More than half the year lags us and the cryptocurrency environment continues to move on, revealing unrelenting growth over the last 6 months. 2019 has also seen a brand-new style develop as speculators think the cryptocurrency environment is experiencing an increase of institutional interest and regulative crackdowns. A range of cryptocurrency research reports evaluating the very first 2 quarters of the year show the area has actually seen a great deal of growth, regardless of regulative headwinds.

Also Read: Banks Stopped Walmart Bank – Now the Retail Giant Hits Back With Crypto

The Cryptoconomy 2019: Institutionalization, Facebook and Exchange Tokens

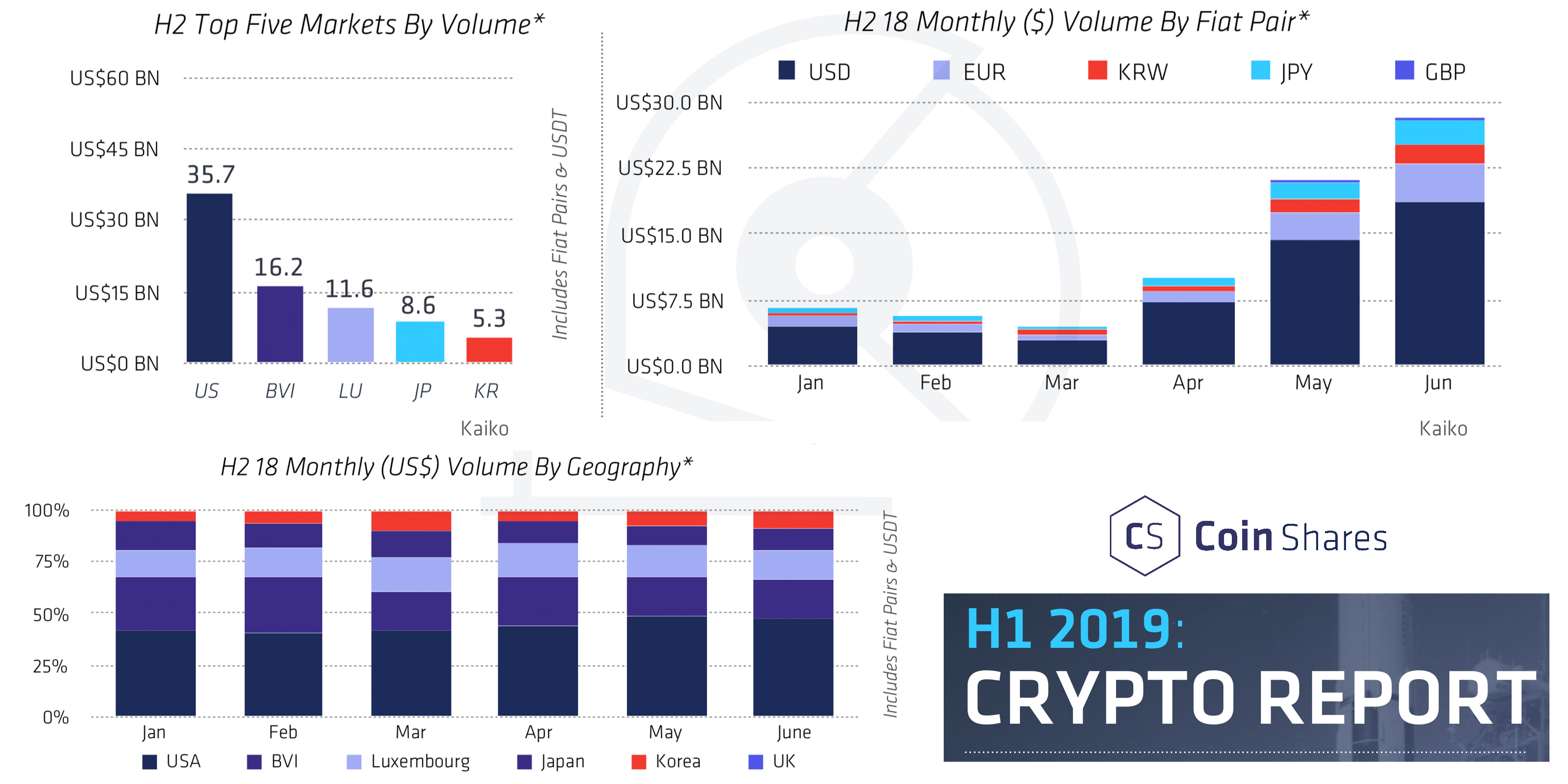

Coinshares and cryptocurrency corporation Circle have actually just recently released really comprehensive research reports worrying the digital property area over the last 6 months. Over the last couple of weeks, the marketplace capitalization of all cryptocurrencies has actually varied in between $250-300 billion. The U.K.-based company Coinshares’ H1 report states that the last 6 months ought to be thought about a net positive for the young industry. “The continuing professionalisation of the procedure services and matching innovations has actually been remarkable and most properties have actually responded by recuperating significantly from in 2015’s ruthless bearishness,” discusses Coinshares’ H1 research study. It keeps in mind that there’s been “no scarcity of speculation” when it concerns individuals thinking what’s driving the rally.

