Over the previous years, Bitcoin has actually regularly surpassed all significant possession classes, therefore developing itself as the standard for digital possession financiers. For those who are committed to Bitcoin’s long-lasting vision, the overarching monetary goal typically develops from merely increasing dollar holdings to making the most of Bitcoin reserves.

Bitcoin as the Hurdle Rate

Bitcoin functions as the fundamental standard for digital properties, similar to treasury bonds in the conventional monetary system. Although all financial investments bring intrinsic threats, Bitcoin saved in self-custody reduces counterparty threat, dilution threat, and other systemic threats common in standard financing.

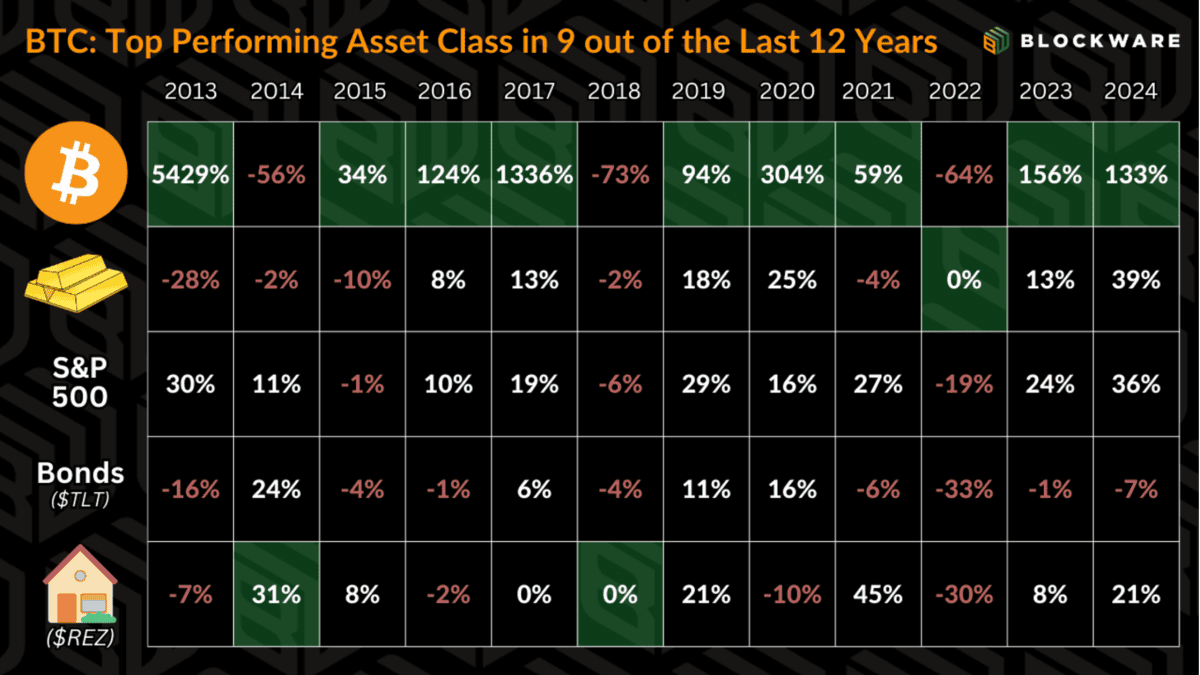

In the previous twelve years, Bitcoin has actually surpassed all possession classes in 9 of those years (by considerable margins), leading lots of financiers—specifically those fluent in financial history—to see it as the brand-new “risk-free rate” in location of treasury bonds, mostly due to Bitcoin’s proven shortage.

Put in a different way, the monetary objective of digital possession financiers focuses on obtaining more BTC instead of more dollars. All potential financial investments or expenses are evaluated with BTC as the referral point for chance expense.

