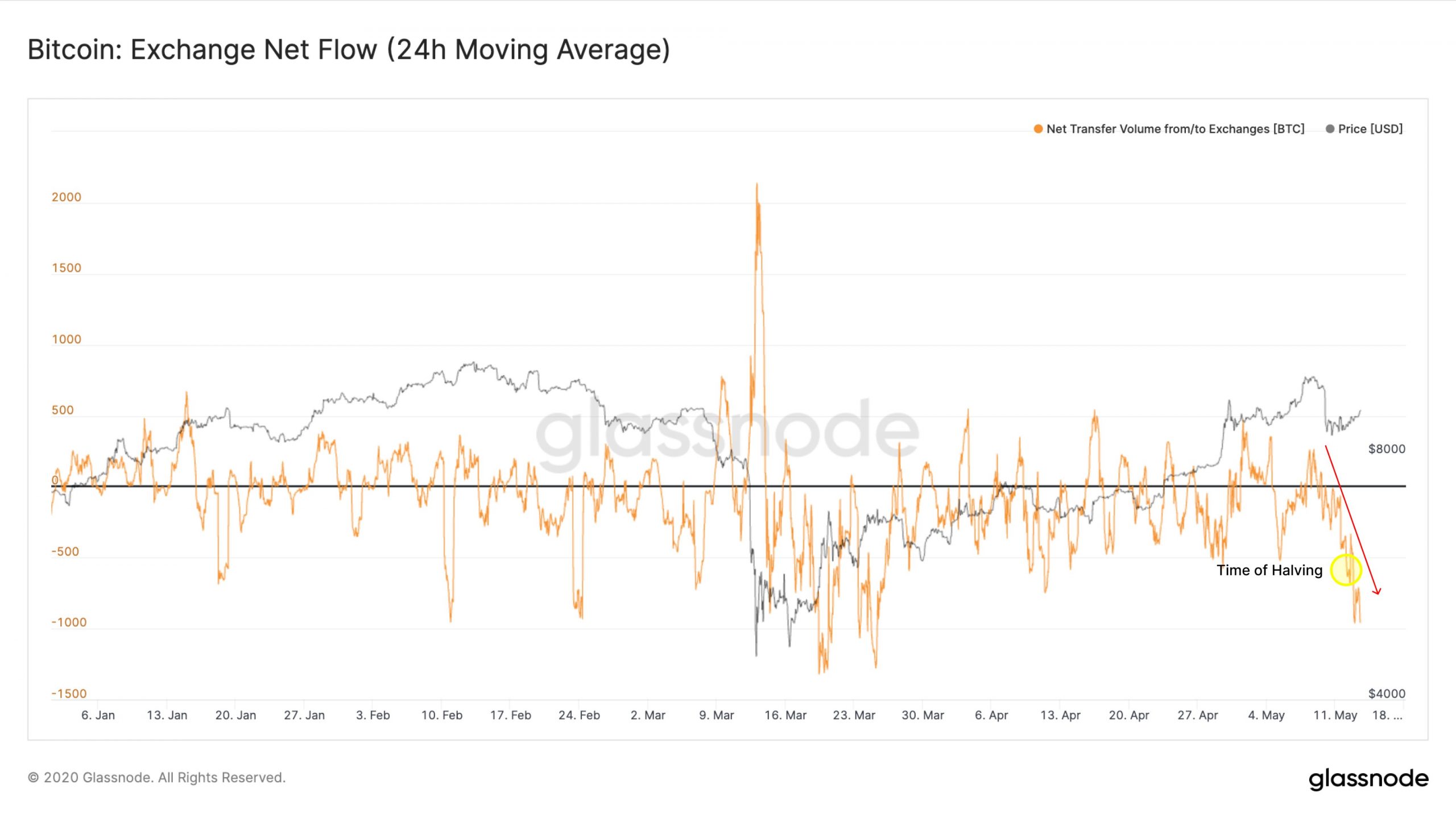

In mid-April, news.Bitscoins.web reported on a variety of BTC withdrawn from cryptocurrency trading platforms and after the 3rd BTC halving, the pattern has actually gotten when again. Data from Glassnode’s Bitcoin Exchange Net-Flow data reveal that near to 24,000 BTC has actually been withdrawn since May 11. Additionally, data from Bituniverse’s exchange reserve information suggest the very same, however withdrawals are just impacting particular exchanges.

Crypto Exchange Bitcoin Withdrawals Grew Before the Halving, While Tether Rises

Just just recently, the BTC blockchain experienced its benefit halving and a variety of observers are keeping track of the network’s health. The cost has actually gradually increased greater, and the total hashrate lost a touch of hashpower, however absolutely nothing extreme like some doubters anticipated. It ought to also be kept in mind that the tether (USDT) market briefly eclipsed XRP’s on May 12, and the total supply of stablecoins has actually crossed a $10 billion evaluation. USDT markets reveal that the market evaluation of the stablecoin tether is $5.74 billion, or over half the evaluation of all the stablecoins in presence. After the bitcoin (BTC) halving on May 11, a variety of users moved close to 24,000 BTC ($222 million) from centralized trading platforms, according to Glassnode’s Bitcoin Exchange Net-Flow data.

In mid-April news.Bitscoins.net leveraged Glassnode’s information, data from Chain.information, and Bituniverse BTC reserve counts also. That information reveals that the majority of the motion came from particular exchanges and not the leading pet dog. For circumstances, Coinbase still has the most reserves in BTC, and reserves have actually stayed approximately the very same. Huobi saw about 20K BTC leave since April 12. Bitfinex and Bitmex have actually seen some good quantities of bitcoin withdrawn ever since also. Bitfinex had around 205K BTC in reserves in mid-April and today there’s just 134K today. Bitmex had around 228K BTC and on March 13, 2020 reserve information now reveals 214K BTC. Bitstamp had 66K BTC on April 12, 2020, however today it has a touch more, holding 71K BTC according to Bituniverse information.

Of course, this has actually triggered a variety of bigger exchanges, by order of reserve count, to move positions. Bitmex and Bitfinex have actually fallen a variety of notches since January 1, 2020. The leading 5 cryptocurrency trading platforms today, after the 3rd BTC halving, consist of Coinbase, Huobi, Binance, Okex, and Bitfinex. Glassnode’s data reveal $200 million leaving a few of the top cryptocurrency exchanges after May 11, however a lot more BTC has actually been withdrawn since mid-April. On Wednesday, Glassnode also tweeted that the Bitcoin Exchange Net-Flow diminished a hair, prior to the halving and following the occasion also. Glassnode composed:

In the hours prior to and after Bitcoin’s halving, exchange web circulation reduced considerably. So far, the occasion has actually had no influence on 2020’s pattern of financiers withdrawing BTC from exchanges.

The millions moved off of exchanges since mid-April have actually been far bigger than the Proof-of-Keys day started by Trace Mayer, which actually didn’t total up to much of anything. Additionally, much like within the mining market, exchanges are seeing an enormous power shift, and those who were when mega-exchanges are being changed by newbies. Coinbase, nevertheless, has actually kept its #1 area for a very long time and still holds 1 million BTC in reserves, according to Bituniverse and Chain.information information.

What do you think of all the BTC withdrawn from exchanges? Let us understand in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.