“What underpins a world order is always the financial system.

We are on the brink of a dramatic change where we are about to, and I’ll say this boldly, abandon the traditional system of money and accounting and introduce a new one. And the new one is what we call blockchain.

It means digital. It means having an almost perfect record of every single transaction that happens in the economy, which will give us far greater clarity over what’s going on. It also raises huge dangers in terms of the balance of power between states and citizens. In my opinion, we’re going to need a digital constitution of human rights if we’re going to have digital money.

Most people think that digital money is crypto and private, but what I see are superpowers introducing digital currency. The Chinese were the first. The US is on the brink of moving in the same direction. The Europeans have committed to that as well.”

This innovative speech about a brand-new monetary system, was provided at the World Government Summit in March 2022 in Dubai, by Philippa “Pippa” Malmgren, a member of the Council on Foreign Relations (CFR) and Chatham House; her dad, Harald Malmgren worked as a senior consultant to United States Presidents Kennedy, Nixon, Ford and others. She’s a innovation business owner and financial expert, who worked as Special Assistant to President George W. Bush, for Economic Policy on the National Economic Council and is a previous member of the President’s Working Group on Financial Markets and Corporate Governance.

Her words about the shift to a brand-new world order that needs a brand-new monetary structure correspond well with the words of French President Emmanuel Macron in June 2023 at the Global Finance Summit in Paris: “The world needs a public financial shock to fight global warming, and the current system is not suitable for dealing with the world’s challenges.” The president of Brazil, Lula da Silva, also required “a clean slate” and stated the Bretton Woods companies (World Bank, International Monetary Fund) do not serve their objectives nor react to society’s requirements.

“The New Bretton Woods Moment”

“A new international monetary system is taking shape, some call it the new Bretton Woods moment that needs to be seized to create a new global financial governance,” states the investigative reporter Whitney Webb in a current sitdown interview, where she discuss that according to Mark Carney, previous guv of the Bank of England & Bank of Canada and the UN Special Envoy for Climate Action and Finance, the 3 pillars of the brand-new multi-polar world are Digital IDs, CBDCs and ESG, through a international carbon market. All world federal governments are pressing this program, that in order for it to prosper, all financial systems and supporting systems need to end up being digital and count on digital information.

A fine example of this was exposed at an occasion of the Central Bank of Israel with the Bank for International Settlements (BIS) – which I went to – in September 2023 in Tel Aviv, where the “Genesis Project” existed. As part of this task, “green” bonds are provided, based upon carbon quotas in the CBDC facilities. This is how the environment program is connected to monetary markets.

“Debt Serfdom”

“Stablecoins could be the way in which the US is further globalizing the dollar, spreading its adoption directly to the world’s general public in order to continue increasing its debt and encourage uptake and usage of the dollar”, states Mark Goodwin, Editor in Chief of Bitcoin Magazine, in this interview with Whitney Webb. He recommends that the political leader’s protest of de-dollarization and the weakening of the dollar are a diversion from perpetuating the dollar as the world’s reserve currency.

“While CBDCs are what people are becoming fearful and aware of, it may just be the red herring, and the real strategy of the US dollar’s survival is highly regulated stablecoins (such as Tether), which can easily be programmable, even more than CBDCs, as well as seized, regulated and controlled indirectly by governments. 100 billion dollars in treasuries were already purchased by Tether, its subsidiaries and owners. Tether is positioned alongside the top 20 nation states buying debt from the US, with around one tenth of China or Japan that have a trillion dollars debt to the US”.

This theory, together with the words of Mark Carney, Pippa Malmgren, Emmanuel Macron & Lula Da Silva, sign up with the calls of international leaders and heads of states, indicating the replacement of the financial and monetary world order, to present a brand-new financial system. Many professionals state that we are reaching the end of the existing fiat financial system experiment, which is predestined to collapse. Since world leaders know of this, they choose to engineer a regulated demolition, to preserve control and guide the course, and get in the brand-new period with power securely within their grasp.