The research also reveals that retail interest in BTC is “fairly warm compared to 2017.” This makes Coinshares’ think the H1 healing was “mostly driven by the long-awaited entryway of institutional cash.” The company states that the business’s sales department has “anecdotal proof” that supports the institutionalization theory. Coinshares points out monetary incumbents like Fidelity and the Intercontinental Exchange (Bakkt) as institutional examples. Moreover, in regards to legitimizing the industry, the business’s report also highlights Facebook’s Libra coin effort. The report’s authors believe that despite the fact that the digital currency might be centralized, it might be advantageous.

“While Libra is centralised, permissioned, trust-based, not censorship-resistant, not limited, and perhaps not even a cryptocurrency at all (though this term is badly specified),” Coinshares’ H1 report notes. “It does use possible advantages to the world’s unbanked that presently put on’t have access to services we consider given in the West, such as online shopping.”

congrats to @Bakkt on the beta launch of their physically settled bitcoin futures agreement!

the marketplace for bitcoin is altering, and rapidly. futures, derivatives, and synthetics will basically alter the nature of the bitcoin market. see below what took place to gold 👇 pic.twitter.com/PI8KKadjFY

— Meltem Demirors (@Melt_Dem) July 22, 2019

Record Open Interest and Volumes in CME Bitcoin Derivatives and Defining Crypto Regulations

