The Loyalty Business on the Fiat Standard

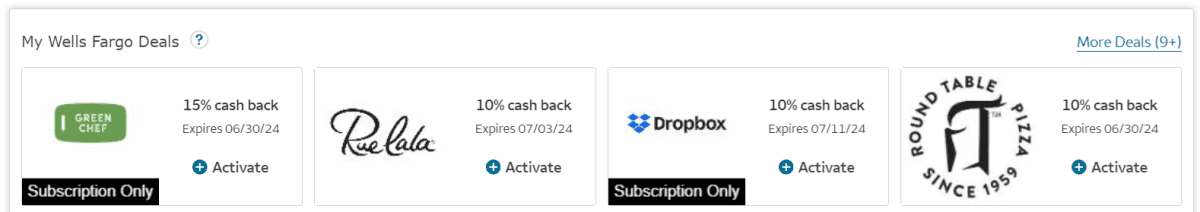

I operated at Mastercard for the last 10 years, in the San Francisco workplace, developing card-connected deal services to drive merchant loyalty. It’s a remarkable company, where cardholders get merchant provides provided through their bank, supplying them with a discount rate if they make a certifying invest at getting involved merchants. Below is an example of a sample of these offers/deals from my individual Wells Fargo checking account.

The provides drive brand-new client acquisition, reactivate lapsed consumers and drive greater invest frequency and ‘basket size’ from existing consumers. Overall, the marketing option is really efficient at driving incremental invest habits, generally through charge card (some debit card) payment channels.

Enter Bitcoin

Bitcoin as medium-of-exchange doesn’t get much attention, as bitcoiners are expected to Hodl their bitcoin and there is reasonable stress and anxiety about sustaining taxable occasions from costs, however setting these issues aside for a minute, let’s take a look at business chance for driving merchant loyalty on bitcoin rails rather of fiat rails. What modifications? It’s no exaggeration to state that bitcoin entirely transformers the worth proposal to provide outsized financial surplus never ever before seen, with performance and usage cases that fiat can never ever match.

Costs

The arrangement of any fiat merchant provides program is a pricey endeavor, needing a considerable and intricate tech stack and a group of individuals to: credentialize getting involved merchants, validate merchant agreement, designate deals to cardholders based on anticipated marketing budget plans, spot certifying invest occasions, benefit redeeming cardholders with declaration credits, put together reporting for merchants to reveal program effectiveness, and fix up billing. Most notably, all of the customer costs is driven on the most costly payments channel (to the merchant); charge card.

Bitcoin rails drop a considerable variety of actions in this procedure. Merchants might take part in a design more similar to Google Adwords through a self-service website credentializing through dedication of bitcoin to money the marketing budget plan in genuine time (which can also be deprecated in genuine time too – never ever possible in fiat deal programs). The bank and card processor are no longer included as gatekeepers in the end-to-end option; they, and their associated costs/fees, are dropped from the worth chain completely. Most notably, the redeeming-deals are all now driven on low expense Lightning Network rails, removing out not simply the direct charge card charge expenses (generally 3% or greater) however also the indirect expenses of chargebacks and scams.

New paradigms

Fiat rails suggest that customers who take part in their bank’s merchant deal program generally do not get any notice at the point-of-sale that they effectively got their discount rate, and the discount rate itself doesn’t appear as a declaration credit up until days later on. A bank can purchase a genuine-time-notice deal-redemption option however it’s excessively costly and intricate to do so, and needs to be done on a bank-by-bank basis; really couple of do this, and there is no universal procedure to be leveraged.

Merchant financing of the fiat provides needs to occur beforehand through pre-financing of a dedicated budget plan, or payment is ferreted out with the normal ‘30 days’ type credit contract, supported by legal commitments.

Bitcoin rails entirely overthrow these tradition structures. Consumers can not just get notice in genuine-time at the point-of-sale when they make the most of a bitcoin-native deal, to get that visceral peace-of-mind, however they get the discount rate in genuine time too. Not just that, however ‘split payments’ is supported by innovation like LN Bits and Bolt 12, where the bitcoin-native deal provider/company can also make money in genuine time at the very same point-of-sale occasion. This basically makes the fiat ‘billing’ action outdated. Merchants can also alter the deal worths, minimum invest limits and most notably the stock of staying offers/discounts (the marketing budget plan) they wish to devote to, in genuine time; such modifications are difficult through the fiat channels which needs budget plan dedication weeks beforehand. I’m just scratching the surface area of the long list of unreasonable benefits bitcoin gives the table in the arrangement of a merchant provides program, however I’ll leave it there, in the meantime.

Caveats

Reach: An use program is basically a 2-sided market and it is necessary to have as big an audience of customers as possible to make merchant involvement rewarding. The bitcoiner audience, and what I call the ‘bitcoin-curious’ audience, are still fairly little sectors, though growing.

Targeting: Fiat merchant deal programs have a silver bullet that is presently not available on bitcoin, a minimum of straight; deal history of the customer. This history allows the merchant to thoroughly invest their marketing budget plan on particular customer sectors fresh, lapsed and devoted groups. This is a vital tool to guarantee greatest return on marketing invest (ROAS) and also allows informative before-vs-after test vs. control ‘incrementality’ reporting, showing invest lift of the marketing project that is extremely persuading and helpful to merchants who require to validate investing cash on the deal projects.

That stated, I’d argue that these cautions are alleviated by the capacity for merchants to bring in the bitcoiner section, even broadly and in an untargeted method, as the section is so important; skewing wealthy, prominent and maniacally devoted to bitcoiner-friendly merchants.There is a very first-mover advantage for any merchant in their vertical/category to attract this indispensable section initially.

The above is an example of how bitcoin strips out expenses from the tradition system, like never ever in the past, opening much greater margins for merchants, and providing a more instant, visceral and rewarding customer experience. This long list of unreasonable benefits provided by bitcoin-native merchant deals cannot be copied by any rival operating on fiat rails. This is based upon my last 10 years experience dealing with CLO merchant loyalty programs.

Michael Saylor states to “Buy bitcoin, and wait”. For a number of us bitcoiners, we have the chance to not simply ‘wait’ however to proactively assist drive hyperbitcoinization. I’m taking this action with merchant deals, leveraging my knowledge and experience to bring bitcoin-native deals to life. I’m curious about what remarkable expense savings and brand-new, distinct usage cases other bitcoiners can reveal by assessing their fiat mining task experience and knowledge, reimagining it through the lens of bitcoin.

This is a visitor post by John McCabe. Opinions revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.