Last week Paypal launched a whitepaper in collaboration with Energy Web and DMG Blockchain Solutions, explaining a “Green Mining Initiative” planned to reroute charges from taking part users particularly to accredited miners powering their operations with renewable resource. I can’t state I’m shocked by this truthfully, mining has at this point ended up being extremely stabilized in regards to its usage to more renewable resource or environment objectives. Mining is really extremely fit to this job offered its nature, miners are mercenaries trying to find the most affordable energy possible to commit towards fixing the next block. If you have actually stranded power, or excess power, they will take it.

The total architecture of this system though is beyond the area of Rube Goldberg. I am sort of surprised that this is the level of technical understanding and elegance that a significant business like Paypal has on tap, specifically in their Blockchain Research Group particularly concentrating on this area. The whole thing mishandles, ridiculous, and a few of completion objectives or possibilities they talk about are not built on sound financial rewards.

The Core Design

The whole essence of the style is to guarantee that when a certified user broadcasts a deal to the network, just a qualified green miner can gather the associated deal cost. The issue with this is that mining charges from a deal are collectible from any miner who includes them in a block, not simply licensed ones. A system is needed to ensure just particular miners can gather a couple of.

The very first thing you need to do is recognize which miners you wish to can declaring the limited cost. They propose making use of a system called “Green Proofs for Bitcoin” used by Energy Web. The evidence are accreditations from the company that a miners energy mix or influence on the grid fulfills some limit of renewable resource usage or favorable influence on the power grid. In the accreditation procedure each miner can sign up a public secret, producing a list of each accredited miners public secret.

This crucial accreditation is at the root of what allows making sure just the proper miners can declare a cost. Compliant users’ wallets can query or be supplied with a list of all accredited miners bitcoin addresses, and from there have actually the details required to develop an unique deal that just they can declare the cost for. The technique is a multisig output. There are no difficult limitations of the number of secrets require to sign for a multisig address, so certified users can consist of the cost to accredited miners in an unique output with a 1-of-n multisig script that any licensed miner can invest. A very little cost at the bottom of the mempool feerate variety is also consisted of typically simply to guarantee that it propagates throughout the network.

The last piece of the puzzle is really declaring the cost. If a qualified miner was to mine a block consisting of a green deal, and not also consist of a deal investing the cost output to themselves, then any accredited miner might declare the cost output in the next block they mine. There, for each green deal a qualified miner consists of in their block, they need to consist of a matching deal sending out the cost output to an address just they hold a secret for.

Special wallets can craft deals with cost outputs just claimable by licensed miners, and these users can preferentially direct their charges towards miners accredited as utilizing renewable resource or producing some other favorable influence on the grid.

Full of holes and insufficient thinking

Firstly, the basic concept of needing miners to consist of a 2nd deal of their own is an exceptionally ineffective style, which they do acknowledge in the paper. What they don’t acknowledge is the financial truths this indicates for deals’ feerates.

A Bitcoin deal pays charges based upon the quantity of area it uses up in regards to information. By presenting the requirement for miners to use up blockspace producing a secondary deal gathering this “green fee” they are financially speaking increasing the size of the green deal itself. This is extremely comparable in practice to Child-Pays-For-Parent from a financial point of view.

With CPFP, a deal investing an output from an unofficial deal pays an unusually high cost. This by balancing the cost the 2nd deal pays throughout both itself and the very first deal, which need to be validated before the 2nd one can be, increases the feerate of the very first deal. This green cost collection system is the exact same dynamic, however in reverse.

By needing the miners to craft a 2nd deal to declare the cost, presuming the cost output pays a typical feerate, the net charges the miner gathers per byte of information is really decreased. The blockspace needed to gather it might have been utilized to consist of another cost paying deal. So in truth, the cost a certified user consists of for accredited miners need to also spend for the miner’s claim deal, in result significance certified users need to pay more outright charges to accomplish a particular cost rate. Why would users do this?

In a vacuum this vibrant warranties that either certified users need to pay too much, or licensed miners end up really earning less profits all things equivalent. The previous is illogical from a customer viewpoint, and the latter entirely stops working to accomplish the objective of gratifying miners utilizing renewables additional profits.

A 2nd glaring concern, and an incredible one, is their thinking about how to structure the 1-of-n multisig script. With conventional pre-Taproot multisig, each specific type in the multisig need to exist in the script. This provides an issue. The size of the green cost output grows linearly for each miner who has a type in the multisig.

The strategy set out in the paper explains breaking miners up into subgroups, and turning in between which group you pay charges to each time you negotiate. I.e. if there are 21 miners, divided them up into 3 groups of 7, transferring to the next group to send out the charges to each time you negotiate. This would develop an extremely irregular circulation of charges in between all the licensed miners, as the rate of deals among certified users and rate of rotation in between them is not something that can be recommended or made routine. Not to point out, it apparently reveals a total absence of awareness of Schnorr based multisig plans like FROST.

