Recent price motions of Bitcoin have actually recorded considerable attention and enjoyment; nevertheless, a detailed analysis of on-chain information supplies important insights that go beyond simple market speculation. By analyzing metrics that examine network activity, financier belief, and the cyclical nature of the BTC market, one can obtain a more nuanced understanding of Bitcoin’s present standing and its capacity for future development.

Significant Potential for Growth

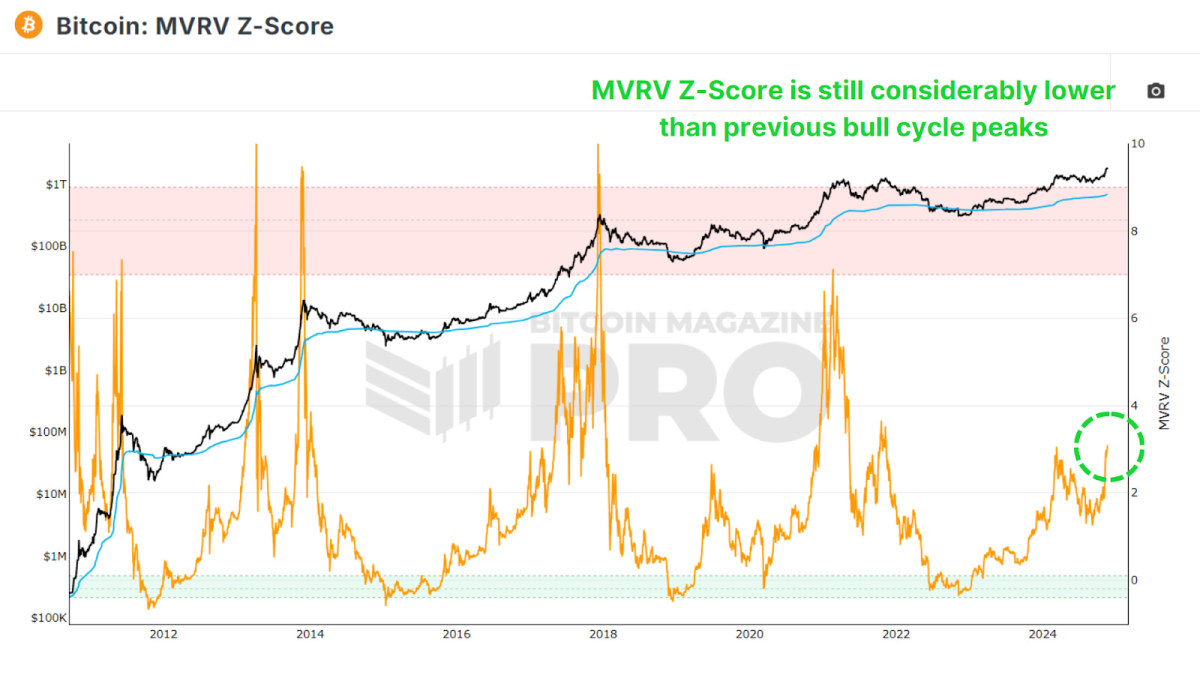

The MVRV Z-Score, which compares Bitcoin’s market capitalization (determined as price increased by flowing supply) with its recognized capitalization (the typical price at which all BTC were last negotiated), acts as an essential sign. Historically, this metric symbolizes an overheated market when it gets in the red zone, while the green zone normally signifies prevalent losses and possible undervaluation.

View Live Chart 🔍

Despite Bitcoin’s climb to brand-new all-time highs, the Z-score stays within neutral area. Previous booming market experienced Z-scores peaking at levels in between 7 and 10, in plain contrast to the present approximation of 3. Historical patterns recommend that this uses adequate chance for additional price gratitude.

