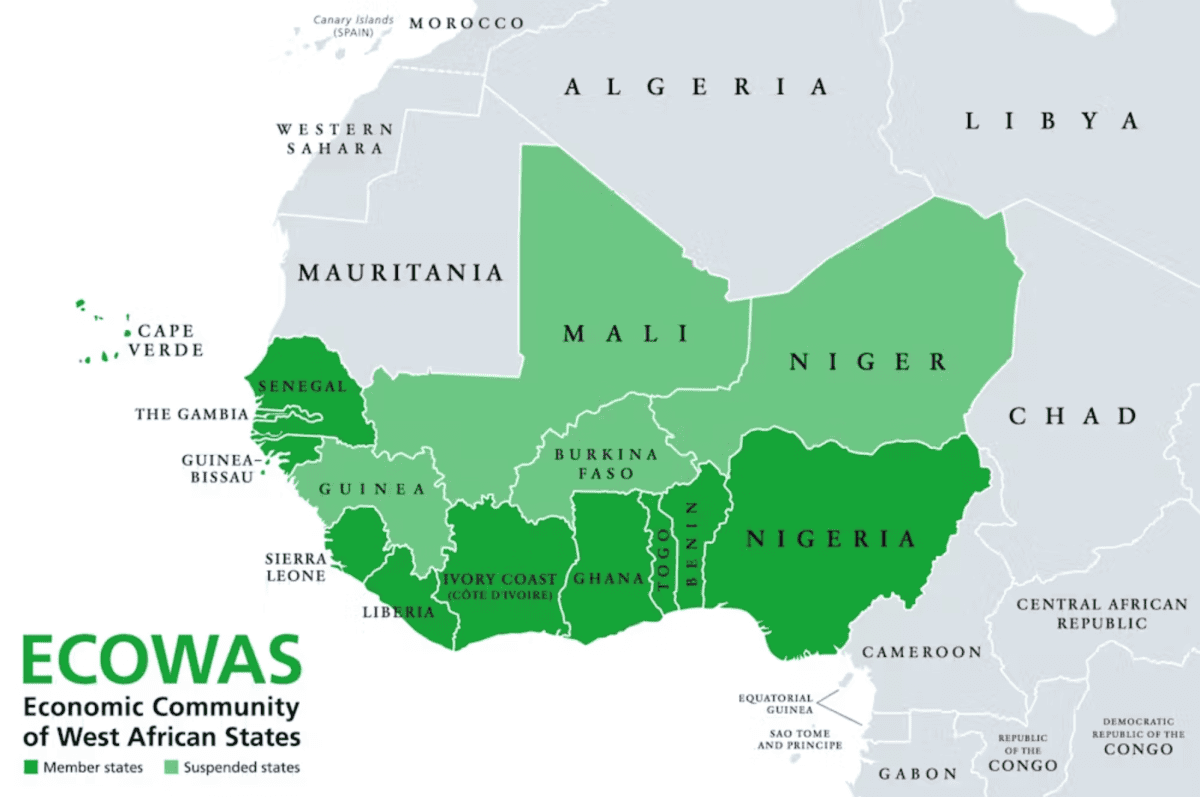

Africa stands at the cusp of a monetary transformation as Ecowas area monetary ministers and reserve bank guvs advanced strategies to introduce the single currency effort, referred to as the ECO. The Economic Community of West African States (ECOWAS) guarantees to improve the financial landscape of 15 countries with the intro of ECO. Amidst the buzz of this combined currency, a digital competitor—Bitcoin—emerges from the shadows, providing unmatched services to the continent’s remittance issues. Could Bitcoin hold the secret to a more inclusive, economical, and resistant monetary future for Africa? Not even a concern over here, however an experience. As the ECO currency effort advances, Bitcoin becomes an engaging option, providing distinct services to longstanding monetary difficulties in Africa.

Exploring some accurate stories, In a declaration by Mr Wale Edun ( Nigeria’s Finance minister ) and his associates in the area, “The vision for the ECO extends beyond a mere currency. It aspires to become a cornerstone of economic integration, streamlining trade and bolstering monetary stability across the region.” One need to wonder about the application prepares towards actualizing this vision. Pathetically, among the main obstacles for the ECO currency is regulative intricacy. Harmonizing financial policies and policies throughout 15 varied nations is a significant job. Each member nation has its own financial conditions, financial policies, and political landscapes, which might make complex the application and governance of a unified currency. Regulatory disparities might cause unequal adoption and efficiency of the ECO currency, possibly weakening its objective of local financial combination.

Interestingly, the success of the ECO currency will depend greatly on the existing technological facilities in member nations. Many areas within ECOWAS still do not have trustworthy web connection and advanced monetary innovations. These infrastructural spaces, if not attended to, stand to prevent the efficient application and operation of the ECO currency, restricting its ease of access and functionality for the basic population. Bitcoin has actually currently passed these phases in the area with its tested technological performance on its core operating layer, and its characteristics even in the face of redundant or no web connection, through Bitcoin based services in the area in contrast to ECO, develop an included benefit paired with a glaring screen of durability and performance.

ECOWAS nations display considerable financial variations, from resource-rich countries like Nigeria to smaller sized, less financially established nations like Guinea-Bissau. A one-size-fits-all financial policy might not resolve the distinct financial difficulties dealt with by each member nation. Disparities like this might cause imbalances and stress within the union, possibly destabilizing the ECO currency and the local economy. Bitcoin nevertheless has a benefit in regards to breaking local predisposition while providing worldwide approval and open trade alternatives.

