U.S. Treasury Secretary Steven Mnuchin mentioned recently that a reported $1.5 trillion in missing out on money — mainly one hundred dollar expenses — was “being in safe-deposit box all over the world.” The notoriously anti-bitcoin U.S. main kept in mind that “there’s a great deal of ‘Benjamins’ all over the world” and highlighted the strength of the currency as the primary factor lots of in other nations want to have it. The remarks come off as flippant to some, thinking about Mnuchin is among the leading pushers for monetary regulation and anti-money laundering rhetoric.

Also Read: The Myth of Authority: Mnuchin Denies USD Is Used Criminally

$1.5 Trillion in Cash Unaccounted For

In a current interview with Fox News’ Lou Dobbs, U.S. Treasury Secretary Steven Mnuchin rejected a concern concerning a reported $1.5 trillion divot in the worldwide money supply. The “vanishing and unaccounted for” money is mainly U.S. 100 dollar expenses. Mnuchin prefaced his response about the missing out on $1.5 trillion by stating that “the dollar is the reserve currency of the world and everyone wishes to hold dollars.” He keeps in mind that in his view the U.S. is a safe location for holding and investing cash. “Literally, you understand, a great deal of these hundred dollar expenses are being in safe-deposit box all over the world. And especially in a world of unfavorable rates of interest, you understand, you can hold U.S. dollars and you wear’t need to lose cash,” Mnuchin specified:

So, uh, there’s a great deal of Benjamins all over the world.

Anti-Bitcoin Rhetoric

Mnuchin’s casual fielding of the concern is intriguing provided his performance history of distinctly pro-surveillance, pro-strict regulation of other currencies such as bitcoin. In July, Mnuchin ensured journalism that “Cryptocurrencies, such as bitcoin, have actually been made use of to support billions of dollars of illegal activity like cybercrime, tax evasion, extortion, ransomware, illegal drugs, human trafficking. Many gamers have actually tried to utilize cryptocurrencies to money their malign habits.” He went on to call bitcoin a “nationwide security concern.”

When faced the very same month with the truth that USD is utilized for the comparable things by NBC’s Joe Kernen, a defensive Mnuchin answered back: “I wear’t believe it’s been effectively finished with money. I’ll push back on that. We’re going to make certain that bitcoin doesn’t end up being the equivalent of Swiss-numbered savings account.”

With 2 things now developed according to Mnuchin — one, that USD is strong, and 2, that it has actually not been utilized effectively for dubious activities — it’s not to unexpected that a cool $1.5 trillion that might be in the hands of wrongdoers is of little issue to the leading U.S. authorities.

The Strength of the USD

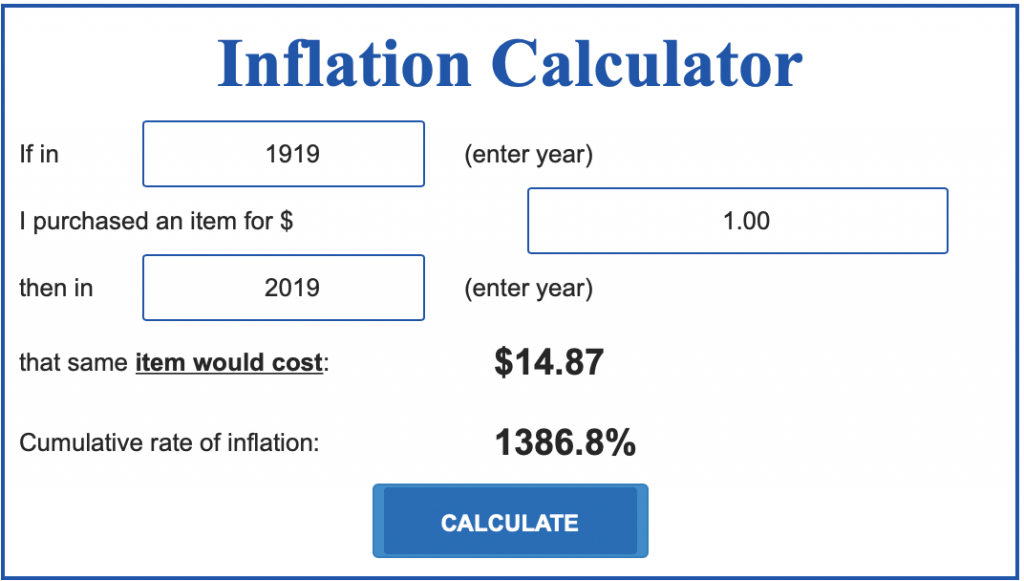

There’s little contention from market specialists that compared to lots of other possessions, the USD is reasonably strong. Examining the constant, huge decline over the last 100 years of the world’s fiat currencies, nevertheless, paints a various image than Mnuchin provides. Although the treasury secretary contrasts the dollar’s strength with unfavorable rate of interest policies around the world, he does not discuss the U.S. Federal Reserve’s existing huge stimulus task, which has actually produced over $3 trillion in newly printed USD considering that September, or the truth that the rate of interest in the U.S. is also heading back towards the no bound once again.

A lower talked about idea is that — in essence — the federal government with the most weapons wins in a world where worth is identified by state decree (lit. “fiat”) and not by a currency really having financially sound homes. The current release of the declassified “Afghanistan Papers” might indicate this truth, with almost $1 trillion invested considering that 2001 on a dispute that, according to those included, lacked instructions and which has now cost the lives of over 43,000 Afghan civilians alone. An unnamed executive with the U.S. Agency for International Development specified:

We were burning $400 million monthly at one point. We lost neutrality. We were provided cash, informed to invest it and we did, without factor.

With the above elements playing into the strength shown by Mnuchin, it’s not hard to question why lots of desire to pull out of the “strong” currency, and make use of noise, non-violent cash in the kind of permissionless, peer-to-peer money like bitcoin. After all, if Mnuchin and business are complimentary to invest and utilize currencies as they want, the argument is that serene individuals ought to have the ability to also.

What do you think about Mnuchin’s declarations on the missing money? What about his declarations on bitcoin? Let us understand in the comments area below.

Image credits: Shutterstock, mark reinstein, reasonable usage.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.