Miner Profitability

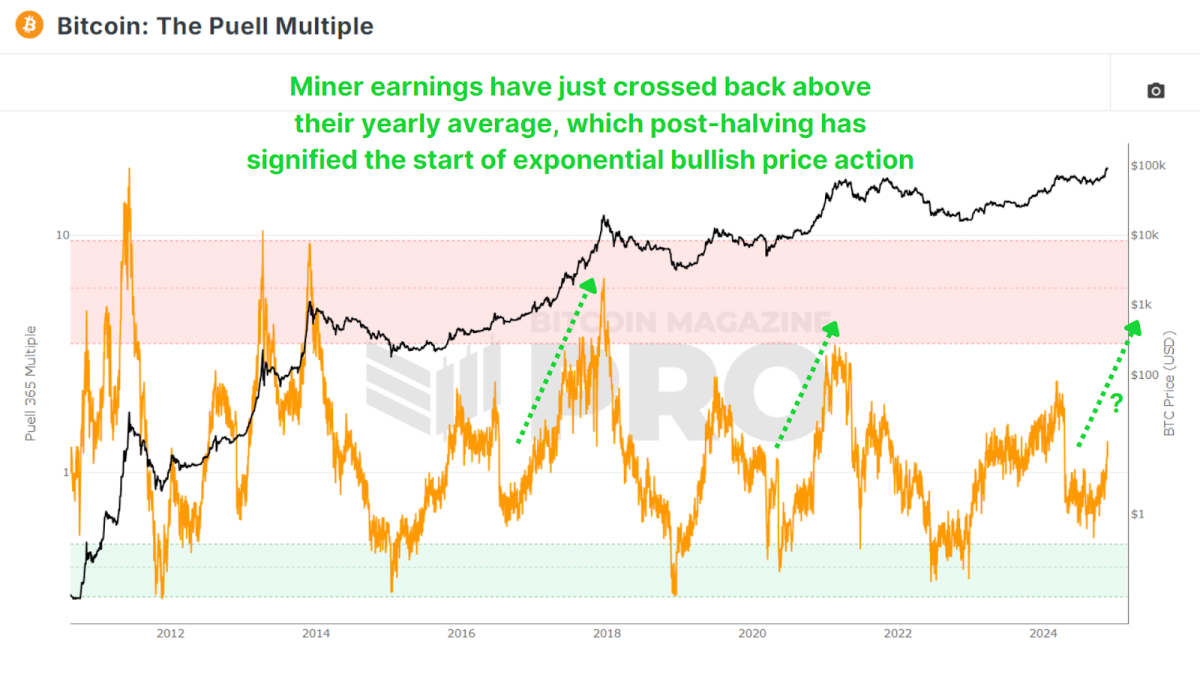

The Puell Multiple evaluates miner success by corresponding day-to-day USD-denominated profits with the previous 1 year moving average. Following the newest halving, miner revenues reduced by 50%, causing a number of months of minimized profits as Bitcoin’s price supported through the majority of 2024.

View Live Chart 🔍

Currently, in spite of the rise in Bitcoin’s worth, the Puell Multiple shows just a 30% boost in success relative to historic averages. This recommends that the market stays in the early to mid-stages of the bull cycle, looking like the explosive development patterns observed in 2016 and 2020. The mix of a post-cutting in half reset, combination stage, and a subsequent recovering of the 1.00 several level might declare a considerable boost in price action.

