The newest study by the World Bank shows that it costs 4.98% typically to remit funds to South Asia that makes it the least costly area while sub-Sahara Africa is the most costly with a typical expense of 8.47%. The quarterly study also discovers that it is more expensive to remit funds when utilizing provider such as banks that charge approximately 10.89%.

Marginal decrease

Mobile operators are the least expensive as their sending out costs balanced 3% and below throughout the duration under evaluation. Still, the study, which naturally leaves out cryptocurrencies, shows a minimal reduction in the Global Weighted Average (GWA) from 5.03% in Q2 to 5.0% in Q3 of 2020.

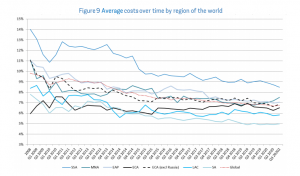

The World Bank’s appropriately called Remittance Prices Worldwide (RPW) report keeps track of remittance costs throughout all areas. Data from the report shows that the Global Average remitting expense dropped from 9.67% seen Q1 of 2009 to the most recent 6.75%. This represents a 2.92% decrease throughout this duration.

Meanwhile, the worldwide banks states that in addition to tracking the Global Average, “another typical overall expense is presented to track the typical cost of digital remittances in RPW database.” In following this expense metric, the study discovers that:

In Q3 2020, the worldwide average for digital remittances was taped at 5.29 percent while the worldwide average for none- digital remittances was 7.24%.” Furthermore, the report information shows remitting costs slowly reducing throughout all sending out passages considering that 2008.

Meanwhile, regardless of their lack in the World Bank’s RPW, cryptocurrencies appear to be more affordable and faster-remitting approaches.

Cryptocurrencies a more affordable alternative

To show, on the Bitcoin Network, negotiating costs for coins like bitcoin money and dash stay unimportant when compared to the expense of sending out funds through Money Transfer Organisation (MTO). For circumstances, throughout Q3 of 2020, the typical charge when sending out or paying $100 with bitcoin money was less than one cent. The exact same held true for Dash along with for Ripple’s XRP token. Yet, on the other hand, it might cost 10% or more to send out funds in between 2 Southern African nations.

Remitting funds through bitcoin and ethereum is also quicker and in some cases more affordable than standard remitting passages. As the information from Bitinfocharts shows, at the start of Q3 2020 on July 1, deal charges on the Bitcoin and Ethereum networks balanced $1.51 and $0.70 respectively. Since then, charges on the 2 networks have actually changed extremely however still went on to typical $5 or below for much of Q3. An typical charge of $5 per deal equates to 5% if the quantity being sent out is $100.

Achieving UN SDG 10.c with cryptocurrencies

With negotiating costs that are a small portion of a percent, cryptocurrencies like bitcoin money and XRP, which the World Bank and others decline to identify, appear to have actually attained among the UN’s Sustainable Development Goals (SDGs) currently.

Under the world body’s SDGs 10.c, the UN and others are devoting to lowering to “less than 3 percent the deal costs of migrant remittances and to remove remittance passages with costs greater than 5 percent.”

The UN is targeting to accomplish this goal by 2030 yet more migrants are currently utilizing cryptocurrencies due to the fact that they are a more affordable and easier alternative.

Do you concur that cryptocurrencies are more affordable for remitting than standard approaches? Tell us what you believe in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.