This post is included in Bitcoin Magazine’s “The Withdrawal Issue”. Click here to subscribe now.

A PDF handout of this post is offered for download.

“The reason that we are focused on financial institutions and payment processors is because they are the so-called bottlenecks, or choke-points, in the fraud committed by so many merchants that victimize consumers and launder their illegal proceeds,” Bresnickat described to the club. “We hope to close the access to the banking system that mass marketing fraudsters enjoy — effectively putting a choke hold on it…”

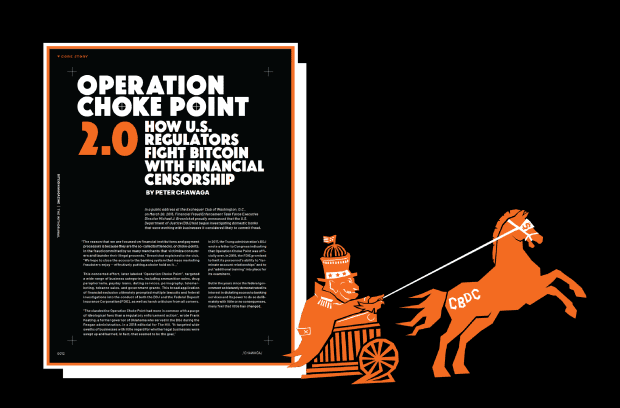

This collective effort, later on identified “Operation Choke Point”, targeted a large range of company classifications, consisting of ammo sales, drug stuff, payday advance loan, dating services, porn, telemarketing, tobacco sales, and federal government grants. This broad application of financial exemption eventually triggered numerous claims and federal examinations into the conduct of both the DOJ and the Federal Deposit Insurance Corporation (FDIC), along with severe criticism from all corners.

“The clandestine Operation Choke Point had more in common with a purge of ideological foes than a regulatory enforcement action”, composed Frank Keating, a previous guv of Oklahoma who served in the DOJ throughout the Reagan administration, in a 2018 editorial for The Hill. “It targeted wide swaths of businesses with little regard for whether legal businesses were swept up and harmed. In fact, that seemed to be the goal.”

In 2017, the Trump administration’s DOJ composed a letter to Congress showing that Operation Choke Point was formally over. In 2018, the FDIC assured to restrict its workers’s capability to “terminate account relationships” and to put “additional training” into location for its inspectors.

But in the years considering that the federal government so blatantly showed its interest in determining access to banking services and its power to do so intentionally with little or no repercussions, lots of feel that little has actually altered.

Bank Runs, With Bias

On March 8, 2023, it was revealed that the cryptocurrency-focused organization Silvergate Bank would be willingly liquidated by its holding business. The bank had actually been concentrated on serving cryptocurrency customers considering that 2013 when its CEO Alan Lane initially bought bitcoin. In 2022, it had actually obtained the innovation behind Meta’s stopped working stablecoin task, Diem, with hopes of introducing its own dollar-backed token. As the cryptocurrency market decreased in late 2022, marked by the collapse of among its most significant customers in cryptocurrency exchange FTX, the bank’s stock cost plunged. It most likely did not assist that at the very same time, U.S. Senators Elizabeth Warren, Roger Marshall, and John Kennedy asked Silvergate to divulge information of its financial relationship with collapsed cryptocurrency exchange FTX.

Soon after, on March 10, 2023, practically 10 years to the day from Bresnickat’s public detailing of Operation Choke Point, Silicon Valley Bank (SVB) was taken by the California Department of Financial Protection and Innovation and positioned under FDIC receivership, marking what was then the second-largest bank failure in U.S. history.

Since 2021, the bank had actually been increasing its long-lasting securities holdings however, as the marketplace worth of these properties degraded amidst U.S. dollar inflation and Federal Reserve rate of interest walkings, it was entrusted to latent losses. Simultaneously, its clients, a lot of whom were popular companies within the cryptocurrency market and were likewise strained by financial conditions, were withdrawing their cash. On March 8, 2023, SVB revealed that it had actually offered more than $21 billion worth of securities, obtained another $15 billion, and was preparing an emergency situation sale to raise yet another $2.25 billion. Perhaps unsurprisingly, this stimulated an operate on its staying funds, amounting to some $42 billion in withdrawals by March 9, 2023. On Sunday, March 12, state and federal authorities actioned in; clients of Signature Bank had actually withdrawn more than $10 billion.

Since 2018, Signature Bank had actually preserved a concentrate on cryptocurrency companies, with some 30% of its deposits originating from the sector by early 2023. Signature Bank had also accumulated a big percentage of uninsured deposits, worth some $79.5 billion and making up practically 90% of its overall deposits. It was holding reasonably little money on hand — just about 5% of its overall properties (compared to a market average of 13%) — so it was badly gotten ready for an operate on crypto-friendly banks stimulated by SVB’s problems. On March 12, 2023, the New York State Department of Financial Services closed Signature Bank and positioned it under FDIC receivership as it dealt with a mountain of withdrawal demands. At the time, this represented the third-largest bank failure in U.S. history.