Assessing Market Sentiment

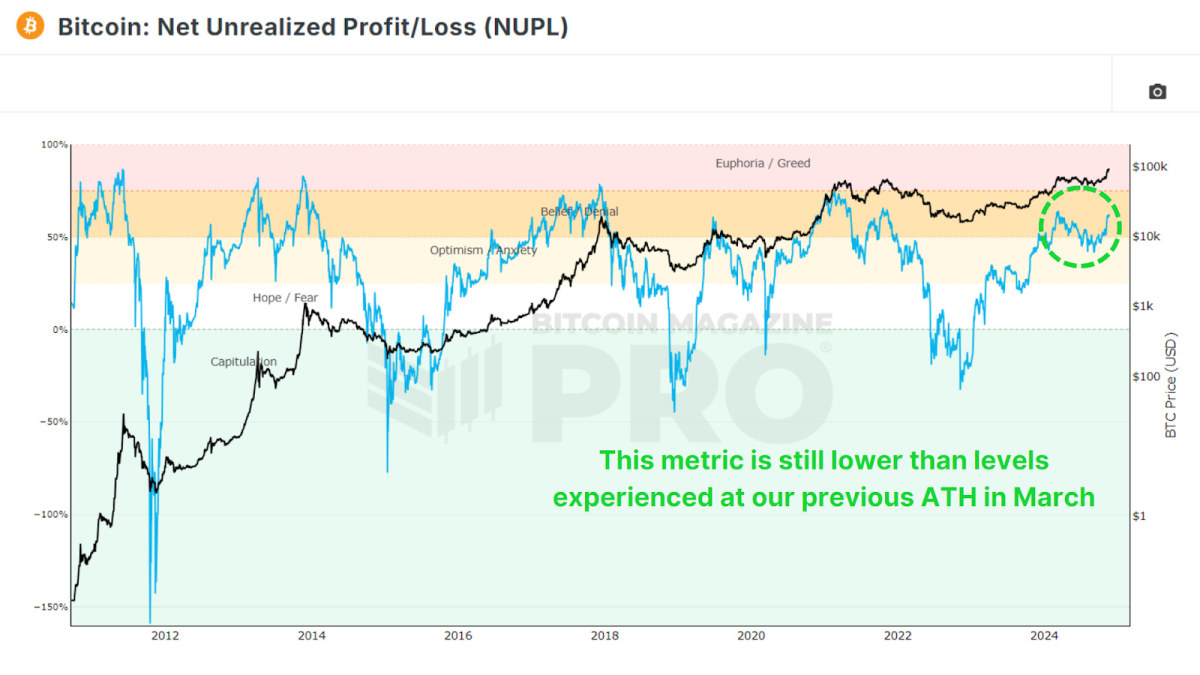

The Net Unrealized Profit and Loss (NUPL) metric supplies insight into the general success of the network, encapsulating beliefs throughout different stages, consisting of optimism, belief, and ecstasy. Similar to the MVRV Z-Score, as it originates from recognized worth or financier expense basis, it assesses the present predicted revenues or losses for all holders.

View Live Chart 🔍

At present, Bitcoin is placed in the ‘Belief’ stage, substantially distanced from the ‘Euphoria’ or ‘Greed’ zones. This lines up with other signs recommending considerable space for price boost prior to reaching market saturation. Notably, this metric is still at lower levels than those observed previously this year in March, when the previous all-time high was developed.

