Last week the Chicago Board Options Exchange (Cboe) launched its bitcoin-based futures markets and the primary day acquired an inexpensive stage of fanfare. Now the most important choices trade on the planet, the Chicago Mercantile Exchange (CME Group) has launched its bitcoin derivatives merchandise. Here’s what you may count on from CME Group’s bitcoin futures opening day.

One of the Oldest and Largest Prediction Markets the Chicago Mercantile Exchange Enters the Bitcoin Arena

Last week Cboe’s XBT futures launch induced fairly the stir and quantity was fairly first rate on the primary day of buying and selling. There’s been curiosity within the January expiry contracts as there are a little bit over 1,500 bought. However, the next months have waned as there are solely 70 for February and 150 for March. Of course, it’s early, however main derivatives gamers see an absence of liquidity. That may all change as CME Group has simply launched its bitcoin futures merchandise. It’s secure to say CME is a far larger whale within the sea of choices markets and has a wider buyer base. CME’s launch ought to present extra liquidity whereas also making longs and shorts simpler for institutional merchants.

Legalized Betting Using Leverage

Futures markets are not any completely different than legalized playing the place merchants are allowed to place bets on the longer term final result of a commodity, inventory, currency, and bitcoin as nicely. Futures are common as a result of they allow leverage choices (utilizing leverage means you might be getting a mortgage based mostly on a deposit) and usually most futures contracts solely require 10 %. However, CME Group’s futures would require traders to meet a margin requirement of 43 %. A contract unit is 5 bitcoins outlined by the value of the CME CF Bitcoin Reference Rate (BRR).

Futures markets are not any completely different than legalized playing the place merchants are allowed to place bets on the longer term final result of a commodity, inventory, currency, and bitcoin as nicely. Futures are common as a result of they allow leverage choices (utilizing leverage means you might be getting a mortgage based mostly on a deposit) and usually most futures contracts solely require 10 %. However, CME Group’s futures would require traders to meet a margin requirement of 43 %. A contract unit is 5 bitcoins outlined by the value of the CME CF Bitcoin Reference Rate (BRR).

So the explanation retail traders dig investing in futures is as a result of at an instance worth of $19Ok per BTC, an individual would have to make investments $95,000 to catch income from worth rises or drops for 5 bitcoins. Essentially by way of the magic of borrowing energy (leverage), merchants solely have to pay $40,850 so as to make some good points. This means making income off the value rises and dips tethered to 5 bitcoins at a less expensive charge. Unlike Cboe’s futures which is solely based mostly on the Gemini index, CME Group’s worth reference charge is gathered from 4. The BRR charge comes from the bitcoin exchanges Kraken, GDAX, Bitstamp, and Itbit which is able to coincide with the agency’s Bitcoin Real-Time Index (BRTI).

Limited Brokerage Service Options Will Mean Limited Liquidity

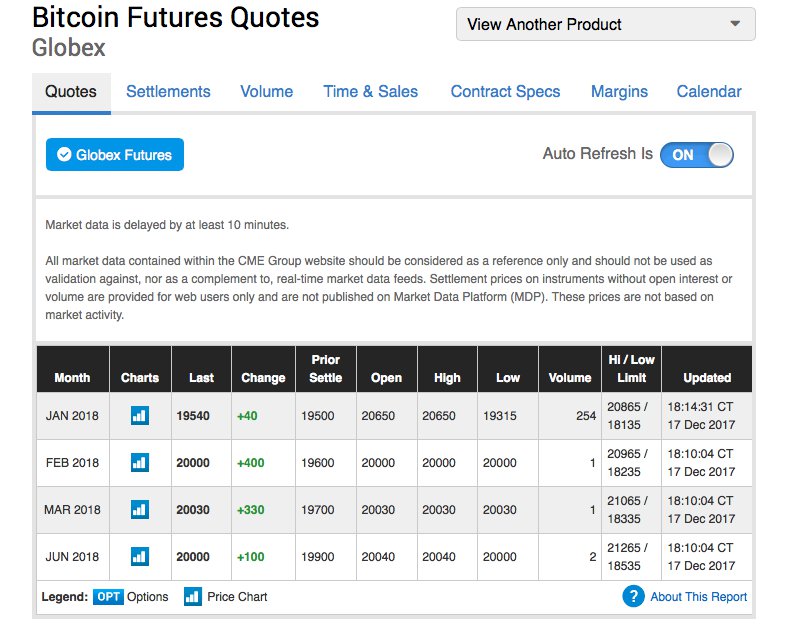

Just like Cboe’s bitcoin futures contracts, for CME Group’s derivatives, traders will want to make the most of a brokerage service. Currently, there will not be that many services providing futures for each corporations which is probably going inflicting the liquidity points. On Monday the most important on-line brokerage service TD Ameritrade will supply Cboe’s contracts however won’t present CME’s merchandise in the intervening time. Interactive Brokers who have been one of many first to present Cboe’s merchandise will also permit CME’s futures. CME’s futures shall be ready to be bought in contracts for the closest two months within the March quarterly cycle (Mar, Jun, Sep, Dec) alongside the closest two serial months.

Many bitcoin proponents have been excited in regards to the CME addition, and a few speculators imagine the spot market worth displays the optimism. Last week simply earlier than Cboe launched its futures product, the spot worth of bitcoin was low and began climbing exactly on the hour the derivatives have been launched. Three days prior to the Cboe launch, bitcoin’s worth tumbled to $13,400 throughout international exchanges however jumped again to $15,400 after the futures launch. The CME launch had the precise reverse occur to the spot worth of bitcoin.

What do you consider CME Group’s bitcoin futures launch? Let us know what you suppose within the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.