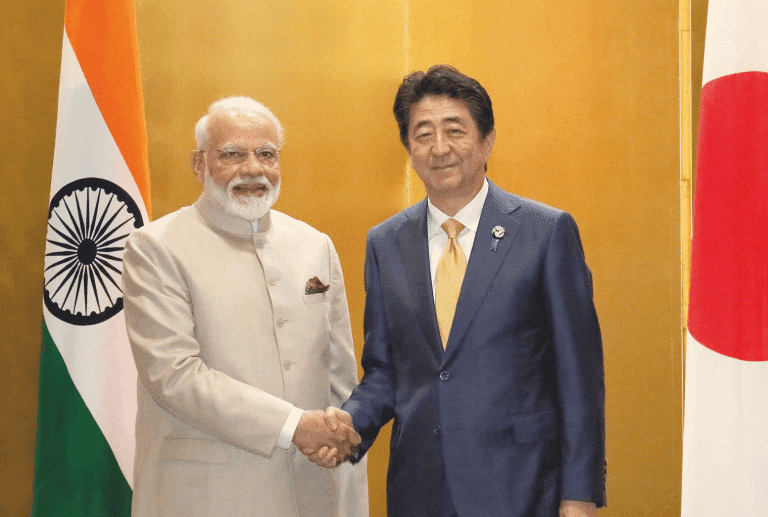

India’s Prime Minister Narendra Modi took part in conversations on crypto possessions at the G20 leaders’ summit in Osaka, Japan. At the conclusion of the summit, the leaders of the G20 nations collectively stated their dedication to using the crypto standards set by the Financial Action Task Force. India’s brand-new financing minister, Nirmala Sitharaman, also signed up with other G20 financing ministers to state the exact same dedication.

Modi Participated in Crypto Discussions at G20 Summit

India’s sherpa to the G20, Suresh Prabhu, detailed today different conversations Modi took part in at the two-day G20 leaders’ summit which happened on June 28 and 29 in Osaka, Japan. India will be the host nation for the G20 summit in 2022.

“As you understand India was looking forward to G20 for numerous point of views,” Prabhu started. “Prime Minister Narendra Modi who led India’s delegation raised numerous concerns of international issue in addition to highlighted the function of India’s brand-new development into making modification in a way that advantages all.”

According to Prabhu, the subject of executing crypto standards was discussed by the G20 leaders at the summit. “In economy, financing will be a crucial problem. Therefore concerns associated to international financing … whether it relates to technological development which can provide advantages in monetary markets or whether it relates to the dedication in using just recently modified FATF [Financial Action Task Force] standards for virtual possessions, all these concerns were also discussed,” he verified.

G20 Leaders and Finance Ministers Separately Committed to FATF Standards

At the conclusion of the summit, the leaders of the G20 countries, consisting of India, collectively provided a statement that includes declarations on crypto possessions. They stated:

We, the leaders of the G20, satisfied in Osaka, Japan on 28-29 June 2019 to make joined efforts to address significant international financial difficulties … We declare our dedication to using the just recently modified FATF standards to virtual possessions and associated companies for anti-money laundering and countering the funding of terrorism.

The FATF is an intergovernmental company accountable for establishing international policies in locations such as combating cash laundering. It presently makes up 37 member jurisdictions, consisting of India, and 2 local companies.

Ahead of the leaders’ summit, the G20 financing ministers and reserve bank guvs satisfied in the Japanese city of Fukuoka on June 8 and 9 where crypto-related subjects were discussed, consisting of FATF’s assistance on crypto possessions. At completion of the occasion, they stated their dedication to using the FATF standards to crypto possessions.

India’s Finance Minister Nirmala Sitharaman and Finance Secretary Subhash Chandra Garg participated in the conference. Garg, who is also India’s Secretary of Economic Affairs, heads an interministerial committee entrusted with preparing a crypto regulative structure for India. He stated last month that the report consisting of the advised structure was prepared to be sent to the financing minister for approval.