Schnorr based multisig scripts utilize aggregate secrets, suggesting no matter the number of member secrets are included, just a single public secret is required for the script, and just a single signature is needed. This would entirely attend to the concern of multisig script size, and get rid of the requirement for the clunk separating of licensed miners into subgroups.

They also make no reference of more effective systems for really gathering the cost. A single secondary deal for each green deal is mind blowingly ineffective. An extremely apparent system to be more effective with usage of blockspace would be to sweep all of the green deal cost outputs in a single deal. This would need just a single deal output to aggregate all of the charges into a single UTXO, instead of a discrete output for each specific cost, and also producing the requirement to integrate them with yet another deal later on.

They lastly go on to talk about the capacity of a centralized out of band system straight to accredited miners, however raise the centralization, intro of trust, and intricacy of carrying out direct interaction to each specific miner as factors for developing the dispersed procedure explained above.

The Market Alright Does This

At completion of the day, the technical inadequacies and absence of understanding blatantly apparent options (a minimum of partly) to them, aren’t even the most confounding part of this to me. It’s trying to place reward misshaping characteristics into the application layer of the procedure to attend to the issue over renewable resource in the very first location. Why? The market actually manages this reward all by itself.

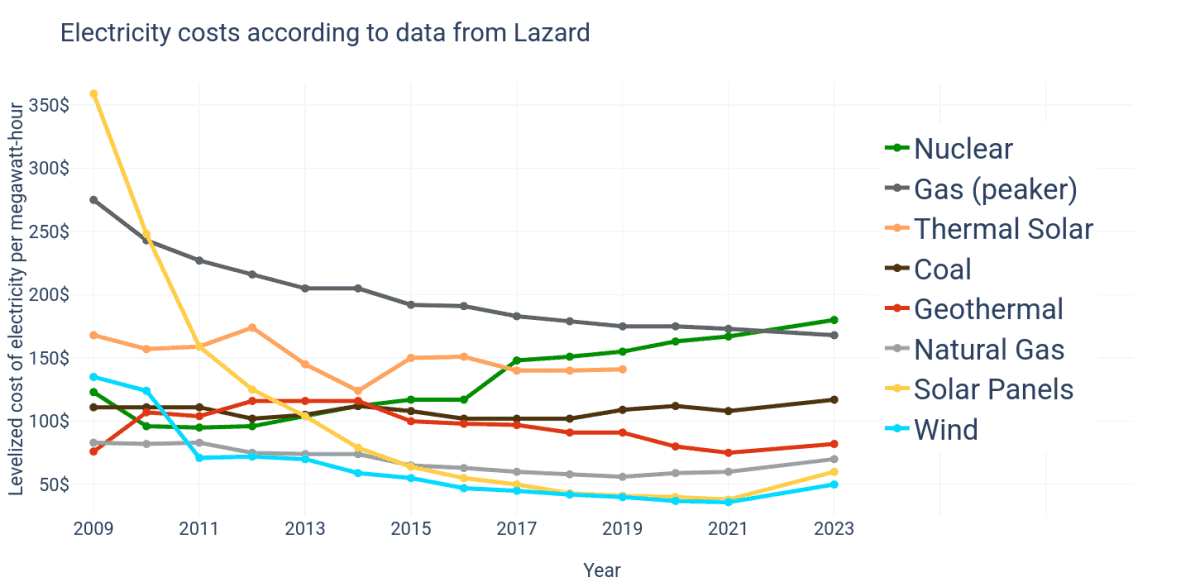

Renewable energy is the most affordable energy even when considering the expense of building and operation of energy production capability. Miners primary issue is discovering the most affordable priced energy they potentially can. Why is Paypal attempting to insert odd systems offering users a distortionary system to limit charges just to particular miners, and total present a distortionary market system into this image? The market currently does what you desire. Renewable energy is low-cost, develop more of it and miners will come and purchase it, bringing profits to fund the operation (specifically when it is at first detached from the grid and has no other customers).

The whole dynamic of charges in Bitcoin is that it is a totally free market, where any miner can complete to gather charges from any deal by including them in their own blocks. This whole dynamic is developed to incentivize optimum competitors in between miners to offer security and finality to users of the network. Trying to present odd distortions like this proposition into the system is a destabilizing consider the balance of competitors and network security, and is entirely redundant offered the marketplace truths of the mining environment.

Do you wish to see Bitcoin mining be a favorable consider incentivizing and assisting broaden renewable resource production? Great! It currently does that, no modifications required. It does not require Rube Goldberg machinations slapped on leading to achieve that objective, the fundamental market based systems of competitors in between miners currently does that.

I actually don’t comprehend what Paypal, DMG, and Energy Web are believing here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.