Following their seizures of SVB and Signature Bank, the U.S. Department of the Treasury, Federal Reserve, and FDIC explained the takeovers as “decisive actions to protect the U.S. economy by strengthening public confidence in our banking system”. But others recommended the actions, especially versus Signature Bank, represented an outright reemergence of the bias showed throughout Operation Choke Point and linked to a bigger effort to stymie cryptocurrency companies.

“I think part of what happened was that regulators wanted to send a very strong anti-crypto message”, Barney Frank, a Signature Bank Board member and previous congressman who assisted prepare the influential “Dodd-Frank Act” to revamp financial policy following the Great Recession, informed CNBC in March 2023. “We became the poster boy because there was no insolvency based on the fundamentals.”

Following an FDIC statement that Flagstar Bank would presume all of Signature Bank’s money deposits other than for those “related to the digital-asset banking businesses”, the editorial board of The Wall Street Journal revealed that Frank was ideal to call out this predisposition.

“This confirms Mr. Frank’s suspicions — and ours — that Signature’s seizure was motivated by regulators’ hostility toward crypto”, the board composed. “That means crypto companies will have to find another bank to safeguard their deposits. Many say that government warnings to banks about doing business with crypto customers is making that hard.”

Targeting A New Choke Point

Public authorities, financial specialists, and Bitcoin supporters had actually been explaining an obvious predisposition versus cryptocurrency companies from the Biden administration well prior to the March 2023 bank runs. There were various policy occasions in the early part of 2023 to support those beliefs.

A January 3, 2023, “Joint Statement on Crypto-Asset Risks to Banking Organizations” from the Federal Reserve, FDIC, and Office of the Comptroller of the Currency (OCC) kept in mind that, “The events of the past year have been marked by significant volatility and the exposure of vulnerabilities in the crypto-asset sector. These events highlight a number of key risks associated with crypto-assets and crypto-asset sector participants that banking organizations should be aware of…”, efficiently serving to discourage banks from handling those threats.

A White House “Roadmap to Mitigate Cryptocurrencies’ Risks” launched on January 27, 2023, showed that the Biden administration sees the expansion of cryptocurrencies as a danger to the nation’s financial system and cautioned versus the possibility of giving cryptocurrencies more access to mainstream financial items.

“As an administration, our focus is on continuing to ensure that cryptocurrencies cannot undermine financial stability, to protect investors, and to hold bad actors accountable”, per the roadmap. “Legislation should not greenlight mainstream institutions, like pension funds, to dive headlong into cryptocurrency markets… It would be a grave mistake to enact legislation that reverses course and deepens the ties between cryptocurrencies and the broader financial system.”

On February 7, 2023, the Federal Reserve pressed a guideline to the Federal Register clarifying that the organization would “presumptively prohibit” state member banks from holding crypto properties as principal in any quantity which “issuing tokens on open, public, and/or decentralized networks, or similar systems is highly likely to be inconsistent with safe and sound banking practices”.

And on May 2, 2023, the Biden administration proposed a Digital Asset Mining Energy (DAME) excise tax, recommended as a method to require cryptocurrency mining operations to economically compensate the federal government for the “economic and environmental costs” of their practices with a 30% tax on the electrical power they utilize.

For Brian Morgenstern, the head of public law at Riot Platforms, among the biggest, openly traded bitcoin miners based in the U.S., these policy recommendations, updates, and guideline modifications plainly suggest a bigger effort to prevent Bitcoin development by targeting financial choke points.

“The White House has proposed an excise tax on electricity use by Bitcoin mining businesses specifically — an admitted attempt to control legal activity they do not like, in the name of environmental protection”, Morgenstern described in an interview with Bitcoin Magazine. “The only explanation for such inexplicable behavior is deep-rooted bias in favor of the status quo and against decentralization.”

Collectively, this habits might affect the conduct of controlled banks, simply as the pressure used by the DOJ in the 2010s unduly restricted business in its crosshairs at that time. For lots of, it’s clear that Operation Choke Point has actually been renewed.

“‘Operation Choke Point 2.0’ refers to the coordinated effort by the Biden administration’s financial regulators to suffocate our domestic crypto economy by de-banking the industry and severing entrepreneurs from the capital necessary to invest here in America”, U.S. Senator Bill Hagerty, a member of the committees on banking and appropriations, informed Bitcoin Magazine. “It appears that financial regulators have bought into the false narrative that cryptocurrency-focused businesses solely exist to facilitate or conduct illicit activities, and they seem blind to the opportunities for the potential innovations and new businesses that can be built.”

Pressure Where It Hurts

It might be relatively apparent how such a pressure project by federal regulators would injure cryptocurrency-focused jobs that depend upon access to banks. But the bigger implications of such financial restrictions for retail clients and the development of Bitcoin in specific might not be.

Why should advocates of Bitcoin, a decentralized financial rail created to operate beyond the tradition system, appreciate a choke point in controlled banks?

