During the last couple of days, individuals experienced history when the cost of petroleum dropped below no to -$40 per barrel, and as time passes numerous experts believe the worst is yet to come. After West Texas Intermediate (WTI) oil-based agreements dried up for May, agreements for June collapsed by 45%. Experts state that the continued sell-off programs the oil issues are not disappearing and the serious concerns could eventually ruin the U.S. dollar. Since 1944, the USD has actually been propped up by the petro-dollar plan and with oil costs below no, the dollar could quickly collapse.

With the Petro-Dollar System Devastated, the U.S. Dollar Is More Fragile Than Ever

Free market supporters, gold bugs, and cryptocurrency supporters have actually constantly stated that today’s financial system was unethical and controlled. Of all the nations in the world, U.S. leaders have actually been a few of the worst manipulators in history and the country’s super-powers might be concerning an end. The U.S. federal government has actually blamed the coronavirus break out on the financial destruction, however America’s monetary system was currently in problem prior to the infection.

On April 20, the world experienced history when the worth of a barrel of petroleum dropped unfavorable 300% below no, sending out oil dealerships into a craze. The day eliminated WTI agreements for May and the following day on Tuesday, WTI agreements fell by 45%. Experts think “the worst is yet to come” and the well recognized company Gunter Financial Group of Raymond James stated oil costs will stay at all-time low for a while.

“We think costs are most likely to stay at basement levels in the short-term with additional shut-ins upcoming – anticipate late-May to bring comparable cost motions as the June agreement rolls over,” Raymond James detailed on Tuesday.

Now with oil well below no and nonrenewable fuel source agreements being eliminated months beforehand, many individuals wonder about nations that base their currencies off the oil trade. There are different country states that utilize oil reserves to back their notes. Venezuelan President Nicolas Maduro developed a crypto called the ‘petro,’ which is presumably backed by the nation’s abundant petroleum reserves. But what most people wonder about is the life of the U.S. dollar, as the fiat currency has actually been connected to barrels of oil for years. The USD is a derivative of petro-dollar recycling, a term that Wiki specifies as “the global costs or financial investment of a nation’s profits from petroleum exports.” With barrels of oil trading for less than no, it indicates that the USD is just backed by military browbeating and risks of force.

The Rise of the Petro-Dollar and Endless Wars

Many Americans throughout the last 20 years have actually questioned why the U.S. has actually been at continuous war in the Middle East and it is most likely due to the petro-dollar. Back when Franklin D. Roosevelt and the ‘House of Morgan’ damaged the American economy, in 1944 the Bretton Woods pact was concurred upon, which was the primary step in developing the petro-dollar.

The offer made it so nations worldwide would trade global products that are constantly priced in USD. The U.S. would also hold and secure gold reserves for different nations as part of the offer. This provided the United States a monetary edge and in return, the U.S. promised not to utilize the Federal Reserve to print huge quantities of USD. The Bretton Woods contract prospered up till the Vietnam War, as American allies recognized the Fed was printing cash like no tomorrow for war expense.

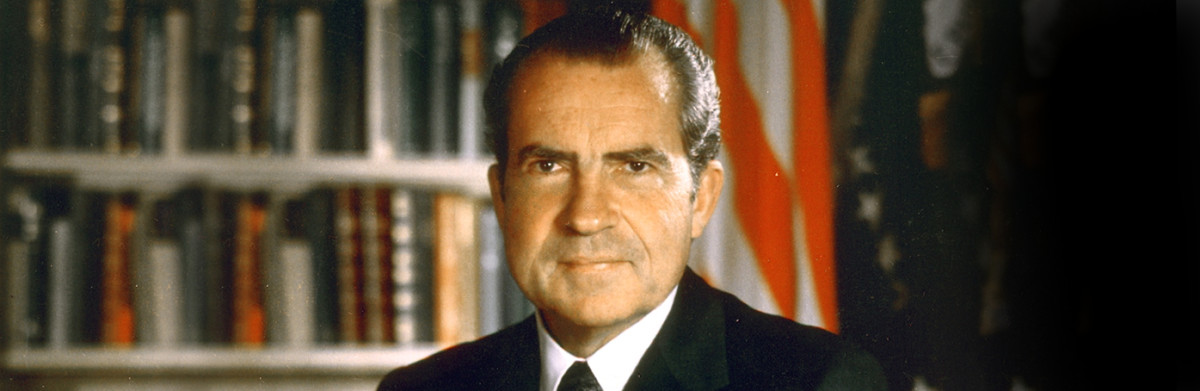

A couple of nations began questioning America’s financial plans and chose to ask the U.S. to repatriate their gold reserves. In 1971, France wished to withdraw their gold reserves from the U.S. and previous President Nixon chose to respond. On August 15, 1971, President Richard Nixon stated a brand-new financial policy, which American’s called the “Nixon shock.” Nixon stated he was getting rid of the USD from the gold requirement for a short-term duration, however the relocation stayed long-term. Two years later on, Nixon asked the King of Saudi Arabia to just accept U.S. dollars for barrels of oil and in exchange, Nixon used military defense. The U.S. President extended the very same deal to essential gamers in the fossil fuel-rich nations and by 1975 the strategy caught every country state connected to the Organization of the Petroleum Exporting Countries (OPEC).

