During the last 2 months considering that the March 12 crypto market thrashing, otherwise called ‘Black Thursday,’ need for cryptocurrencies appears to be on the rise in specific areas in Latin America. Various reports released today have actually kept in mind that nations like Colombia, Venezuela, Argentina, Chile, Brazil, and Mexico have actually seen considerable bitcoin trade volumes. However, other reports reveal that despite the fact that the volumes are high in these particular nations, they are tough to determine due to inflation or devaluation.

Trade Volumes Spike in Countries Like Brazil, Mexico, Venezuela, and Argentina, But the Region’s Fiat Currencies Are Also Stricken by High Inflation

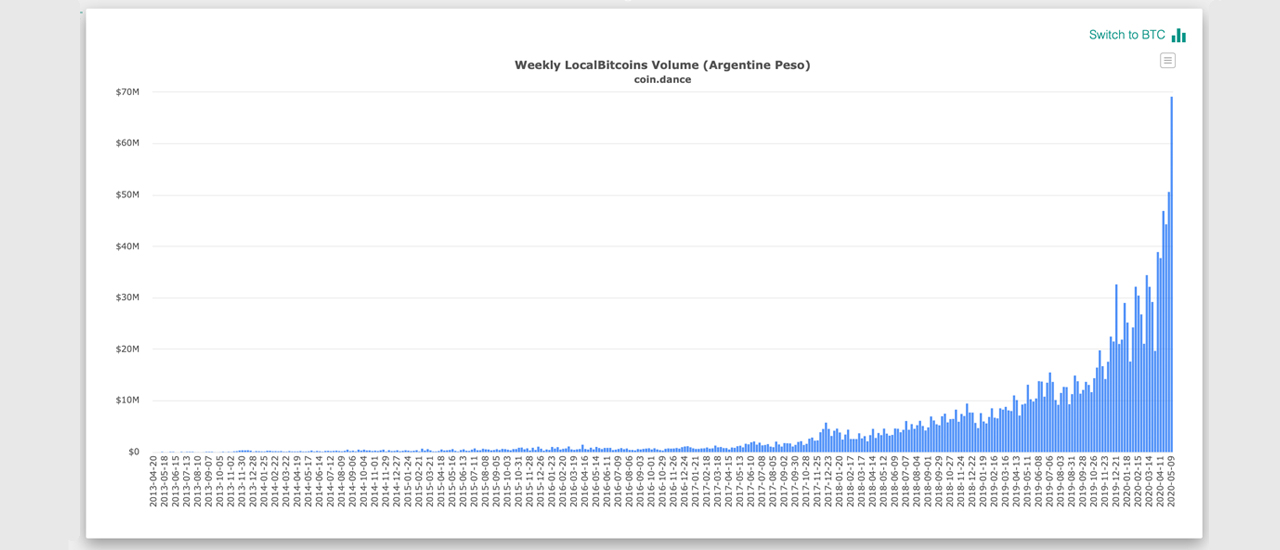

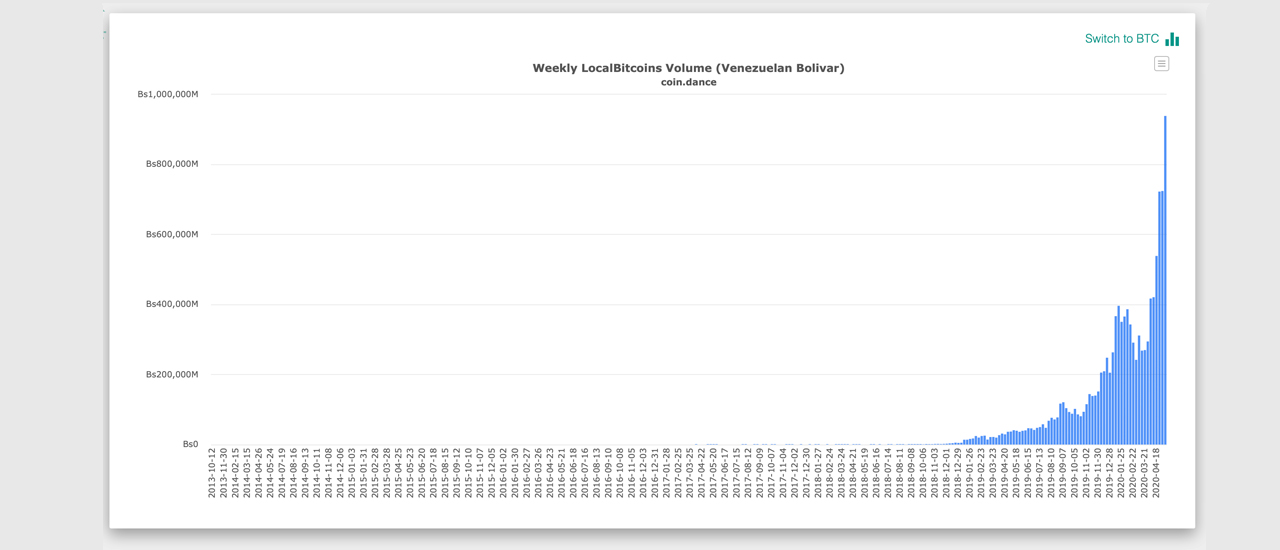

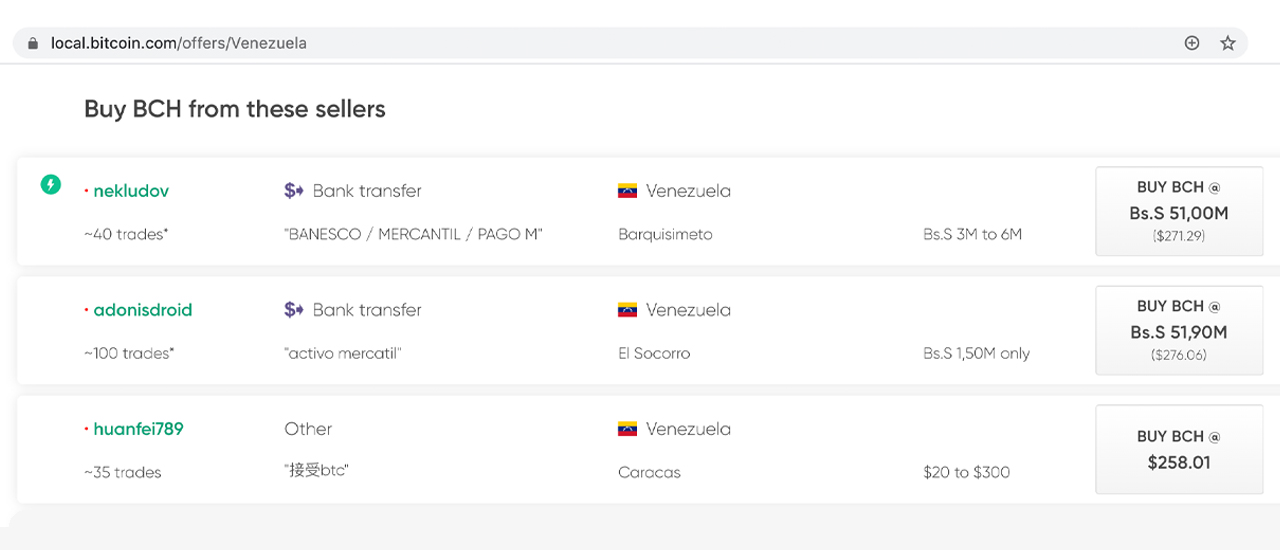

A great deal of bitcoin trade volume has actually been happening in a range of Latin American nations. Peer-to-peer markets that offer cryptocurrencies are seeing strong volumes in these areas. According to Coin Dance volume data, Colombia, Brazil, and Chile have actually seen considerable bitcoin trade volumes on Localbitcoins week after week. Venezuela and Argentina bitcoin trade volumes suggest brand-new all-time highs and the pattern can be seen on Paxful, Mycrypto, Local.Bitscoins.web, and other platforms too. Because of this large crypto trade volume in Latin America, it had actually triggered a variety of monetary news outlets to report that there is considerable need originating from these locations. For circumstances, Nikkei Asian Review personnel author Naoyuki Toyama just recently composed that “bitcoin shines in emerging markets afflicted by falling currencies,” and “from Bueno Aires to Beirut, financiers accept cryptocurrency as a safe house.”

Despite the reports, a couple of media outlets like Decrypt, Crypto Globe, and a couple of others revealed a various side of the story. For circumstances, it appears individuals are not considering that the fiat currencies in these nations are ending up being less important every day. Yes, the volumes are at an all-time high in Argentina, however inflation is even worse than it has actually ever been for Argentines in 3 years. Well prior to the coronavirus, Argentina’s inflation rate hit 53.8% at the end of 2019.

Venezuela is the very same method, as the inflation rate for Venezuelans is enormous. In February 2020 the inflation rate was 2,910%, however it did be up to 2,430% in March. However, the considerably bigger inflation rate in Venezuela makes it the worst inflation rate in the world by a long shot. Despite the truth that Localbitcoins trade volumes in the nation are touching an all-time high, it doesn’t compare to the trade volumes in 2017 when the bolivar deserved more.

