After FTX collapsed, scornful critics extensively mocked Caroline Ellison’s technique to stop losses. ‘I simply do not do not believe they’re a reliable danger management tool,’ she infamously informed an audience throughout FTX’s prime time. But did she have a point?

Venturing into the crypto property management world provides a unique set of challenges that vary extensively from the conventional fund area. In this guide piece, we will look into the challenges that striving fund supervisors deal with when releasing a bitcoin sector fund and analyze the essential distinctions that exist when you step outdoors the world of conventional property management.

Volatility and Risk Management

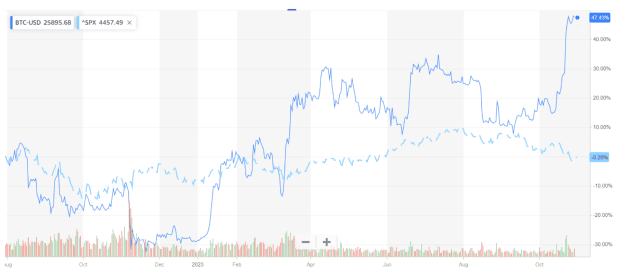

One of the most considerable challenges dealt with by bitcoin sector funds is the severe volatility that exists within the cryptocurrency market. Bitcoin’s rate has actually experienced strong bullish rises, driving enjoyment amongst financiers. However, it has also experienced strong bearish decreases, resulting in significant losses for those unprepared for such rate swings. Managing danger in such a vibrant environment needs advanced techniques, strenuous danger structures and evaluations, and a deep understanding of market patterns.

Unlike most conventional and traditional blue chip properties, which frequently experience fairly steady rate motions, bitcoin’s rate can alter meaningfully within a matter of hours. Consequently, bitcoin sector fund supervisors need to be fully equipped to deal with unexpected rate changes to secure their financiers’ capital. Traditional stop loss structures might not work to the degree anticipated, as the closing market order might get performed far below the pre-programmed trigger rate due to orderbook slippage and fast rate motions, the proverbial “catching of a falling knife”. Using tight stop losses as a fundamental danger management system can be your opponent. For example, in a flash crash situation, positions might be instantly cost a loss despite the fact that the market went back a couple of minutes (or seconds) later on.

While stop losses are an option, they’re not an choice! Options are agreements you can purchase that offer you the right to purchase or offer an offered property at an established rate (i.e., the strike rate) at an offered time (i.e., the expiration date). An choice to purchase a possession is a call and an alternative to offer one is a put. Buying an out-of-the-cash put (i.e., far below the present rate) can serve as a flooring on your possible losses if the rate collapses. Think of it as a premium paid to guarantee your position.

Sometimes to prevent binary outcome occasions or especially high volatility timeframes you simply need to flatten your positions and take no danger, living to eliminate another day in the bitcoin market. Think for instance of essential procedure upgrade dates, regulative choices or the next Bitcoin halving; though note the market continues of those occasions so you might need to do something about it ahead of time.

Creating a reliable danger management prepare for a bitcoin sector fund might include utilizing different hedging strategies, item and instrument diversity (possibly throughout property classes), trading location danger scoring and risk-adjusted allotments, vibrant trade sizing, vibrant take advantage of settings, and using robust analytical tools to keep track of market belief and possible market and functional threats.

Custody and Security

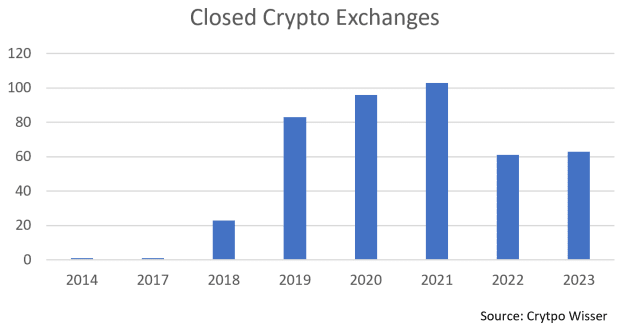

The custody of Bitcoin and other cryptocurrencies is an important element that differentiates bitcoin sector funds from their conventional equivalents. One essential distinction is that unlike conventional exchanges that just match orders, bitcoin exchanges do the order matching, margining, settlement, and custody of the properties. The exchange itself ends up being the clearinghouse, focusing counterparty danger instead of relieving it. Decentralized exchanges feature a unique set of threats also, from warding off miner-extracted worth to being prepared to move properties in case of a procedure or bridge hack.

For these factors, securing digital properties from theft or hacking needs robust security steps, consisting of however not restricted to multi-signature procedures, freezer options, and danger tracking tools. The duty of firmly managing personal secrets and picking and keeping an eye on reputable trading locations rests totally with the fund supervisor. The concern to keep track of the market facilities itself presents a level of technical intricacy missing in conventional fund management where custody and settlement are standardized and commoditized standalone systems.

Custodial options for bitcoin sector funds need to be thoroughly picked, guaranteeing that properties are secured versus cyberattacks and expert dangers. With the history of prominent cryptocurrency exchange hacks, financiers are especially worried about the security of their properties; any breach in security might cause considerable monetary losses and damage the track record of the fund.

Conclusion

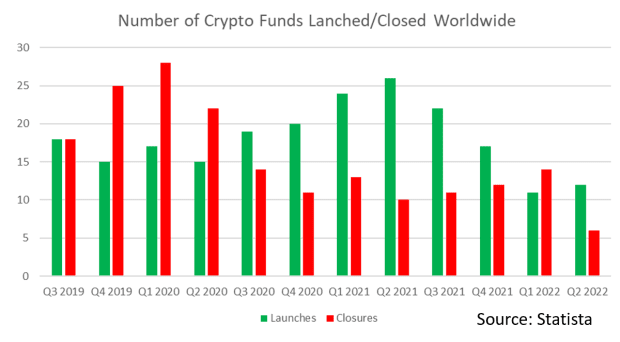

Launching a bitcoin sector fund is an awesome venture that provides unmatched chances for financiers looking for direct exposure to the fast-growing cryptocurrency market. It is necessary, nevertheless, to comprehend that releasing a fund is no simple accomplishment with risks surpassing the success of the trading method. It is not a surprise that every quarter the fund closures remain in the very same series of fund launches.

Those going into the bitcoin sector fund area ought to approach it with a pioneering spirit, remain notified, and welcome the vibrant nature of this amazing emerging market. While the roadway might be tough, the possible benefits for effective bitcoin sector fund supervisors might be huge.

If you’re prepared to begin the fund structure journey, currently en path, or would much like for more information, connect to us at [email protected].

This is a visitor post by Daniel Truque. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.