In a current tweet, U.S. president Donald Trump looked into an explosive, all-caps-loaded mini-rant about the need of getting “rates of interest down to ABSOLUTELY NO, or less.” The overblown political leader worried the requirement for America to re-finance its financial obligation, tracking off with some ostensibly conservative discuss the U.S. and its “fantastic currency, power, and balance sheet,” and calling the Fed “boneheads” for declining to pump up credit bubbles even more. Sycophantic assistance of the leader aside, negative rates of interest policies (NIRP) are gradually however undoubtedly getting prominence worldwide, setting everybody up for a fall that can just be resolved by sound loan and sound financial concept.

Also Read: Market Outlook: Uncertainty Builds With Thin Trade Volumes and Bitcoin Futures Launch

Pretty Vacant

As the popular idiom goes, talk is inexpensive and lies are costly. When it pertains to nationwide rates of interest policies worldwide, the story is the very same. While slashing rates might produce short-term development in a offered economy, the long-lasting result is to pump up credit bubbles which eventually need to break if not paid for. With the U.S. nationwide financial obligation presently sitting at over $22.5 trillion, it’s hard to envision anything being paid up on. Ever.

While Trump’s tweet is worded to please the ears of a honestly conservative-identifying assistance base, the underlying ramifications of what is being recommended have to do with as “conservative” as choosing to invest one’s whole income at the strip club, and after that offering plasma to fund a Maoist commune of out of work California college hippie kids, all in order to get their support later on for aid paying one’s costs.

NIRP policies are racking the world with more financial obligation than ever just recently, and while the flowery talk might sound quite, it’s the typical person who constantly consumes the dirt. Take Japan, for example. The present usage tax was set to 8% in April, 2014. Next month, on October 1, it will leap to 10%. This is spite of the Bank of Japan’s (BOJ) present quantitative easing-friendly (QE) nationwide rates of interest of -0.1%. As Investopedia’s Sean Ross precisely speculates:

Wherever they have actually been attempted, chronically low-interest rates and substantial financial growths have actually stopped working to promote genuine financial development. Quantitative easing (QE) did not accomplish its specified goals in the United States or the European Union (EU), and persistent low-interest rates have actually been not able to restore Japan’s once-thriving economy.

To handle the walking and mask the down spiral into economic downturn, some Japanese companies are just altering rate display screens to not consist of tax, in a desperate quote to soften the viewed effect of the gutting.

Denmark and the 2008 U.S. Housing Crisis

As news.Bitscoins.internet has actually reported formerly, negative rates of interest in Europe are “conserving” regional economies and worth holders to the tune of more financial obligation, illiquidity, and negative yielding bonds. Taking out loans for real estate is now extremely inexpensive in Denmark, with some home loan funding even dipping into the negative area. Thanks to the reality that loaning has actually never ever been more affordable, Danes are anticipated to get increasingly more loans. For Americans and others knowledgeable about the real estate crisis and collapse of 2007-08, all of this sounds strangely familiar.

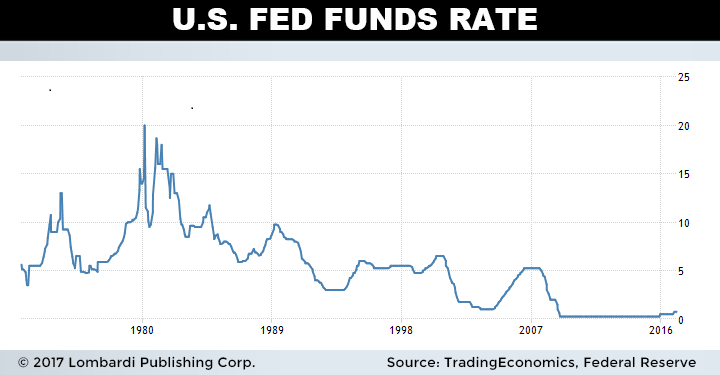

Prior to the U.S. real estate crisis and occurring worldwide economic downturn, the American federal government was — according to Trump’s present prescription — slashing rates of interest. The federal funds rate was decreased from 6.5% to 1.75% in December 2001, and the liquidity that followed drawn in debtors without sufficient earnings or properties to look for low-grade loans. Lenders and banks enjoyed to require.