Central Bank Digital Currency System (CBDC)

Central Bank Digital Currencies (CBDC), tie the monetary liberty of residents to the federal government and the banking facility. The reserve bank concerns its central digital currencies, and basically develops a brand-new financial system, “fiat on steroids”, a system that takes whatever that is bad in the fiat system, and includes more of it; security, control, censorship, and enforcement abilities. A modern-day jail? Indeed, the CBDC is the supreme model of a jail without physical chains. By linking CBDCs to digital identity cards, and to federal government systems such as universal fundamental earnings, social credits and more, we get the supreme control device. This device will determine to residents what they’re permitted to buy, what the allowed quotas are while restricting intake according to guidelines and utilize cases, at set times, locations and cadences. The system has the ability to identify the usage of a geographical radius (geo-fencing), and to identify expiration dates on the money. Each remote regulated digital wallet can also be turned on and off by its operators. More than 130 nations remain in the preliminary phases of piloting CBDC systems, of which 36 nations remain in sophisticated pilots, and 3 nations have actually currently introduced systems (Nigeria, Jamaica and the Bahamas).

Will Ripple (XRP) Be The Chosen Platform for CBDC?

Ripple, a digital payment network and deal procedure that owns the cryptocurrency XRP, is thought about one of the most popular cryptocurrencies, and is tactically placing itself at the heart of federal government monetary development, intending to be the foundation of future CBDCs.

The business remains in talks with about twenty federal governments around the world to establish their CBDCs utilizing Ripple’s innovation. In May 2023, Ripple introduced a devoted CBDC platform to help reserve banks, federal governments and banks around the world in releasing CBDCs and stablecoins. To date, Ripple has actually partnered with 6 federal governments for CBDC pilot tasks: Georgia, Colombia, Montenegro, Hong Kong, Bhutan and the Republic of Palau.

The National Bank of Georgia, for instance, has actually selected Ripple as its innovation partner for its CBDC pilot in 2015, mentioning Ripple’s technical competence and group abilities. Its interest in CBDCs remains in leveraging modern-day innovations, such as the programmability element of CBDCs, intending to develop a platform with wise agreement and programmable token abilities to promote development in the monetary sector.

In the case of Bhutan, Ripple’s innovation was selected in 2021 for the nation’s CBDC task to allow sophisticated cross-border payments, and help in “financial inclusion” – in line with Bhutan’s objective to increase monetary addition in Bhutan to 85% by 2023.

In 2022, Ripple reached the last of the G20 Techsprint CBDC Hackathon, hosted by Indonesia and the Bank of International Settlements (BIS), and in August 2023, the Republic of Palau introduced a USD-backed digital currency, established by Ripple.

Promoting its platform as a facilities for a CBDC, Ripple supporters for federal government guideline of cryptocurrencies, and attempts to place itself as the chosen option for CBDC tasks. Its specialty of being the perfect CBDC partner for federal governments is the mix of speed, effectiveness, a sustainable and “green” blockchain network that utilizes little energy (compared to the Bitcoin network), and interoperability – the capability to interact and deal with CBDC services in other nations on the Ripple facilities. The business cautions that there is a threat for CBDC adoption by the public, triggered generally by a absence of market education, and it motivates the programs and expiration dates abilities, which are viewed by the majority of of the public as especially Orwellian functions of CBDCs.

Ripple motivates the abolition of money (and a relocate to a cashless society), and unsurprisingly, it promotes the environment program; The business’s site provides its dedication to a tidy, thriving and safe and secure low-carbon future, with a strategy to reach carbon net-zero by 2030.

Apparently, in line with Ripple’s growth method vis-a-vis federal governments, the business ensures to hire workers who originated from main and business banks. One of the business’s magnates is Andrew Whitworth, policy director at Ripple, who formerly operated at the Bank of England. At the very same time as his function in Ripple, Whitworth also acts as a Director of the “Digital Pound Foundation”, a company that has actually stated itself the authority on the Digital Pound; it recommends and affects the federal government’s choices concerning CBDC tasks and releases. Clearly a within connection such as this may offer Ripple a benefit in forming digital currency policies to fit their platform and services. Does this tip a dispute of interests, or a minimum of an unreasonable play?