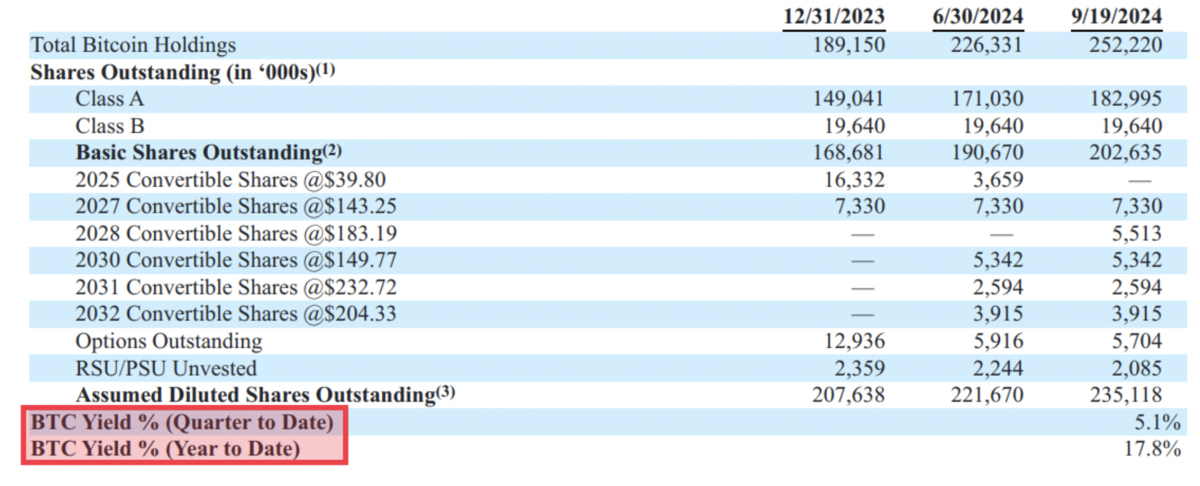

MicroStrategy has actually exhibited this paradigm in the business arena with the intro of their brand-new Key Performance Indicator (KPI): BTC Yield. In their September 20th 8-K kind, they specified, “The Company uses BTC Yield as a KPI to help assess the performance of its strategy of acquiring bitcoin in a manner the Company believes is accretive to shareholders.” By leveraging the tools offered to them as a public business, such as access to low-interest financial obligation and the ability to release brand-new shares, MicroStrategy has actually efficiently raised its BTC acquisition rate per impressive share, in spite of taking part in an activity typically thought about dilutive.

In summary, their method has actually effectively led them to build up more Bitcoin.

However, MicroStrategy has benefits that a lot of fund supervisors or retail financiers do not have: as an openly traded business, they can effectively access capital markets. Individual financiers are not able to release shares to the public in order to raise funds for Bitcoin purchases, nor can they release convertible notes to obtain dollars at near-zero rate of interest.

This causes a significant concern: how can specific financiers build up more Bitcoin? How can they accomplish a favorable ‘BTC Yield’?

