The Bitcoin Halving: Gold is on Borrowed Time

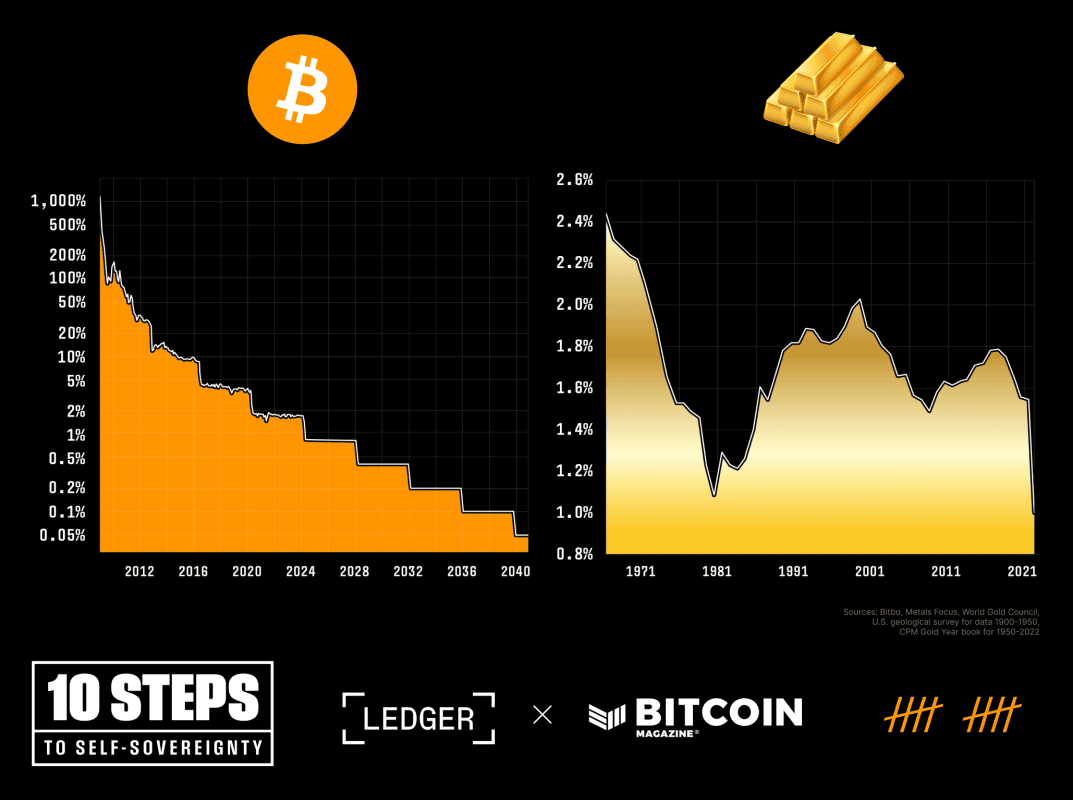

For the very first time given that its beginning, Bitcoin’s yearly inflation rate is poised to become less than that of gold, the essential shop of worth. At Bitcoin block height 840,000, the yearly supply of Bitcoin will be halved, leading to a decline in its yearly inflation rate from 1.7% to 0.85%. In contrast, the supply of gold is approximated to boost by 1-2% each year, depending upon technological modifications and financial conditions.

To date, Bitcoin has actually experienced 3 cutting in half occasions:

November 28, 2012: Bitcoin’s block aid reduced from 50 BTC per block to 25 BTC per block.

July 9, 2016: The 2nd Bitcoin cutting in half reduced the block aid from 25 BTC per block to 12.5 BTC per block.

May 20, 2020: The 3rd Bitcoin cutting in half lowered the block aid from 12.5 BTC per block to 6.25 BTC per block.

The upcoming 4th Bitcoin halving is forecasted to happen on April 20, 2024 EDT, and with it, the recently provided bitcoin per block will reduce from 6.25 to 3.125 BTC. This date — a duration of 210,000 blocks or around 4 years – will see Bitcoin’s supply boost by 164,250 BTC (from 19,687,500 to 20,671,875), a simple 328,124 bitcoin from the optimum supply limitation of 21 million.