Another opportunity through which institutional impact and implicit control over Ripple might manifest is by means of a legal fight with the SEC (U.S. Securities and Exchange Commission) worrying the XRP cryptocurrency. Engaging in such legal disagreements undoubtedly positions Ripple in a situation where preserving a favorable relationship with organizations ends up being vital. Consequently, it’s not a surprise that Ripple focuses on federal governments, reserve banks, and banks as its main target market in its market method.

Interesting Developments in CBDC

China invested a couple of years presenting fairly stopped working CBDC tasks without prevalent adoption, while injecting 30 million yuan as complimentary money to motivate user adoption. Transactions utilizing the digital yuan struck 1.8 trillion yuan (US$249 billion) in June 2023.

Recently, considerable development has actually been made: the 2 primary payment services and applications in China – WeChat and Alipay – which have a traffic of about 3-4 trillion dollars each year, incorporated the Chinese CBDC service into their applications. The reserve bank regulator made it clear that digital yuan isn’t implied to take on the 2 payments giants. Rather, it’s expected to play a complementary function.

Elon Musk, who owns, to name a few things, the Twitter/X platform, has actually mentioned that he wishes to make the platform an “everything app” like the Chinese WeChat, consisting of payment management. Will X also follow the Chinese path and incorporate the CBDC option into it, or will it attempt to end up being a CBDC facilities itself with the assistance of Musk’s preferred cryptocurrency, the Dogecoin?

The CBDC pilot in Nigeria didn’t precisely remove either, after the residents required to the streets to demonstration the abolition of money in the nation, and frowned at the intro of an unwanted digital option, while requiring the return of money. After a long and unpleasant demonstration, the money was returned along with the brand-new digital currency, which was not canceled and ended up being part of truth. Furthermore, a brand-new stablecoin remains in preparation in Sandbox mode in Nigeria. The cNGN is a Naira stablecoin which some claim has more prospective than the e-Naira to be extensively embraced. “The stablecoin will be more broadly interoperable than the CBDC, which is only available in the central bank’s wallet. At launch, the central bank’s wallet usability was weak, although it is now quite good”, stated Bolu Abiodun, a press reporter at Techpoint Africa.

The UK saw a strong public reaction to Prime Minister Rishi Sunak in 2015, with more than 50,000 reactions sent out to the Bank of England following a public hearing on the Digital Pound, aka the UK’s nationwide CBDC.

Germany – Awareness of “Excessive Surveillance”

In Germany, the technical standards record for a digital currency of a reserve bank was released in January 2024. Below are a number of quotes from the file, showing the dictatorial nature of the brand-new currency, and the awareness of the reserve bank for trust concerns it can develop:

- Programmability is the organization’s authority to devote your money for specific usages, and to restrict the usage of your wallet when it is “outside the permitted scope”.

- “The central bank can revoke CBDC notes, e. g. as an instrument of monetary control. Revocation of CBDC notes is performed by an authorized entity, the revocation authority, controlled and operated by the central bank.” This seems like a method to seize and use a service life to money.

- “Payments permitted under certain restrictions.. if the central bank sees fit to impose them” – the file notes constraints that can be used to wallets, depending upon the quantity of individual details that will be offered. For example, the quantity of money in the wallet, the number of payments each day, the quantity of money per deal or each day.

- The great news: The German reserve bank understands of the possibility of public opposition to a security system: “Many of these design choices are general decisions on the trade-off between excessive surveillance and legitimate monitoring functions for AML and KYC purposes in conjunction with measures for mitigating fraud and misconduct. These decisions are extremely sensitive in nature and can strongly influence the level of trust that users place into the CBDC”.

Israel – The Digital Shekel Will Be Distributed Through Commercial Banks

Israel takes an extensive and active part in various CBDC pilots, such as the Sela project, Eden, Icebreaker and more, which I have reported on extensively in the past. The Deputy Governor of the Bank of Israel announced that in December 2024 a technical design document for the Digital Shekel will be published, and its implementation will then begin in partnership with the private sector.