Moreover, India’s Department of Revenue had actually been dealing with the FATF on the international standards for crypto possessions, the nation’s financing ministry exposed in its March report of all essential activities in 2018. The FATF provided its brand-new assistance for the risk-based method for virtual possessions and virtual property provider (VASPs) on June 21, a week prior to the G20 leaders’ summit began.

Varun Sethi, creator of Blockchain Lawyer, informed news.Bitscoins.internet that, because India belongs to the FATF, “preferably, it might obtain the suggested arrangements from the suggestions of FATF. Hence FATF is an appropriate company for India to establish legal literature for crypto standards.”

Impact on Indian Crypto Industry

Nischal Shetty, CEO of regional crypto exchange Wazirx, discussed to news.Bitscoins.net the possible effect of using the FATF standards on the Indian crypto market, specifying:

Implementing the FATF standards would imply that crypto gets a legal status in India. The most significant benefit is to completion clients as the crypto market can as soon as again provide banking services to the fiat on ramps.

Currently, there is a banking restriction in India on crypto provider consisting of exchanges. The nation’s reserve bank, the Reserve Bank of India (RBI), provided a circular in April in 2015 restricting managed entities from handling cryptocurrencies or supplying “services for assisting in anyone or entity in handling or settling” in cryptocurrencies. The restriction entered into result in July in 2015. A variety of writ petitions have actually been submitted with the supreme court to raise the restriction, however the court consistently held off hearing the case. The next hearing is set up for July 23.

Since the restriction worked, at least 4 crypto exchanges have actually closed down due to the banking constraint. Zebpay, previously among the nation’s biggest crypto exchanges, shut down all of its regional exchange operations in September in 2015. Coindelta revealed its shutdown in March and Coinome in May. Koinex did the same recently, blaming the banking restriction and the federal government’s hold-up in presenting crypto guideline.

Sumit Gupta, CEO of regional exchange Coindcx, stressed to news.Bitscoins.internet that “The FAFT suggestions are not binding on members,” keeping in mind that it will be up to each member nation “to figure out whether to enact the suggestions through legislation or guideline.” However, he asserted:

For India, it looks to be a no brainer and will search for guaranteed execution as its position for cryptocurrency has actually been unfavorable as it thinks cryptos to be a huge hideout for black cash and cash laundering.

How Indian Exchanges Could Apply FATF Standards

A variety of market individuals have actually raised issues concerning the technical difficulties of abiding by FATF’s requirements. Blockchain forensics company Chainalysis summed up that the FATF standards “need VASPs not just to validate their clients’ identities, however also to determine the receivers of their clients’ transfers, and transfer that details. This would apply to all deals above a 1,000 USD/EUR limit.”

Gupta highlighted some concerns concerning the execution of the FATF standards such as “How will one determine whether a counterparty is a specific or company” and “How to determine an individual with 2 identities at 2 various provider e.g. most Chinese have different English names.” He mentioned:

There will be a requirement for brand-new facilities for sending out consumer details amongst provider … So numerous provider currently have customers without any KYC applications. Collecting details from them will be lengthy and a prolonged workout.

Former FATF President Roger Wilkins AO commented, “What we are speaking with market is that the brand-new guidelines might have the opposite result to which they were meant, successfully requiring crypto deals off the regulated platforms.” He provided a keynote speech at the V20 summit, a conference where policymakers and agents of a variety of crypto business assembled to talk about how VASPs might follow the FATF standards.

At completion of the two-day V20 summit, a number of crypto associations signed a Memorandum of Understanding (MOU) to develop an association to “help in developing a method to engage with federal government firms and the FATF to guarantee our benefits are comprehended and valued at a worldwide level,” the V20 revealed.

Shetty continued to discuss to news.Bitscoins.net that using FATF’s suggestions “is certainly not uncomplicated however it’s an excellent action in the ideal instructions for nations fretted about cash laundering.” He kept in mind that “to be able to execute them, nations will require to comply with each other so that crypto markets in every nation can collaborate to execute this,” elaborating:

The FATF standards cannot be embraced in silos in each nation as there are suggestions that need the partnership of exchanges and crypto wallets throughout nations.

