Cryptocurrency markets and bitcoin cost stability may be coming to an end quickly, as a variety of doubters and speculators expect a huge relocation after today’s options derivatives agreements expire. Bitcoin rates have actually been less unpredictable throughout the last 3 weeks, however over 114,000 bitcoin options with a notional worth over $1 billion set to expire on Friday, June 26, might alter that pattern.

Traders are considering bitcoin (BTC) derivatives agreements that are set to expire at the end of the trading day. At the time of composing, BTC is switching for $9,249 per system and has a $170 billion market assessment. The whole market capitalization of all 5,000+ crypto possessions is around $263 billion on Friday early morning.

This week, traders and crypto market experts have actually been concentrated on seeing the options agreements set to end today. The scientists from Arcane Research just recently released a report and talked about the bitcoin options concern.

“Close to $1 billion bitcoin options agreements will expire on Jun 26, accounting for 60% of the overall open interest in the BTC options market,” Arcane’s report kept in mind. “In scenarios like this, there might be substantial monetary rewards to move the area cost towards a specific level prior to the expiration date.”

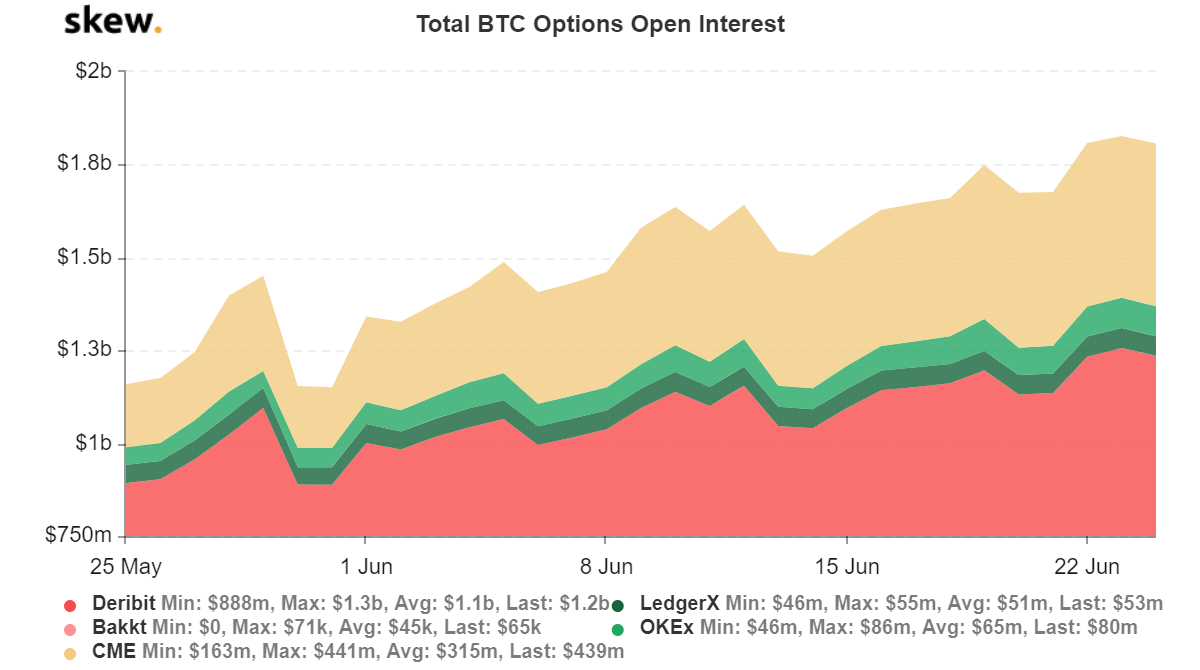

The options expiration of over $1 billion in notional worth is the biggest expiration of its kind and a variety of traders think that it will set off a huge relocation. Data from Skew’s analytics reveal that in between Deribit, Bakkt, Okex, CME, and Ledgerx there is well over $1.8 billion in open interest for options.

Deribit is the biggest service provider of options, while the managed institutional exchange CME has the 2nd biggest variety of agreements.

Traders also have actually discovered a $7-8k-strike cost, while a variety of other speculators also see a $10-11k-strike cost. Most traders think that the ‘huge relocation’ will wind up being in variety of either among these 2 cost patterns.

Traders have actually been going over the options expiration all week, and have actually been thinking on whether it will shake crypto markets.

“In case you missed it, $930,000,000 worth of bitcoin options are ending on Friday – practically 70% of all overall open interest. Seems typical,” described one person on Twitter.

Another trader called Altcoin Psycho also talked about the huge expiration anticipated today. “Everyone is anticipating substantial BTC volatility due to the fact that of options expiration tomorrow, however let’s go into that,” Altcoin Psycho tweeted to his 35,000 Twitter fans.

“Heaviest volume is for calls at $10k and puts at $9k. The max discomfort circumstance would be bitcoin merely varying sideways. I believe this is what will occur.” “I’ve end up being a max pain/game theory maximalist since late,” the trader included.

What do you consider the big bitcoin options expiration today? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.