ECO plans to boost monetary addition by supplying access to monetary services for the unbanked population. But ECO being a suggested local currency based on standard financing systems interoperably in the ECOWAS regulated nations, suggests ECO will unconsciously acquire native issues such as having a significant part of the population unbanked due to minimal access to standard banking services. Won’t this leave this currency at the grace of an equalized digital option ? That’s absolutely a concern: “utility and efficiency” will justify overtime as things keep unfolding. Bitcoin offers an alternative ways of accessing monetary services without the requirement for a savings account. By providing a decentralized and available monetary system, Bitcoin empowers people and small companies, promoting financial development and smooth monetary operations.

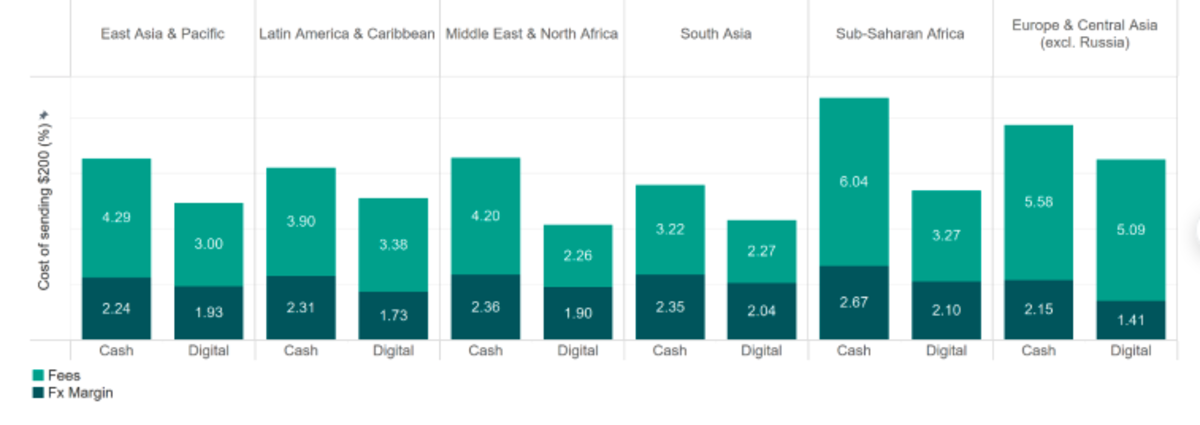

Looking even more by comparing the “costs for remittance services among different regions, by breaking down the cost into two components: fee and foreign exchange (FX) margin. Within each region, as displayed below, it differentiates between digital and non-digital remittances. It shows fees account for a large portion of the costs for remittance services. Moreover, costs for non-digital services are consistently higher than those for digital services regardless of the region where the money is being sent to.”

As the only decentralized digital currency, Bitcoin uses an innovative service to the high expenses related to standard remittance services. Migrant employees sending out cash home to their households frequently sustain considerable costs as revealed above, wearing down the worth of their hard-earned cash. Bitcoin deals, nevertheless, are dramatically lowering these expenses by getting rid of intermediaries and providing direct peer-to-peer transfers. This expense performance is especially advantageous in Africa, where remittance circulations are a crucial income for numerous households.

Facilitating smooth cross-border deals with Bitcoin is an important benefit in the ECOWAS area, where intra-regional trade is motivated. Unlike the ECO currency, which will still need some level of governmental oversight and guideline, Bitcoin runs separately of nationwide borders. This self-reliance enables fluid and effective deals in between organizations and people throughout various nations, promoting local trade and financial combination. The constant adoption of Bitcoin will drive development financially by drawing in financial investments into the fintech and remittance sector while producing brand-new task opportunities and payment rails. The ingenious edge of Bitcoin and blockchain innovation will stimulate constant technological improvements and financial diversity. By welcoming these innovations, African nations will gradually place themselves at the leading edge of the worldwide digital economy, promoting a culture of development and entrepreneurship.

Blockchain innovation and the cryptographic algorithms which underpins Bitcoin uses a level of openness and security that can boost trust in monetary deals. The immutable nature of blockchain records makes sure that deals are protected and proven, lowering the threat of scams and corruption. This openness is crucial for remittance services, making sure that funds are moved safely and effectively. Additionally, reacting to the remittance concern on the Mara livedesk in Nashville, Femi Lounge of the Human Rights Foundation mentioned: “the decentralized nature of Bitcoin provides a financial system less susceptible to centralized failures or manipulations. In Africa, we have 46 currencies, one of the big problems is settlement.The last hope of importers and exporters in Nigeria and Sub-Saharan Africa in general is Bitcoin and USDt.”

The application of the ECO currency in West Africa is unneeded if Bitcoin is totally embraced. Bitcoin’s peer-to-peer networks and exchange rails provide remarkable performance and energy compared to the proposed ECO currency. By leveraging Bitcoin’s strengths, West African nations can bypass the requirement for a brand-new local currency and develop a robust, inclusive monetary system. This adoption would resolve regulative difficulties, boost technological facilities, and enhance monetary literacy, making sure a smooth shift to an up-to-date monetary environment. The prospective to lower remittance expenses, boost monetary addition, and assist in cross-border deals makes it an effective tool for financial advancement in Africa. The future of Africa’s monetary system lies in welcoming ingenious services that resolve its distinct difficulties. By leveraging the strengths of Bitcoin, Africa will develop a dependable, inclusive, and forward-thinking monetary environment that supports sustainable financial development and advancement.

This is a visitor post by Heritage Falodun. Opinions revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.