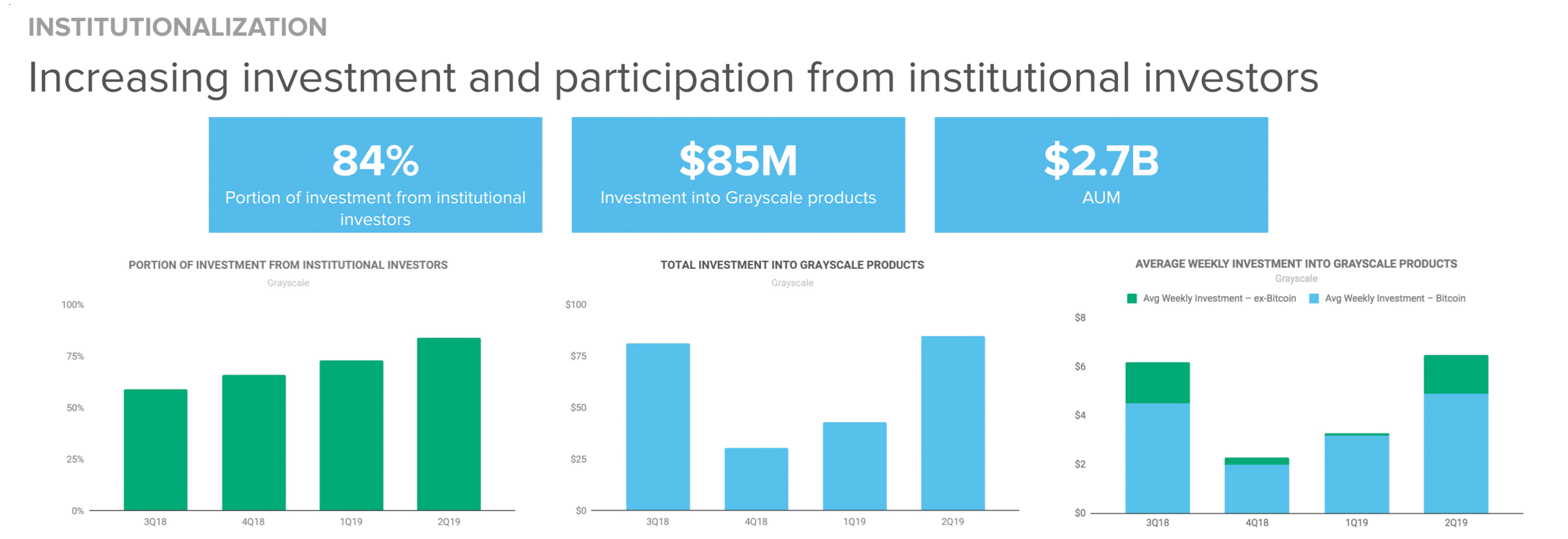

Circle’s 80-page report is much more in-depth, and also notifications the growth of institutionalization within the crypto area. The business’s research states that some noteworthy indications of institutional interest originate from information like inflows into Grayscale’s items and CME’s futures open interest and trade volumes reaching all-time highs. To Circle’s scientists covering 2019’s Q2, the statement from Facebook was a watershed minute for some individuals although others have actually been doubtful. As far as stablecoins are worried, the business stated it saw its own USDC managed stablecoin market cap increase a lot.

“Grayscale just recently supplied a second-quarter upgrade, showcasing ongoing strength given that market lows at the end of 2018,” Circle’s report notes when looking into the identifying indications of institutionalization. “Assets under management were up 125% quarter over quarter (q/q), driven by a boost in underlying costs, to name a few elements. The part of inflows from institutional financiers has actually been experiencing action function growth, increasing from 59% in 3Q18 to 84% in 2Q19 — Grayscale notes this figure was controlled by hedge funds.”

“Grayscale just recently supplied a second-quarter upgrade, showcasing ongoing strength given that market lows at the end of 2018,” Circle’s report notes when looking into the identifying indications of institutionalization. “Assets under management were up 125% quarter over quarter (q/q), driven by a boost in underlying costs, to name a few elements. The part of inflows from institutional financiers has actually been experiencing action function growth, increasing from 59% in 3Q18 to 84% in 2Q19 — Grayscale notes this figure was controlled by hedge funds.”

As far as CME Bitcoin futures interest, Circle keeps in mind that Gareth MacLeod, partner at Gryphon Labs, recommended that the current rise in CME’s crypto futures volumes is likely due to “conventional financing taking a higher interest in bitcoin.” Circle’s research also declares that specifying regulative advancements might be reinforcing institutionalization within the cryptoconomy.

The report reveals recognized regulative modifications like the SEC’s structure for financial investment agreements (April 3), China’s proposed restriction on crypto mining (April 9), Ohio agent Warren Davidson reestablishing the “Token Taxonomy Act” (April 9), NY’s Attorney General revealed examining Ifinex (April 26), FinCEN releasing assistance on BSAs and digital currencies (May 9), the SEC holding off Vaneck/Solidx ETF (May 20), Internal Revenue Service revealing brand-new tax standards for cryptos (May 16), and the Egyptian reserve bank proposing digital currency regulative action (May 29). Other guideline subjects consist of the SEC’s action versus the Kik preliminary coin offering (ICO), India’s current crypto conversations, the G7 taskforce, and the current A+ token offerings given approval by the SEC in mid-July.

Crypto Funding Gathers New Tailwinds, Noncustodial Trade Volumes Increase, and Lightning and Maker Network Usage Declines

