A brand new report from Greenwich Associates, a supplier of market intelligence and advisory services to the financial services trade, tries to reply the query: “Why have the tech and financial industries lagged their own blockchain expectations?” It identifies technical challenges as inflicting firms to fail to ship on the hype they created round a buzzword for database simply to trip the coattails of Bitcoin’s recognition.

Also Read: The Daily: Robinhood Reaches 25th State, Fake Adobe Crypto Malware

Harder Than Expected

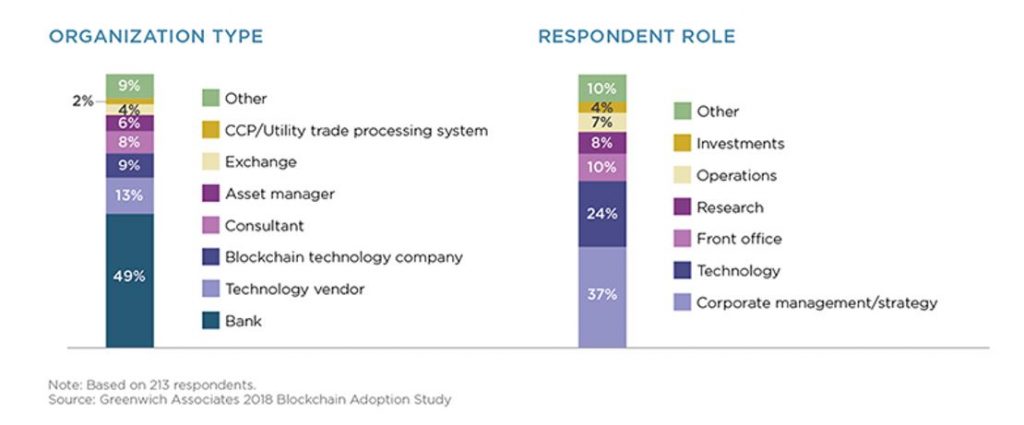

Greenwich Associates interviewed 213 international market contributors mentioned to be working on blockchain expertise. Respondents included representatives from an array of firms, like expertise distributors, exchanges, and consultancy corporations, however nearly half (49%) work within the banking sector. And 93% of them are mentioned to be both key decision-makers or actively concerned in blockchain initiatives.

The researchers notice it’s honest to say that “the industry has lagged behind its own optimistic expectations from two years ago. Implementing enterprise technology designed to replace decades of legacy market infrastructure is no simple task, and 57% of blockchain executives told us it has been harder than expected.”

Transparency Not Desirable

Forty-two p.c of respondents cite scalability as a prime concern for corporations implementing distributed ledger expertise (DLT) options. Trying to shine a optimistic gentle on the findings, Richard Johnson, Vice President of Greenwich Associates Market Structure and Technology and creator of Building Blockchains, added that: “It’s important to note that a few firms have achieved much faster transaction speeds with DLT solutions—showing that competitive speeds are possible.”

Forty-two p.c of respondents cite scalability as a prime concern for corporations implementing distributed ledger expertise (DLT) options. Trying to shine a optimistic gentle on the findings, Richard Johnson, Vice President of Greenwich Associates Market Structure and Technology and creator of Building Blockchains, added that: “It’s important to note that a few firms have achieved much faster transaction speeds with DLT solutions—showing that competitive speeds are possible.”

Additional challenges embody {hardware} safety, transaction confidentiality, the funds leg, and the drive for so-called ‘editable blockchains’.

The survey also discovered that the transparency probably supplied by a blockchain is a not a very fascinating function for corporations. Almost two-thirds of respondents answered that incorporating zero-knowledge proofs (ZKP), or related expertise, are an vital a part of an enterprise answer. “ZKPs are a recent innovation,” commented Richard Johnson. “They require an additional layer of cryptography in the consensus protocol that allows one party to prove to another that something is true without revealing any other information.”

Interestingly, the report also mentions that 14% of corporations mentioned that they had been working with central banks for a answer to digital currency.

Are so known as non-public blockchain options actually one thing that banks want? Share your ideas within the comments part below.

Verify and monitor bitcoin money transactions on our BCH Block Explorer, the perfect of its variety anyplace on the earth. Also, sustain together with your holdings, BCH and different cash, on our market charts at Satoshi’s Pulse, one other authentic and free service from Bitscoins.web.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.