The Bank of Israel’s latest document from last week covers the proposed architecture of the Digital Shekel. Here are some interesting points from the document:

- The distribution of the Digital Shekel will be two-tiered: instead of direct contact between consumers and the central bank for funding and defunding, an indirect method similar to the distribution of cash today will be used. The banks will purchase digital shekels from the central bank in large quantities and transfer them to customers upon wallet charging.

- The system will be able to apply and enforce limits, for example limits on the balance that users are allowed to hold in the Digital Shekel.

- The system will support the possibility of applying interest on the Digital Shekel.

- Users will be able to access the Digital Shekel through several payment providers, including credit cards, Google/Apple Pay, wearables, payment apps and more.

- Unlike most retail CBDC solutions, Israel’s model allows users to open a wallet with a payment service provider (PSP) and connect to multiple third-party banks to fund and defund balances.

Another interesting development in Israel is the announcement of a plan to launch a new stablecoin pegged to the shekel, called BILS, by the exchange platform, Bits Of Gold. Crypto Jungle website reports that the Israeli Capital Market Authority approved the pilot, according to the draft principles published by the Central Bank of Israel. Interesting to note that the company providing the infrastructure for the issuance and custody of the currency is the Israeli technology giant “FireBlocks”, which took part in the “Eden” pilot project of the Tel Aviv Stock Exchange for the issuance of digital bonds, built to adapt in the future to a potential CBDC infrastructure.

No Internet? Don’t Worry, Governments Will Take Care Of Connectivity Anyway

A number of CBDC pilots, like in India, the European Union and more, focus on the adoption of the system by everyone, even amongst people without internet access. The washed-up name “monetary addition” implies that the system will not skip anyone, not even citizens without Internet connectivity in remote areas, or without reception. In India for example, there are 683 million people living without an internet connection and largely outside the control of the state. The Reserve Bank of India (RBI) plans to bring these remote areas into a new surveillance network through various technological means. A successful launch of CBDC in India also corresponds with the government’s overarching goal of reducing cash usage and improving financial monitoring.

Thailand – Free Money for the Masses

In September 2023, the Thai government announced that any Thai citizen over the age of 16 who chooses to participate in the CBDC pilot, will receive free CBDC worth $280 (10,000 baht) – quite a lot of money in Thai terms. This digital money will be loaded into the digital wallet application and will be available for use within 6 months, and within a radius of 4 km from the residence of the registered citizens. The pilot targets low-income citizens as a first stage, and later expands to entrepreneurs and small business operators – provided they are registered in the tax system. In Thailand many citizens are not registered in the government systems and not everyone has a bank account. It seems that air-dropping “complimentary money” is another technique to tempt residents into federal government systems, with the bait of “free” regulated federal government money. But exists such a thing as “free lunch”?

The European Union – a Positive Marketing Campaign in High Gear

The European Union introduced a marketing project to promote the digital euro about 6 months back, to begin informing the European public about a truth where that they will be required to utilize a monitored digital euro, led by Christine Lagarde, who was formerly founded guilty of criminal offenses and was promoted to act as the guv of the European Central Bank, the ECB.

The Digital Euro brand-new marketing project. Source: Christine Lagarde’s Twitter account

At the very same time, a charade is going on in the European Union Parliament where the risks of CBDCs are being talked about, just thanks to the public awareness and discourse, while Lagarde hurries forward and begins the marketing project to impart in the public the following messages: the digital euro is simple, safe, quick and trusted. Not a word about its Orwellian abilities to track, program, limitation and condition activity through expiration dates, geo-fencing, and remote on and off changing.