Issues With the Iranian Rial and the Fall of the United States Dollar

The Covid-19 pandemic has actually made things even worse in these nations as the economies in Chile, Venezuela, Columbia, Mexico, and all the other areas with high BTC trade volumes have actually aggravated. The problems have actually gotten so bad in Venezuela, today President Nicolas Maduro enacted a lease and wage freeze throughout the entire nation. On numerous events, Localbitcoins information has actually had some disparities, especially when it utilized to serve Iran. Not too long back, numerous people and publications stated that Iranians were paying $24,000 per BTC.

The issue with that cost quote was a typical misunderstanding about the currency exchange rate in Iran and how it works. At the time, individuals observed that a person BTC was around a billion Iranian rials, however the currency exchange rate mathematics is completely various. An Iranian nationwide called Mehran Jalali discussed when these $24K per BTC headings came out, how individuals can get the market rate utilizing USD, and the Iranian rial. “The going market rate for the U.S. dollar to the Iranian rial is one dollar to 136,500 rials,” Jalali stated this past January. Making things a lot more complicated, news.Bitscoins.net’s Kevin Helms reported on how Iranian legislators just recently talked about slashing 4 nos from the rial. Localbitcoins, nevertheless, prohibited Iranian traders from switching digital currencies on the platform and homeowners now need to utilize other alternatives.

It’s hard to determine just how much need is originating from any nation based on Localbitcoins volumes alone. Especially when there are substantial disparities and enormous inflation messing up these fiat currencies from numerous Latin American nations. The very same might be stated for the U.S. dollar one day, and financial experts have actually anticipated the end of the USD after the petro-dollar collapse. Analysts projection that BTC might reach 1 million dollars, at some time in time, and it effectively might occur in the middle of devaluation in the U.S. if it was to happen. A variety of financial experts believe that the death of USD effectively might occur specifically in the middle of the Federal Reserve producing trillions of dollars out of thin air. So if you think of it realistically and picture BTC touching a million USD per coin — Would it be really significant if the USD was near useless?

What do you think of the trade volumes in Latin America taking inflation into factor to consider? Let us understand what you think of this subject in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.