Caitlin Long, the creator of Custodia Bank, which is concentrated on bridging the space in between digital properties and tradition financial services, acknowledges that for users in the U.S. to legally take part in Bitcoin, the regulative landscape needs to be accommodating.

“I’ve been working for years to help enable laws to be enacted, in multiple U.S. states and federally, precisely because in the absence of legal clarity about Bitcoin, legal systems can become attack vectors on Bitcoiners”, she stated in an interview with Bitcoin Magazine. “All of us live under legal regimes of some sort, and we should be aware of legal attack vectors and work toward resolving them in an enabling way.”

Long’s advocacy might best represent the capacity that beneficial or perhaps simply fair financial gain access to might suggest for Bitcoin adoption and the development of its innovation for everybody. Through her work, Custodia (then under the name Avanti) acquired a 2020 bank charter in its house state of Wyoming that made it a special-purpose depository organization efficient in custodying bitcoin and other cryptocurrencies on behalf of customers. But, following an extended hold-up in approval of Custodia’s application for a master account with the Federal Reserve that would permit it to utilize the FedWire network and assist in big deals for customers without registering intermediaries, Custodia submitted a claim versus the Fed in 2015.

“Operation Choke Point 2.0 is real — Custodia learned about its existence in late January when press leaks hit and reporters started calling Custodia to say they learned that all bank charter applicants at the Fed and OCC with digital assets in their business models, including Custodia, were recently asked to withdraw their pending applications”, Long stated. “Reporters told us that the Fed’s vote on Custodia’s application would be a foregone conclusion before the Fed governors actually voted.”

But, more than simply suppressing innovators who look for to develop bridges in between Bitcoin and tradition financial services, targeting the choke points of Bitcoin platforms will just press these platforms beyond the scope of regulators, offering those with harmful intent a benefit over those who are trying to play by the guidelines.

“Internet-native money exists. It won’t be uninvented”, Long included. “If federal bank regulators have a prayer of controlling its impact on the traditional U.S. dollar banking system, they will wake up and realize it’s in their interest to enable regulatory-compliant bridges. Otherwise, just as with other industries that the internet has disrupted — corporate media, for example — the internet will just go around them and they will face even bigger problems down the road.”

As was laid bare by the collapse of cryptocurrency exchange FTX, Bitcoin is still quite connected to the world of cryptocurrency at big in the portfolios of financiers and the eyes of many people worldwide. Indeed, the discoveries around FTX’s criminal operations have actually been a case in point for regulators who look for the financial restriction of cryptocurrency companies. But this really restriction might have allowed FTX’s operators to fleece billions in consumer funds: Based on a Caribbean island, the huge bulk of FTX’s company was beyond the jurisdiction of U.S. regulators. As U.S. regulators restrict the development of domestic companies, offshore options like FTX advantage.

And while lots of Bitcoiners might believe that policymakers are helpless to figure out the success of this permissionless innovation, negative or missing policies can restrict Bitcoin-particular companies simply as roughly as they do more comprehensive, cryptocurrency-associated ones. In reality, it might be Bitcoin’s special homes that make the existing regulative landscape such an intimidating one for development.

“Bitcoiners should care about Operation Choke Point 2.0 because certain policymakers are trying to take away our ability to participate in the Bitcoin network”, Morgenstern argued. “Moreover, Bitcoin is different. It is not only the oldest and most tested asset in this space, it is perhaps the only one that everyone agrees is a digital commodity. That means the on-ramp for inclusion into any policy frameworks will have less friction inherently, and Bitcoiners need to understand this.”

Relieving The Choke Points

Reviewing the current, hostile policy updates from federal regulators, it appears clear that Bitcoin is strongly entrenched in addition to “crypto” in their minds. And, Bitcoin advocates in specific will concur, lots of companies concentrated on other cryptocurrencies are apt to injure financiers. But some in the Bitcoin sector believe that more education might assist highlight the differences in between Bitcoin and altcoins, and much better safeguard Bitcoin from more warranted regulative limitations on controlled tokens and vaporware.

“Engage with your elected officials”, Morgenstern motivated. “Help them understand that Bitcoin’s decentralized ledger technology is democratizing finance, creating faster and cheaper transactions and providing much-needed optionality for consumers at a time when the centralized finance system is experiencing distress. This will take time, effort and a lot of communication, but we must work together to help our leaders appreciate how many votes and how much prosperity is at stake.”

Indeed, for those chosen authorities who do acknowledge this predisposition as unduly damaging to development, continued advocacy from Bitcoin’s fans is the very best escape of the choke hold.

“This isn’t an issue where people can afford to be on the sidelines anymore”, Hagerty concluded. “I encourage those who want to see digital assets flourish in the United States to make your voice heard, whether that is at the ballot box or by contacting your lawmakers and urging them to support constructive policy proposals.”

This post is included in Bitcoin Magazine’s “The Withdrawal Issue”. Click here to subscribe now.

A PDF handout of this post is offered for download.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.