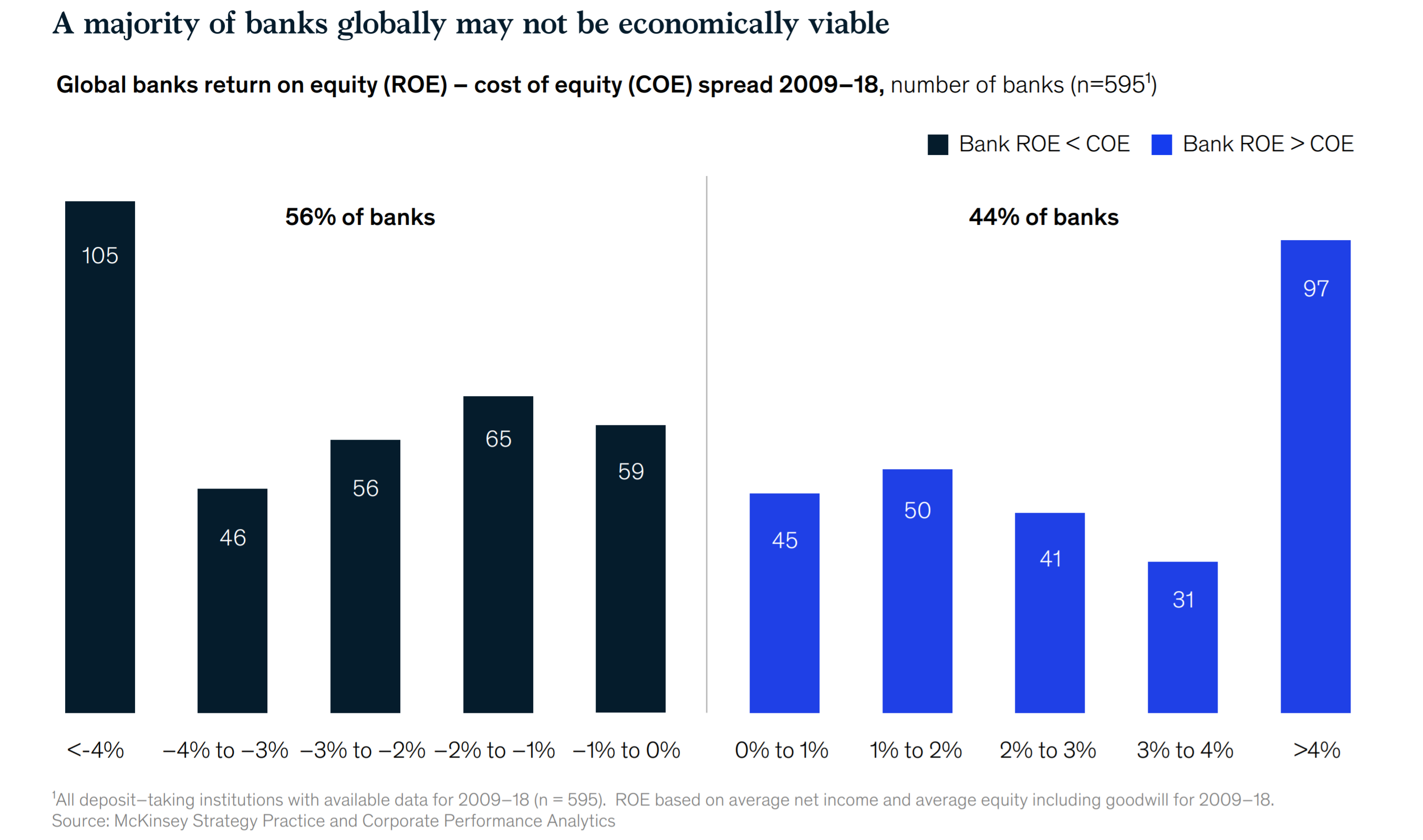

Management consulting company McKinsey & Company has actually released an international banking evaluation and discovered that a majority of banks worldwide may not be economically viable. More than half of them still do not produce their expense of equity 10 years after the crisis and may not make it through a financial recession.