Bitcoin Mining

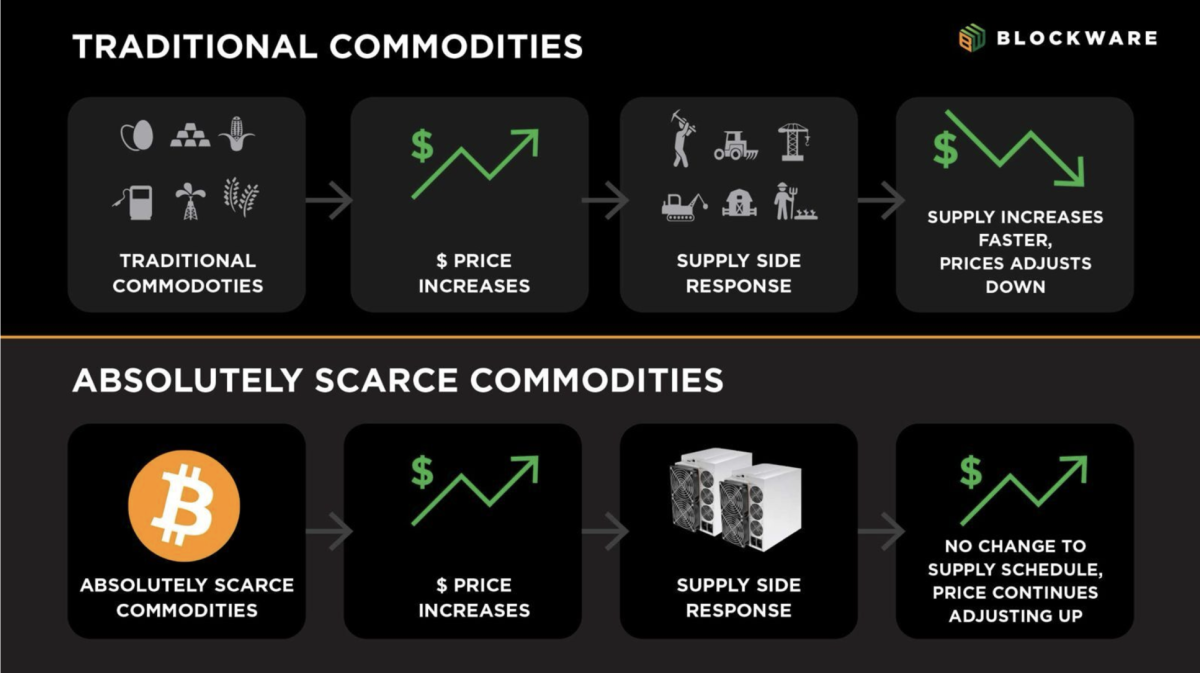

Bitcoin miners build up BTC by contributing computational power to the Bitcoin network, preferably producing more BTC than the expense sustained in electrical energy for their operations. Achieving this balance is not without obstacles. The Bitcoin procedure imposes a repaired supply schedule through “difficulty adjustments,” significance that as more computational power is used to Bitcoin mining, limited block benefits end up being progressively divided.

The most competent Bitcoin miners are those who enhance their computational output while reducing functional costs. This involves obtaining the newest, most effective mining hardware and operating with the least expensive possible electrical energy rates.

As of present market conditions (since 11/21/2024), the rate of one Bitcoin loafs $98,000. An Antminer S21 Pro, running with an electrical energy expense of $0.078/kWh, can producing one BTC for roughly $40,000 in energy expenses, yielding an operating margin of almost 145%. Businesses generally regard revenue margins of 5-10% as healthy; hence, mining operations considerably surpass this standard, even due to the cutting in half that took place in April 2024, which minimized BTC profits per computational system by half.

Price Growth Outpacing Difficulty Growth

The evaluation of Bitcoin, like any monetary possession, is identified at the margin, showing the deals in between purchasers and sellers. This limited rates system adds to Bitcoin’s popular rate volatility. When there are less sellers at a provided rate, purchasers should bid above that rate to protect Bitcoin, while the reverse holds true for purchasers.

This vibrant renders Bitcoin’s rate considerably more unstable than the mining problem, which increases more slowly due to developments in ASIC production, energy production, and mining facilities. The time and human capital required to improve the overall computational power of the Bitcoin network must not be downplayed.

This interaction provides chances for Bitcoin miners to get significant quantities of Bitcoin with time.

