The historic patterns showed by Bitcoin have actually regularly shown a four-year cycle. Presently, 2 years into the existing cycle, financiers are diligently keeping track of market signs and emerging patterns to obtain insights relating to the prospective advancements in the upcoming 2 years. This post takes a look at the complexities of Bitcoin’s four-year cycle, evaluates previous market habits, and ponders future possibilities.

The 4-Year Cycle

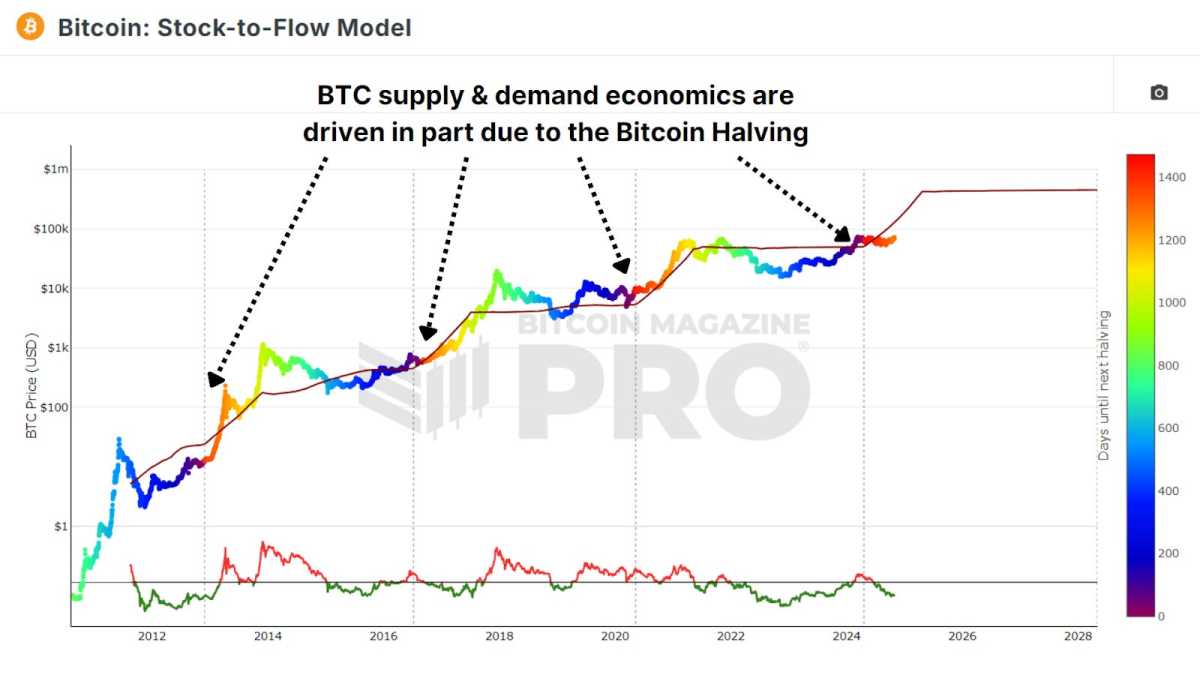

Bitcoin’s four-year cycle is substantially affected by the set up cutting in half occasions, which cut in half the block benefit assigned to miners every 4 years. This decrease in the block benefit reduces the supply of brand-new Bitcoin getting in the market, frequently leading to supply-demand characteristics that can raise rates.

The Stock-to-Flow Model functions as an important visualization tool for comprehending this phenomenon; it juxtaposes the existing Bitcoin in blood circulation with its inflationary rate, proposing a ‘reasonable worth’ by drawing parallels with similar tough possessions such as gold and silver.

Currently placed in the middle of this cycle, the market might be getting in a stage of rapid gains, reflective of the common 1 year healing duration that follows each cutting in half occasion.

A Look Back at 2022

In November 2022, Bitcoin experienced a significant recession in the middle of a series of business failures. The collapse of FTX, catalyzed by insolvency reports, prompted prevalent sell-offs. This series of occasions sped up even more failures throughout other crypto entities, consisting of BlockFi, 3AC, Celsius, and Voyager Digital.

During this duration, Bitcoin’s cost dropped from around $20,000 to $15,000, matching the wider market panic and raising issues relating to Bitcoin’s practicality. However, in a way constant with historic patterns, Bitcoin rebounded substantially, climbing up fivefold from its 2022 lows. Investors who stayed resistant throughout this troubled duration were eventually rewarded, strengthening the argument that Bitcoin’s cyclical nature continues.

