The popular bitcoin analyst Willy Woo informed his 132,000 Twitter fans that he’s dealing with a new pricing design that suggests a bull run impends. In reality, Woo states the design suggests bitcoin is close to “another bullish run” with “possibly another month to go.”

The cost of bitcoin (BTC) has actually been decreasing throughout the last 7 days, as BTC has actually lost 2% in general this previous week. The worth has actually been getting better and forth in between $8,800 to a touch over $10k per BTC. At the time of composing on Sunday, June 27, 2020, the cost has actually been varying in between $9,010 to $9,150 throughout the last 24 hours.

The $165 billion market assessment, still comprises 63% of the whole market assessment of all 5,000+ crypto possessions. Despite the recession, a variety of experts anticipate a bullish go to pertain to fulfillment in the future. On Sunday, Willy Woo (@woonomic), the popular bitcoin chart analyst and the cofounder of Hypersheet tweeted that he’s been establishing a new pricing design for BTC.

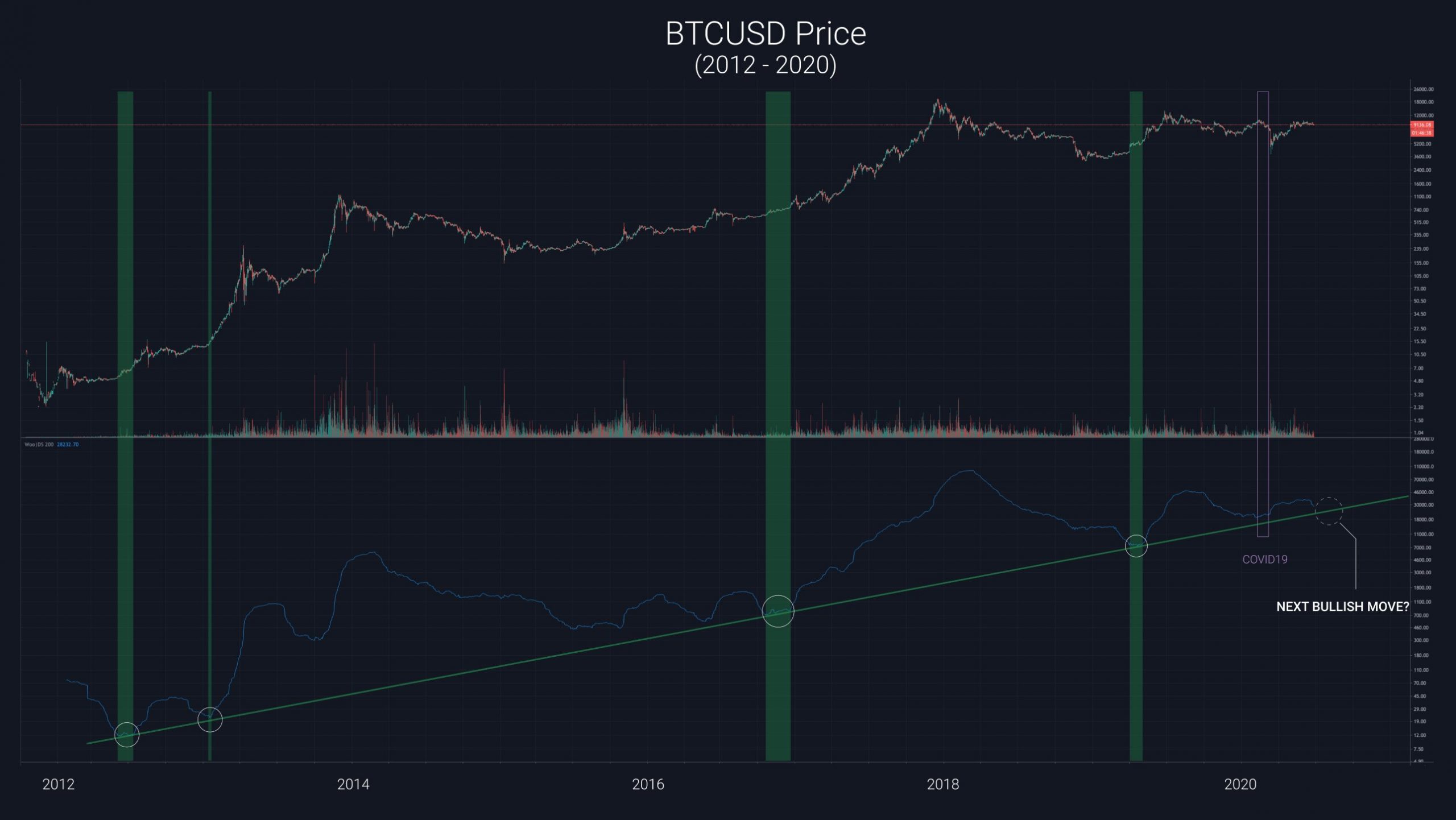

“This is a new design I’m dealing with, it chooses the start of rapid bull runs,” Woo tweeted. “Bitcoin was establishing for a bullish run up until the COVID white swan eliminated the celebration. This design suggests we are close to another bullish run. Maybe another month to go,” he included.