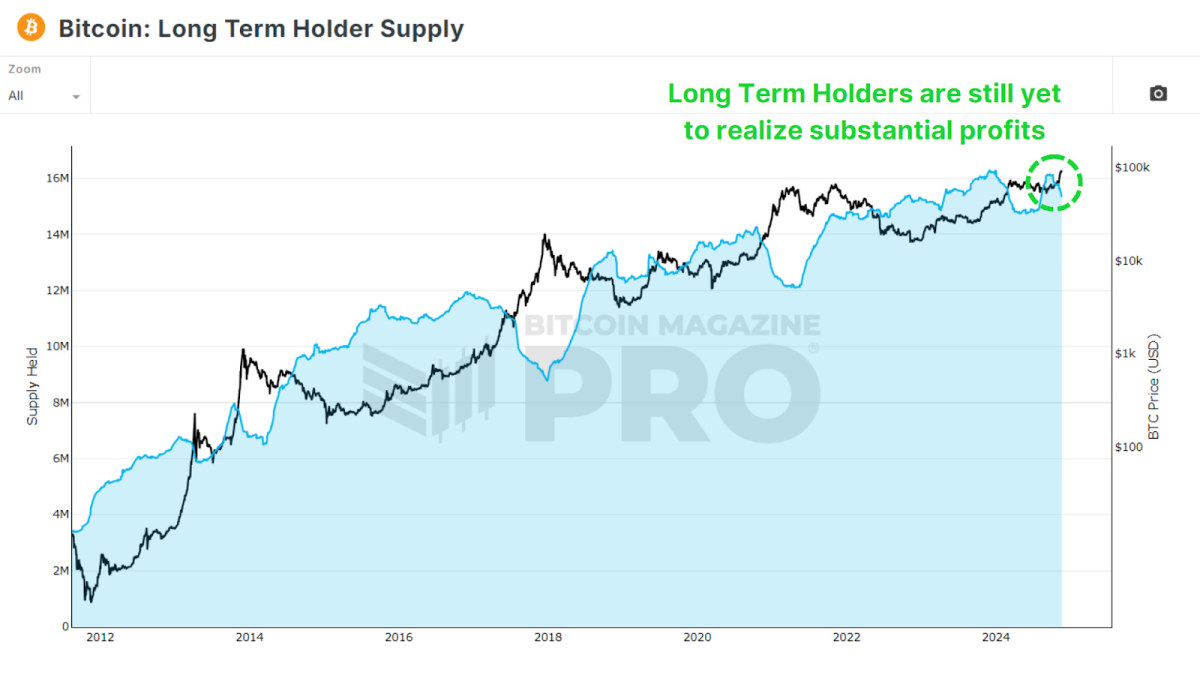

Trends Among Long-Term Holders

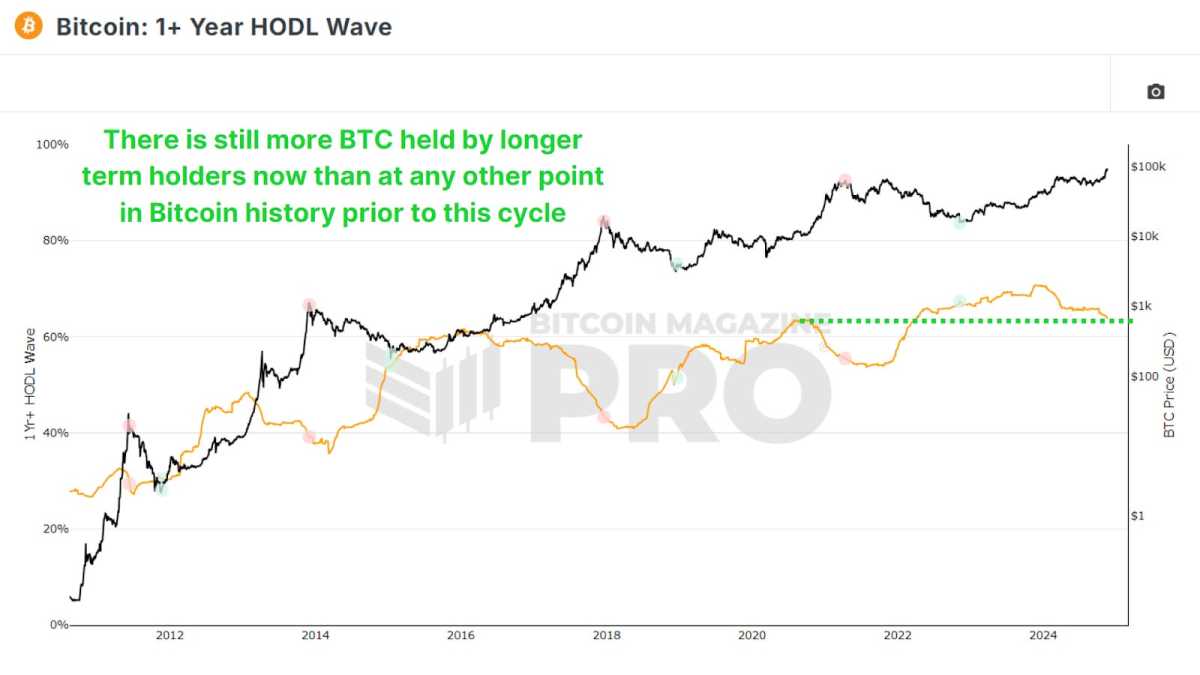

The portion of Bitcoin held for over one year, as represented by the 1+ Year HODL Wave, continues to stay extremely high at around 64%. This metric surpasses any previous point in Bitcoin’s history prior to the present cycle. Previous price peaks in 2017 and 2021 saw these levels dip to 40% and 53%, respectively, as long-lasting holders started to understand their revenues. Should a comparable pattern reoccur in the present cycle, countless Bitcoin might possibly shift to brand-new market individuals.

View Live Chart 🔍

To date, just around 800,000 BTC have actually transitioned from long-lasting holder supply to more recent market individuals throughout this cycle. Historical patterns show that in previous cycles, 2–4 million BTC were exchanged, highlighting the facility that long-lasting holders have yet to completely liquidate their positions. This indicate a continuous nascent stage within the present bull run.

