Originally released on Unchained.com.

Unchained is the main United States Collaborative Custody partner of Bitcoin Magazine and an important sponsor of associated material released through Bitcoin Magazine. For more info on services provided, custody items, and the relationship in between Unchained and Bitcoin Magazine, please visit our site.

There are several methods to custody bitcoin, and there isn’t one best approach that fits everybody in all scenarios. The quantity of bitcoin, the frequency it requires to be accessed, and other elements can figure out which technique makes one of the most sense.

The resources and security requirements of private bitcoin holders will vary from those of organizations. In this short article, we’ll have a look at how the custody methods for these 2 groups compare, and after that reveal an essential fact about the application of multisig.

Custody for people

For normal people wanting to hold bitcoin in self-custody, there are a variety of tools to pick from. Depending on the scenario, a basic singlesig wallet might be enough, with the choice to include adjustments such as seed expression copying or BIP 39 passphrases. We developed a short article explaining on numerous setups, comparing their strengths and weak points.

Individuals less worried with making regular withdrawals, and wanting to protect bigger quantities for long-lasting cost savings, must think about a multisig wallet. Multisig deals threshold security, which can secure users from single points of failure, guaranteeing that no funds are lost if any one part of the setup is ruined, lost, or taken. Achieving threshold security is important for anybody who wants to secure a significant quantity of funds.

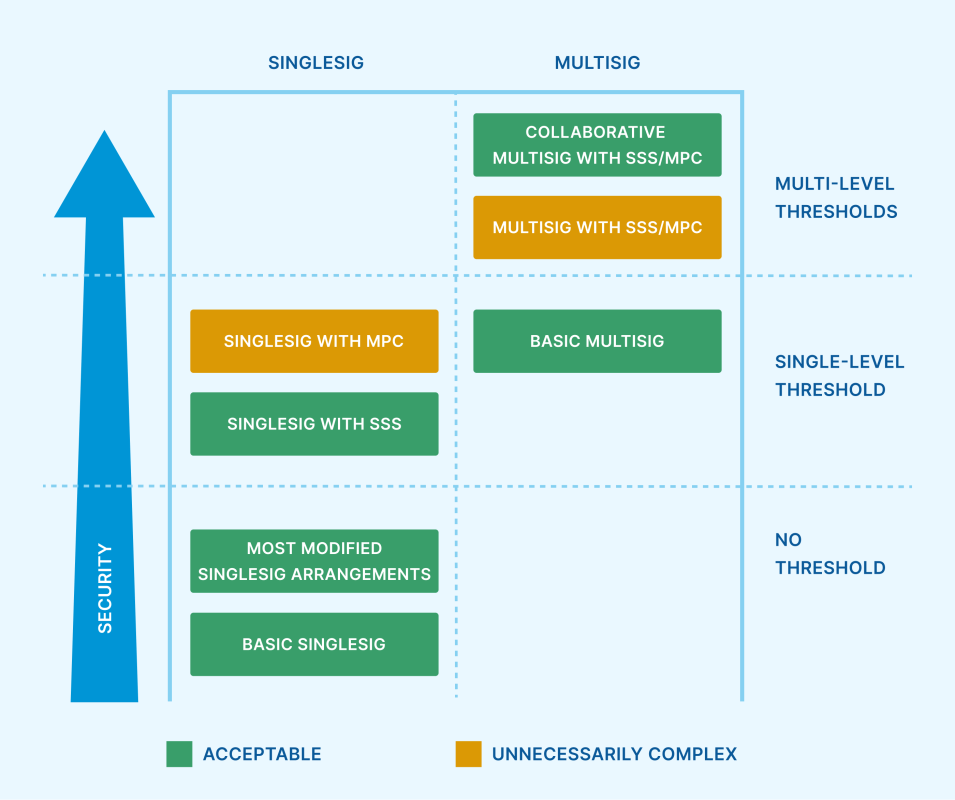

There are a number of other approaches of limit security besides multisig, however they are less suitable for the typical individual. Shamir’s secret share (SSS) is one approach that still results in short-term single points of failure throughout the preliminary setup, and throughout a withdrawal treatment. Multiparty calculation (MPC) is another approach which is very made complex to securely utilize. You can discover more about these in our short article about limit security designs.

Multisig can be integrated with SSS or MPC to develop multi-level limits. Multi-level limits describes a limit on the blockchain level (multisig) along with a limit on the crucial level (SSS or MPC). By integrating these principles, an essential limit of secrets works as the main security for bitcoin holdings, and each secret can have security from ending up being jeopardized by utilizing a limit of its own. Despite a more complex structure, 2 levels of limits uses clear benefits for keeping bitcoin maximally safe.

For a sole person attempting to secure their bitcoin, this technique is extensively thought about needlessly complex. However, if the private gets in a collective custody collaboration with several institutional secret representatives efficient in releasing SSS or MPC, this increased layer of security ends up being more quickly available.