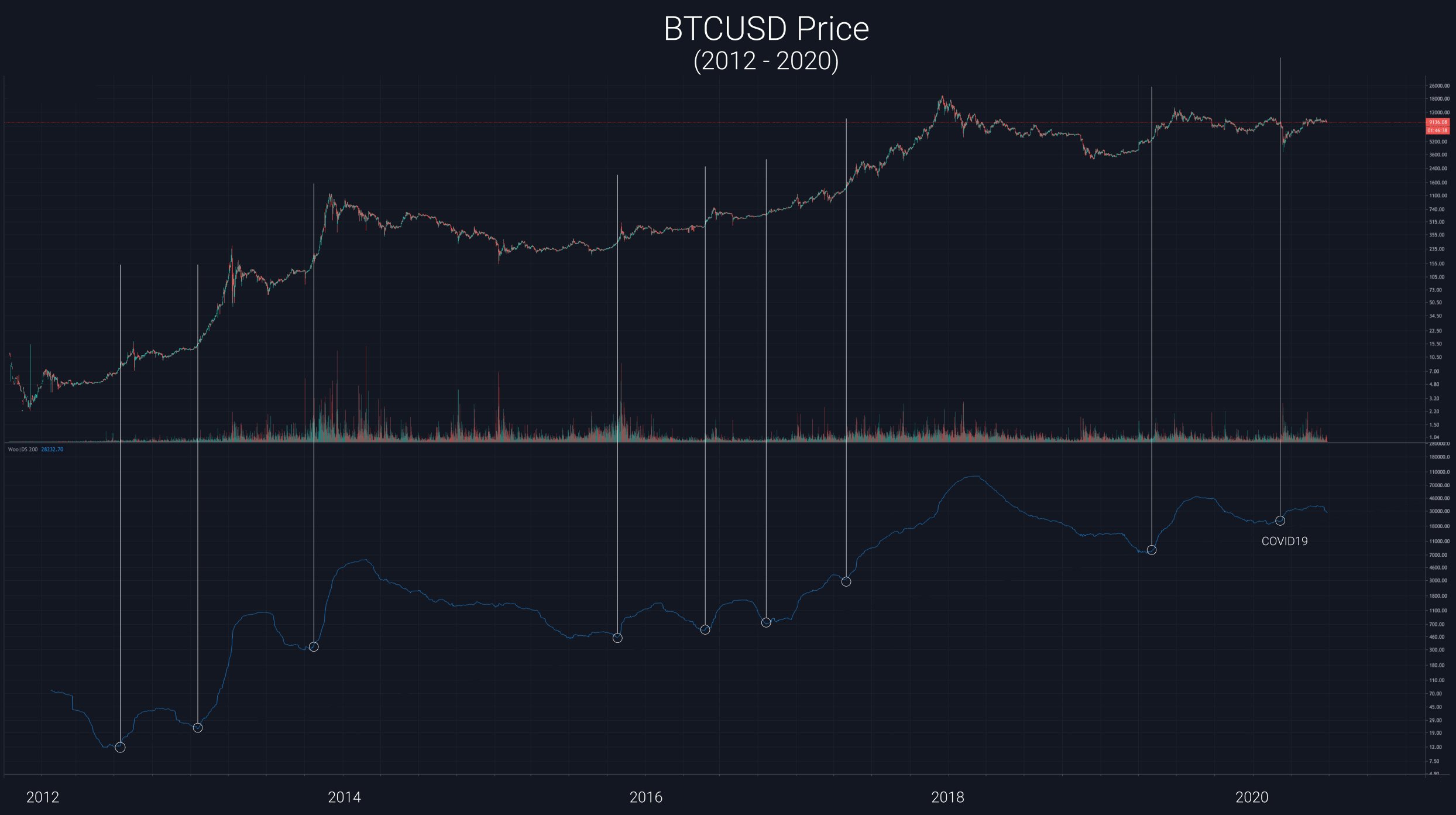

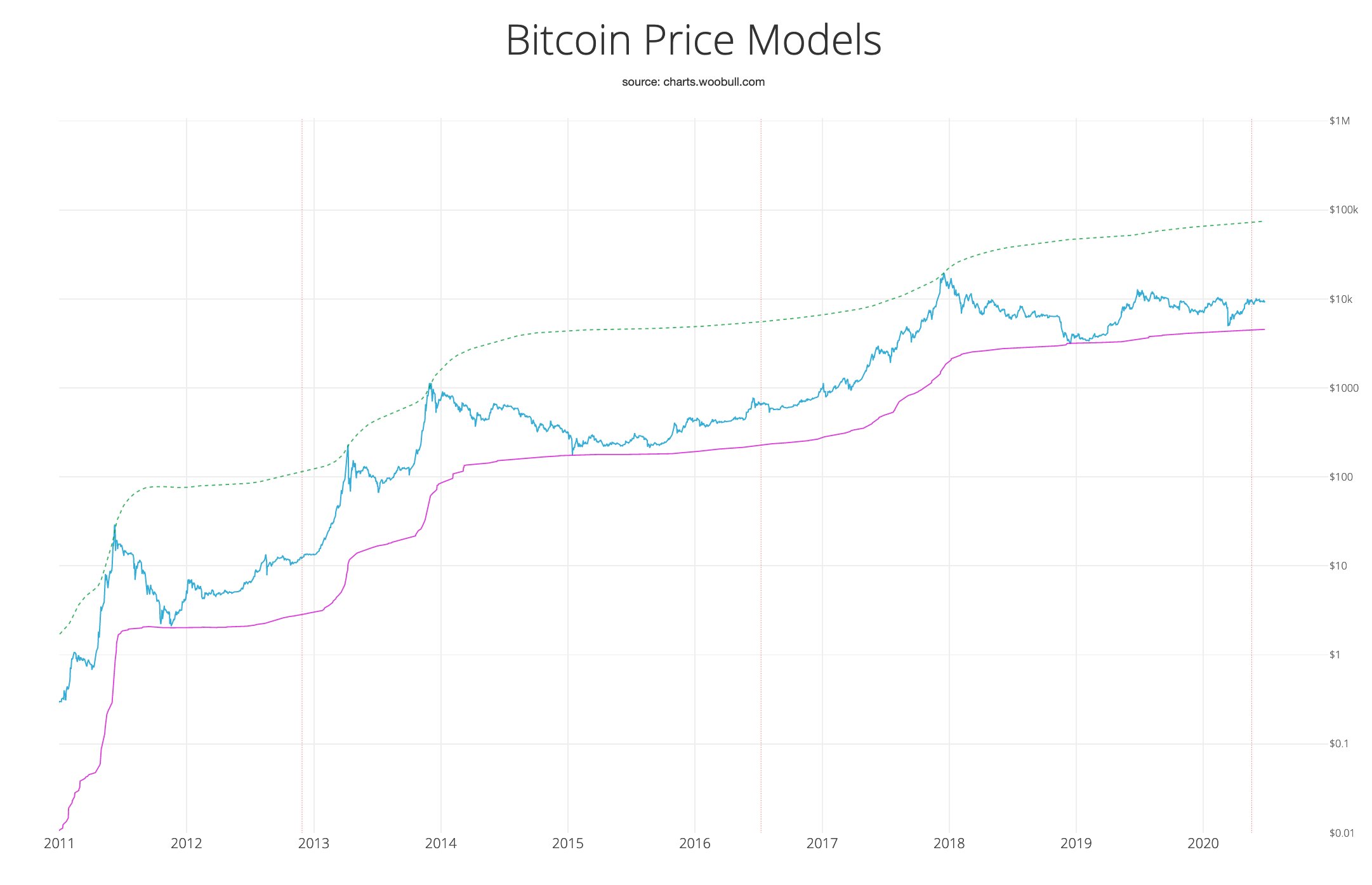

Showing another chart, Woo stated that the 2nd chart “extremely plainly demonstrates how [Covid-19] was a design breaking outlier.” And another chart Woo released suggests that “the longer this booming market requires to end up, the greater the peak cost (Top Cap design). A long sideways build-up band is eventually a advantage,” Woo even more worried.

Essentially what the Hypersheet cofounder informed his 132,000 Twitter fans is that his new design reveals that BTC is “possibly” about a month far from lift-off. If it wasn’t for Covid-19, then Woo thinks the booming market would have currently begun.

Of course, not everybody concurred with Woo’s prediction and the proof coming from his new design. “Technical analysis doesn’t deal with BTC,” Adam Bornstein responded to Woo. “There are a lot of exchanges with too thin volume, a lot of [arbitrage] chances, and excessive sound constructed into every relocation,” Bornstein included.

Although Woo defended his position and the analyst reacted to Bornstein’s criticism. “I’d concur with you for intra-week relocations, however this chart is 8 [years] of macro, where natural financial investment takes precedence,” Woo responded. Despite, Woo’s defense some still called the prediction “hopium.”

Other Bitcoin evangelists disagree with Woo’s prediction also, as Tone Vays informed the International Business Times (Ibtimes) there’s a possibility “bitcoin’s cost won’t go beyond $10,000 up until 2021.”

“Like I’ve been stating for months now, I have no factor to ignore my prediction early in the year that Bitcoin is going to get stuck in between $6,000 and $10,000 for most of this year,” Vays informed the news outlet. Of course, Ibtimes also discussed that Vays forecasted a dive to $2,800 prior to the benefit halving occurred, however the analyst’s anticipate never ever taken place.

What do you consider the design Willy Woo produced that states a bull run might be one month away? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.