Are Countries Really Stockpiling Weapons of Mass Destruction? Or Are Countries Simply Looking to Exchange Oil for Other Reserves?

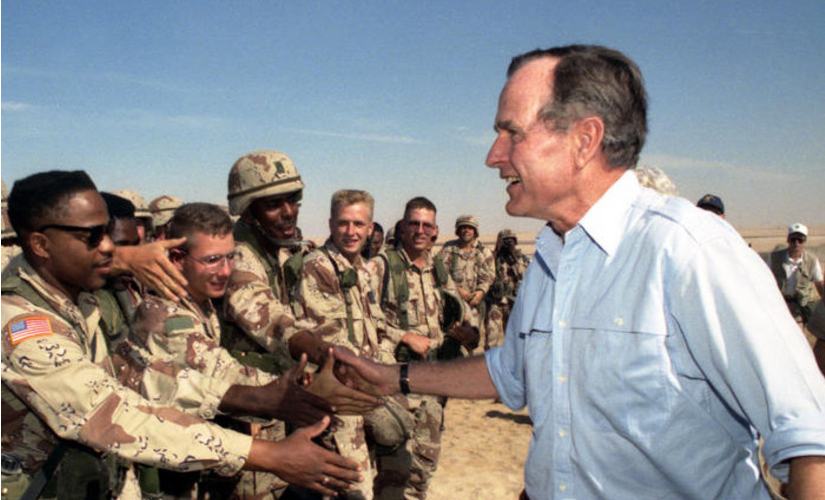

Cracks in the petro-dollar began to reveal throughout the Reagan presidency and the Cold War. The U.S. also began threatening and approving oil-rich countries in South America. In 1991 the petro-dollar began ending up being more vulnerable and the world seen the fall of the Eastern Bloc, otherwise referred to as the Communist Bloc. At the very same time, U.S. forces attacked Iraq throughout President Bush’s Desert Storm mess (Gulf War). People began understanding the unethical plan the U.S. was associated with and how the war was conjured up by arguments worrying oil.

After 1991’s Desert Storm intrusion, 9 years later on the U.S. observed that Iraq’s leaders chose to offer oil for euros rather of dollars. During the years that followed, the U.S. media and its allies painted a photo of Iraq’s leaders hoarding “weapons of mass damage (WoMD),” which was never ever shown. In 2003, U.S. forces attacked Iraq declaring that Saddam Hussein was lying about WoMDs. After the intrusion was total, Iraq coincidently reversed its euro policy and began accepting USD for oil once again.

Most anti-war supporters have actually found out why the U.S. has actually been released all over the Middle East and numerous African countries. The just factor for these intrusions was to keep the petro-dollar alive, however throughout the Bush and Clinton administration, 500,000 kids had actually passed away due to these wars. Muammar Mohammed Gaddafi attempted to leave the petro-dollar system when he had Libya develop the Dinar with a couple of allies.

In reaction, the American federal government and NATO forces messed up the existing Libyan program and performed Gaddafi in 2011. The petro-dollar has actually conjured up U.S. military forces to threaten different nations such as Libya, Iraq, Afghanistan, Lebanon, Syria, Yemen, Somalia, Sudan, and Iran. With the aid of its allies in Israel, the U.S. and NATO forces frightened Iran when they chose to trade barrels of oil for gold. U.S. leaders pulled the very same smoke and mirrors technique as they made with Iraq, by declaring that Iran was hoarding nuclear arms. However, Iran has actually been a serene nation and hasn’t assaulted a single country considering that the late 1700s.

Will America’s World Police System and Bullying South American Countries Keep the Dollar Afloat?

Trump and the rest of the American bullies have actually been doing the very same thing in South American nations and particularly with Venezuela. Both Iran and Venezuela are abundant in oil reserves and these nations have actually threatened the American’s petro-dollar plan. Both nations have actually been talking with Russia and China and taking part in backroom offers to trade oil for other currencies and products. Chinese and Russian leaders have actually alerted the U.S. not to tinker Iran. Syria has also informed American leaders it will secure Iran if the Americans get into. Now that oil markets worldwide have actually been ravaged, all the U.S. has actually delegated secure the dollar is military force.

One of the most significant reasons that oil costs have actually collapsed is since OPEC members had actually stopped working to concur with each other. With all the side offers happening and megatankers of oil being saved at sea, nations who wish to acquire more difficult reserves than the USD will cost gold and more powerful currencies. Oil tankers not able to dock are presently remaining at sea off the coast of California, with a declared 20 million barrels worth of crude. Additionally, much of these nations are abundant in oil reserves, which still powers a lot of the world’s markets. The U.S. has plentiful reserves of oil in Texas, Alaska, and Oklahoma however it might not suffice to sustain a petroleum war.

After taking a look at the U.S. dollar from a various angle and in the context of the petro-dollar, it’s hard to think of the currency not experiencing devaluation. When Americans discover that their dollars are asserted on the usage of military force, then they might understand how useless the tender has actually ended up being. Barrels of oil dropping below no is not something financial experts are ignoring and it truly demonstrates how vulnerable the U.S. dollar is today.

What do you consider the petro-dollar? Let us understand in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.