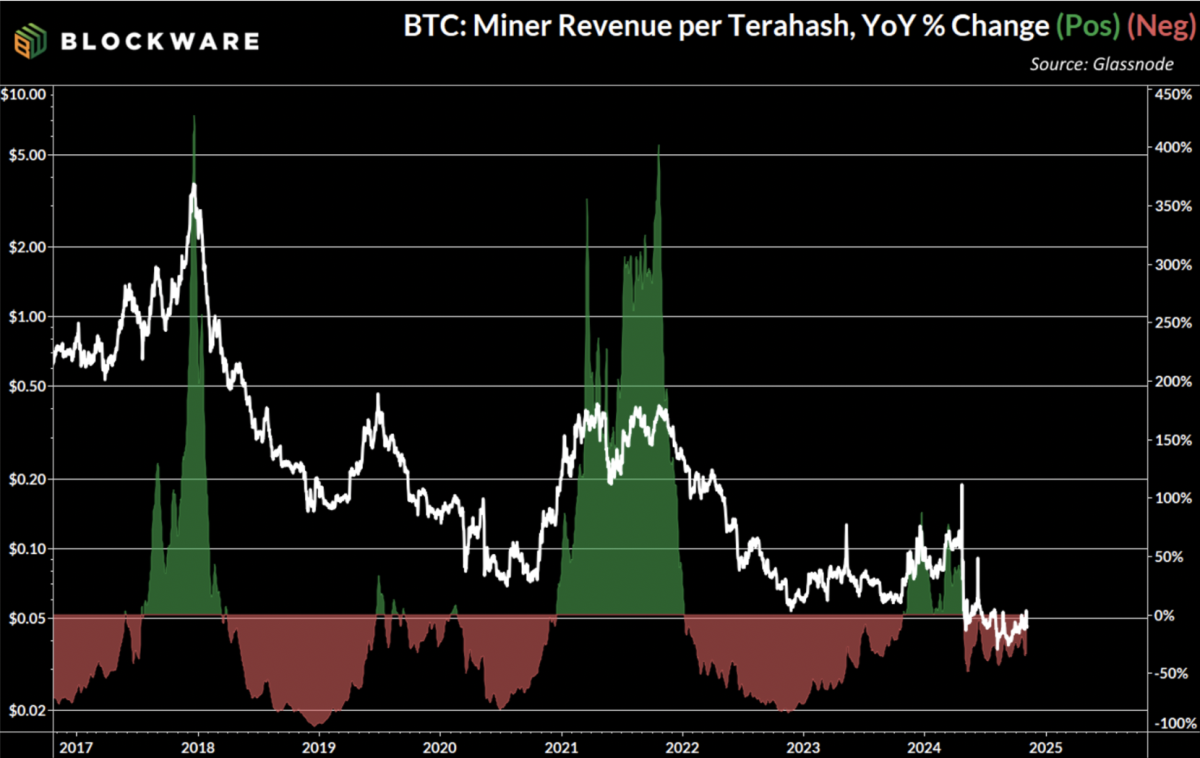

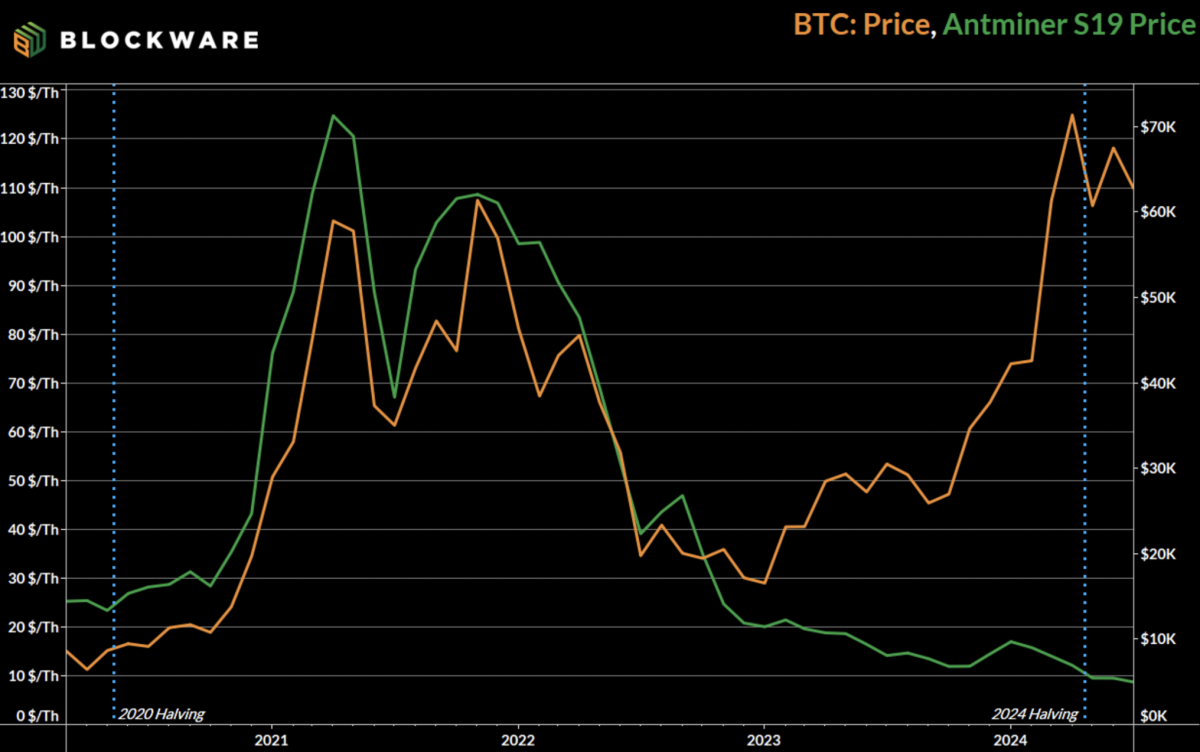

The accompanying chart shows the exceptional success experienced by Bitcoin miners throughout booming market. “Hashprice” measures the everyday income made by miners per system of computational power. Over yearly cycles, the hashprice has actually seen over 300% development at the peaks of Bitcoin mining cycles, leading to revenue margins that have actually tripled within a 12-month duration.

While this metric generally patterns downward in the long term as competitors boosts, miners update devices, and block aids cut in half every 4 years, throughout booming market the speeding up Bitcoin rate development outweighs the elements that adversely effect mining success.

Price Volatility in Bitcoin Mining Hardware

Alongside larger revenue margins throughout booming market, Bitcoin miners gain from the interrelated rate motions of ASIC hardware and Bitcoin itself. Within the 2020-2024 cycle, for instance, the Antminer S19 (the most effective ASIC at that time) experienced a cost rise from roughly $24/T to over $120/T by November 2021, concurrent with Bitcoin’s rate peak.

