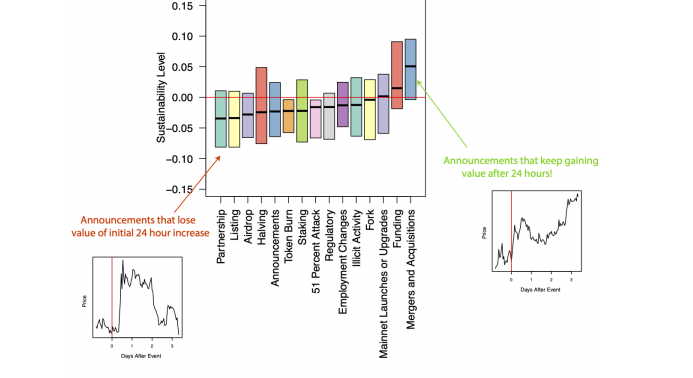

A research study by Etoro and The Tie discover listing and collaboration statements as considerable advancements (Sigdev) that have an instant, big, and positive influence on token price. This influence, which peaks within the initially 24 hr, typically wears away after a week, according to the research study report.

The Impact of a New Token Listing

Yet, on the other hand, financing, in addition to Merger and Acquisitions statements, tend to have positive impacts on the token price that extend beyond one week. The research study, which notes and ranks an overall of 15 Sigdevs, discovers token burning and 51% attacks as elements with the least positive influence on price.

The Etoro and The Tie quarterly report, which zeroes in on brand-new token listings, covers a duration controlled by brand-new listings and airdrops, especially within the decentralized financing (defi) area. Just just recently, the defi token of Andre Cronje’s brand-new job, KP3R skyrocketed by 3,600% after going from $10, its opening price on Uniswap, to over $373.00 in 24 hr.

Token Listings Are Similar to an Equities IPO

Explaining why brand-new listings appear to have a higher and instant influence on token price motion, the research study states “when a crypto-asset gets noted on an exchange it right away appears to a big set of prospective users.” Before any such listing, financiers might not have had direct exposure to that specific possession.

After drawing contrasts with an equities going public (IPO), the report, nevertheless, states that “crypto-assets might trade on numerous private exchanges, and therefore various listing occasions might have considerably various effects on price.”

The report describes the distinction in between a token listing on a liquid market and an illiquid one. It states:

However, when a more recent possession that was formerly noted on more illiquid markets gets put on a big trading place, like eToro, Coinbase, or Binance, the prospective price impact is the biggest. This is due to the fact that markets formerly didn’t exist for that coin on any of the bigger exchanges.

The report utilizes the example of the aragon (ANT), which noted on a variety of big cryptocurrency exchanges, consisting of Okex, Binance, and Huobi in between August 12th and 13th respectively. Within 2 hours of listing on Okex, the token went “from $4.34 to $5.38 in simply under 2 hours, a gain of 24%.”

However, the listing of ANT on the other 2 exchanges saw bigger gains being made. The report states:

“Less than 24 hr later on, the token was noted on Huobi and Binance simultaneously, and the price of Aragon skyrocketed to a high of $11.45, a 164% gain in under 24 hr.”

At the time of composing, ANT was trading at $3.12.

Mergers and Acquisitions Generate Better Returns

In the meantime, the research study information reveals that mergers and acquisitions have “a 90% opportunity of a positive return after a week, balancing 8.23% in returns.” Explaining this development extraordinary development, the Etoro and The Tie group states “this outsized return is most likely due to the truth that the majority of token-related M&A news is securely held tricks.”

Other Sigdevs balancing greater returns after a week consist of financing with 4.21%, illegal activity (5.59%), and mainnet launches (3.08%).

Do you concur with the findings in the token research study? Share your views in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.