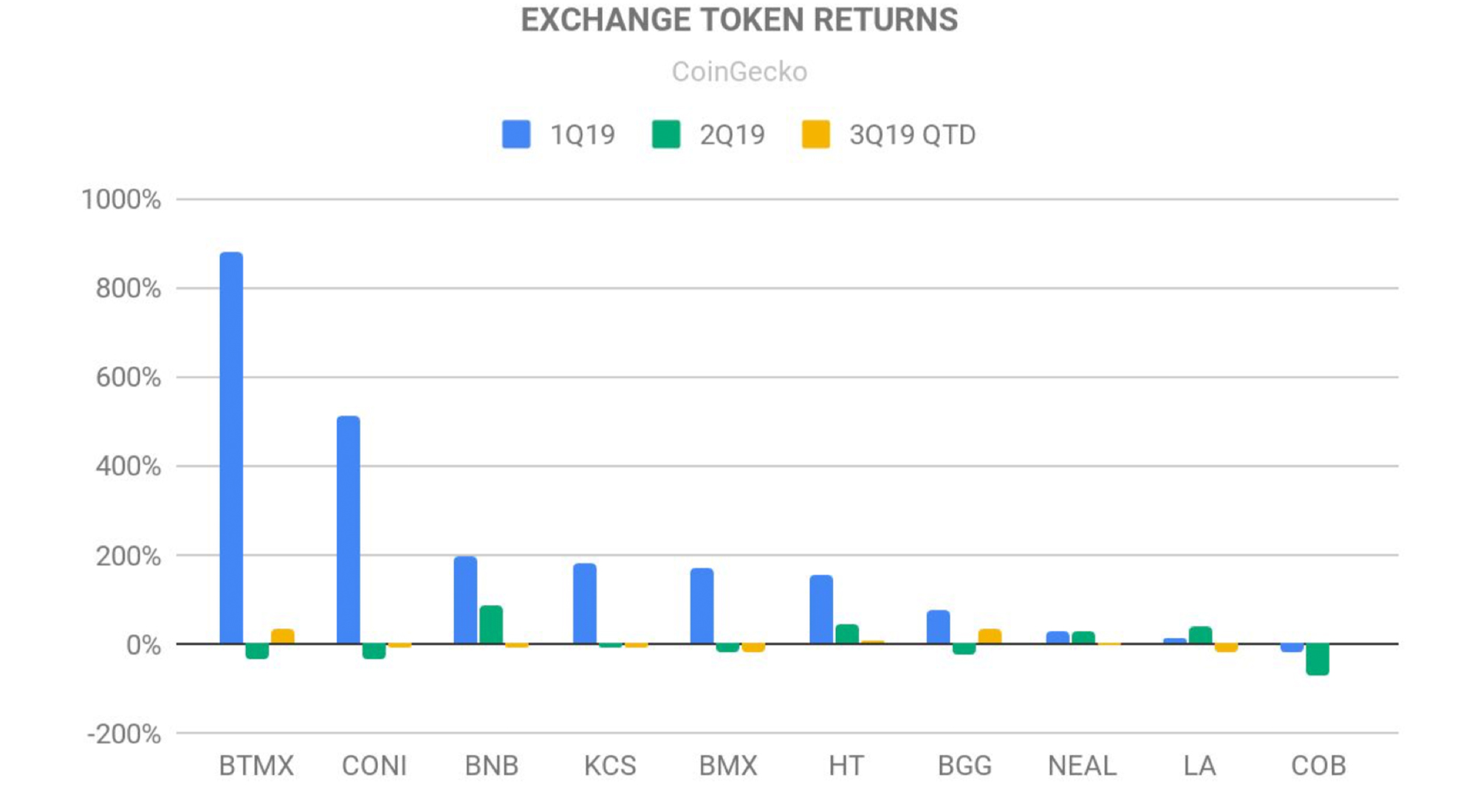

After the fluctuate of ICOs, the brand-new pattern Circle sees is the “increase of exchange tokens.” Exchange tokens are offered likewise to ICOs however are specifically utilized on the trading platform for different advantages like affordable trading charges, benefits, governance systems, and token burns. The scientist highlights 2019’s popular exchange tokens consisting of Binance (BNB), Huobi (HT), Coinflex (FLEX), and the LEO token released by Bitfinex. Even though these tokens are a little various to the previous ICO design, Circle scientists state that the providers might deal with regulative difficulties. “A significant difficulty that exchange tokens deal with is around how they ought to be categorized by regulators — as energy tokens or security tokens,” the authors of Circle’s Q2 research study remark.