Majority of Banks ‘Destroy Value’

McKinsey & Company released its Global Banking Annual Review 2019 today. The 58-page report highlights issues over the health of the international banking sector. The company groups banks worldwide into 4 broad classifications, keeping in mind that “Every bank is distinctively bound by both the strength of its franchise and the restrictions of its markets or service design.”

The very first classification is “market leaders” which are the top 20% of banks worldwide that capture practically 100% of the financial worth contributed to the whole market. The next is “resilients” which are almost 25% of banks that have actually kept management in tough markets such as Europe.

The other 2 classifications consist of distressed banks. About 20% of them are categorized as “fans” which are those that have actually not attained scale and are weaker than their peers, the report explains. “They are at threat from a recession and need to act without delay to develop scale in their existing organisations, shift service designs to separate, and drastically cut expenses.”

The last classification, “challenged banks,” consists of about 35% of banks worldwide that are both sub-scale and struggling with running in undesirable markets, McKinsey discussed, asserting:

Their service designs are flawed, and the sense of seriousness is intense. To make it through a recession, combining with comparable banks or offering to a more powerful purchaser with a complementary footprint may be the only alternatives if reinvention is not practical.

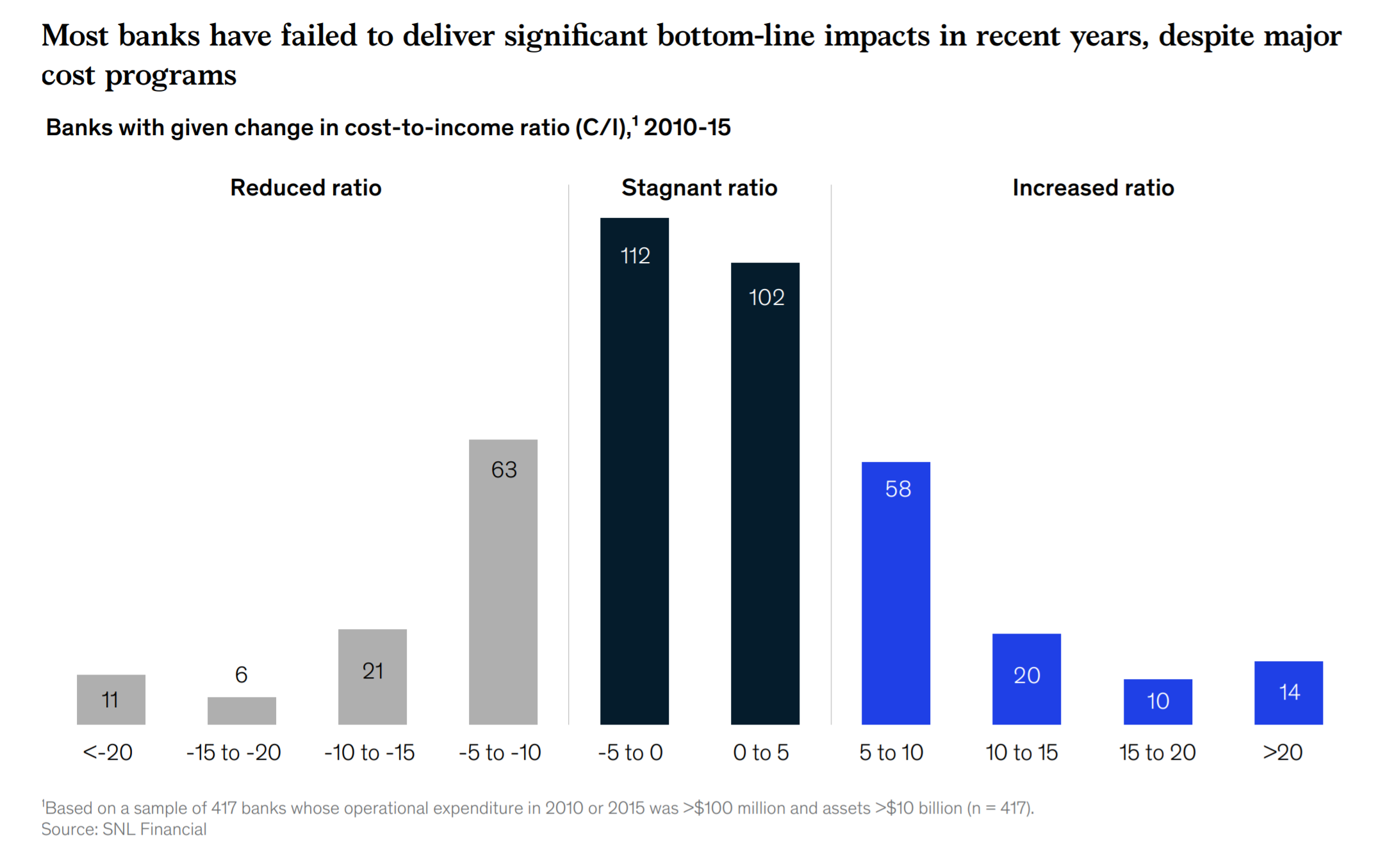

The company even more kept in mind that “Risk expenses are lower than ever, and yet 60 percent of banks ruin worth.” These banks still do not produce their expense of equity 10 years after the crisis, McKinsey detailed, including that “Imaginative organizations are most likely to come out leaders in the next cycle” while “Others threat ending up being footnotes to history.”

Time Is Running out for Many Banks

The report also describes patterns impacting the banking sector worldwide such as the increased use of electronic banking, which grew by 13% from 2013 to 2018, according to McKinsey. The company thinks that there is space for more development of more than 30% in numerous markets as customers are progressively happy to negotiate online. The increase in appeal of non-bank company has also provided brand-new competitors to standard banking.

