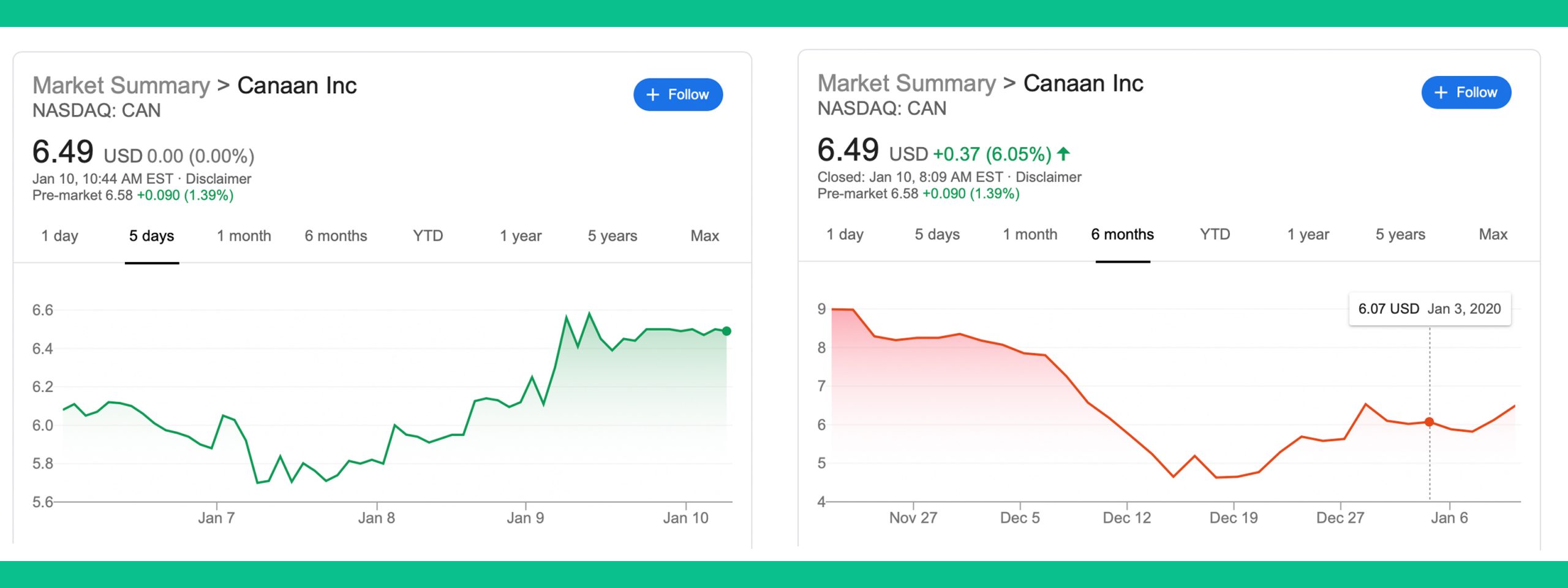

On November 21, the Chinese mining rig maker Canaan Inc. released its going public (IPO) sale of $90 million worth of U.S. shares. Canaan shares at first cost $8.99, however plunged over 48% on December 16 to $4.65 per share. Since then, Canaan has actually released a series of 5 brand-new mining rig batches that process in between 48 terahash per 2nd (TH/s) to 68TH/s for January and February shipment durations. Canaan stock offered on the Nasdaq Global Market has also handled to leap back 39% because the considerable plunge in mid-December.

Also Read: 2019’s Bitcoin Miners Are 5x Faster Than Predecessors

Canaan’s IPO Shares Lost 48% But Have Regained Much of the Losses in 2020

Months earlier, 3 giant mining rig companies from China, Bitmain, Canaan, and Ebang, stopped working to IPO on the main stock market in Hong Kong. Then Canaan stunned everybody when the mining rig maker declared its preliminary public stock offering in October with the U.S. Securities and Exchange Commission (SEC). Following the IPO filing by Canaan, reports have actually been distributing that both Ebang and Bitmain are applying for IPO status in the U.S. too. Canaan’s stock is called CAN (NASDAQ: CAN) and the shares were contributed to Nasdaq on November 21 with a basic opening event. During the very first day of trading, CAN lost a couple of cents per share, however then dropped 7.68% on November 23rd’s trading sessions. By mid-December Canaan’s public shares were down 48% prior to restoring some ground.

Canaan’s shares leapt from a lowest level of $4.65 on December 16 to increase 11% the really next day. However, after another day of trading on Nasdaq, CAN dropped even lower to $4.63 a share. Canaan’s stock has actually been apparently following BTC’s market steps and the stock worth began to increase together with BTC’s progressive climb. On January 9, CAN was trading for $6.49 per share and the stock is up 6% today. Market observers can’t identify precisely why Canaan’s stock plunged throughout its very first month out of eviction however it’s not unusual for nascent shares to move. However, speculators believe that the CAN stock will follow together with BTC’s rate motions and have actually kept in mind that Canaan has actually stiff competition. Following the IPO, Canaan has launched an overall of 5 high-powered bitcoin miners with 48-68TH/s. Chinese mining rig rivals like Bitmain and Innosilicon have also launched a variety of miners in the wake of Canaan’s preliminary IPO upset.