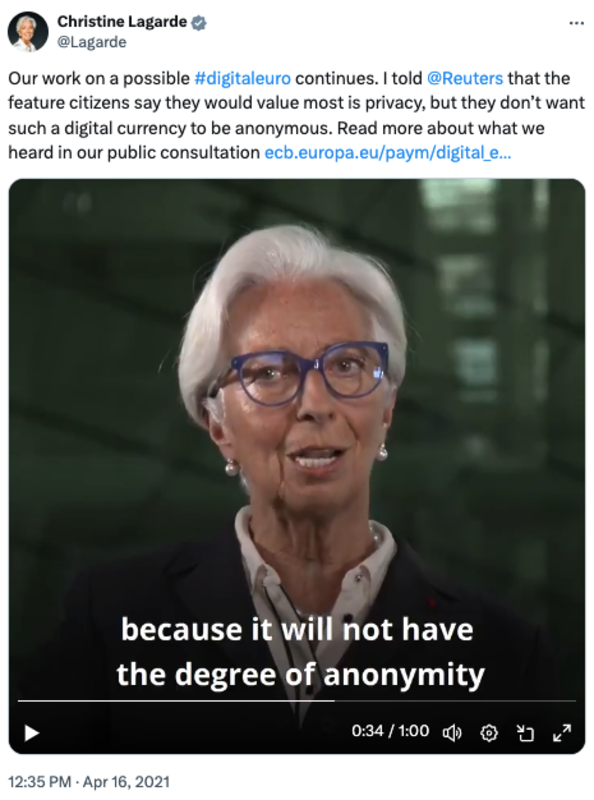

The Digital Euro Will Not Be Anonymous

In a conversation at the European Union Council in 2023, Lagarde highlights a point: the digital euro will not be confidential. Privacy will exist in the system, however not privacy. Let’s break this up in a various method: for the banks, the essential to security and control is recognition. The bank should understand who the person is and confirm their identity, in order to work out police or guidelines, through technological constraints. Lagarde’s declare that the innovation will permit personal privacy however not privacy is unproven: obviously the reserve bank considers itself and the monetary company some kind of God, given that in front of them the person will be recognized, and for that reason it is unclear what kind of personal privacy can exist, without privacy.

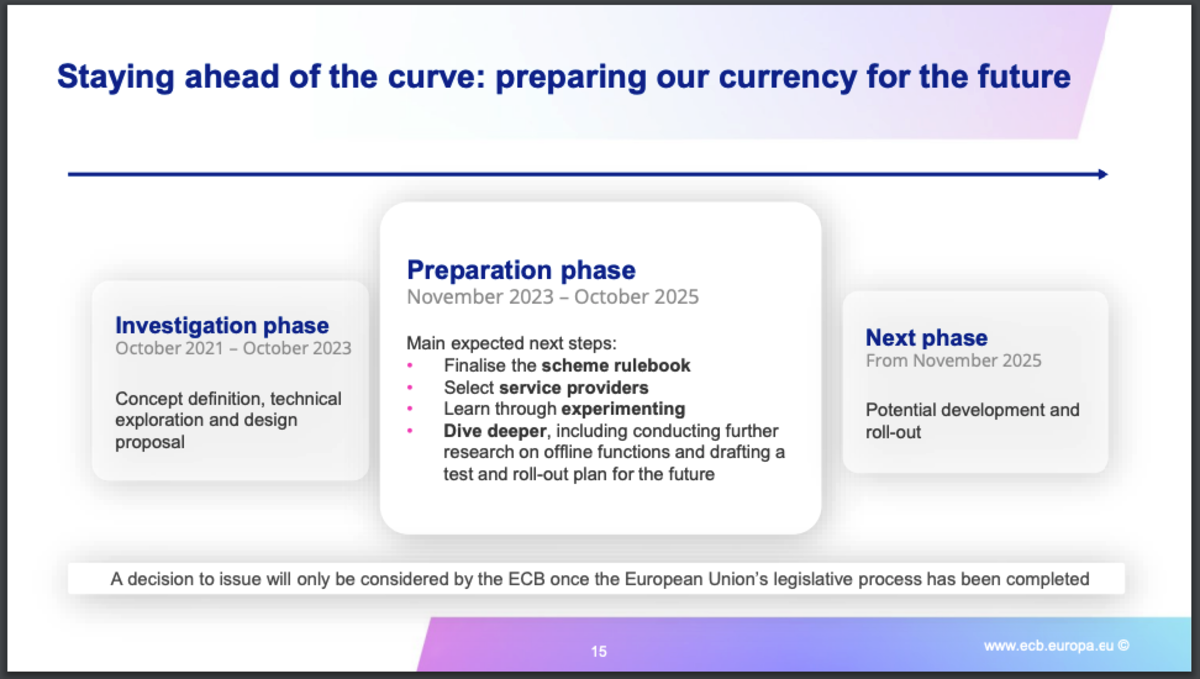

In a discussion from March 2024, the ECB provides a schedule for the Digital Euro. In November 2025, the advancement and execution stage will start, with the conclusion of the “democratic” legal procedure.

