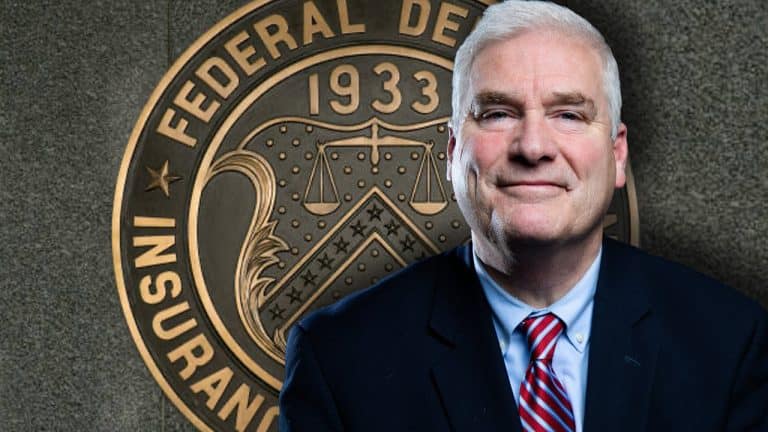

On Wednesday, Tom Emmer, the U.S. Republican congressman from Minnesota, exposed he sent out a letter to Martin Gruenberg, the chairman of the Federal Deposit Insurance Corporation (FDIC), relating to reports that the FDIC is “weaponizing recent instability” in the U.S. banking market to “purge legal crypto activity” from the United States. Specifically, Emmer asked Gruenberg if the FDIC advised banks not to offer banking services to cryptocurrency companies.

GOP Majority Whip Emmer Questions FDIC’s Involvement in Purging Legal Crypto Activity

Tom Emmer, a Republican political leader from Minnesota, sent a letter to the chairman of the FDIC questioning whether the company directed banks not to offer services to digital currency services. “Recent reports indicate that federal financial regulators have effectively weaponized their authorities over the last several months to purge legal digital asset entities and opportunities from the United States,” Emmer’s letter read.

The Minnesota congressman included:

Individuals from throughout the market, consisting of previous House Financial Services Committee chairman Barney Frank highlighted the targeted nature of these regulative efforts to ‘single out’ banks and ‘send a message to get people away from crypto.’

Emmer has actually been querying other U.S. legislators and firms about their actions versus crypto services, consisting of questioning Securities and Exchange Commission (SEC) chair Gary Gensler about actions taken throughout the arrest of FTX’s disgraced co-founder, Sam Bankman-Fried. The political leader has also presented legislation that would forbid the U.S. reserve bank “from issuing a [central bank digital currency] directly to anyone.”

Emmer’s comments about previous legislator Barney Frank stem from the Signature Bank board member’s commentary about being shocked by Signature’s collapse. Frank stated he thought there was an “anti-crypto message” behind the bank’s death. The New York State Department of Financial Services disagrees and described that positioning Signature into receivership of the FDIC had “nothing to do with crypto.”

Despite the regulator’s rejection of such allegations, Emmer’s letter to the FDIC’s Gruenberg implicitly asks the chairman whether the FDIC particularly directed banks not to offer banking services to cryptocurrency companies.

”Have you interacted — clearly or implicitly — to any banks that their guidance will be more burdensome in any method if they take on brand-new (or keep existing) digital property customers,” the political leader asked. Emmer is firmly insisting that Gruenberg offer the details as quickly as possible and no behind 5:00 p.m. on March 24, 2023.

What are your ideas on the policy of cryptocurrency in the United States and the prospective effect it could have on the future of the market? Do you think that regulators are unjustly targeting crypto services? Share your viewpoints in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.