Similar Sentiment

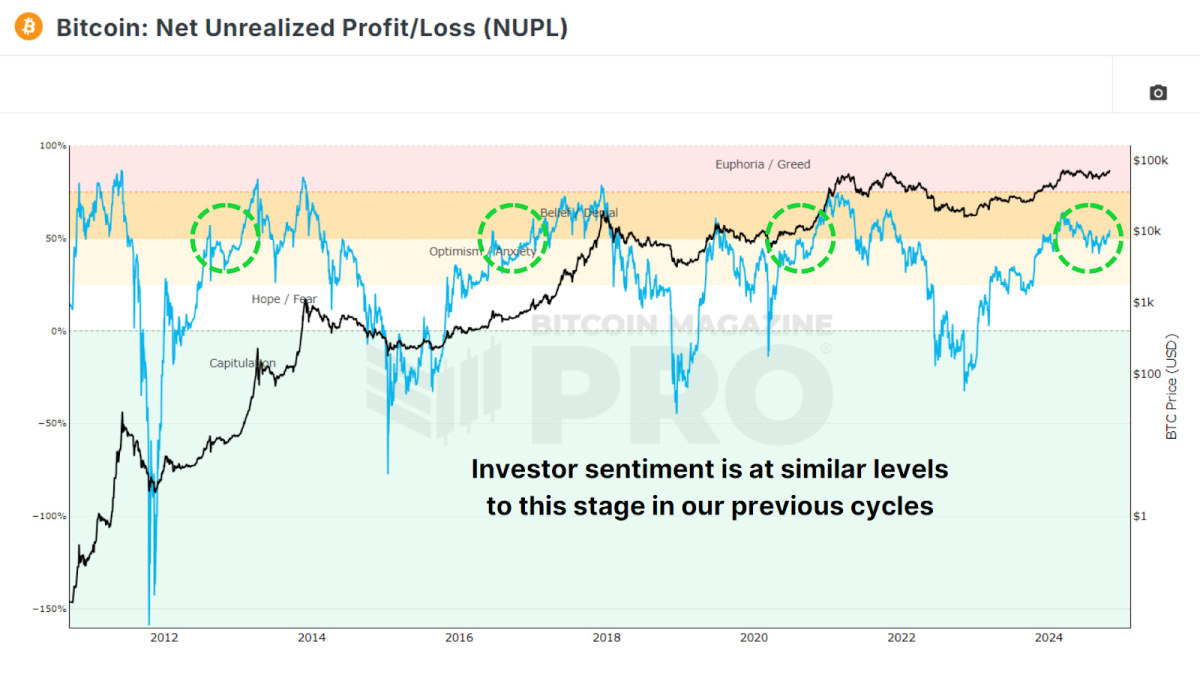

In addition to cost patterns, financier belief shows a foreseeable rhythm throughout each cycle. An analysis of the Net Unrealized Profit and Loss (NUPL), which shows latent gains and losses within the market, shows that psychological reactions such as bliss, worry, and capitulation tend to repeat. Typically, Bitcoin financiers experience increased sensations of worry or pessimism throughout bearishness, just to shift back towards optimism and bliss as rates recuperate. Presently, the market seems getting in the ‘Belief’ phase following an early cycle rise and subsequent debt consolidation.