The timing of the launch of the Digital Euro corresponds well with the European Union’s effort to release digital identity cards to all EU homeowners in between now and 2030, to allow the essential federal government recognition and tracking of its residents. Identical efforts are enacted and promoted in lots of other nations around the world at the very same time. Where I live, in Israel, ID cards and passports have actually been obligatory and digital for several years, and also biometric given that 2013 – for that reason there is no requirement to begin the marketing project for the Digital Shekel yet, as the digital facilities exists thus the initial step of digitalization is currently done.

This stage of the task is the “preparation phase”, the ECB exposes, in which they are getting ready for the launch stage of the Digital Euro. Of course, we are assured that no decision has actually yet been made concerning the launch of the CBDC, and this will just occur with the approval of the “Government Council” after the conclusion of the democratic legal procedure of the European Union. Therefore, in parallel with the democratic argument for or versus the Digital Euro, the advancement of the innovation will continue, in order to be gotten ready for the launch.

Central bank guvs such as Lagarde and Bank of Israel Governor Amir Yaron firmly insist that the CBDC is digital money, and also firmly insist that physical money will not be eliminated. It is possible that these main lenders feel the require to make a U-turn from the incriminating speech of the head of the Bank for International Settlements (BIS), Augustin Carstens, who triggered a public protest when he mentioned in 2020 that the CBDC innovation, unlike money, will permit tracking of monetary deals and will be a indicates of enforcement by the facility:

“The key difference with the CBDC is the central bank will have absolute control of the rules and regulations that will determine the use of that

expression (money) of central bank liability, and also we will have the technology to enforce that.”

Agustín Carstens – BIS General Manager

The Future: Centralized and Controlled, or Free, Decentralized and Secure?

Ayn Rand, author and thinker, stated that “We can ignore reality, but we cannot ignore the consequences of ignoring reality.” Are we taking huge actions towards a brand-new financial truth, where the fiat currencies we understand ended up being fiat on steroids, aka CBDCs? Or into the truth of “stable” and carefully managed cryptocurrencies, connected to fiat? Either method, the sensation is that the facility is doing whatever to maintain the financial obligation economy, and its intrinsic modern-day slavery. The just method to break these fiat-matrix borders is to pull out and participate in a brand-new system, which appears to run in a parallel truth, the Bitcoin system. On the Bitcoin requirement, under self-custody, no 3rd party has the capability to seize, program or take control of personal properties. Not even the federal government or the state. Bitcoin utilizes a lot of energy for its mining, however this evidence-of-work system makes the blockchain network incredibly safe and secure and the Bitcoin currency really important. Bitcoin is “safe money”, which is out of grab the facility. Unlike most other cryptocurrencies, Bitcoin is a digital currency without intermediaries or 3rd parties (peer-to-peer) in a decentralized and safe and secure network, which enables everybody to be their own bank, rather of depending on banks and external celebrations. With a repaired and understood supply, it represents the most effective digital property on the market as a shop of worth and as a system of account, and in the future will also be utilized as a medium of exchange.

In my current interview with the media and financing specialist, and one of the most popular Bitcoiners, Max Keiser, he compared the CBDC to a parasitic and central cancer: “If you were to look at the amount of energy that Bitcoin uses and the rate at which it’s increasing, you would say good is triumphing over evil. So this gives me a lot of hope. And I don’t think centralization in anything works at all, except cancer. Cancer is the only thing that seems to work to be overly centralized and parasitic. That’s the cancer model, but I think we’re gonna win against the cancer of CBDCs.”

Follow Efrat’s work here.

This is a guest post by Efrat Fenigson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.