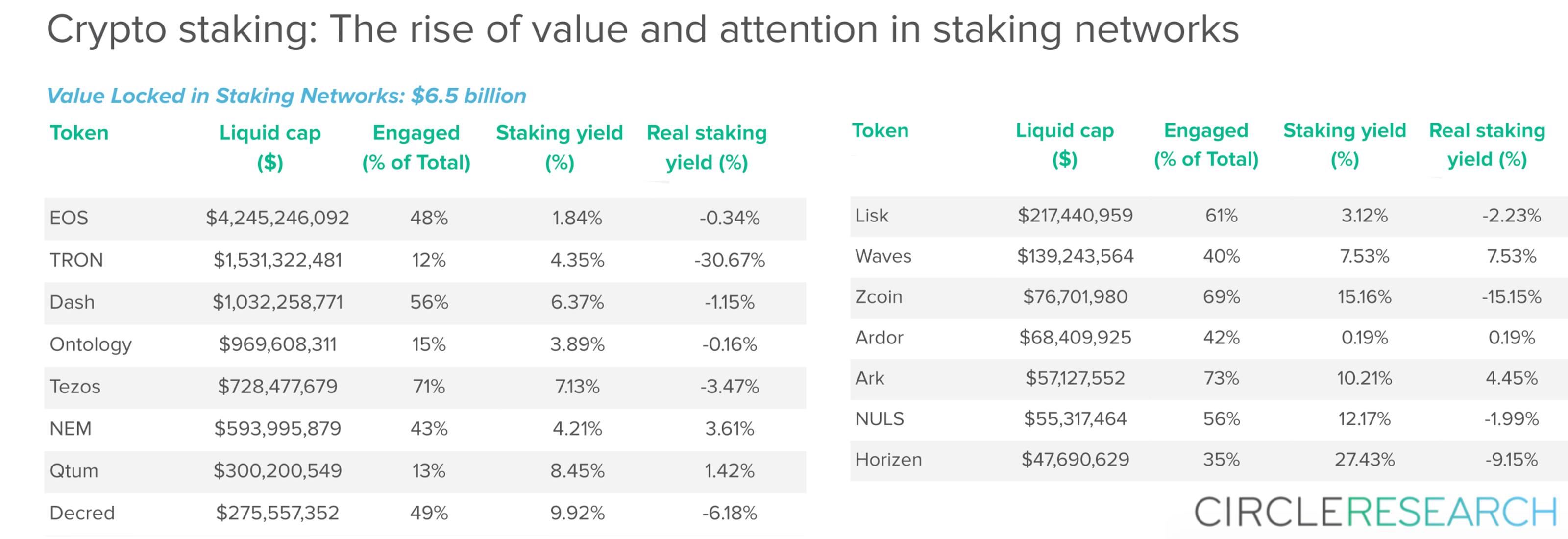

2019 saw a lot of seed financing rounds and endeavor financial investments into crypto-based business according to Circle’s research study. This consists of start-ups like Sparkswap ($3.5 million), Cambridge Blockchain ($3.5 million), Flexa ($14.1 million), Chainalysis ($6 million), and Celo ($25 million). The 80-page report also highlights topics like the variety of funds included in cryptocurrency staking. According to Circle’s research study, there’s $6.5 billion worth of digital properties secured in (proof-of-stake) staking networks. Circle keeps in mind that the boost of staking this year is driven partially by jobs like Cosmos and V Systems.