Custody for organizations

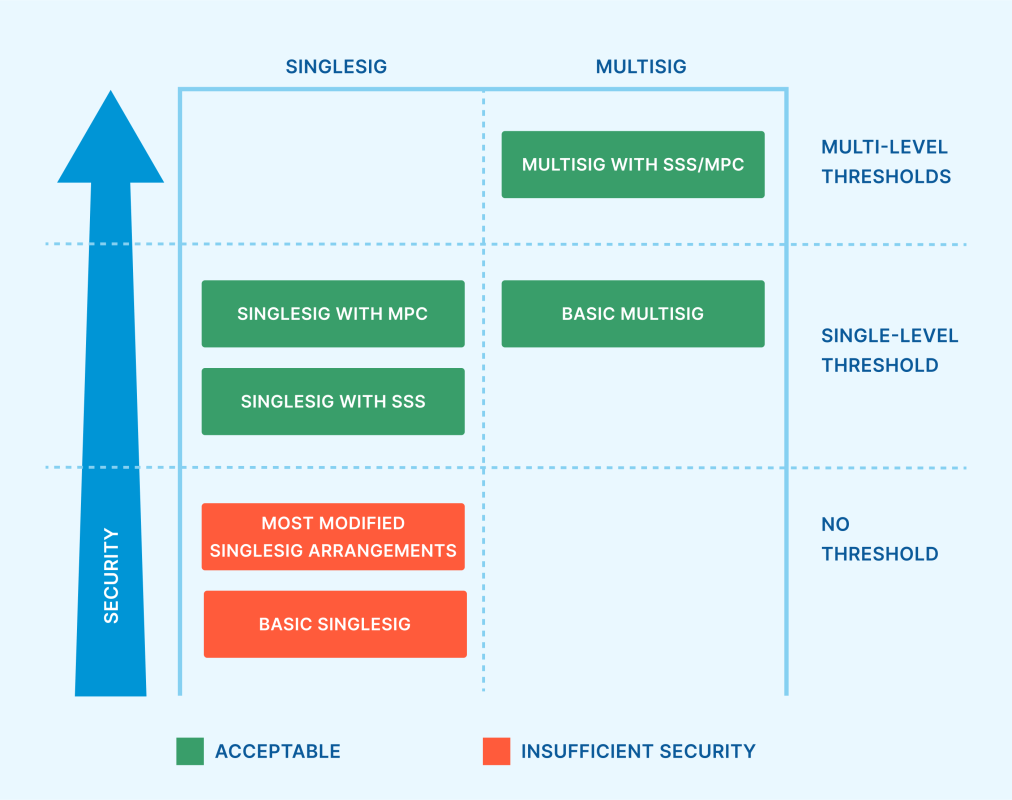

For business, federal governments and other organizations who wish to protect a bitcoin treasury, it wouldn’t be suitable to utilize a few of the custody methods utilized by normal people. If numerous individuals are accountable for large amounts of cash, more extensive controls are essential. Institutional-grade bitcoin custody needs threshold security as a bare minimum.

Multisig, SSS, and MPC are the readily available options to fulfill that requirement. While MPC is without a doubt the most complex to securely utilize, and wouldn’t be suggested for people, an organization with a group of professionals may consider it. However, the additional effort to establish MPC doesn’t indicate that it’s a remarkable choice to standard multisig. All 3 designs have trade offs, as talked about in our earlier short article comparing them.

If an organization desires the greatest level of security possible, they must think about utilizing multi-level limits. In this plan, the structure is multisig, which enables a limit of numerous different personal type in order to gain access to funds. Several various business crucial representatives can be accountable for each secret, lessening counterparty threat from any single custodian. Additionally, each crucial representative can use their own limit security for the secret they are accountable for, by utilizing SSS or MPC. This safeguards the secret from any single officer within the crucial representative company.

Multisig has a higher security ceiling

As you might have discovered from the charts above, there is an unique distinction in between the upper security limitations of singlesig and multisig. With singlesig, there is just a single secret which can have a limit used to it, developing a single-level limit. Multisig can serve as a single-level limit too, however also take a trip an action even more: it can be the structure of multi-level limits.

Therefore, substantial bitcoin holdings that make use of a singlesig structure instead of a multisig structure—which can frequently be observed by taking a look at the address type—have a chance for a security upgrade. Multi-level limits can open a robust multi-institution custody structure that disperses threat throughout crucial representatives. Unchained personal wealth and business customers have a number of high-end crucial representatives to pick from in order to establish this structure. Learn more and book an assessment!

Originally released on Unchained.com.

Unchained is the main United States Collaborative Custody partner of Bitcoin Magazine and an important sponsor of associated material released through Bitcoin Magazine. For more info on services provided, custody items, and the relationship in between Unchained and Bitcoin Magazine, please visit our site.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.