The Global Liquidity Cycle

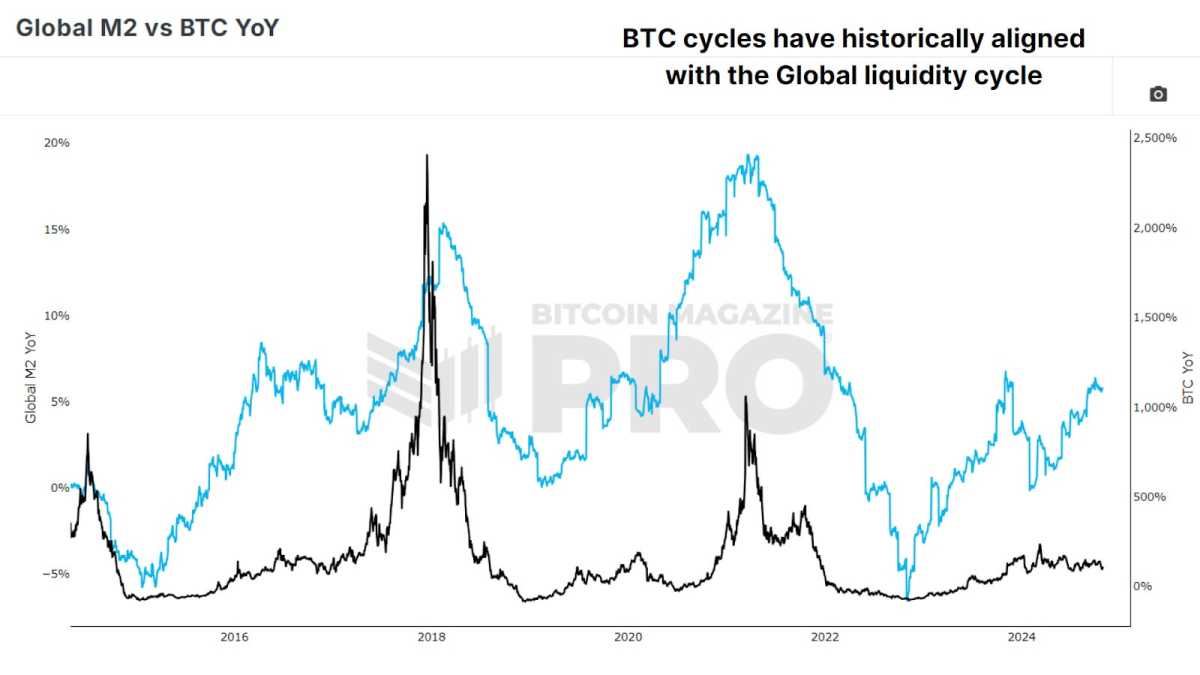

Global liquidity, as determined by the year-over-year modification in the cash supply (M2), has also abided by a four-year cycle together with Bitcoin. For circumstances, M2 liquidity struck a low in 2015 and 2018, accompanying Bitcoin reaching its nadir. Additionally, in 2022, M2 once again tape-recorded a low point, lining up with the bearishness bottom for Bitcoin. Following these stages of financial contraction, financial growth from reserve banks and federal governments tends to take place, producing more beneficial conditions for Bitcoin’s cost gratitude.

Familiar Patterns

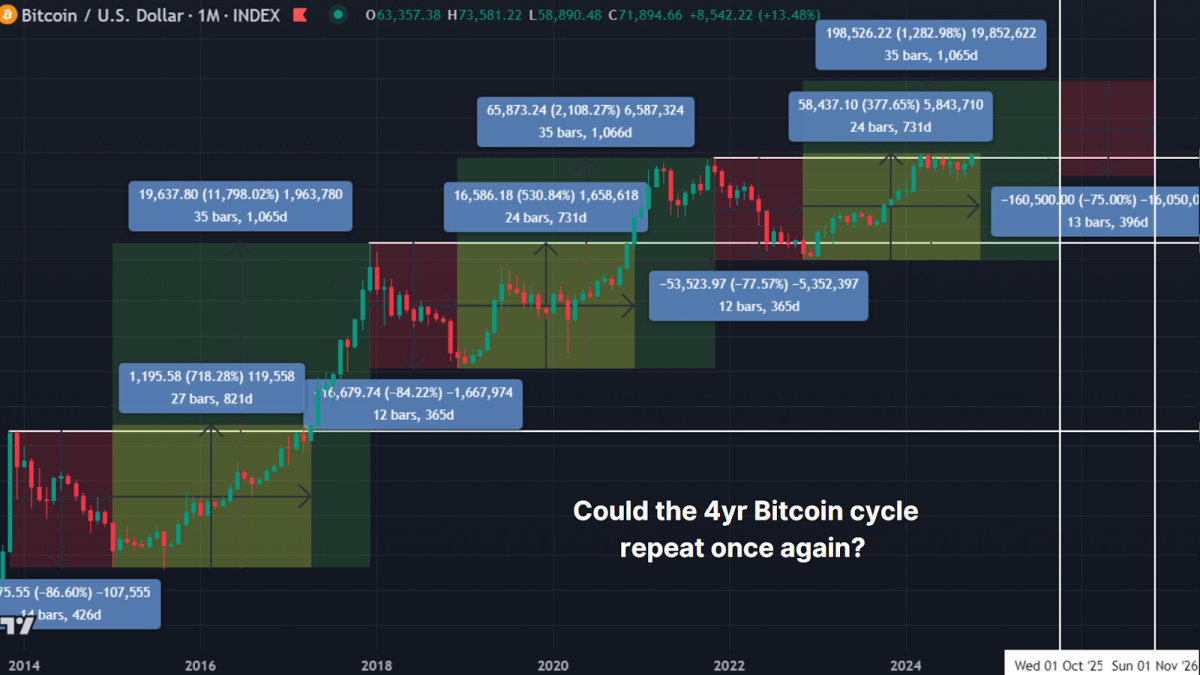

Historical cost analyses show that Bitcoin’s existing trajectory carefully looks like previous cycles. Typically, Bitcoin takes around 24-26 months to exceed previous highs following a market low. In the last cycle, this turning point was attained in 26 months, while the existing cycle appears to follow a comparable climb after 24 months. Historically, Bitcoin tends to reach its peak approximately 35 months subsequent to its lows. Should this pattern continue, considerable cost boosts might be prepared for through October 2025, possibly followed by another bearishness.

Following this anticipated peak, historic patterns recommend that Bitcoin would go into a bear stage in 2026, lasting around one year up until the initiation of the next cycle. While these patterns are not ensured, they offer a structure that Bitcoin has actually regularly abided by in previous cycles, permitting financiers a basis for preparing for and adjusting to market motions.

Conclusion

Despite dealing with considerable obstacles, Bitcoin’s four-year cycle has actually shown durability, mostly affected by its supply schedule, international liquidity characteristics, and financier psychology. Consequently, this four-year cycle functions as a necessary analytical tool for financiers trying to translate prospective cost motions in Bitcoin throughout the rest of the cycle. However, it might be sensible for financiers not to rely entirely on this cycle. By incorporating on-chain metrics, liquidity analysis, and real-time financier belief, data-driven approaches can improve financiers’ capability to react expertly to developing market conditions.

For a more extensive expedition of this topic, interested readers are motivated to see a current YouTube video entitled “The 4 Year Bitcoin Cycle – Halfway Done?”

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.