House rates soared thanks to the brand-new loan on the marketplace, and by June 2003 the rates of interest was cut even more to 1%, which was the most affordable in 45 years. Sub-prime loans were then being repackaged and offered to financiers as collateralized financial obligation, and when individuals started to default, the entire home of cards imploded. The federal government’s service? Just print numerous billions of dollars to purchase the bad loans, even more cheapening the U.S. dollar and increasing the nationwide financial obligation. For those with eyes to see, this is all a video game being had fun with Monopoly loan, where the lender can just produce more money willy-nilly at any time. Trump might call bitcoin a “thin air” currency, however the fact is that his cherished USD is the genuine vapid fraud being pressed here.

Nature Abhors a Vacuum – Sound Money As a Hedge

These days, increasingly more financiers are discussing hedging versus a worldwide liquidity crisis with crypto and gold. The fundamental factors are relatively easy: both properties are minimal (supply and need characteristics hence safeguard versus inflation), and both properties can be managed independently, without the approval of 3rd parties like federal governments or significant banks. This remains in plain contrast to the fiat design, where loan is developed arbitrarily, and the supply changed by self-centered 3rd parties with little to no reward to serve the currency’s bigger userbase.

The Chicago Mercantile Exchange (CME) just recently launched a letter to the U.S. Commodity Futures Trading Commission (CFTC) on September 12, revealing they are “self-certifying a boost of the area month position limitations for the Bitcoin Futures agreement (the “Contract”), starting with the October 2019 agreement month and beyond.”

Intercontinental Exchange’s (ICE) Bakkt has actually revealed they will release day-to-day and month-to-month bitcoin futures on September 23.

Bakkt Warehouse custody is live.

Now accepting consumer bitcoin deposits and withdrawals. Only 17 days up until the Bakkt Daily and Monthly Futures agreements launch on Sep 23.

— Bakkt (@Bakkt) September 6, 2019

For the daily financier not thinking about high-falutin, leveraged futures as a hedge, just holding and purchasing gold and bitcoin serves the very same fundamental function, and typically with less danger. In today’s unstable financial environment where significant federal governments — even in generally anti-negative interest, Five Eyes Alliance (FVEY) nations — are slicing rates like there’s no tomorrow, an action as easy as holding sound loan silently is a relocation that might possibly conserve much monetary distress down the roadway.

Japan, Denmark, Sweden, Switzerland, and significant banks like the European Central Bank and UBS are currently utilizing negative rates. Australia, New Zealand and the U.S. are explore slashing rates regularly. President Trump’s wild pronouncement that this is simply what the physician bought comes at a time of around the world apprehension, when increasingly more people are getting up to the reality that no matter just how much loan is printed, resources are restricted, and supply and need is a truth that needs to be dealt with.

Should the vacuum seal of negative rates and Keynesian QE fracture, felt confident that the oxygen of free enterprise concepts and sound loan will enter to fill the spaces right away, however there might not suffice to walk around. In this light, Trump’s call for more credit can be viewed as a call to people worldwide to buy sound loan as quickly as possible, and with importunity.

What are your ideas on Trump’s tweet? Let us understand in the comments area below.

Op-ed disclaimer: This is an Op-ed short article. The viewpoints revealed in this short article are the author’s own. Bitscoins.internet is not accountable for or accountable for any material, precision or quality within the Op-ed short article. Readers needs to do their own due diligence prior to taking any actions associated with the material. Bitscoins.internet is not accountable, straight or indirectly, for any damage or loss triggered or declared to be brought on by or in connection with making use of or dependence on any details in this Op-ed short article.

You can now buy Bitcoin without checking out a cryptocurrency exchange. Buy BTC and BCH straight from our relied on seller and, if you require a Bitcoin wallet to safely save it, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.