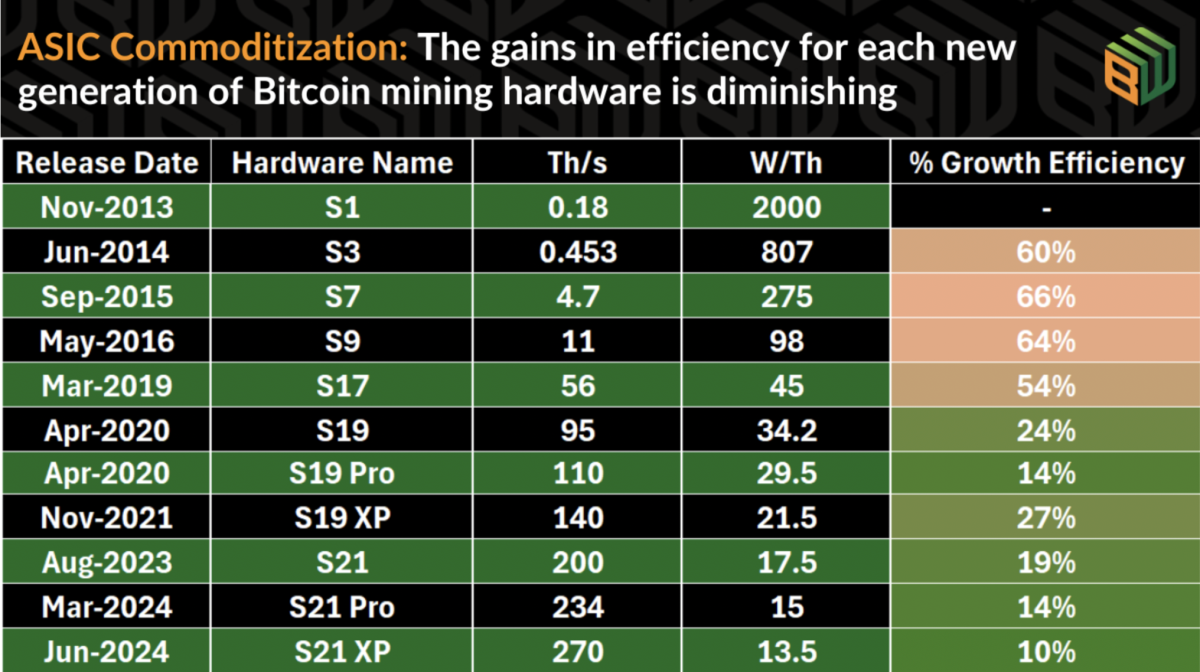

The resale worth of Bitcoin mining hardware has actually grown more steady with each brand-new generation. In Bitcoin’s earlier years, quick technological developments rendered older designs outdated practically immediately. However, incremental enhancements in ASIC innovation now permit older designs to stay competitive for a number of years post-launch.

Given that the S19 was presented in 2020 and continues to keep market price, one can expect that the S21 line of makers will likewise preserve its worth for a prolonged duration. This stability supplies miners with a benefit in building up Bitcoin, as the preliminary expenses of these makers are no longer thought about “sunk” costs. Each device maintains a market value associated to Bitcoin, permitting miners access to liquidity.

Blockware Marketplace

Blockware has actually developed a market developed to provide any financier—be they institutional or retail—the possibility to straight purchase Bitcoin mining. Users can buy Bitcoin mining rigs that are hosted within Blockware’s top-tier information centers, making it possible for access to commercial power rates. These makers are functional upon acquisition, therefore getting rid of the extended preparations that have actually traditionally led to missed out on chances for miners.

Furthermore, this platform is crafted by Bitcoin lovers for Bitcoin lovers, permitting purchases utilizing Bitcoin as the cash. Importantly, mining benefits are never ever held by Blockware, making sure that they are straight moved to the user’s wallet.

This structure supplies miners with the alternative—though not the commitment—to offer their makers at any offered time and rate, permitting them to profit from the volatility of ASIC costs, recover their preliminary financial investments, and accelerate their Bitcoin build-up compared to conventional techniques.

This ingenious service minimizes the obstacles that have actually made hosted mining formerly troublesome, making it possible for miners to concentrate on their main goal: the build-up of more Bitcoin.

For institutional financiers thinking about bulk rates for mining hardware, the Blockware group is offered for direct questions.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.