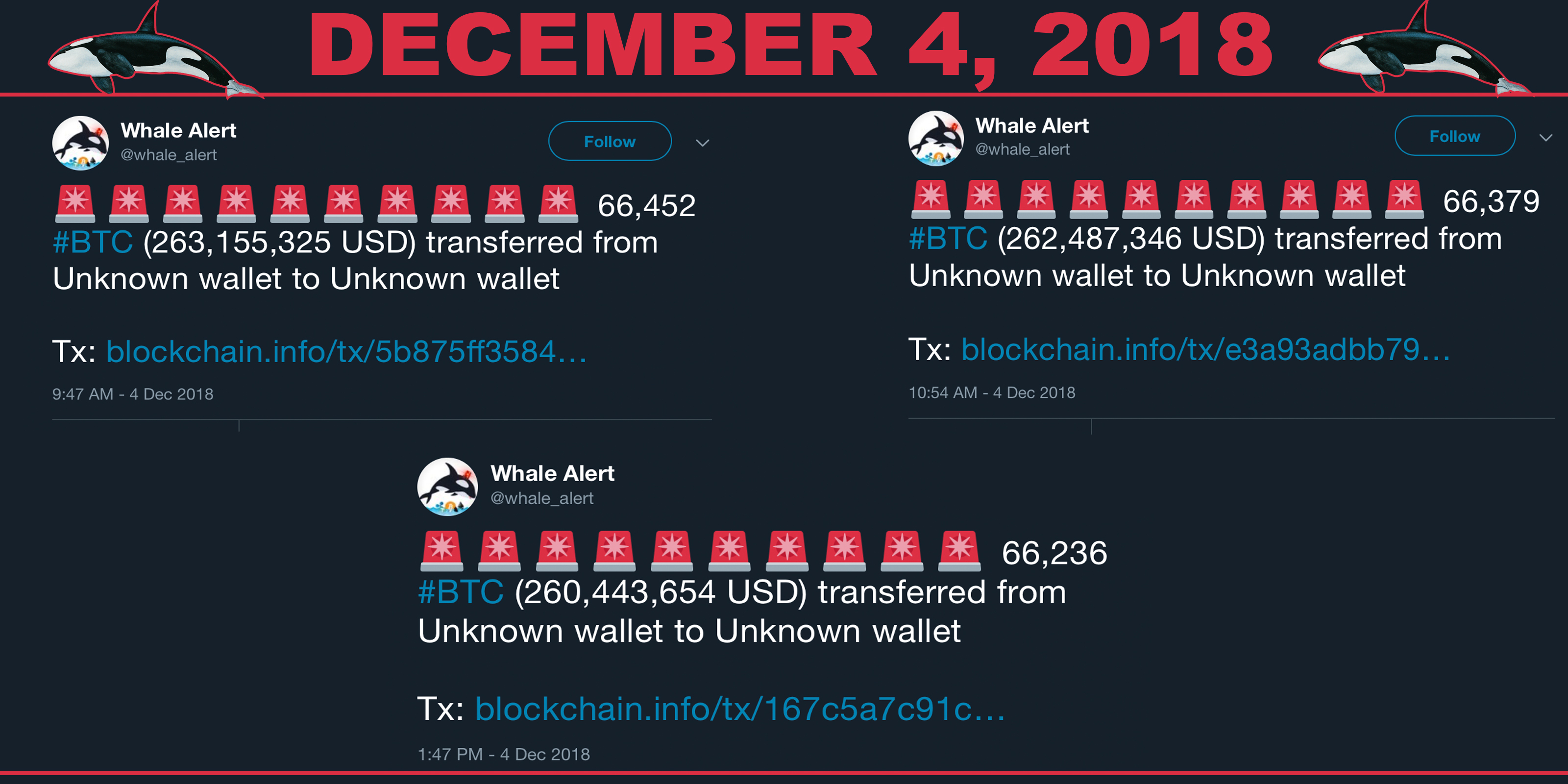

Earlier this week, armchair sleuths started declaring that giant quantities of cryptocurrency from long-dormant addresses have been on the transfer. For occasion, one pockets that’s been inactive since its inception in 2013 moved 66,452 BTC — price round $245 million — to an unknown tackle. Hours later, a number of extra addresses from the highest 20 wealthy record moved one other $728 million price of BTC.

More Than $1.5B Moved From Dormant BTC Wallets

Cryptocurrency markets have been dreadfully bearish currently and have misplaced appreciable worth. Some folks have blamed whales, as those that maintain giant portions of digital property are recognized, for dumping cash on markets to scare folks sufficient to panic promote, to allow them to then scoop up extra at cheaper charges.

Traditionally, throughout such bearish occasions, bitcoin fanatics have concocted every kind of loopy theories about these huge holders. But it doesn’t assist when huge whales truly begin transferring giant quantities of BTC from wallets which were inactive for years.

On Tuesday, based on knowledge from the Whale Alert bot and numerous blockchain explorers, greater than $1 billion price of BTC was shifted out of 4 dormant addresses to different wallets. The following day, greater than 151,000 BTC — valued at over $562 million — was moved from different long-inactive wallets to a quantity of beforehand unknown addresses.

But huge holders of cryptocurrency should not simply transferring BTC. Large sums of ETH, XRP, BCH and all of the stablecoins have also been shifting round. In one occasion on Dec. 5, a bitcoin money transaction price round $13 million was performed for lower than a penny. And the night time earlier than the BCH arduous fork on Nov. 15, an tackle moved greater than 1 million BCH ($300 million) to a different pockets.

Internet detectives later found that the proprietor of the pockets that shifted 66,452 BTC had truly moved a whopping 608,000 BTC, valued at roughly $2.5 billion. According to at least one particular person investigating the matter, the 608,000 BTC was moved by one entity in a five-day interval to roughly 76 totally different wallets. “The coins didn’t move out since 2013-2015,” explained a Twitter consumer named Spiry.

Whale Watching in Crypto Bear Markets

Whale sightings are a scorching matter this yr, as folks have observed a quantity of huge actions in current months. Back in February, most cryptocurrencies had already misplaced 60 p.c of their worth after touching all-time highs in mid-December 2017. At the time, information.Bitscoins.web reported that the highest 100 greatest BTC addresses had made much more cash as a result of bearish decline.

In truth, many of these whales had offered their holdings one to a few months previous to the massive dips in worth, solely to later collect extra cash as soon as they’d develop into cheaper. Then in May of this yr, cryptocurrency fanatics as soon as once more began speaking about Nobuaki Kobayashi, the Mt. Gox trustee who had beforehand revealed plans to promote tens of hundreds of BTC and BCH that had been held within the custody of the Japanese courtroom system.

Mysterious actions of giant sums have fueled rather a lot of hypothesis through the previous yr of steady value declines. Similar whale actions and large BTC settlements had been also seen through the bear market of 2014-15. But at the moment, as an alternative of speaking about whales just like the Mt. Gox trustee, bitcoiners had been primarily discussing the U.S. Marshals Service’s sale of hundreds of BTC that had been seized within the Silk Road bust. There are rather a lot of similarities between then and now — whales transferring cash to wallets and exchanges should not out of the odd.

What do you consider the current experiences of whales transferring giant sums of BTC and different cash? Let us know within the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.