The fight for the future of Bitcoin is raving in genuine time on twitter as we are on the cusp of international financial contraction, thanks to 50+ years of the USD fiat program, and are excitedly awaiting the approval of an area Bitcoin ETF by the SEC. Yet, in the trenches on Twitter, the skirmish being combated is over what bitcoin is and how it needs to and shouldn’t be utilized. I covered this fight in some information on Orange Label, however to sum up there are 2 camps in this fight: Monetary Maximalists & Blockspace Demand Maximalist. The huge concern is should inscriptions belong of Bitcoin and how can they be stopped?

The function of this piece is not to sway you one method or another, however rather share some numbers that make the case that inscriptions will be evaluated gradually. Over the previous year, we saw a doubling of BTC cost and hashrate and throughout that time inscriptions triggered some huge modifications in blockspace need. We saw costs increase to a 4 year high as mempools were purging sensible costs1, which indicates there were a lot of high charge deals in mempools that lower charge deals were being dropped from mempools. In other words, there was no possibility for low charge deals to be consisted of in blocks. What began as an absurd novelty 12 months back has actually generated legions of brand-new bitcoiners. This is an indisputable truth when you search for the variety of obtainable nodes on the network over the previous couple years.

As bitcoin twitter has actually started to divide on the subject, a meme has actually emerged recommending that inscriptions will be evaluated as NGU innovation does its thing. This causes the next sensible concern… at what point do inscriptions get evaluated? That’s for the marketplace to choose. For now, we can merely run the numbers and see the number of dollars an engraving will cost as Bitcoin cost values.

The Calculator

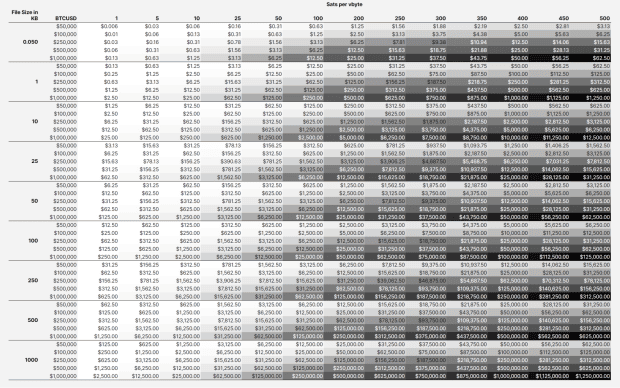

I am a huge fan of table calculators23 and utilize them frequently when developing a story. For this piece I wished to comprehend just how much it would cost to engrave a 100kb picture at different costs. That then became asking just how much these BRC20 shitcoiners are investing, and when will that rubbish end. These are around 50bytes or 0.05 kb in size for recommendation. I had the ability to locate4 a streamlined formula for making an engraving:

Ordinal Inscription Cost Calculator Formula

Total USD Cost = ((((Inscription size in kb * 1000) / 4 * Fee Rate)) / 100,000,000 ) * Current BTCUSD Price

The essential variables for this computation is the file size in kilobytes, the charge rate in sats/vbyte, and the present BTCUSD cost. With this little bit of details I had the ability to make a basic fixed table to see how various sized inscriptions will increase in USD expense as NGU for costs and BTCUSD.

This chart exposes much details and the huge takeaway for me is simply how pricey it will be to put information in blocks in the not too long run. Let’s take our 100kb image example. At present costs around 100 sat/vbyte and $50,000 BTCUSD that will cost $1,250 to engrave. That is a huge tablet to swallow. Now let’s analyze the shitcoin token BRC20 that’s utilized for cash laundering… It is around 0.05kb in size. ‘At current fees around 100 sat/vbyte and $50,000 BTCUSD that will cost $0.63 to inscribe. That is a small amount, but these things are being inscribed by the truckload. We are talking collections with 1m units. So not a small amount and there is not a single BRC20, there are tons popping up. The question about the liquidity for these things is for a different post.

As you move down the chart to higher BTCUSD prices for each inscription size, you can see just how ridiculous things become. Our humble 100kb jpg will cost $62,500 to inscribe when BTCUSD hits $1m and 200 sat/vbyte. Similarly the same BRC20 would increase to $25 for a single token. These kind of prices start to price out the really dumb like monkey pictures and memecoin shitcoins.

As you can see, these inscriptions production cost increases linearly with BTCUSD increases. This alone will price out large portions of the market, however you must ask yourself as the overall market size increases, that will bring new entrants who will drive additional demand, in other words the pond will get bigger and the fish will get bigger, the small fish just won’t get to consume.

What to anticipate?

Thinking through what takes place next is difficult, as there are numerous possible results however the one I am returning to is the meme that I discussed at the start of this post, inscriptions will be evaluated. Just run the numbers, they don’t lie. I don’t believe we are anywhere near inscriptions passing away in the short-term, however there will come a time where it is simply too pricey for dumb things to exist on chain. Low time choice activities will dominate.

I see the total engraving community continuing to progress which indicates individuals’s minds and viewpoints will continue to alter too. We are seeing thoughtful commentary from devs5 caution6 of how altering the procedure to address or remove inscriptions use will just press individuals to “exploit” other parts of the procedure for it’s valuable blockspace. We are seeing unique brand-new methods to crowd fund inscriptions and reward the seeding of information by means of bitcoin + gushes such as Demand, Durabit, and Precursive Inscriptions. Inscriptions are a thing, blockspace is valuable, and individuals want to spend for it. Bitcoin is for opponents, and it is going to get strange(er). Cope and fume however keep in mind to have a good time.

- Reasonable is subjective, markets clear. I think I saw deals with costs as high as 20 sat/vbyte being purged, which in current memory feels unreasonable. ↩︎

- Demystifying Hashprice ↩︎

- Satsflow Scenarios ↩︎

- Someone made this and it is quite convenient. I utilized this formula to construct out my table in google sheets. https://instacalc.com/56229 ↩︎

- “Concept NACK.

I do not believe this to be in the interest of users of our software. The point of participating in transaction relay and having a mempool is being able to make a prediction about what the next blocks will look like. Intentionally excluding transactions for which a very clear (however stupid) economic demand exists breaks that ability, without even removing the need to validate them when they get mined.

Of course, anyone is free to run, or provide, software that relays/keeps/mines whatever they want, but if your goal isn’t to have a realistic mempool, you can just as well run in -blocksonly mode. This has significantly greater resource savings, if that is the goal.

To the extent that this is an attempt to not just not see certain transactions, but also to discourage their use, this will at best cause those transactions to be routed around nodes implementing this, or at worst result in a practice of transactions submitted directly to miners, which has serious risks for the centralization of mining. While non-standardness has historically been used to discourage burdensome practices, I believe this is (a) far less relevant these days where full blocks are the norm so it won’t reduce node operation costs anyway and (b) powerless to stop transactions for which an existing market already exists – one which pays dozens of BTC in fee per day.

I believe the demand for blockspace many of these transactions pose is grossly misguided, but choosing to not see them is burying your head in the sand.” – Peter Wuille Link ↩︎ - “Ever since the infamous Taproot Wizard 4mb block bitcoiners have been alight, fighting to try and stop inscriptions. Inscriptions are definitely not good for bitcoin, but how bitcoiners are trying to stop them will be far worse than any damage inscriptions could have ever caused.” – Ben Carman Link ↩︎

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.