View Live Chart 🔍

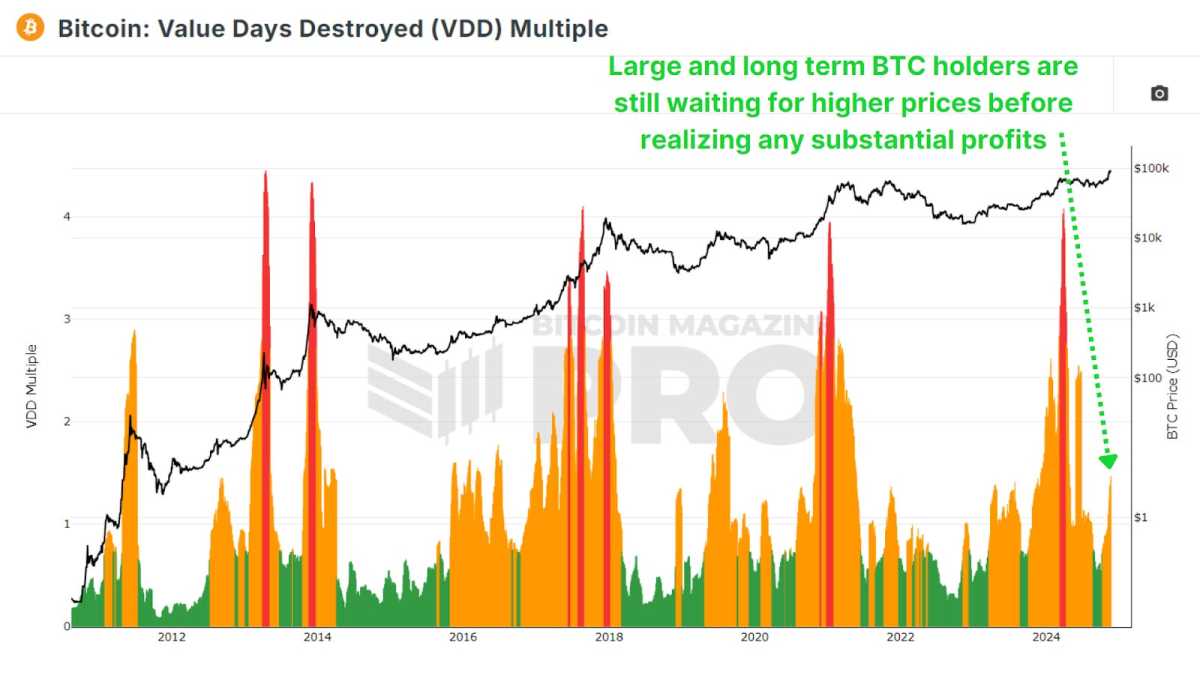

Monitoring “Smart Money”

The Coin Days Destroyed metric assesses deals based upon the period that coins have actually been held, consequently highlighting whale activity. By increasing this worth by the BTC price at the time of the deal, the Value Days Destroyed (VDD) Multiple emerges, offering clearness relating to whether the most considerable and educated BTC holders are starting to understand revenues on their financial investments.

View Live Chart 🔍

Current readings stay well below the red zones normally experienced throughout market tops, showing that whales and “smart money” financiers are not yet divesting big parts of their possessions, rather possibly waiting for greater price points before starting considerable profit-taking.

Conclusion

In light of the current rally, on-chain metrics regularly show that Bitcoin stays far from being overheated. Long-term holders show substantial strength, and essential signs such as the MVRV Z-score, NUPL, and Puell Multiple all recommend substantial capacity for development. Nonetheless, emerging profit-taking by some and the entry of brand-new market individuals might mean a shift towards mid- to late-cycle stages, perhaps extending throughout much of 2025.

For financiers, the significant takeaway is the value of a data-driven method. Emotional decision-making affected by worry of losing out (FOMO) and ecstasy can cause pricey errors. Instead, it is a good idea to follow the fundamental information assisting Bitcoin’s motion and use the metrics gone over to notify individual financial investment choices and analyses.

To explore this subject in higher depth, please describe a current YouTube video readily available here: What’s Happening On-chain: Bitcoin Update.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.