Canaan Reveals January and February Mining Rig Batches Aiming to Compete With Other Market Leaders

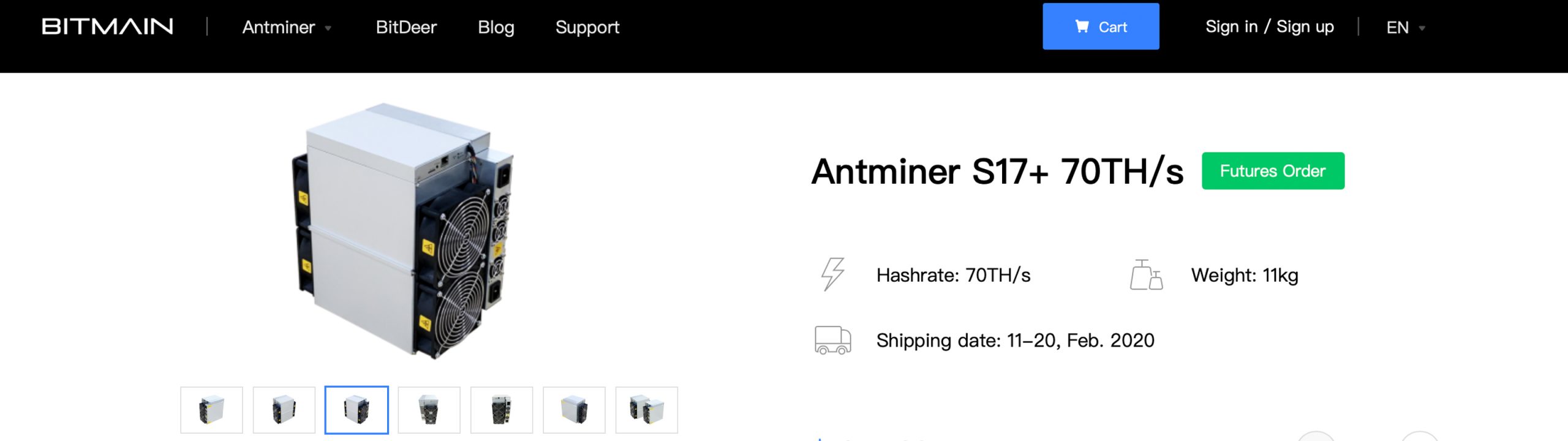

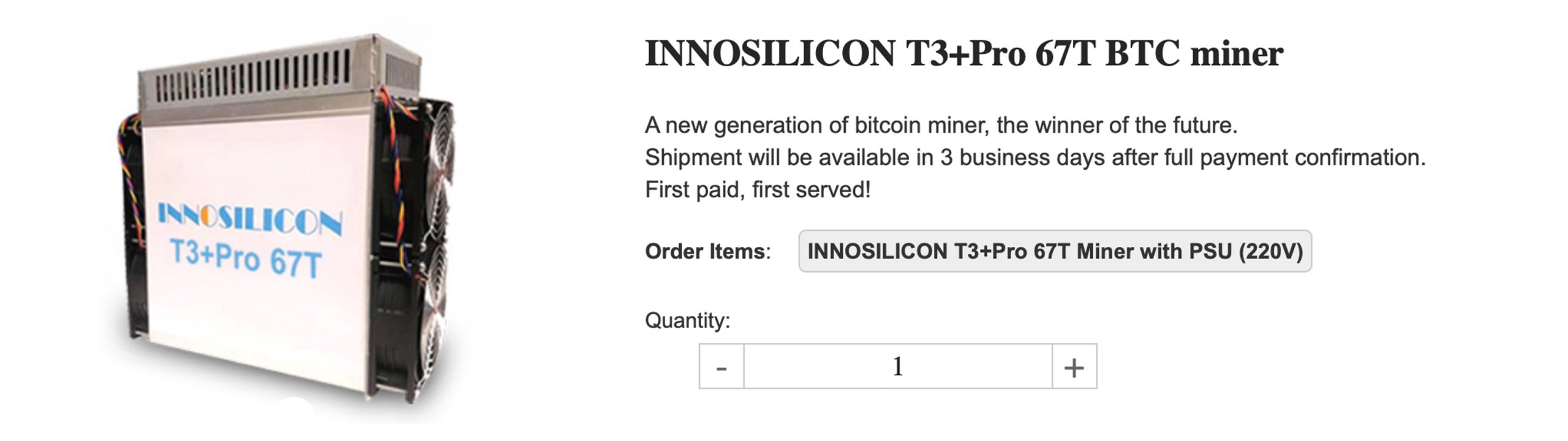

Canaan’s shop is now offering February batches of the brand-new Avalonminer 1166 series (68TH/s) at $1,978 per system. The next generation Avalonminer is approximately the exact same rate as Innosilicon’s Terminator 3+ Pro 67TH/s device at $1,999 per system. Canaan also has a lower design device, the Avalonminer 1146 ($1,204 per system with 56TH/s), as both the 1166 and 1146 are arranged for February shipment. Now Canaan customers can acquire miners that will provide in January as the business is offering 3 variations of the Avalonminer 1066 series. These 3 miners procedure in between 48-50TH/s and cost $1,032 to $1,075 per system. However, Bitmain buyers can get January shipping for mining rigs that produce in between 40-64TH/s and costs are a couple hundred less.