~94% of the overall #bitcoin supply has actually now been provided and the halving remains in 11 days 👀

Digital deficiency at its finest 🚀 pic.twitter.com/fjbLs1tq7r

— Bitcoin Magazine (@BitcoinMagazine) April 8, 2024

Gold Throughout the Ages

One benchmark typically utilized to highlight the store-of-worth function is that the value of an ounce of gold matches the cost of a “fine man’s suit” with time. This concept, called the “gold-to-decent-suit ratio,” can be traced back to Ancient Rome, where the expense of a state-of-the-art toga was stated to be comparable to an ounce of gold. After 2,000 years, the quantity of gold you would spend for a premium match is still close to the cost of a comparable Ancient Roman toga.

While gold has actually held extremely real to the expectation of acquiring a great male’s match for its holders throughout the years, the shiny yellow metal does include its difficulties.

For example, the expense of confirmation – or assaying – gold needs it to either be liquified in a service or melted down. This is definitely an obstacle for somebody who desires to purchase daily family products with their hard-fought shop of worth.

Additionally, the expense and difficult nature of transferring and saving gold itself perhaps led to the death of the gold requirement. While certificates of deposit were traditionally redeemable for gold, the underlying product was typically rehypothecated, leading to the notorious ”Nixon Shock” in 1971, when the United States left the gold requirement for great.

This is not to point out the threats that originate from protecting physical gold, its physical nature once again showing a danger and liability in serving its function as currency. Executive Order 6102 comes to mind, when then-President Franklin Delano Roosevelt forbidden “the hoarding of gold coin”, highlighting the distinct difficulty of sufficiently and independently protecting rare-earth elements to shop worth.

Bitcoin’s Transition from Speculation to Safe Haven?

Initially considered a speculative possession due to its noteworthy cost changes in the early days, bitcoin has actually progressively been embraced as a shop of worth. Today, financiers acknowledge its prospective worth, and exceptional qualities as a financial possession. Bitcoin represents the discovery of digital deficiency while providing a variety of usage cases far beyond those of rare-earth elements.

As such Bitcoin has actually become a substantial force in the economy in simply 15 years – reaching a market cap of $1.4 trillion on March 13, 2024.

While this development cannot be monocausally ascribed to the reality that Bitcoin pleases the requirements of a shop of worth much better than gold, it is definitely appealing. This “magic internet money” continues to quickly acquire on gold’s approximated $15.9 trillion market capitalization.

Gold’s Monetary Qualities: Perfected Digitally

Scarcity: Bitcoin has a limited supply of 21 million coins, that makes it resistant to the approximate inflation that ails standard currencies, and the market-driven supply of rare-earth elements.

Durability: Bitcoin is a simply data-based, immutable type of cash. Its digital journal system utilizes evidence of work and financial rewards to withstand any efforts to change it, guaranteeing it stays a reputable shop of worth with time disallowing unexpected disastrous tail threats. Given its educational nature, the capability to shop Bitcoin regardless of the efforts of foes to avoid you from doing so is another favorable financial characteristic.

Immutability: Once a deal is validated and taped on the Bitcoin blockchain, it is exceptionally challenging, though possible, to change or reverse. This immutability, originated from the geographical circulation of Bitcoin’s network of nodes and miners, is a crucial function. It guarantees that the stability of the journal is kept, and deals cannot be damaged or falsified. This is specifically essential in a progressively digital world, where trust and security are vital issues.

Conclusion

Bitcoin’s increase as a financial great – foreseeable, without terminal inflation, and quickly transferable – has actually contributed to it getting approval as a shop of worth amongst holders. With the upcoming halving, its deficiency will go beyond gold’s for the very first time and will likely function as a wake-up call for market individuals looking for to prevent the drag of financial debasement.

While there are no certainties in life, and specifically none in investing, the near-certainty that Bitcoin supplies in its capability to preserve the stability of its 21 million supply cap through its decentralized nature continues to drive adoption one block at a time.

Gold had a great run. But, with the cutting in half on the horizon, it’s Bitcoin’s time to shine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.