“You cannot anticipate an exchange in one nation to embrace FATF standards while exchanges in other nations wear’t, that simply won’t work,” he restated. While keeping in mind that his exchange “currently carries out strict KYC,” Shetty confessed, “We’ll certainly have to put in more resources in ending up being certified.” He thinks that doing so will “also make sure maximum security for our users in addition to assurance versus cash laundering for our nation.”

Gupta mentioned that, if the FATF standards are carried out, “the exchanges will begin executing KYC standards hence making it hard to handle cryptos with personal privacy and privacy.” He included that “They will also stop supplying items and coins that support confidential deals. For a great deal of exchanges, this would be jeopardizing on the concept of decentralization.”

Potential Benefits to India

India has actually been pestered with reports of a draft expense to restriction cryptocurrencies over the previous couple of months. Bloombegquint reported that an expense entitled “Banning of Cryptocurrency and Regulation of Official Digital Currency Bill 2019” proposes a 10-year prison term for a variety of crypto-related activities.

Tanvi Ratna, a policy expert and EY Blockchain Lead who has actually dealt with the Indian federal government on a number of jobs, shared some ideas with news.Bitscoins.internet. “I question that India would deal with any issues abiding by FATF standards,” she started. “By all signs, all crypto deals are going to be closed down. The just deals most likely to continue would be with a sovereign digital currency, which ought to be relatively simple to do AML/KYC in.”

Ratna continued: “There is absolutely nothing truly to gain or lose for India by abiding by the standards, maybe just a degree of cohesion with other reserve banks. Nobody yet has actually broken a method to do total KYC/AML of deals, so with a sovereign coin, India may even be the very first. The barriers for other nations and the bigger cryptocurrency area will stay, India is not going to supply any services to that.”

The Indian federal government has actually not made any statement concerning crypto guideline so reports of the previously mentioned expense stay simply reports. A variety of Right to Information (RTI) demands have actually been submitted concerning this expense, among which exposes that the reserve bank had no understanding of this expense and did not propose a restriction on crypto possessions.

Shetty thinks that executing the FATF standards will “eliminate all the unpredictability and fear that the crypto neighborhood in India goes through every couple of weeks when there’s a brand-new report of a crypto restriction,” asserting:

India needs to certainly follow what most of the G20 countries choose. FATF standards are developed to generate total openness to crypto deals. This is way much better than a restriction where the nation will never ever have any presence into crypto deals.

“If India embraces these guidelines instead of prohibiting cryptocurrency, the market would be without harmful characters and will permit development and development,” Gupta believed. The alternative “will also avoid individuals from utilizing cryptocurrencies for their favorable qualities instead of as hideout for tax evasions,” he explained.

In Prabhu’s declaration to journalism after the G20 leaders’ summit, he declared that Modi “thinks in altering the world for [the] much better through a procedure where innovation, standard understanding, excellent governance and making certain that whatever is incorporated into a unified policy.”

Prabhu also stated that India and Japan will “talk about much more things in extension.” Japan has actually been at the leading edge of crypto guideline, having actually legislated cryptocurrencies as a method of payment back in April 2017 and currently authorized 19 crypto exchanges to run in the nation. In addition, over 140 more business have actually revealed interest in signing up crypto exchanges in Japan, the nation’s leading monetary regulator formerly informed news.Bitscoins.internet.

Editor’s Note: This post has actually been upgraded to even more clarify that Prabhu merely offered the information of the conversations Modi took part in to journalism, not that Prabhu himself took part in the conversations in location of Modi.

Do you believe India should follow the FATF standards? How do you believe India will manage cryptocurrency? Let us understand in the comments area below.

Are you feeling fortunate? Visit our authorities Bitcoin gambling establishment where you can play BCH slots, BCH poker, and much more BCH video games. Every video game has a progressive Bitcoin Cash prize to be won!

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.