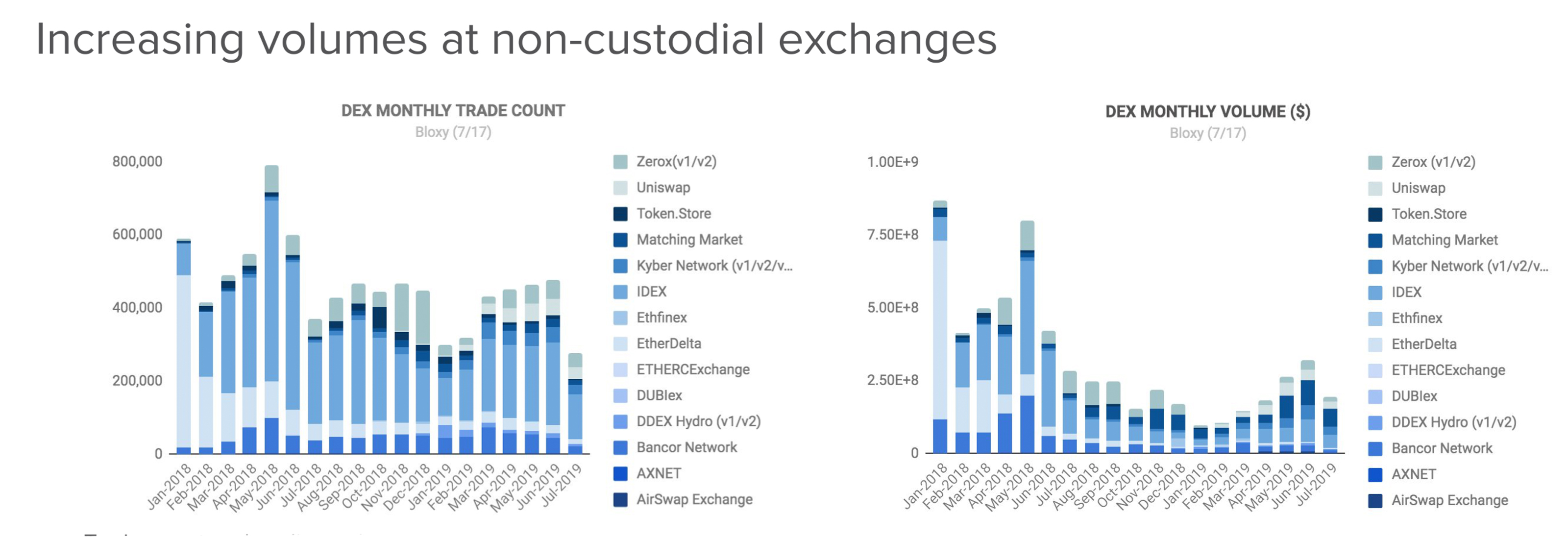

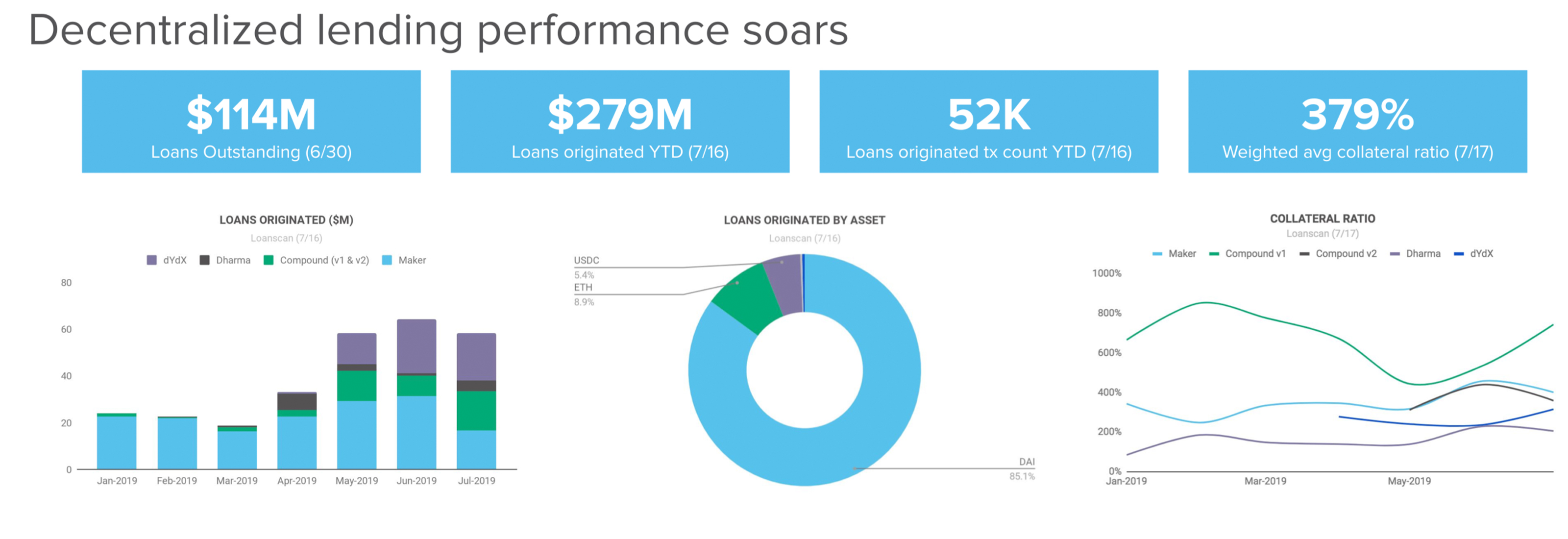

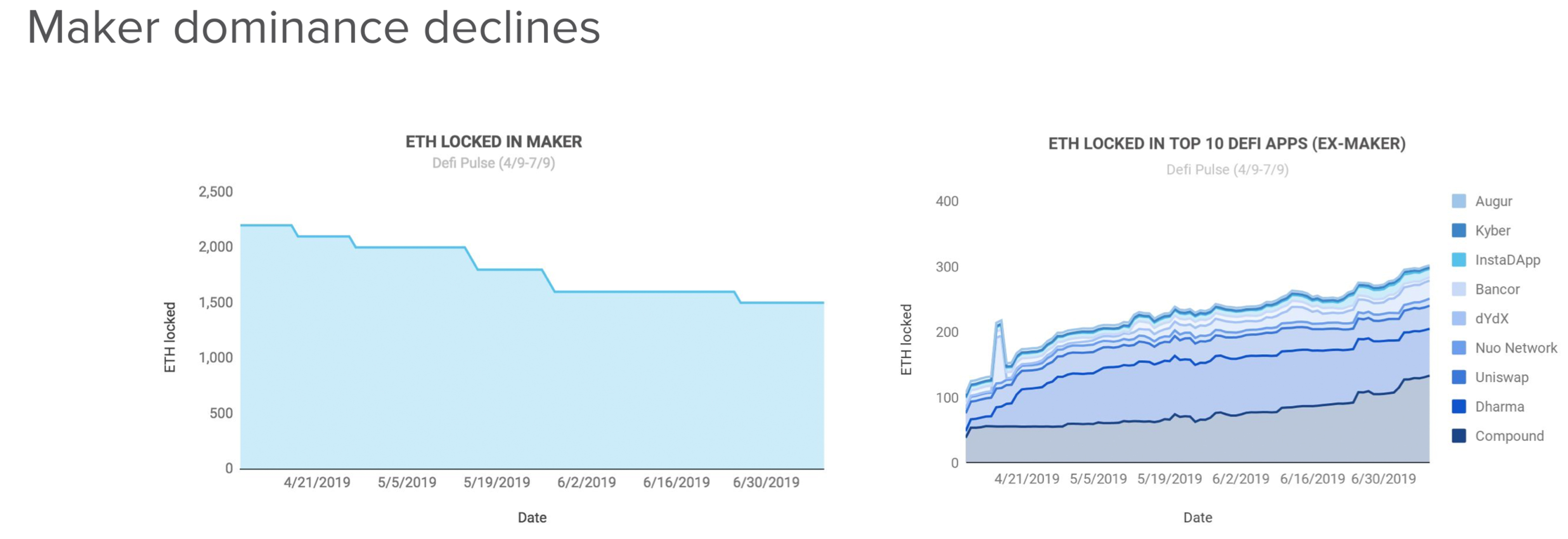

Additionally, Circle determined the activity of decentralized applications (dapps) and discovered there were +43 included monthly in 2019 on Ethereum and +16 on the EOS network. Circle’s research also reveals that there’s been increasing trade volumes on noncustodial exchanges as this metric has actually increased by 32% q/q. During the very first week of June, Bitscoins.web just recently released a peer-to-peer, noncustodial BCH market called Local.Bitscoins.web, including another alternative to the multitude of available noncustodial platforms presented in 2019. Additionally, the report discusses that there’s been an activity decrease on both the Lightning Network on BTC and the decreasing supremacy of ETH locked into the Maker agreement.

Overall, both reports show there’s been a great deal of cryptocurrency activities and positive outlooks throughout H1 and a great rating of stable growth increases quarter over quarter. Coinshare’s report highlights that “absolutely nothing is specific in this area and things typically seem like they move at a breakneck speed.” However, the business anticipates seeing what the next half of the year brings. Circle’s research also reveals a net positive for 2019’s Q2 and it will be intriguing to see if the cryptoconomy’s action and the hidden network advancement behind these jobs continue to increase in H2.

Overall, both reports show there’s been a great deal of cryptocurrency activities and positive outlooks throughout H1 and a great rating of stable growth increases quarter over quarter. Coinshare’s report highlights that “absolutely nothing is specific in this area and things typically seem like they move at a breakneck speed.” However, the business anticipates seeing what the next half of the year brings. Circle’s research also reveals a net positive for 2019’s Q2 and it will be intriguing to see if the cryptoconomy’s action and the hidden network advancement behind these jobs continue to increase in H2.

What do you think of the total activities and market action of the cryptoconomy in H1 2019 explained by Coinshares and Circle’s reports? Let us understand what you think of this topic in the comments area below.

Image credits: Shutterstock, Circle Research, Twitter, Coinshares, Kaiko, Coingecko, and Pixabay.

Are you searching for a safe method to buy Bitcoin online? Start by downloading your totally free Bitcoin wallet from us and after that head over to our Purchase Bitcoin page where you can quickly purchase BTC and BCH.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.