completion of March, Santander had 32,366 staff members and 4,366 branches in Spain. Earlier this year, the bank stated it will close 140 branches in the U.K., putting more than 1,200 jobs at threat. Another Spanish bank, Caixabank, revealed in January a layoff of 2,157 staff members, cutting 7.3% of its overall labor force. The biggest Catalan bank also prepares to shut down over 800 branches in Spain out of its 4,461 branches in operation by 2021.

One of the biggest independently owned banks in Russia, Alfa Bank, is also lowering its labor force. The bank presently utilizes more than 24,000 employees. CEO Vladimir Verkhoshinsky apparently stated that 3,000 staff members, or 12% of the bank’s labor force, will be laid off by the end of the year. This number contributes to the 2,000 employees who left the bank throughout the very first quarter. According to reports, the layoffs are primarily due to the bank’s choice to move from supplying loans in brick-and-mortar shops to providing them online.

France’s third-largest bank, Societe Generale, has also exposed its strategies to cut 1,600 jobs, primarily at its business and financial investment banking arm. The bank, which utilizes 18,000 individuals in 30 nations, also stated in April that it would cut 750 jobs in France.

Other banks that are scaling down consist of Citigroup, which exposed in July its strategies to lay off numerous individuals. BNP Paribas reached a contract with unions in March to cut as lots of as 2,500 jobs at its Belgian retail banking system by 2021. The bank utilizes 13,000 individuals in Belgium. Further, the information put together by Bloomberg reveals that the National Bank of Greece is laying off 1,700 employees.

What do you consider banks’ massive layoffs? Let us understand in the comments area below.

Did you understand you can purchase and offer BCH independently utilizing our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitscoins.net market has countless individuals from all around the world trading BCH today. And if you require a bitcoin wallet to safely keep your coins, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.