Despite seeing a 3.11% drop in worth in September, bitcoin still outperformed both the S&P 500 and Nasdaq, the most recent Cryptocompare report has actually revealed. Ethereum, on the other hand, was called “the worst entertainer after the long-awaited Merge showed to be a ‘purchase the rumour, offer the news’ occasion.” Increased tether and U.S. dollar trade volumes for bitcoin are stated to recommend panicking financiers were disposing diminishing currencies in favor of the cryptocurrency.

Ethereum Sees ‘Biggest Decline’

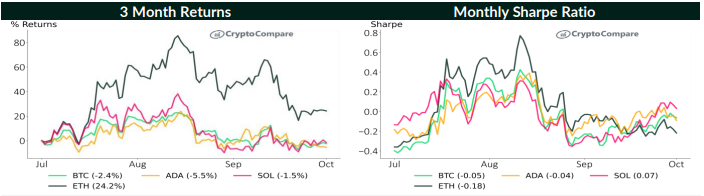

According to the most recent Cryptocompare report, bitcoin, which saw an unfavorable return of 3.11% in September, still outperformed “both the S&P 500 and Nasdaq which saw unfavorable returns of 9.34% and 10.5% respectively.” Only Solana — the cryptocurrency amongst the tracked 4 that saw a favorable month-to-month return of 5.59% — and gold (2.87%) had much better risk-adjusted returns than bitcoin.

Ethereum, on the other hand, is recognized in the report as “the worst entertainer [among four tracked cryptocurrencies], after the long-awaited Merge showed to be a ‘purchase the rumour, offer the news’ occasion.”

To support this assertion, the report indicate the crypto possession’s contrasting fortunes in August and September. After seeing its finest risk-adjusted returns in August, ETH still went on to have “the greatest decrease” in September, the very same month the Ethereum blockchain was changed to a proof-of-stake (PoS) agreement system.

Traders Dumped Fiat and Piled Into BTC

In regards to the various properties’ volatilities, the report stated bitcoin was the “least unpredictable possession and the most dominant” amongst 4 cryptocurrencies that were tracked in the month of September.

Explaining the study’s crypto market volatility findings, the report states:

Volatility throughout cryptocurrency markets saw a minor boost in September in the middle of the rate of interest spikes and the unsteady macro environment. ETH and SOL continued to be the most unpredictable properties, with 30-day volatility of 80.0% and 82.6% respectively. Bitcoin’s volatility increased 19.2% in September breaking a decreasing pattern that began in June.

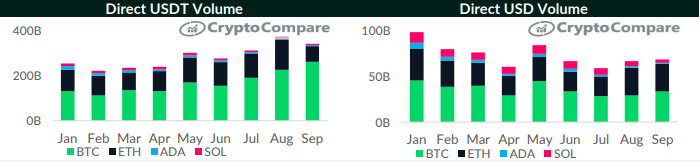

Meanwhile, the findings of Cryptocompare’s evaluation of both USDT and U.S. dollar traded volumes recommend that panicking financiers were disposing diminishing currencies in favor of BTC. In September alone, traded volumes in tether and the greenback increased “by 15.4% and 15.1% respectively.”

According to the report, this might imply “market individuals are stacking into BTC following current volatility in fiat currencies, consisting of the British pound and Japanese yen.”

In contrast, USDT volumes for ETH throughout the very same “saw a huge drop of 49.4%,” while SOL saw “a visible increase of 10.5% in USDT volumes in September.” ADA and SOL both saw decreases in USD volumes.

Do you concur with Cryptocompare’s newest findings? Let us understand what you believe in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.