If a consumer wished to wait the exact same timeframe for the Avalonminer 1166 series (68TH/s) however purchase Bitmain’s Antminer S17+ (70TH/s) they would conserve $323 per system. Miners needs to also remember that the Avalonminer 1166 takes around 3196W off the wall, while the Antminer S17+ takes 2800W. That’s a referral power effectiveness distinction of 40 joules per terahash (J/TH) for the Antminer S17+ to the 47J/TH for Canaan 68TH/s design.

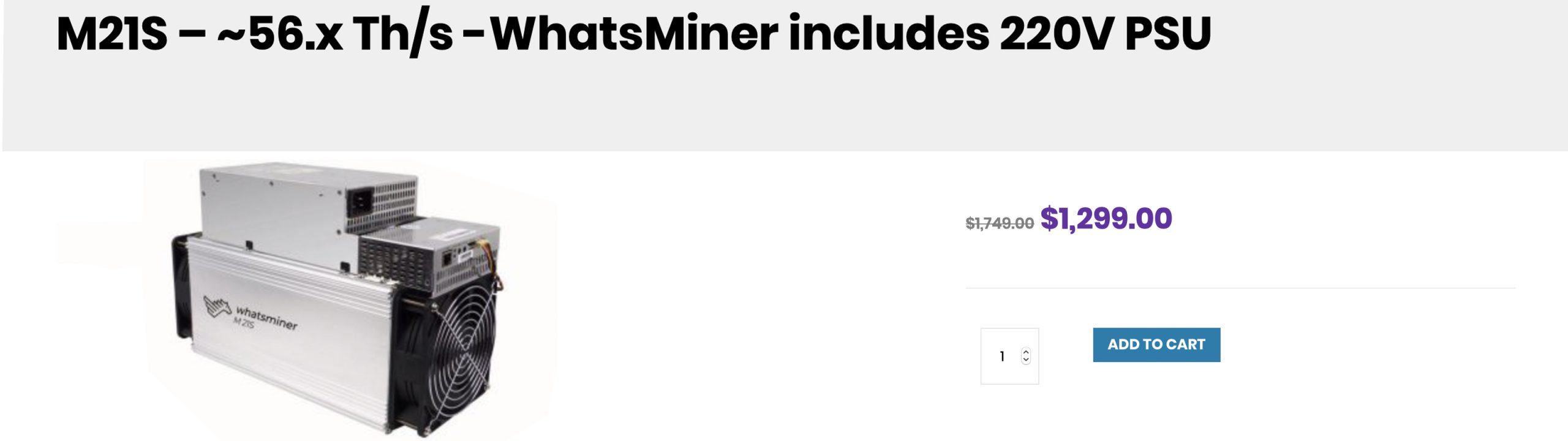

The Avalonminer 1166 power usage resembles Innosilicon’s Terminator 3+ Pro 67TH/s gadget which utilizes 3300W. Another rival Canaan needs to handle is the Chinese company Microbt which is offering the Whatsminer M21S ($1,299 per system with 56TH/s). Microbt just recently slashed the M21S rate after at first charging $1,749 per mining rig and the business declares products ship 1-2 organisation days after the payment is settled.

The increasing BTC costs may assist Canaan’s shares offer much better, however as far as producing sales, the business has stiff competition. All of the Chinese mining rig producers appear to be well-stocked with gadgets and are banking on financiers ‘equipping their farms’ with high-powered miners. Canaan’s public shares, nevertheless, might assist the business a touch longer if the bull run doesn’t take place immediately. Right now as far as 50TH/s to 70TH/s next-generation miners are worried, there’s a high supply thanks to Canaan, Bitmain, Innosilicon, and Microbt. Out of all the rivals, Bitmain and Canaan have more options as far as the mining rigs offered for individuals searching for hashrates in between 40-70TH/s.

What do you think of Canaan’s public stock efficiency over the last month? What do you think of Canaan’s brand-new mining rigs and the stiff competition the business faces? Let us understand what you think of this subject in the comments area below.

Image credits: Shutterstock, Canaan, Bitmain, Microbt, Innosilicon, Wiki Commons, Fair Use, and Pixabay.

Did you understand you can make BTC and BCH through Bitcoin Mining? If you currently own hardware, link it to our effective Bitcoin mining swimming pool. If not, you can quickly begin through among our versatile Bitcoin cloud mining agreements.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.