“Consumers have actually ended up being familiar with real-time and customized services and anticipate the very same of digital banking services,” the report describes. While this has actually primarily affected retail banking and possession management, the very same patterns have actually begun to emerge in business banking along with in capital markets and financial investment banking, McKinsey highlighted, elaborating:

Regulators in varied markets are also adding to disturbance in banking, specifically as they take actions focused on increasing openness and enhancing competitors by decreasing barriers to entry.

Chira Barua, a London-based McKinsey partner and co-author of the report, calls this international banking issue a “do or pass away” minute, CNBC reported. Barua discussed that a major recession might be disastrous for a number of banks if they do not transform themselves.

“There are actions every bank can take today to alter their fortunes and start the next cycle on a more powerful footing, however time is going out. Boards and management need to actively think about tactical relocations now rather of the cycle requiring it on them in a recession,” the partner mentioned.

Kausik Rajgopal, a senior partner at McKinsey and another report co-author, was priced quote by Reuters as stating, “The market in aggregate is not in terrific health, due to the fact that 60% of banks put on’t have returns that surpass expense of equity and we see that as a call to action.”

McKinsey’s report concludes:

The call to action is immediate: Whether a bank is a leader and looks for to ‘safeguard’ returns or is one of the underperformers aiming to turn business around and press returns above the expense of equity, the time for vibrant and crucial relocations is now.

Banks worldwide have actually been bearing the impact of record-low rates of interest which cut into their success. The European Central Bank (ECB) kept its essential rates of interest at a record low of -0.5% on Thursday. A number of banks have actually needed to hand down the unfavorable rate concern to their clients, such as in the event of German bank Berliner Volksbank.

Do you concur with McKinsey that a majority of banks may not make it through a recession? Let us understand in the comments area below.

Did you understand you can purchase and offer BCH independently utilizing our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The regional.Bitscoins.net market has thousands of individuals from all around the world trading BCH today. And if you require a bitcoin wallet to firmly keep your coins, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.